Bussiness

JetBlue’s Bold Move: Stop Chasing Business Travelers, Cut Costs, And Downsize To Profits – View from the Wing

JetBlue’s Bold Move: Stop Chasing Business Travelers, Cut Costs, And Downsize To Profits

JetBlue surprised by earning $25 million in the second quarter. That should be their strongest quarter, but they didn’t lose money. And they announced they’re going to be spending a lot less on aircraft, which caused their stock to pop – up over 20% in early trading, though this trailed off somewhat.

It’s striking that less growth drove higher share price, underscoring how badly the market has thought of the airlines prospects. Normally growth is valued but that requires a likelihood that it will be profitable.

JetBlue has been trying to retool its business, which has underperformed for 15 years but finally cost its Chief Executive his job. Now they’ve been looking for revenue anywhere they can find it (such as continuing to lead the industry in checked bag fee increases) while dropping unprofitable routes out of places like Los Angeles and scaling back loss-making adventures in Europe.

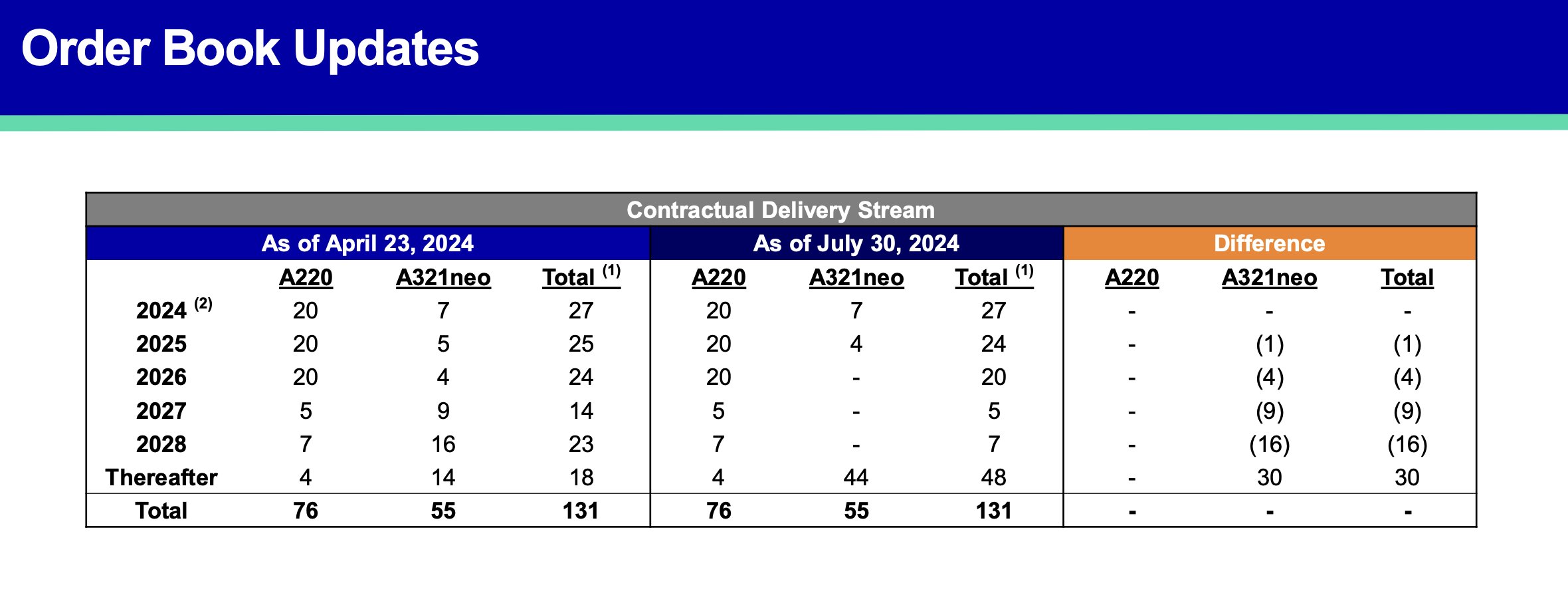

The big reveal was that they will be reducing plans to buy planes, deferring orders past 2030. And without new A321XLRs coming this decade that means a lot less Europe ahead than in earlier plans and a longer way to a fleet refresh.

JetBlue Is Scaling Back Aircraft Orders

While blaming their engine manufacturer, JetBlue is deferring delivery 44 Airbus narrowbodies – including 30 A321neos that would have come between 2025 and 2028.

