Jobs

How Might Markets React To May 2024’s Job Report This Week

AzmanL/E+ via Getty Images

Investors who are keen to follow the Federal Reserve’s interest rate policy have three things to consider. The first and foremost is the Fed policy meeting, where investors may infer the Fed’s interest rate intention. Inflation, both reported as Consumer Price Index and Core Price Consumption Expenditure, matters next. The non-farm payroll report is the third crucial data to consider. Readers may explore those three aspects through my coverage of the S&P 500 (SP500). On Friday morning, what impact might the upcoming NFP report have on stock markets?

Review of April 2024 Jobs Report

In April, the Bureau of Labor Statistics reported an increase of 56,000 jobs in healthcare, 31,000 in social assistance, 22,000 in transportation and warehousing, and 20,000 in retail trade. My last preview report expected the government to increase employment again. However, it added only 8,000 jobs. This resulted in jobs growing by 175,000, sharply lower than the average monthly gain of 242,000 over the prior 12 months.

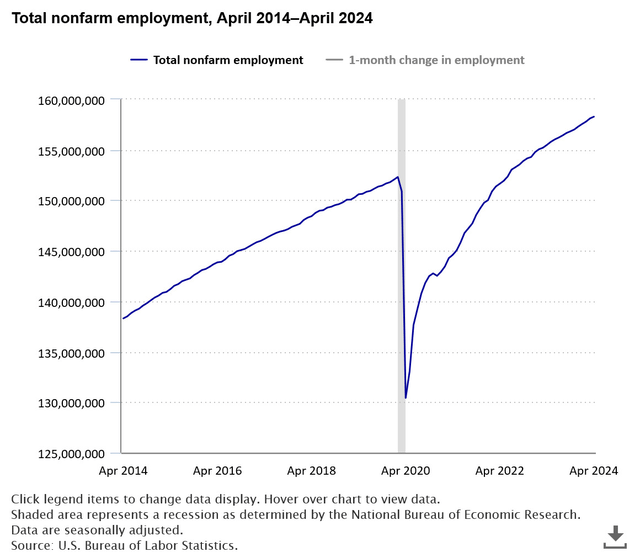

Since 2014, the employment growth has been in a consistent uptrend, excluding the shaded area as indicated below. That area represented a recession.

The BLS revised NFP for February down by 34,000, from +270,000 to +236,000. In March, it revised the figure up by 12,000, from +303,000 to +315,000. The combined revision of -22,000 than previous reports is not a big enough change to move stock markets.

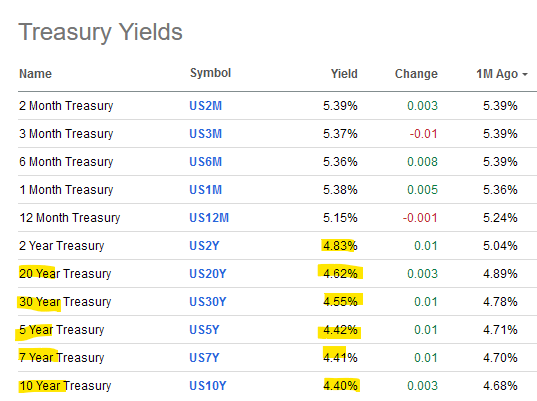

In the month since the BLS posted job data, treasury yields are generally lower, starting with the 2-Year Treasury (US2Y):

treasury bond

Investors who bet on yields falling bought the iShares 20+ Year Treasury Bond (TLT). TLT stock is up by nearly 3% in the last month, but is down by around 7.4% YTD. The long-term bond has yet to break its downtrend, which began when TLT traded at over $100 last Dec. 2023. The markets need core Personal Consumption Expenditure closer to 2.0% and signs of a weaker May 2024 jobs report to lift TLT stock.

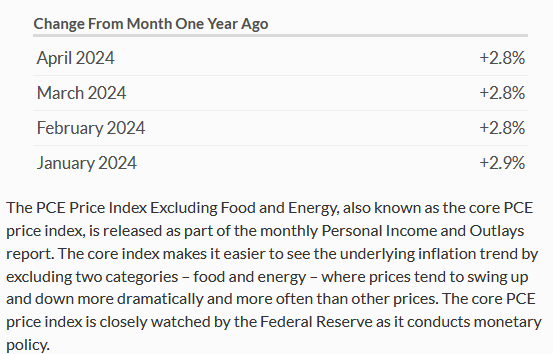

The PCE Price Index, which excludes food and energy, was 2.8% in April.

Core PCE

Job Increases in May

The economy will likely add jobs in transportation and warehousing again. Jobs increased by 8,000 for Couriers and Messengers in April. Investors who hold United Parcel Service (UPS) or FedEx (FDX), however, are less bullish than the job growth suggests. Shares in both companies are down by around 6.2% in the last month.

