Gambling

Gamblers Prefer Betting on Sports Than Investing in Stocks, New Study Reveals

Gamblers would rather bet on sports than invest in stocks, according to a recent study from a working paper titled “Gambling Away Stability: Sports Betting’s Impact on Vulnerable Households.”

Study reveals that for every dollar gamblers spent on sports betting, net investments in stocks dropped by just over $2

The study claims to find evidence that for every dollar spent on sports betting – now legalized in 38 states and Washington D.C. since 2018 — net investments in stocks and other financial instruments dropped by just over $2.

According to the findings, this recent trend is more common among financially constrained households. Even middle-class households are struggling to cope with rising costs of essentials like groceries, housing, and healthcare.

Households become further constrained as credit card debt increases, available credit decreases, and overdraft frequency rises. The study’s findings highlight the potential adverse effects of online sports betting on vulnerable households.

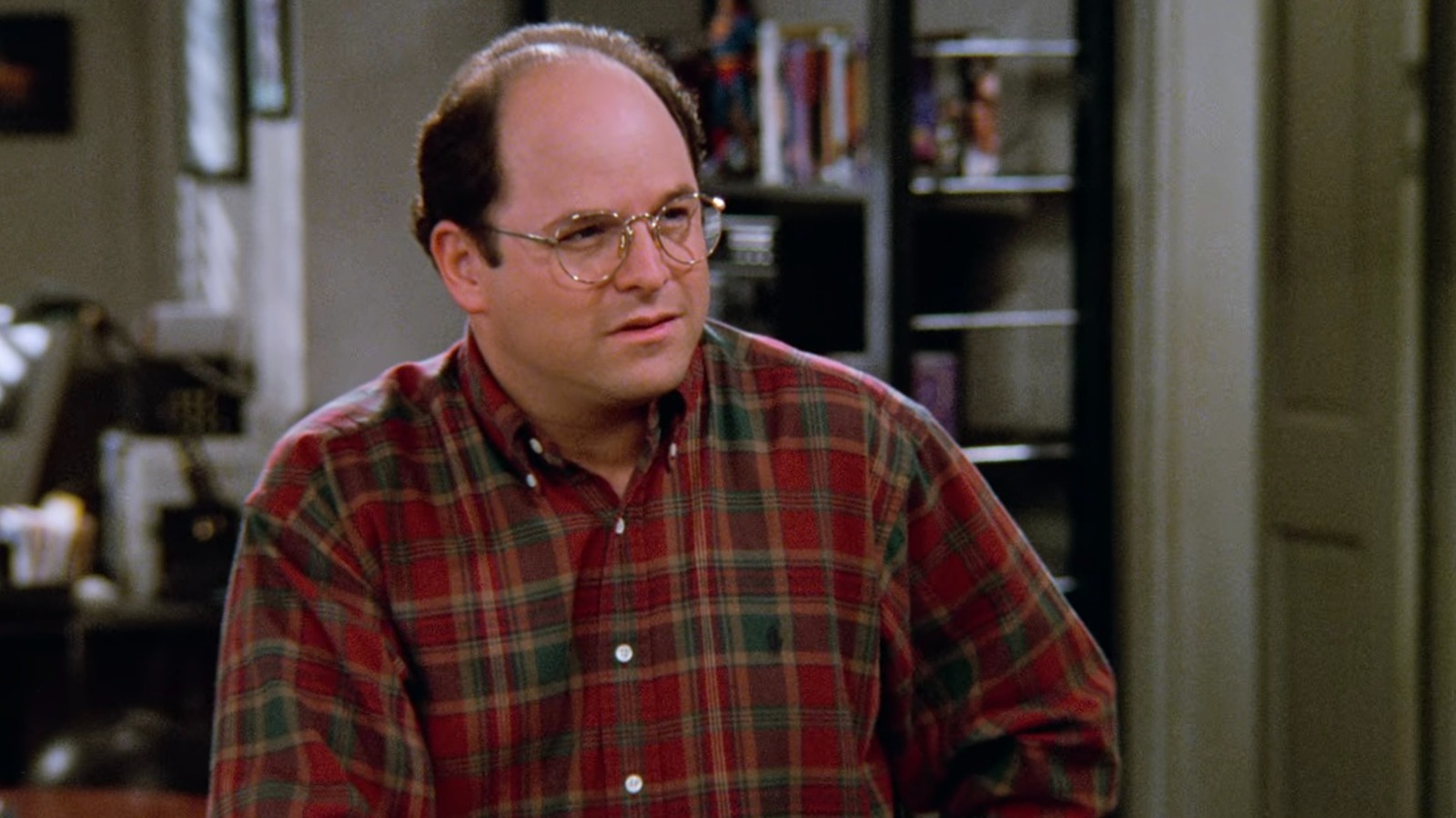

“It’s not just an innocuous rise of a fun entertainment industry, although it surely is that to some types of households,” Jason Kotter, an assistant professor of finance at Brigham Young University who co-authored the paper, said in an interview.

“There’s a real cost particularly to constrained households here that I think should concern policy makers.”

The results show that not only does sports betting lead to increased betting activity, but it also leads to higher credit card balances, less available credit, a reduction in net investments, and an increase in lottery play.

Legalization of sports betting is causing households to invest less

According to Table 6 on page 47 of the paper, betting causes households to invest less. This was based on quarterly income and stimulus payments. Those living in poverty are more likely to pursue get-rich-quick schemes in financial markets such as meme stocks.

Online sports betting leads to a significant decline in net investments to Robinhood and Stash, with a drop exceeding 30% relative to the average investment in these brokerages.

However, casino industry analysts believe the research was flawed, since the study has yet to be vetted by academic peers, and they say it draws false comparisons between investing and gambling.

David Forman, vice president of research at American Gaming Association, said the paper exaggerated the effect of gambling on households’ financial health, and for that reason, he believes the premise is flawed.

“They talk about spending on sports betting as a negative expected value investment compared to other positive expected value investments,” he said. “That’s just not how consumers think about spending their entertainment dollars on sports. It is not an investment, it’s an entertainment option.”

Regardless, it would appear that gamblers are still betting on sports more than they are investing.

/static.texastribune.org/media/files/f5fdb1dff4d6fd788cba66ebaefe08d0/Paxton_GOP_Convention_2018_BD_TT.jpg)