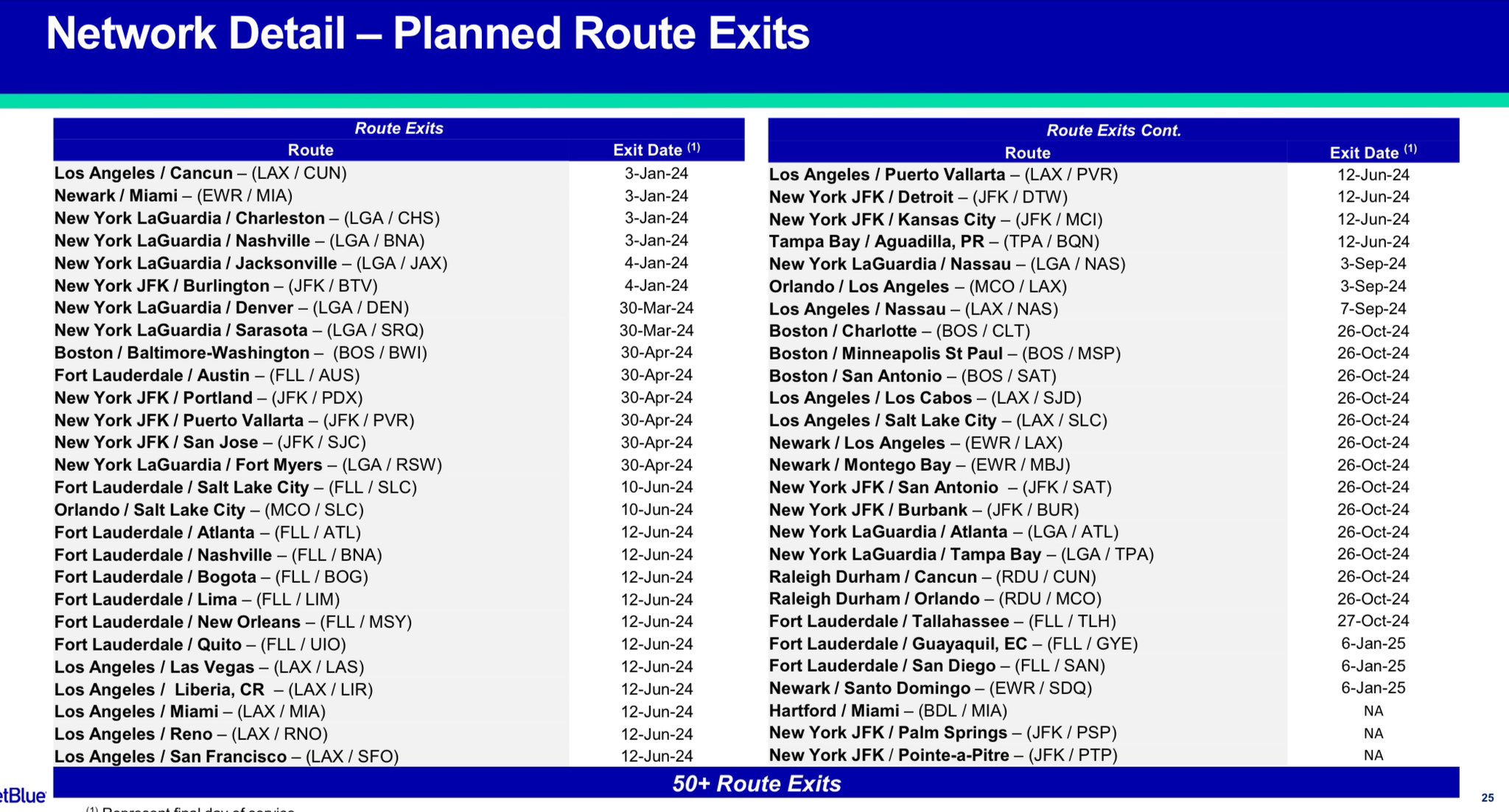

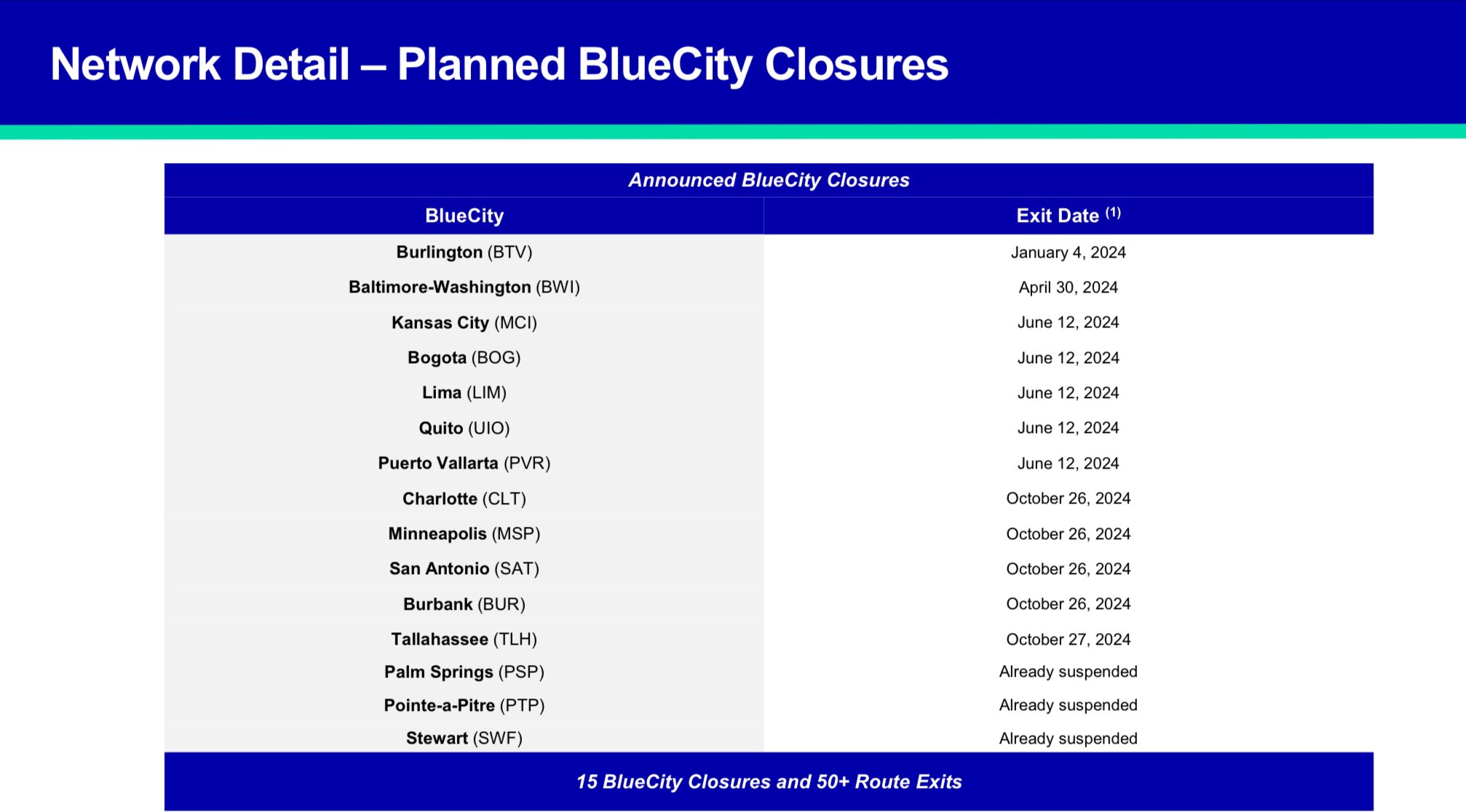

They’re Scaling Back The Network Dramatically

JetBlue has dropped 50 routes, and announced elimination of service to 15 cities entirely.

What’s JetBlue’s Focus?

JetBlue says their focus is on the “core franchises” of leisure customers, visiting friends and relatives, and cross-country flying from New York, Boston and Florida – plus to Puerto Rico and the Caribbean.

While they wouldn’t describe themselves as “walking away from” corporate travel, they are no longer “designing the network for corporate” like they once tried to.

The strategy is called “JetForward” and involves a leisure network along the East Coast and “enhancing our existing product offerings” (“enhancement” in the airline industry is never good for customers).

