Entertainment

Live Nation Entertainment: Misses The Most Important Aspect In Investing (NYSE:LYV)

Anton Vierietin/iStock via Getty Images

Live Nation Entertainment (NYSE:LYV) reported second-quarter results that missed expectations, as the company continues to have an underwhelming profit story.

I’ve been negative on Live Nation for a well, and the reason is very basic. When you invest in stocks, you get a piece of a business. If that business doesn’t generate consistent real earnings, then your investment solely relies upon the next person to be willing to buy your piece for a higher price.

Let’s break that idea into parts.

Revising The Bearish Thesis On Live Nation Entertainment

I’ve been saying for over a year now that Live Nation is uninvestable. Frankly, this was and still is a stock that constantly reminds me how the market can be quite inefficient.

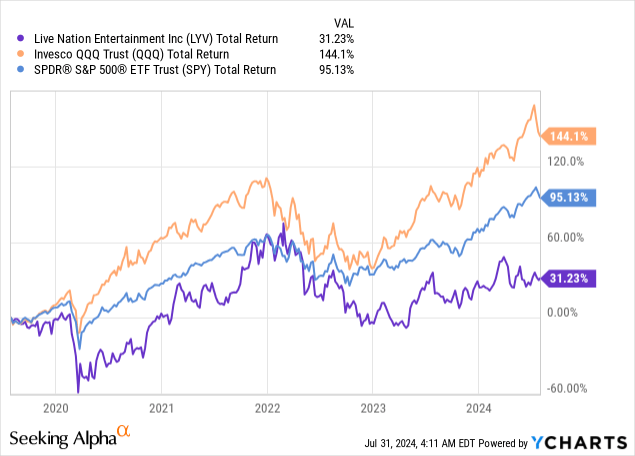

Although shares severely underperformed the market over the past five years, Live Nation still traded at a valuation that I found to be detached from reality.

I never questioned Live Nation’s leadership, and essential monopoly, in the live event industry. However, I think the company’s business model is not working, at least not for investors.

It never generated true profits but rather enjoyed a favorable cash cycle primarily because of the timing of ticket purchasing, which occurs several months ahead of the event itself.

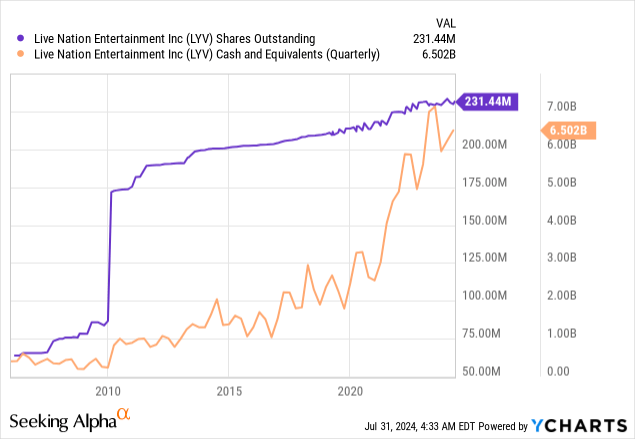

This is best reflected by the fact that despite sitting on a massive pile of cash, the company consistently dilutes its shareholders.

Now this is a good time to get back to basics. I don’t think anybody would consider investing in an asset that doesn’t generate a return in the form of cash. Let’s take an apartment as an example.

What if I told you that the apartment can only be acquired by other investors, and you cannot rent it? Would you buy the apartment? I think that paints the absurd picture of investing in a mature company that isn’t generating consistent earnings for the shareholder.

And with that, let’s dive into the recent report.

Another Quarter Of Unprofitable Growth For Live Nation

Revenues in the second quarter were $6.0 billion, slightly beating revenue estimates (although estimates declined sharply during the quarter). EPS was $1.03, below expectations for $1.07.

Revenue growth of 7% Y/Y was offset by a 30 bps margin contraction, leading net income to be essentially flat.

Cash flow metrics deteriorated across the board, with operating cash flow margins contracting 190 bps, and capex more than doubling.

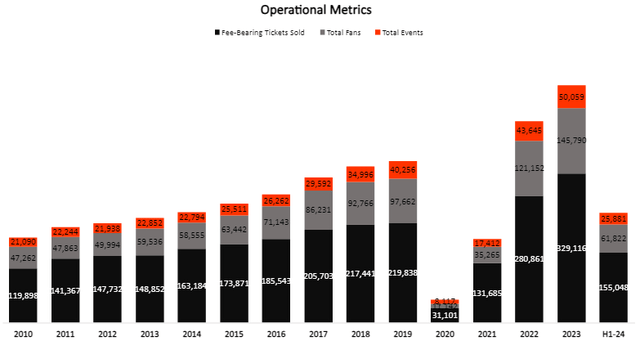

Once again, operational metrics paint a much brighter picture, reflecting the detachment between the company’s financial and operational results:

Created by the author using data from Live Nation Entertainment financial reports (10-K); Numbers in thousands except Total Events.

Total events, total fans, and fee-bearing tickets sold are on pace to deliver 17%, 10%, and 4% growth, respectively.

