Bussiness

Global Microfinance Strategic Business Report 2024: Market to Reach $506 Billion by 2030 – Microenterprises Emerge as Vital Driver of Growth

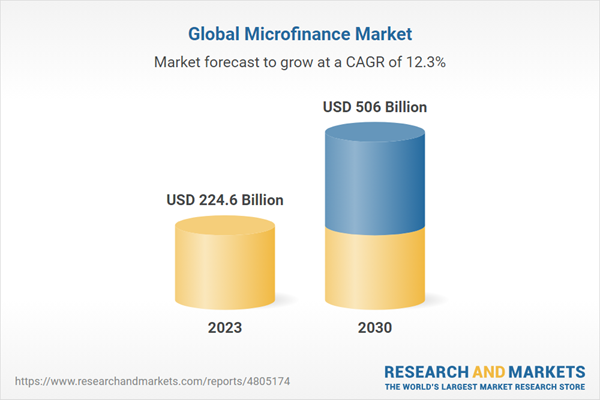

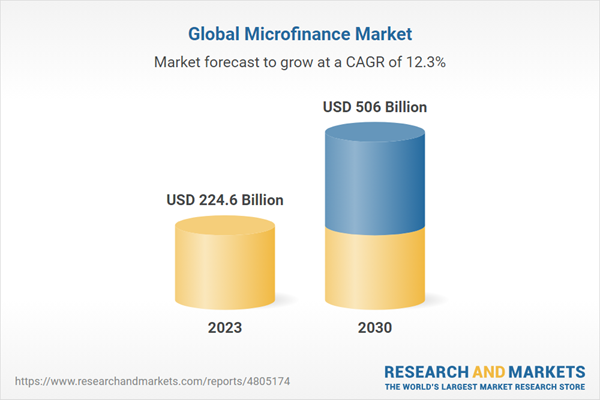

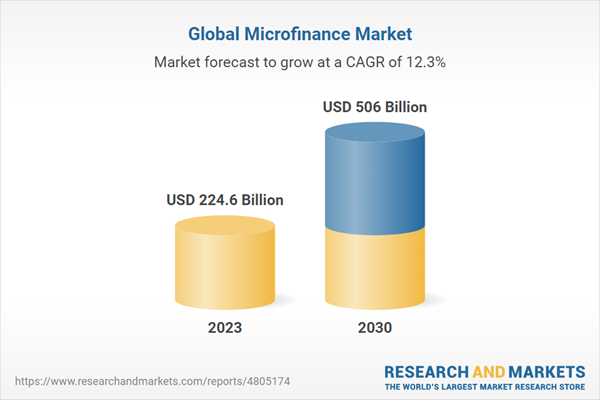

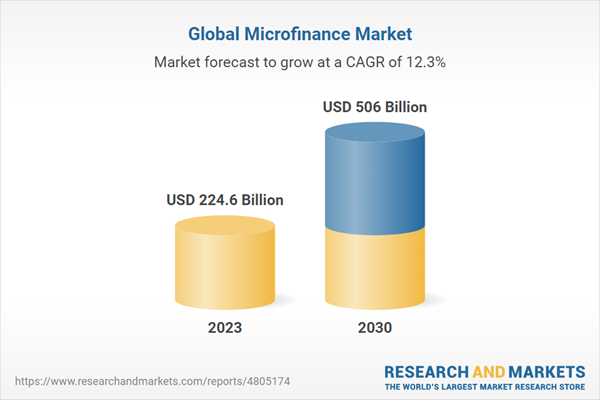

Global Microfinance Market

Dublin, July 31, 2024 (GLOBE NEWSWIRE) — The “Microfinance – Global Strategic Business Report” report has been added to ResearchAndMarkets.com’s offering.

The global market for Microfinance is estimated at US$224.6 Billion in 2023 and is projected to reach US$506.0 Billion by 2030, growing at a CAGR of 12.3% from 2023 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

Understand the significant growth trajectory of the Banks Institution Type segment, which is expected to reach US$295.5 Billion by 2030 with a CAGR of a 13.2%. The Non-Banks Institution Type segment is also set to grow at 11.2% CAGR over the analysis period.

The growth in the microfinance market is driven by several factors. Firstly, the increasing emphasis on financial inclusion and poverty alleviation is boosting the demand for microfinance services. Secondly, advancements in digital technology and mobile banking are enhancing the accessibility and efficiency of microfinance. Thirdly, supportive regulatory frameworks and government initiatives promoting microfinance are driving market growth.

Additionally, the rising awareness of the social and economic benefits of microfinance is encouraging investments and partnerships in this sector. Lastly, the expansion of microfinance into new regions and the diversification of services, including microinsurance and micro-savings, are further propelling market growth, ensuring that more individuals and small businesses can access the financial resources they need to thrive.

Why You Should Buy This Report:

-

Detailed Market Analysis: Access a thorough analysis of the Global Microfinance Market, covering all major geographic regions and market segments.

-

Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

-

Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microfinance Market.

-

Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Report Features:

-

Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2023 to 2030.

-

In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

-

Company Profiles: Coverage of major players such as Accion International, Al Amana Microfinance, Al-Barakah Microfinance Bank, and more.