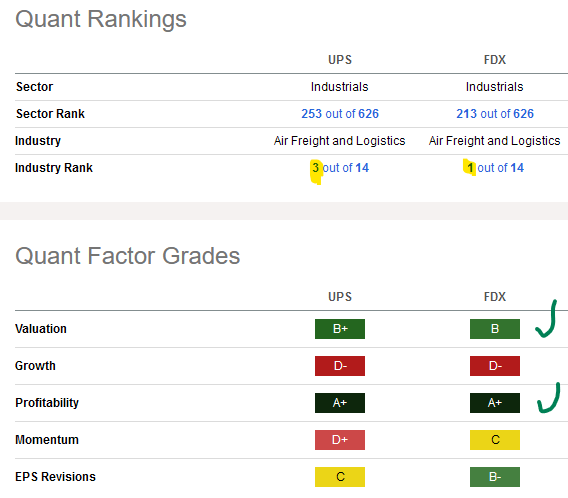

The industry rank of 3rd and 1st, respectively, on UPS and FDX suggests that investors should take advantage of any weakness in their share price.

FedEx and UPS

Both companies have strong valuation and profitability grades.

FedEx is focused on a return to profitable growth. It will invest in healthcare and technology along with cutting costs to expand its profitability.

Retail Trade Employment

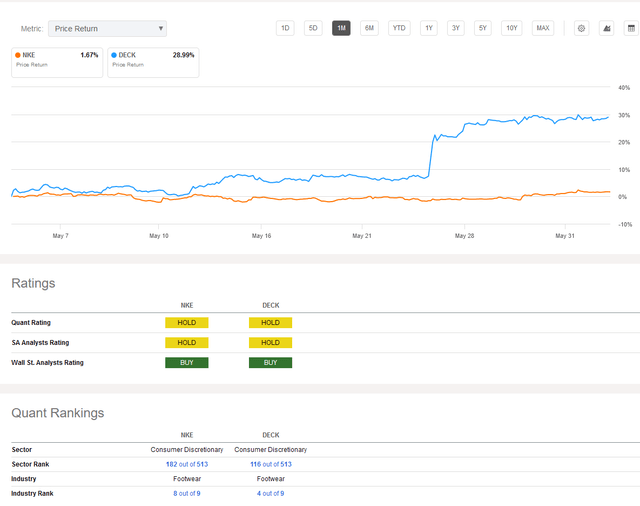

Expect the economy to increase in employment in retail trade in May. For investing picks, selectivity will matter. Companies that relied on branding previously enjoyed strong profitability. That trend changed for companies like NIKE (NKE).

Nike said that it will focus on consumer and sports markets to revitalize its growth. Conversely, Deckers (DECK), whose industry rank is fourth, rallied in the last month after posting quarterly results.

Deckers Outdoor will thrive regardless of the employment figures in retail. Direct-to-consumer sales of HOKA accounted for 38% of the product mix in its fourth quarter. It will invest in product innovation to distinguish itself from competitors. Additionally, it will rely on authentic consumer engagement to strengthen customer loyalty.

Sectors With Modest Job Growth

Similar to April’s report, investors may no longer expect strong job growth in the government sector. It will spend more of the funding on the rollout of the $95 billion aid package to buy military hardware. This benefits companies like Lockheed Martin (LMT), RTX (RTX), General Dynamics (GD), and AeroVironment (AVAV).

In the year-to-date period, Howmet Aerospace (HWM) is a notable winner. The stock gained almost 60% after raising its profit estimates. The supplier of jet-engine parts expects strong demand to continue. More recently, China’s restriction on aviation exports, announced on May 30, 2024, is unlikely to hurt the aerospace sector.

Investors should, however, avoid Boeing (BA). The CFO said plane production levels are unlikely to rise. Still, a Boeing Starliner launch may help improve the company’s image for innovation.

Job Declines

Employment in commercial banking and the credit intermediation sectors may fall. Banks will continue to expand profit margins by increasing operating efficiency. That will pressure bank staffing levels. In Canada, TD Bank (TD) and CIBC (CM) posted strong results, so job cuts at their U.S. divisions are likely minimal. Conversely, Bank of Montreal (BMO), which owns Bank of the West, posted poor quarterly earnings. It may reduce staff levels in response to its higher provision for credit losses.

Your Takeaway

The stock market is somewhat detached from the jobs report. This does not excuse readers from ignoring the data. It weighs on the Federal Reserve’s interest rate policy. Rates matter for bond yields, which eventually have an impact on stock market valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.