Entertainment

Golden Entertainment (NASDAQ:GDEN) Misses Q2 Revenue Estimates

Casino, tavern, and slot machine operator Golden Entertainment (NASDAQ:GDEN) fell short of analysts’ expectations in Q2 CY2024, with revenue down 41.6% year on year to $167.3 million. It made a GAAP profit of $0.02 per share, down from its profit of $0.40 per share in the same quarter last year.

Is now the time to buy Golden Entertainment? Find out in our full research report.

Golden Entertainment (GDEN) Q2 CY2024 Highlights:

-

Revenue: $167.3 million vs analyst estimates of $172.4 million (2.9% miss)

-

EPS: $0.02 vs analyst estimates of $0.18 (-$0.16 miss)

-

Gross Margin (GAAP): 55.6%, up from 43.4% in the same quarter last year

-

EBITDA Margin: 24.6%, up from 20.4% in the same quarter last year

-

Market Capitalization: $801 million

Blake Sartini, Chairman and Chief Executive Officer of Golden, commented, “In the second quarter, we continued to strengthen our balance sheet by fully repaying our outstanding bonds in April and reducing our interest rate on our term loan in May. We also aggressively returned capital to shareholders through our recurring dividend and repurchasing nearly one million shares. Our healthy operating cash flow and strong balance sheet will continue to provide us with strategic and financial flexibility while we return capital to shareholders throughout the year.”

Founded in 2001, Golden Entertainment (NASDAQ:GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can’t do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