-

Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

519 |

|

Forecast Period |

2023 – 2030 |

|

Estimated Market Value (USD) in 2023 |

$224.6 Billion |

|

Forecasted Market Value (USD) by 2030 |

$506 Billion |

|

Compound Annual Growth Rate |

12.3% |

|

Regions Covered |

Global |

MARKET OVERVIEW

-

Microfinance: Holding Potential to Break the Cycle of Poverty

-

Microfinance Functioning

-

Key Principles Related to Microfinance

-

Key Benefits and Drawbacks of Microfinancing

-

Microfinance Market: Focus on Providing Access to the Unbanked and Alleviate Poverty Propels Growth

-

Active Borrowers of Microfinance Institutions Continue to Grow

-

Global Microfinance Industry: Number of Active Borrowers in Million for the Years 2010-2023

-

% of Rural Borrowers in Microfinance Institutions (in %) by Geographic Region for 2023

-

Borrower Mix in MFIs: Percentage Breakdown of Active Borrowers by Male and Female Individuals for 2023

-

Financial Difficulties Facing Microfinance Institutions Worldwide Due to COVID-19 Outbreak: % of Large and Smaller MFIs Facing Challenges During the Crisis Period

-

Competition

-

Microfinance – Global Key Competitors Percentage Market Share in 2024 (E)

-

Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E)

-

Recent Market Activity

MARKET TRENDS & DRIVERS

-

As Important Growth Mechanisms for Economic Progress, Microenterprises Emerge as Vital Driver of Growth for MFIs

-

The Large Unbanked Population and Focus on their Financial Inclusion to Stimulate Microfinance Industry: Unbanked Population as a % of Total Population by Region for the Year 2023

-

Global Breakdown of Unbanked Adult Population (in %) by Gender for 2023

-

Top Factors Cited as Barrier to Account Ownership: % of Adults Citing the Reason for Being Unbanked

-

Changing Business Landscape Drives Microenterprises to Review Strategies

-

How Microfinance Can Live Up to Expectations & Unlock a Promising Narrative?

-

Strategies to Resolve Existential Issues

-

Microfinance Emerges as a Powerful Tool for Small Businesses & Entrepreneurs to Access Capital

-

Microfinance: Providing a Level Playing Field for MSMEs

-

The Need for MFIs to Invest in Technology for Helping SMEs

-

Microfinance Industry’s Growing Role in Impact Investments and Achievement of SDGs

-

Growing Importance of Digitalization for Traditional MFIs

-

High Appetite for Digital Payment & Financial Technology in Microfinance Domain

-

Rising Adoption of New Technologies to Push Market Growth

-

Increased Use of Technology in the Field of Microfinance to Benefit Customers Immensely

-

Mobile Payments Transform Microfinance Industry Landscape

-

Mobile Technology to Play a Vital Role in Expanding Reach of Microfinance: Global Mobile Payments Market in US$ Billion for 2021, 2023, 2025 and 2027

-

Microfinance Organizations Serving African Countries Embark Upon Offering Mobile Financial Services but Challenges Remain

-

Mobile Money Systems-A Saving Grace during Tough Periods

-

Going Digital Represents Inevitable Move for Microfinance Institutions

-

Microfinance Industry Leverages Big Data Analytics to Enable Financial Inclusion

-

Digitization Raises Data Security Concerns

-

Roadblocks to Adoption of Technology- A Review

-

Digital Technologies Shape Rural Microfinance Market

-

Enhancing Equity and Accessibility of Digital Microfinance for the Rural Families

-

Artificial Intelligence Poised to Transform the Future of Microfinance

-

Start-ups in Microfinance Sector Leverage AI and Other Advanced Technologies for Democratizing Access to Credit

-

Growing Significance of Blockchain-based Microfinance

-

Huge SME Financing Gap Boosts Need for Blockchain-based Microfinance Solutions: World Formal MSMEs Finance Gap (in $ Billion) by Region

-

Islamic Microfinance Emerges as a Vital Tool for Poverty Alleviation in Islamic Nations

-

Global Islamic Finance Market by Segment (in %) for 2023E

-

Large Commercial Banks Venture into Microfinance Market, Presenting Opportunities and Challenges for Existing Players

-

Microinsurance Products: Providing Insurance Coverage to Low Income Customers

-

Addressing the Risks of Climate Change with Microfinance

-

Rising Carbon Dioxide Emissions an Indication of Climate Change: Global CO2 Concentrations (in ppm) for the Years 2000-2100

-

Microfinance along with Macrofinance Holds Critical Significance in Financial Realm

-

Microfinance Offers Support for Problems Confronting Women Entrepreneurs

-

Emergence of For-Profit Microfinance Institutions Draws Criticism

-

Microfinance Institutions to Embrace Hybrid Model

-

Microfinance Providers to Collaborate with Fintechs

-

Key Issues Faced by Microfinance Industry

-

Notable Microfinance Networks: A Review

FOCUS ON SELECT PLAYERS(Total 178 Featured)

-

Accion International

-

Al Amana Microfinance

-

Al-Barakah Microfinance Bank

-

Annapurna Finance (P) Ltd

-

Asirvad Microfinance Pvt. Ltd.

-

Banco do Nordeste do Brasil S.A.

-

Bandhan Bank

-

Bank Rakyat Indonesia

-

BRAC International

-

BSS Microfinance Ltd.

-

FINCA International

-

Fusion Micro Finance Ltd.

-

Grameen Foundation

-

IndusInd Bank Limited

-

Kiva

-

Manappuram Finance Limited.

-

Opportunity International

For more information about this report visit https://www.researchandmarkets.com/r/p4c8yi

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900