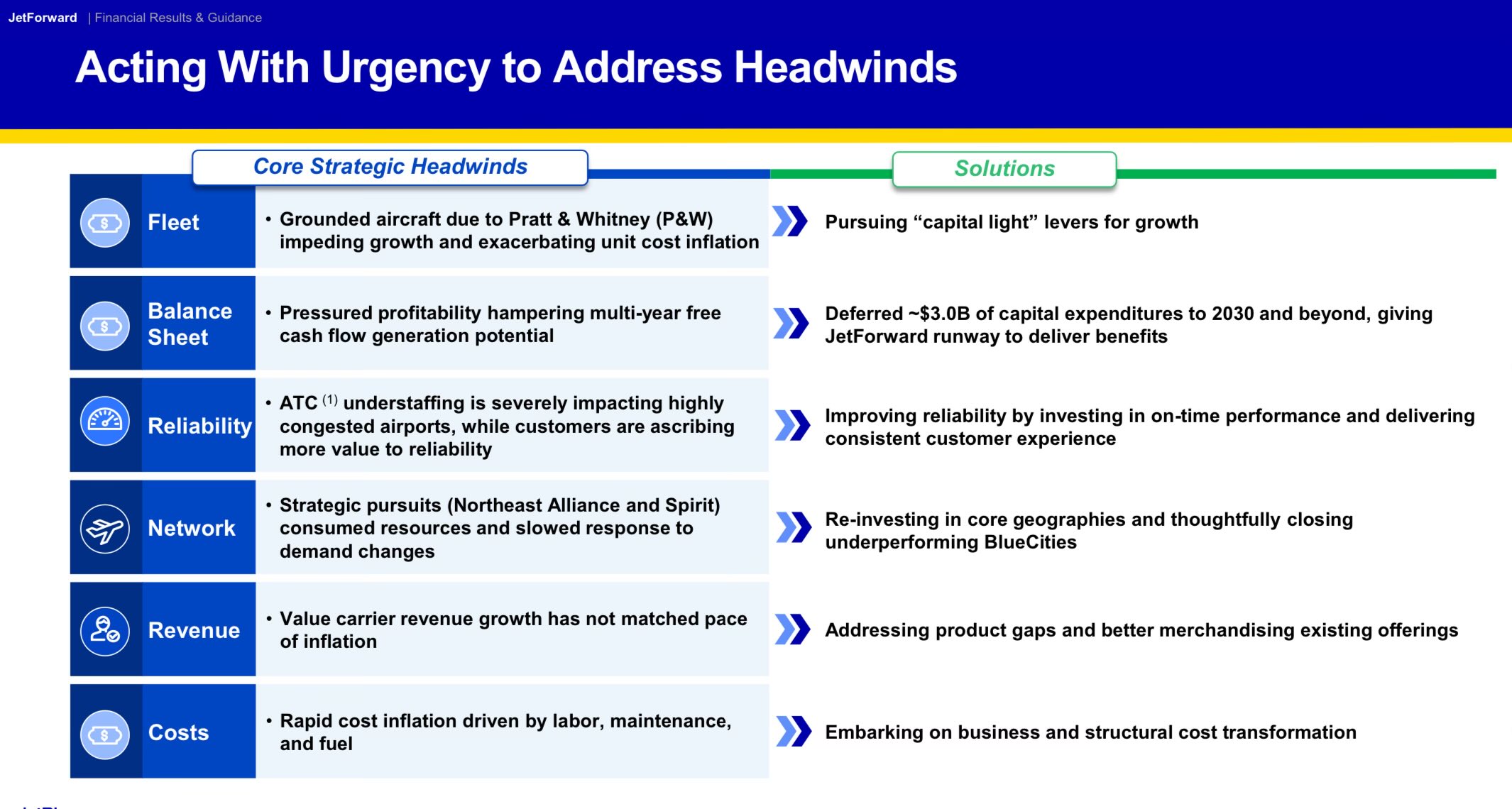

- They’re cutting capital spending and seat growth (which hopefully raises fares) by deferring $3 billion in aircraft.

- They blame their reliability issues on air traffic control, which is a very small part of the story, and say their solution is to… improve reliability. How? By investing in improved reliability.

- Their network cuts, they say, are because they were slow (distracted by partnerships and mergers) to adjust routes that were losing money.

- They’re going to add a domestic first class to sell in future years and “better merchandis[e..] existing offerings” which means more fees.

- And they’re going to lower costs through strategies to lower costs.

Government Anti-Trust Cases Backfired, Sacrificing Competition

The American Airlines partnership gave JetBlue a big opportunity to grow in New York. But they needed planes and pilots for that, so they did a deal to buy Spirit Airlines. I thought they were substantially overpaying, and they’d be better taking the cash and diversifying out of the low profit airline industry than sinking more cash into a merger. But it was a bold plan to scale.

Without that plan, JetBlue is flailing – and so is Spirit. The Department of Justice claimed they were preserving competition by preventing JetBlue and American from together being big enough to compete with Delta and United in New York. And they claimed they were preserving the low cost business model by keeping Spirit out of JetBlue’s hands.

Instead both JetBlue and Spirit are weaker than ever. JetBlue is shrinking and becoming more like a legacy airline, and Spirit is abandoning its low base fare brand in favor of bundled fares and first class. Those interventions in the name of anti-trust haven’t worked out well – and American Airlines is flailing in New York, too.