Entertainment

How Did Disney’s Visual Entertainment Assets Do In Fiscal Q4? | Radio & Television Business Report

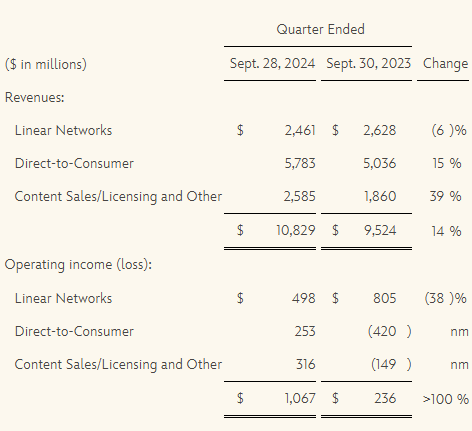

The Walt Disney Company has revealed its fiscal 2024 fourth quarter results, and for its Entertainment segment, revenue was up a healthy 14% year-over-year. However, a closer look at the results indicates the growth was largely due to Disney+ and OTT platforms; and content sales and licensing dollars.

For the linear networks, challenges abound.

For the quarter ended September 28, 2024, Entertainment segment revenue climbed by 14%. Operating income surged. But, this was fueled by 15% gain in direct-to-consumer revenue as content sales and licensing revenue increased by 39%.

Linear networks’ revenue declined by 6%, as operating income tumbled by 38%

Driving the decline is weakness in the international marketplace. That said, domestic year-over-year revenue performance was attributed to four reasons:

- Higher marketing costs linked to more season premieres in the current quarter, reflecting the impact of dual guild strikes in fiscal Q4 2023

- Lower affiliate revenue, “primarily attributable to fewer subscribers including the impact of the non-renewal of carriage of certain networks by an affiliate”

- A decline in advertising revenue resulting from a decrease in impressions reflecting lower average viewership, which was partially offset by higher rates

- Higher average cost programming at the ABC Television Network, in part due to the impact of the twin guild strikes one year ago

In contrast, D2C revenue growth is being fueled by subscribers, more ad dollars thanks to higher impressions, and lower Disney+ marketing costs.

In the U.S., Disney+ paid subscribers grew by 2% in fiscal Q4, to 56 million; Hulu subscription video-on-demand subscriber rolls increased by 1%, to 47.4 million.

Here’s the problem, however: average monthly revenue per paid subscriber for fiscal Q4 was down by 1% for both Disney+ and Hulu on an SVOD-only basis.

ESPN domestic revenue increased by 1% to $3.49 billion. But, operating income declined by 5% to $936 million. Why? Fewer subscribers resulted in lower affiliate revenue as an increase in college football rights costs and higher production bills impacted the bottom line.

Overall, Disney’s fiscal Q4 revenue climbed to $22.57 billion from $21.24 billion, as net income improved to $460 million ($0.25 per share), from $264 million ($0.14).

BACKED FOR THE FUTURE

Investors appeared to be pleased with the results, as Disney shares were up 3.6% in midday trading on Friday, to $113.03. That puts the company’s stock at its highest level since May 6. For MoffettNathanson Senior Analyst Robert Fishman, Disney is an entity that has seen “many changes and evolutions one can point to as the company has repositioned its assets for the streaming future.”

Indeed, Disney offered guidance for both fiscal year 2026 and fiscal year 2027. “While this degree of guidance may be a departure for Disney, the broader industry in which the company operates remains as volatile as ever,” Fishman remarked as he added, “Now it is left to all of us to dig into how confident management is in the forward projections.”

Fishman also took a deep dive into the Linear Networks decline. He calls this a “wildcard” for fiscal year 2025, and leaves MoffettNathanson’s forecast of -10% EBITDA for the Disney unit unchanged. But, Fishman admits there is potential for greater declines, “depending on how aggressive the company will be on cost-cutting to offset the revenue pressures.”

For Madison & Wall’s Brian Wieser, the respected media advertising analyst took note of how Disney provided commentary in response to a question around separating its cable networks, “which are generally experiencing high-single digit or double-digit declines in distribution at the present time.” The answer: Disney is not looking at divestitures at this time given the proceeds they would expect to receive and the friction that such an effort would produce for the rest of the business, Wieser explained.

He also looked at linear revenue in fiscal Q4 on an ex-political basis, and this showed results that were “probably closer to flat year-over-year, with gains in DTC-related revenue (up 14% globally and probably something similar domestically) offset by declines in linear TV advertising.”