Jobs

Inflation ‘virtually a non-issue’; Jobs now dominate the Fed’s dual mandate

Douglas Rissing

The monetary policy narrative in the U.S. has undergone a rapid shift from inflation to the labor market, especially since the July nonfarm payrolls report.

The Federal Reserve’s goal is to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates,” commonly known as the dual mandate.

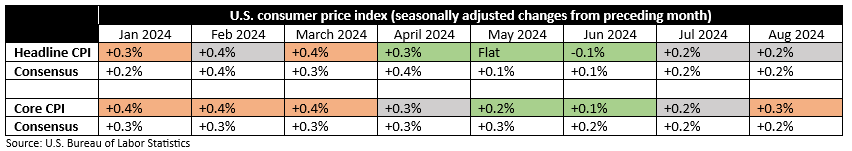

For much of the last two years, rampant inflation was the problem facing policymakers. But this year, consumer prices have largely shown a cooling trend. Meanwhile, jobs growth has come in towards the softer side while the unemployment rate has steadily ticked up, which in turn has resulted in slowdown and recession concerns.

“The Fed has gradually shifted its primary focus from inflation to growth. Back in August, at the Jackson Hole Economic Symposium, (Fed Chairman Jerome) Powell noted significant progress in reducing inflation and increasing downside risks to employment,” Seeking Alpha contributor Mike Zaccardi said.

“Inflation is virtually a non-issue now. This week’s (consumer price index) report was basically in line. Moreover, if we apply real-time shelter price data to the CPI calculations, inflation is below 2%,” WisdomTree’s Jeremy Schwartz noted this earlier in the week.

And the “‘Truflation’ indicator is near cycle lows, close to 1%,” Zaccardi said.

“Inflation is on the path toward 2%, thanks to falling wage growth levels and strong worker productivity this year. More recently, falling commodity prices are yet another factor in the disinflationary narrative. Outright deflation at times in China this year also helps cool the global inflation trend,” he added.

See below for a table showcasing the progression of consumer inflation this year on a M/M basis. Note that cells shaded in red indicate a hotter-than-expected reading; green indicate a cooler-than-expected reading; and gray indicate an in-line reading:

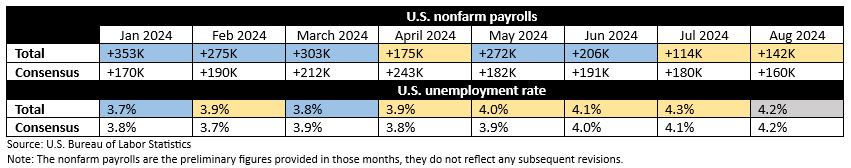

One of the pivotal moments in the current shift towards the labor market from inflation happened in early August with the release of the July employment situation report. Data from the U.S. Bureau of Labor Statistics showed 114K nonfarm payrolls added in that month, significantly lower than the 180K consensus. Additionally, the unemployment rate ticked up to 4.3%.

The jobs report triggered the so-called “Sahm Rule.” Created and named after Claudia Sahm, a macroeconomist who worked at the Fed and the White House’s Council of Economic Advisers, the rule is a recession indicator.

According to the rule, the early stages of a recession are signaled when the three-month moving average of the U.S. unemployment rate is half a percentage point or more above the lowest three-month moving average unemployment rate over the previous 12 months.

The July report sparked widespread growth concerns, and was a primary driver in Wall Street’s (SP500) rout on August 5, a day that evoked “Black Monday” vibes.

The August employment situation update last week wasn’t much of an improvement. The data showed softer-than-expected jobs growth in the month along with significant downward revisions to the figures for June and July.

See below for a table showcasing the progression of the employment situation this year. Note that cells shaded in blue indicate a better-than-expected reading; yellow indicate a worse-than-expected reading; and gray indicate an in-line reading:

All eyes now turn to the Fed’s monetary policy committee meeting next week. The Federal Open Market Committee (FOMC) is widely expected to finally kick off its easing cycle by delivering its first interest rate cut since 2020, but debate is simmering over the size of the cut.

“The balance of U.S. risks has shifted substantially this quarter as inflation pressure eases while job growth materially slows. A shift in focus toward the labor market side of the dual mandate seen in recent Fed communications points to a break from the FOMC’s mid-year gradualism guidance,” JPMorgan’s Bruce Kasman said on Friday.

“We look for 100 (basis points) of policy rate cuts in relatively short order, with next week’s meeting delivering a front-loaded 50 (basis point) move,” Kasman added.

For investors looking to track Wall Street’s three major averages – the benchmark S&P 500 (SP500), the tech-heavy Nasdaq Composite (COMP:IND) and the blue-chip Dow (DJI) – here are some exchange-traded funds of interest: (VOO), (IVV), (RSP), (SSO), (UPRO), (SH), (SDS), (SPXU), (QQQ), (QLD), (TQQQ), (QID), (SQQQ), (DIA), (DDM), (UDOW), (DOG), (DXD), and (SDOW).