Jobs

Moving Markets: The All-Important Jobs Data (SP500)

DNY59

We’re continuing with our moving markets series. Last week, we discussed the importance of Nvidia’s earnings report, GDP, and PCE data. While we witnessed mild volatility last week, much of the crucial data came in positive, enabling the S&P 500 (SP500) “SPX” and other markets to remain afloat. This week, we have the critical jobs data. Last month, the worse-than-anticipated job numbers caused fears of a substantial slowdown to fester, causing one of the most significant spikes in volatility.

Therefore, the market looks forward to this week’s nonfarm payroll report with skepticism and anxiety. Nonetheless, the technical image has improved, the fundamental backdrop remains solid, and the sentiment has strengthened recently. Moreover, the Fed continues moving closer to adopting a more accessible monetary policy, there could be substantial upside potential in the AI rally, and there are other favorable variables to consider. Due to the constructive setup, I am keeping my SPX year-end target at 6,200.

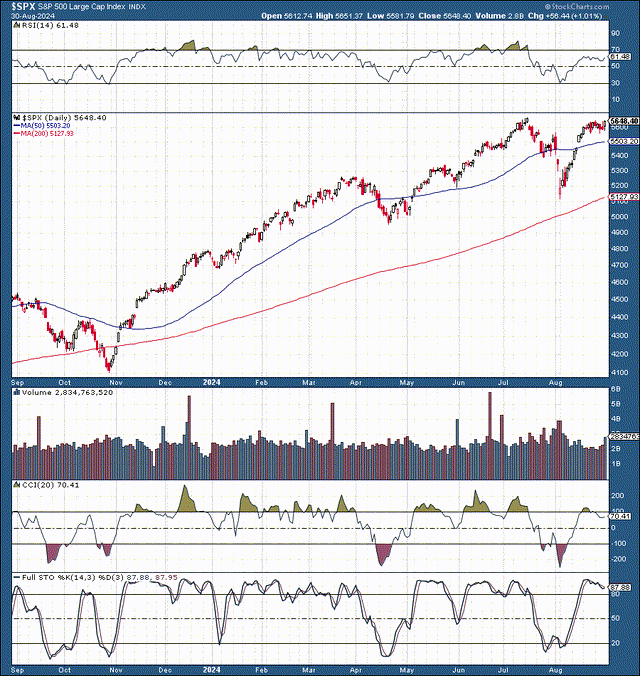

The SPX Technicals Continue Improving

The technical image has improved drastically, as we’ve seen one of the sharpest V-shaped recoveries on record in the SPX. Also, the SPX is going through a long-term inverse head-and-shoulders pattern and could move above the neckline in the approximate 5,600-5,700 range. Moreover, despite the RSI being around 60, the SPX is not significantly overbought and could experience a melt-up to new ATHs soon. On the downside, significant support is around the 5,500 level, and we certainly want the SPX to stay above the critical support 5,400-5,300 range.

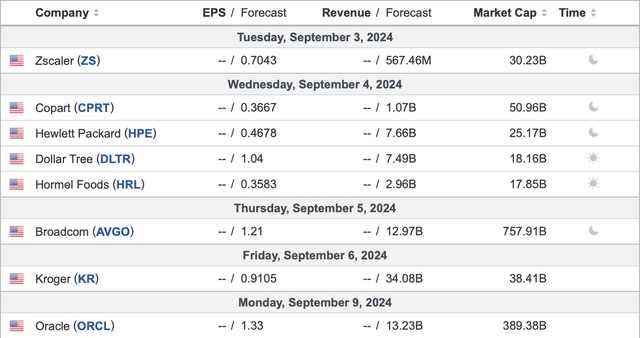

Several Earnings to Consider

While the heart of earnings season has passed, we have several exciting reports this week. One of the most crucial earnings reports I can recall came in last week (Nvidia). Despite the muted market reaction, Nvidia’s (NVDA) earnings report was solid, and the company offered excellent guidance. Therefore, Nvidia’s earnings were successful in keeping the AI bull market alive. This week, we have more crucial AI-related earnings reports from Broadcom (AVGO), Zscaler (ZS), Oracle (ORCL), and others.