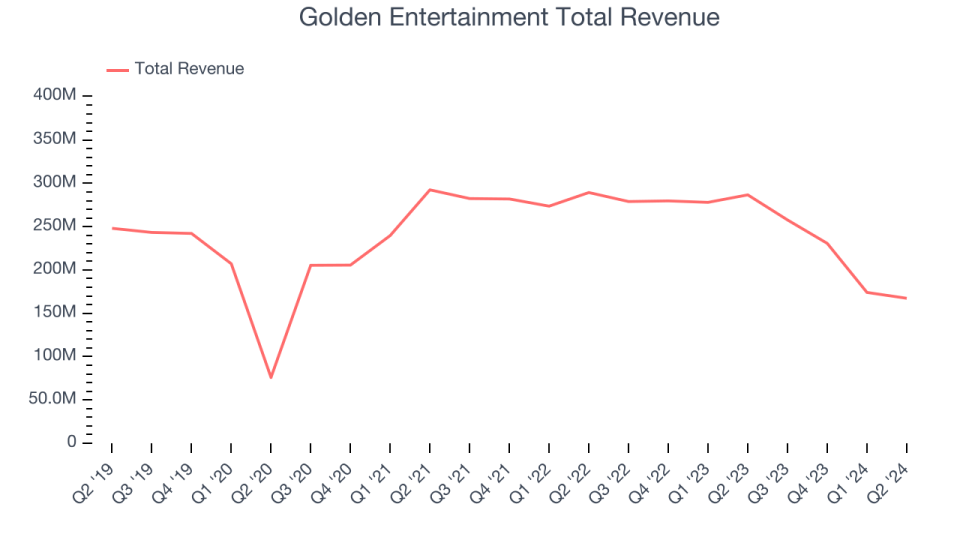

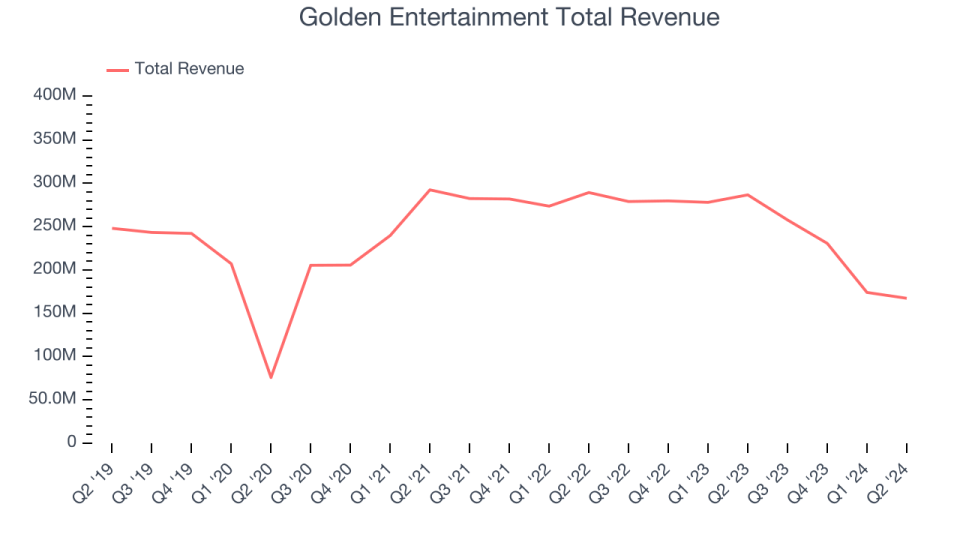

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Golden Entertainment struggled to generate demand over the last five years as its sales dropped by 1.8% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Golden Entertainment’s recent history shows its demand has stayed suppressed as its revenue has declined by 14.2% annually over the last two years. Note that COVID hurt Golden Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Gaming. Over the last two years, Golden Entertainment’s Gaming revenue (Poker, Blackjack) averaged 18.8% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Golden Entertainment missed Wall Street’s estimates and reported a rather uninspiring 41.6% year-on-year revenue decline, generating $167.3 million of revenue. Looking ahead, Wall Street expects revenue to decline 14.7% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

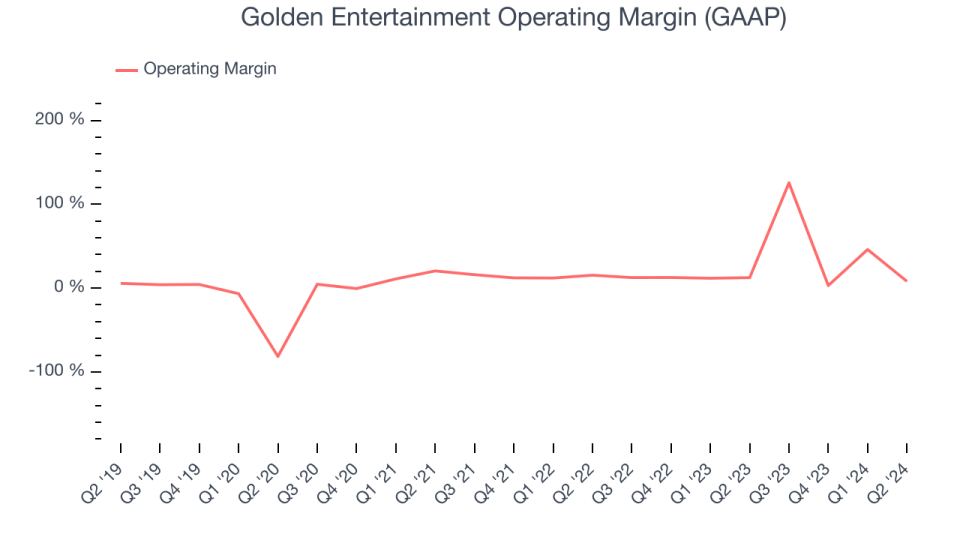

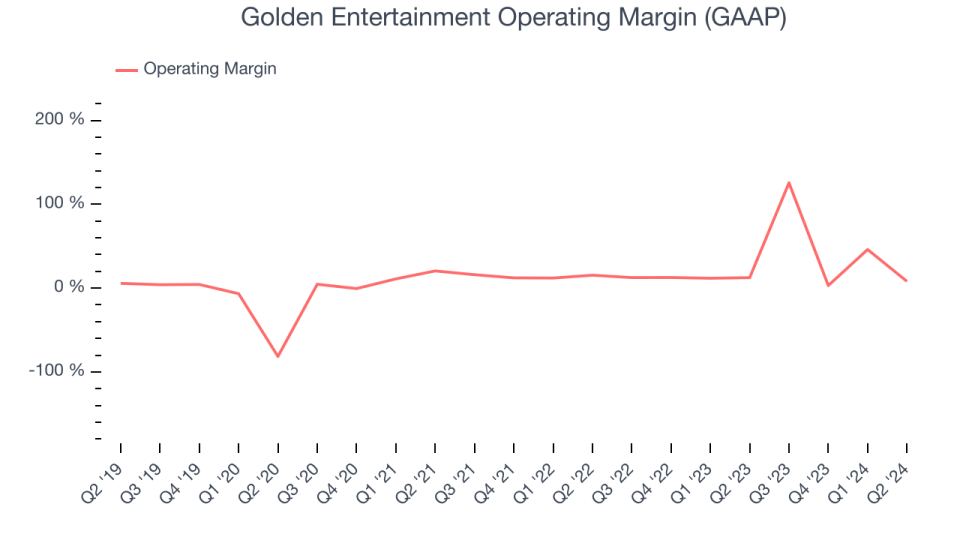

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Golden Entertainment’s operating margin has risen over the last year and averaged 28.8%. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

This quarter, Golden Entertainment generated an operating profit margin of 8.1%, down 4.4 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Key Takeaways from Golden Entertainment’s Q2 Results

We were impressed by how significantly Golden Entertainment blew past analysts’ Gaming revenue expectations this quarter. On the other hand, its EPS missed and its revenue fell short of Wall Street’s estimates. This quarter featured some positives but overall could have been better. The stock remained flat at $28.12 immediately after reporting.

Golden Entertainment may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.