Entertainment

Golden Entertainment: Current Divestitures And Valuation Offer Compelling Opportunity

Juanmonino/iStock Unreleased via Getty Images

Investment Thesis

Golden Entertainment (NASDAQ:GDEN) owns and operates a portfolio of entertainment assets, including casino resorts and pubs and taverns in Nevada. Golden recently sold its Distributed Gaming sector and Maryland Casino Resort to repay a substantial portion of its debt and focus on its core operations in Nevada. I believe these divestitures are beneficiary for shareholders in the long term as the remaining sectors offer higher EBITDA margins compared to the sold assets. Additionally, increasing the number of taverns and completion of the major renovations in their most valuable property, The STRAT, will boost the revenue and cash flows. At the current valuation, I believe new investors are paying only for The STRAT and Taverns businesses and getting the rest of the assets for free.

Golden after Divestitures

Following the sale of Distributed Gaming Operations in January 2024, Golden has 3 reportable business segments, including:

- Nevada Casino Resorts

- Nevada Locals Casinos

- Nevada Taverns

I think the current divestitures have had three significant impacts on Golden’s business:

- Focusing on Nevada operations has decreased the effective tax rate, as Nevada has the lowest tax rates on gambling revenue (6.75%) among the states.

- Debt repayment significantly decreased business leverage and interest expenses. Golden fully paid its 2026 Unsecured Notes in April, which saved shareholders more than $20 million of interest expenses. The company currently has $400 million of debt, consisting of a term loan maturing in 2030. The current Net Debt/EBITDA ratio is around 1.5 which is notably lower than most of its competitors. For instance, Net Debt/EBITDA is around 9 for Caesars Entertainment, Inc. (CZR) and 6 for MGM Resorts International (MGM).

- The overall EBITDA margin is expected to increase, as Distributed Gaming Operations had an adjusted EBITDA margin around 11-13% over the last 3 years, which was significantly lower than that of the remaining 3 segments (more than 30%).

Although I see these impacts as beneficial for shareholders, Golden’s share price has decreased around 30% over the last year. Why? I am not sure, and to be honest, I don’t really care. As long as I see the current business attractive at the current price, the rest is not really important. This is why I will focus on valuing the remaining assets in the following sections.

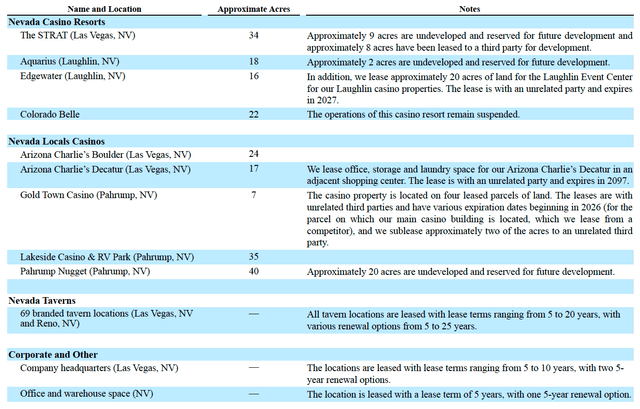

Current Properties

As shown in the following figure, Golden owns approximately 213 acres of real states in Las Vegas, Laughlin, and Pahrump, Nevada. They currently operate 8 casino resorts and own one (Colorado Belle) which has been non-operational since March 2020. Additionally, they had 69 taverns under operation in 2023, which will increase to 72 by the end of this quarter.

Golden Properties (2023 Annual Report)

Expected EBITDA in the STRAT

Golden’s most valuable asset is The STRAT which is its only resort on the Las Vegas Strip. The resort includes the tallest observation tower in the US, more than 2400 hotel rooms, 10 restaurants, and other entertainment facilities. Golden invested more than $170 million in this asset between 2018 and 2023 for major renovations. While in 2023 the renovation caused the occupancy rate in The STRAT to be 10-15% lower than the average occupancy rate in the Las Vegas Strip reported by LVCVA, I think the completion of renovations will increase the occupancy rate in 2024. Additionally, Atomic Golf was opened in March on the north section of the property, which will benefit Golden in two ways: 1) by collecting a portion of gross revenue under a lease agreement, and 2) by increasing traffic and spending in the entertainment facilities within the property.

To value The STRAT alone, I assumed the occupancy rate will reach 85% following the completion of renovations. The assumed rate is consistent with the current average rate on the Las Vegas Strip and the rate at the property in 2019. I also used the data from LVCVA for the average daily room rate ($200 per day), which is fairly consistent with what I observed on thestrat.com. On top of that, each occupied room is assumed to have $100 of average spending per day on food, beverage, and gaming. Using these numbers, the annual revenue of the property would be:

2400 x 0.85 x (200 + 100) x 365 = 223.4 million

The adjusted EBITDA margin of the Local Casinos section was 38% in 2021, 33% in 2022, and 29% in 2023. The decline in the margin was primarily due to the increase in labor costs after the current strike and the renovations and Atomic Golf construction activities within the property. I think the current level is the bottom line and the margin will improve going forward. Using the conservative 30% level, the adjusted EBITDA for The STRAT will be around $67 million. Additionally, management believes the completion of Atomic Golf will contribute an additional $4-5 million of EBITDA. Based on that, I think expecting $70 million of annual adjusted EBITDA from The STRAT is reasonable, if not conservative.