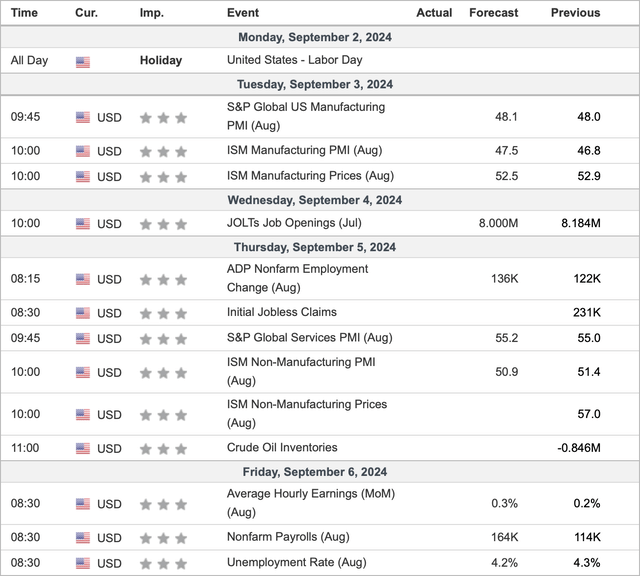

Critical Data Week Ahead

Last week, we saw better-than-expected GDP and slightly lower-than-anticipated PCE inflation data. Generally, it was a healthy data flow-wise week, but we need the positive news flow to continue. This week, we have the all-important nonfarm payroll number. Last month, the worse-than-expected jobs data enabled panic to engulf markets. On Friday, preferably, we can see 150-200K, which may be the Goldilocks zone. Below the 150-120 mark, the market could get skittish again.

Also, it is uncertain how the rate cut probabilities would be impacted if the job number was substantially higher. We also want to prevent the unemployment rate from surging on us. Therefore, a 4.2-4.3% unemployment rate may be optimal, and the market may be disappointed if unemployment increases to 4.4% or higher.

The Fed – 25 or 50 Bps?

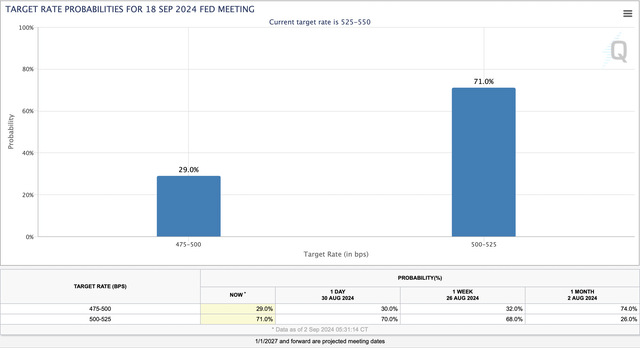

Rate Probabilities (CMEGroup.com)

There is about a 30% probability that the Fed will cut by 50 Bps instead of just 25 Bps this month. However, we still have the crucial jobs number on Friday, which could skew the Fed rate cut exceptions. A nonfarm payroll report below 150K could increase the probability of a 50 Bps rate cut. Likewise, a number that is hotter than the estimates could cause the likelihood of a 50 Bps rate cut to drop. The positive factor is that the market is set on a rate cut in September, and the Fed appears ready to cut.

Therefore, seeing the Fed and the market on the same page is constructive. The most crucial element is that the Fed is beginning to cut, which could be the beginning of a long easing cycle. Thus, we may see substantially lower rates, potentially going to zero, and QE and other easing measures before the upcoming easing cycle is complete. This upcoming economic environment should benefit high-quality stocks and other risk assets. Valuations could rise as increased liquidity searches for a home.

Why Valuations Likely Will Increase

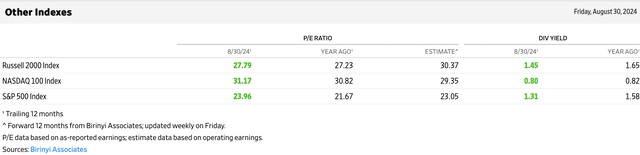

Major Average Valuations (WSJ.com)

While valuations could increase, they will likely not do so blindly. Instead, valuations could rise for a good reason. The “good reason” may be a lack of alternative asset classes as the increased liquidity looks for its home. Why would market participants invest in low-yielding bonds and treasuries in an elevated inflation environment when they could invest in fast-growing companies during the AI boom era?

Also, higher earnings and continued efficiency increases could lead to better-than-anticipated profitability for many companies. Therefore, we should see substantial earnings increases underneath the higher valuations, enabling the market to stay together while appreciating in future years.

Provided the more accessible monetary atmosphere, likely growth improvements, considerable AI potential, and other constructive variables, we could see solid H2 and 2025 ahead. Therefore, I am keeping my year-end SPX target at 6,200. The SPX could move on to the new ATHs in 2025 – 6,500-7,000 (target range).