Fashion

Inditex: No Stopping The World’s Premier Fast Fashion Compounder (OTCMKTS:IDEXY)

bestravelvideo/iStock Editorial via Getty Images

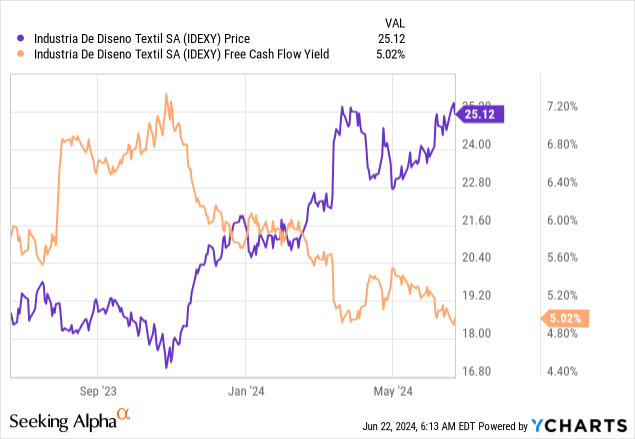

Apparel retailer Industria de Diseño Textil, or ‘Inditex,’ (OTCPK:IDEXY) continues to go from strength to strength. Despite intense competition from incumbents (H&M (HNNMY)) and upstarts (Shein) alike, the business remains as profitable as it’s ever been. Growth hasn’t slowed either. Since I last covered the stock (see Inditex: Fast Fashion Compounder With A Possible Near-Term Catalyst), the company has delivered a solid set of Q1 2024 numbers and an even better guidance update. As for the mid-term outlook, things look rosy as well, with management well on track with its growth and efficiency initiatives. Progress here will not only add to earnings growth but also capital efficiency, which bodes well for the ~4% (and growing) dividend yield. In the meantime, pricing isn’t too demanding at 20x free cash flow (high-teens ex-cash), leaving ample room for this consistent compounder to keep working its magic.

A Positive Top-Line Surprise

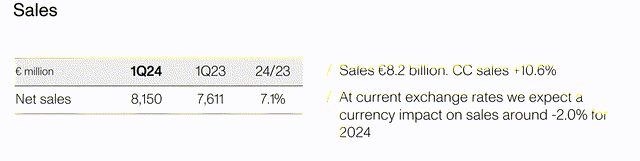

Inditex trading had been choppy heading into the Q1 print, largely on concerns about the sustainability of its sales growth momentum. Thus, the very solid +11% pace of growth in constant currency terms (+7% headline) came as a positive surprise, as did management’s update that sales had further accelerated to +12% through the 1st May to 3rd June period.

Now, commentary from the call suggested that space growth, in addition to “the creativity of the teams and the strong execution of the fully integrated business model,” is already playing a part in the headline sales number. Given Inditex remains in the early stages of its growth plan, however, Q1 space contribution is likely running a lot lower in the low-single-digit % range (vs the +5%/year target). Combined with the “very stable” pricing disclosure, this implies Inditex’s growth was volume-driven – an impressive result, considering the challenging backdrop in its more mature European markets.

From here, all eyes will be on the sustainability of Inditex’s top-line growth. We are coming off a relatively high Q2 base from last year, so YoY % comparisons will naturally be tougher; the fact that Q2 is already off to a very good start, on the other hand, indicates Inditex could be poised for more upside surprises to come. Meanwhile, Inditex continues to make headway in the US, its new growth market, while enhancing the in-store experience (and, by extension, store productivity) in its core markets. Incremental sales contributions from Ukraine (online and 48 reopened stores by month-end) will also flow through next quarter, along with the launch of Massimo Dutti in China (via JD.com (JD)). Note that consensus expectations remain in the high-single-digits % through 2025/2026, so the bar for more beat-and-raise quarters isn’t particularly high.

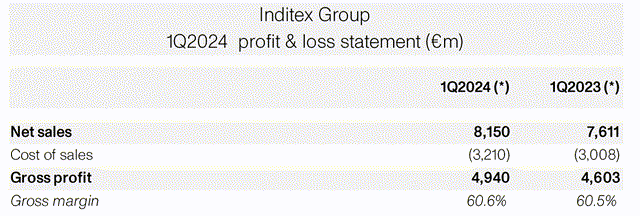

Holding Steady on Gross Margin

The key drawback in Q1 was that although Inditex did grow headline gross profits in the high-single-digits %, gross margin was only up by ~13bps. To some extent, this wasn’t too surprising, considering that growth was volume-driven (as opposed to pricing) this time around.