Expected EBITDA for Taverns

After The STRAT, I believe the Taverns sector is the second most attractive business for Golden. To calculate the average EBITDA generated from each tavern, I divided the total revenue and total adjusted EBITDA in each quarter of 2023 by the total number of taverns in that quarter, as follows:

| Q1/2023 | Q2/2023 | Q3/2023 | Q4/2023 | |

| Revenue | $27.6 M | $27.3 M | $26.5 M | $27.8 M |

|---|---|---|---|---|

| Adjusted EBITDA | $8.5 M | $8.5 M | $7.5 M | $8.2 M |

| Number of Taverns | 64 | 65 | 65 | 69 |

| Adjusted EBITDA per location | 0.13 M | 0.13 M | 0.12 M | 0.12 M |

Average generated EBITDA by each tavern (Author’s calculation using data from the company’s financial statements)

Adding up the numbers for each quarter, each tavern is expected to generate around $0.5 million of EBITDA per year. This number has been pretty consistent in recent years, which makes the expected revenue and EBITDA of this sector fairly predictable. This is something I really like about this business. Additionally, considering the regulatory requirements to enter this business and the number of operational taverns by Golden, I believe they have a competitive advantage and will be able to generate the same amount of EBITDA in each location, if not higher.

According to the latest earnings call (Q1/2024), the plan is to increase the number of taverns to more than 90 locations within the next few years. This means the expected adjusted EBITDA from the tavern locations is around $45 million.

Valuation

For the valuation, I am using the EV/EBITDA multiple, which is common for the Casino and Gaming sector. Golden is currently trading with an EV/EBITDA of less than 7. However, the average EV/EBITDA of Golden for the last 5 years and the sector median are around 10. Given the location of The STRAT and the predictability of the Taverns sector, I think 10 is a reasonable multiple for those businesses. Using this multiple and a combined expected EBITDA of $115 million, the EV for the two businesses stands at $1.15 billion, which is very close to the current EV of Golden. This means, at the current valuation, new investors are only paying for The STRAT and Taverns sector and owning the rest of the assets for free.

Although I don’t see the rest of the Golden’s resorts as valuable as The STRAT, they certainly have some values. The Nevada Local Casinos sector, which includes 5 of the current operational resorts, generated annual revenues of more than $150 million and adjusted EBITDA of around $75 million in recent years. Use whatever multiple you think is appropriate for these properties; at the end of the day, we can own them for free.

For the rest of the resorts in the Nevada Casinos sector, Aquarius is the largest resort in Laughlin with around 2000 hotel rooms and 1100 slot machines. Even considering a 50% occupancy rate and $100 spending per occupied room, the resort can easily generate around $40 million in annual revenue. For the Edgewater and Colorado Belle, Golden acquired them for $190 million in 2019 and even if you believe their value has decreased since then, you would agree that they still worth more than $100 million.

Overall, I don’t really think we need to value all of the assets, as long as we can make sure what we are paying is far less than what we are getting. As Joel Greenblatt put it in his book, You Can be a Stock Market Genius:

One way to create an attractive risk/reward is to limit the downside by investing in situations with a large margin of safety. The upside will take care of itself. In other words look down not up, when making investment decisions. If you don’t lose, most of the remaining alternatives are the good ones.

Catalysts

By now, I hope you have been convinced that Golden is extremely undervalued. However, any cheap stock can remain cheap without a catalyst to unlock the value. I think the most likely catalyst for Golden would be a share buyback. Management already authorized $100 million for repurchasing shares, of which only $9 million was used during last year. At the current valuation, management has revealed its plan for capital allocation that is prioritizing investing in their own assets and share buybacks.

The second possible catalyst would be selling Colorado Belle, which has remained non-operational since the pandemic. Considering the current traffic and occupancy rate in Laughlin, I don’t think we can expect that property to reopen soon. Additionally, it probably needs some investments and renovations before reopening. Although management has not explicitly mentioned its plan for this property, they surrendered the gaming license for Colorado Belle during 2023. That is why I think the most likely scenario for this property would be selling.

Third is the mix of what I explained in the previous sections. The current debt repayment happened in April and will be visible in Golden’s financial statements for the first time in Q2/2024. Additionally, following the completion of the major renovations at The STRAT, maintenance capex will likely decrease. The effect of the Atomic Golf opening on revenue and EBITDA will also be visible in the next earnings call. Overall, I think the next earnings call in August will be interesting for Golden’s shareholders.

Risks

After repaying the 2026 Unsecured Note, I believe the most significant risk to the Golden’s business in the recent years, its ability to repay that debt, has been gone. However, there are still some risks that can affect shareholders. The most important one, in my opinion, is the rise of competitors. Two new resorts, Fontainebleau and Durango, started their operations in Las Vegas at the end of last year. The new resorts can reduce the number of visitors to the older ones. This may cause the recovery of the occupancy rate at The STRAT to take longer than I expect. This risk may be in part offset by an increase in the number of visitors to Las Vegas. While the number of visitors has significantly increased after the pandemic, it’s still around 2 million lower than pre-pandemic levels.

The second risk is the huge amount of maintenance capex required to maintain the current market share, especially in the Las Vegas Strip. Although Golden just completed major renovations at The STRAT, competitors have been constantly doing the same to increase their market shares. Therefore, there is a constant need for innovations and investments for Golden to maintain its position. Overall, I believe the current valuation gives new shareholders enough margin of safety to offset these risks.

Conclusion

I see Golden as an asymmetric bet with limited downside and huge upside. In my opinion, the current valuation only considers the value of the Taverns business and The STRAT resort, while the rest of the assets are basically being offered for free. Even though the quality and locations of Golden’s properties may not seem as attractive as some of its competitors, they certainly have value and have provided attractive returns in the past years. The current debt repayment along with the potential buyback or sale of the non-operational asset can unlock value for shareholders in the near future. The fact that insiders own more than 20% of the company and their interests are aligned with shareholders makes me optimistic about the future of Golden. Overall, I recommend a “Strong Buy” to Golden.