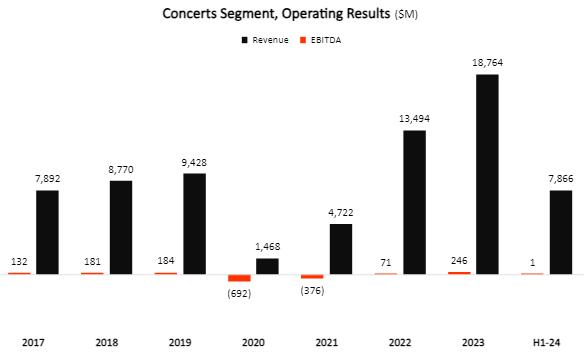

Created by the author using data from Live Nation financial reports.

The concerts segment grew by 14% in the first half of 2024, driven by more concerts. However, revenue growth was more than offset by an increase in SG&A and direct operating expenses, leading to a margin contraction. In the second quarter, margins improved to a 60 bps expansion.

Created by the author using data from Live Nation financial reports.

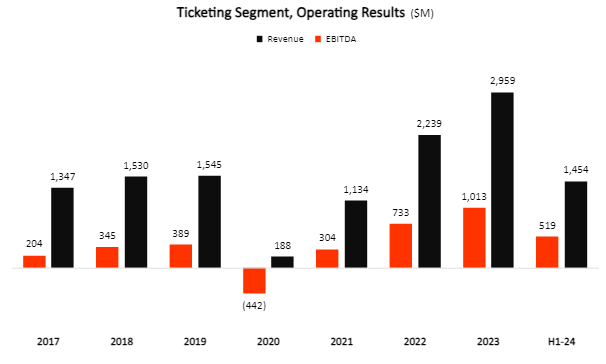

Revenues in the ticketing segment grew 5% Y/Y, in line with volume, reflecting steady pricing. Notably, tickets sold grew slower than events and concerts, reflecting smaller events and market share losses. Live Nation may be taking fewer events in an attempt to ease regulators.

Created by the author using data from Live Nation financial reports.

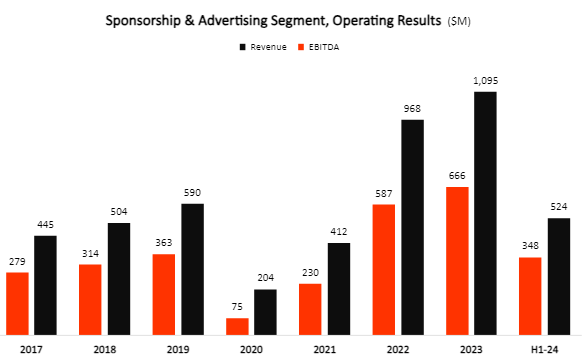

A bright spot was Sponsorship & Advertising, with revenue growth of 11% in the first half, and a 6.9-point improvement in margins, leading to growth of 25% in operating income. If the DoJ ends up breaking Ticketmaster from the company, the sponsorship segment might be the savior.

Overall, this quarter was more of the same. Live events remain strong (although growth is slowing down), but there are no material profits to speak of. By the way, the share count increased by an additional 0.6% Y/Y.

LYV Stock’s Valuation Still Isn’t Based On Relevant Metrics

There are several ways to simply evaluate whether a company’s price is reasonable.

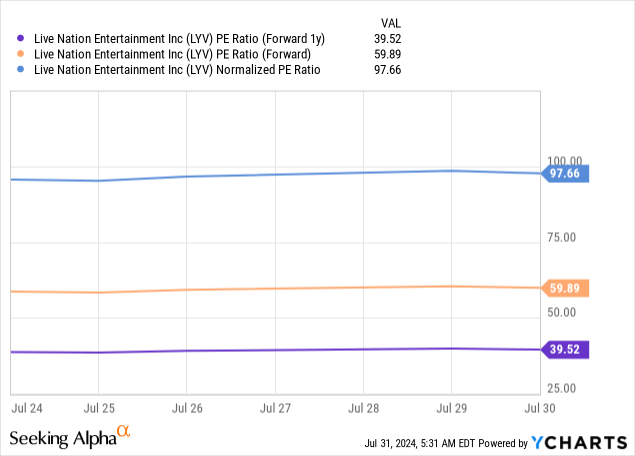

If we look at P/E, I think it’s safe to say it’s impossible to justify Live Nation’s current valuation, at 60 times forward earnings:

Consensus estimates still put ’25 EPS growth at 65%, expecting a miraculous margin improvement on revenue growth of 8.5% for the year. This seems more like a glitch than a real projection in my view, as Live Nation has never demonstrated an ability to drive such operational leverage.

Another relevant way to judge Live Nation’s price is by relying on normalized free cash flow, which I calculate by adding depreciation and amortization and subtracting capex from the company’s net income. This makes up for the timing effect of the company’s cash cycle.

However, for the near term, capex is expected to equal depreciation, as they invest in Venue Nation, so it’s not that different from the P/E analysis we did above.

Conclusion

Live Nation remains a pricey stock in a company that doesn’t generate shareholder earnings on a consistent basis, and is under major regulatory and growth slowdown risks. I want no part of that.

The second-quarter results showed no sign of change, as dilution continued, no cash was returned to shareholders, and the detachment between operational and financial results remained clear.

I reiterate Live Nation at “Sell.”