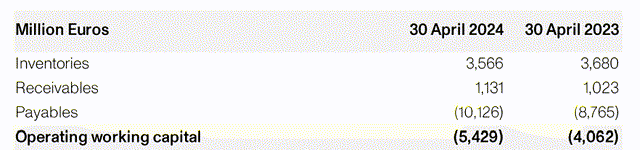

More important is that Inditex is ahead of the pack on inventory. Despite on/off logistical disruptions, good execution, and “proximity sourcing” (i.e., sourcing in/near its European base) have allowed inventory growth (down ~3% YoY) to run well below sales. Then there’s the “high quality” inventory balance, which will be a near-term tailwind for gross margins, particularly with sales already up in the low-teens % in early Q2.

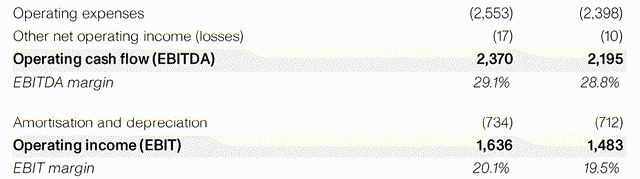

All about the Operating Leverage

Inditex also kept a lid on operating expense growth (~110bps below sales), and as a result, Q1 operating margins continue to expand.

While slightly below last year’s ~125bps delta between opex and sales growth, it’s worth noting that management is in growth mode this year as it starts to ramp up space growth toward +5%/year. Plus, there’s the marketing expense to consider, as Inditex looks to drive up online sales as well. Against these cost pressures, operating efficiencies are offering some relief, while the focus on speed (“proximity sourcing”) has kept the business insulated from freight rate volatility.

In this context, things are going very well, in my view. If management can keep this top-line outperformance going while also keeping cost discipline intact, expect more operating leverage benefits (and by extension, margin expansion) down the line.

Kicking Off a Reinvestment Cycle…

Over the decades, Inditex has built a best-in-class model built around speed and efficiency that competitors have struggled to replicate. Case in point – efforts to reduce lead times by European peers like H&M and Asos haven’t impacted its industry-leading sales growth and capital efficiency. On the other hand, online Chinese upstarts like Shein have the speed advantage but are nowhere near bridging the quality gap.

Still, maintaining the moat requires reinvestments, and Inditex is currently at the start of its latest cycle. For context, growth initiatives in the pipeline include a 5%/year gross new space target from 2024-2026, as well as per-store productivity improvements via in-store refurbishments, enlargements, and relocations. Q1 sales numbers are already seeing the benefit from this positive space contribution, albeit on a much smaller scale at this early stage, so further progress should yield sales upside from here. The challenge will, naturally, be to keep both costs and capex contained in the meantime; for now, though, Inditex’s margin expansion indicates management is more than up to the task.

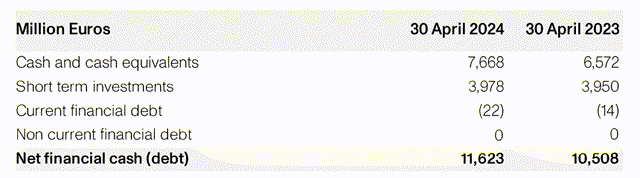

…but More Than Enough Left for Capital Returns

A reinvestment cycle typically means less cash available for distributions and Inditex is no different. But the model has become so capital efficient that even after deducting the required cash outlay (e.g., ~EUR900m/year for logistics expansion), there will still be plenty of cash left to fund the ordinary dividend payout (currently at 60% of profits). Thus, the more interesting question, in my view, is the special dividend, given the company currently sits on a massive ~EUR11.6bn net cash position that will only grow over time. Plus, the founding Ortega family retains a near 60% stake, so incentives are well-aligned.

No Stopping the World’s Premier Fast Fashion Compounder

Coming off an impressive Q1 2024 report, Inditex clearly isn’t slowing down. With Q2 to date also shaping up very well, the company remains primed for more beat and raise quarters to come. Last but not least is the intact (and widening) Inditex moat – despite the rise of new ‘fast fashion’ competition. Coupled with a relatively undemanding valuation, Inditex stock should continue to move higher.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

:quality(70):focal(338x272:348x282)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/FOAF2O2ZIBEC5FYGY6GCKFXN3E.jpg)