Bussiness

NFIB Expert Testifies Before Senate Finance Committee on Stopping the Massive Tax Hike | NFIB

NFIB Expert delivered testimony to Congress on why the 20% Small Business Deduction should be permanent.

What it means: NFIB Vice President of Government Relations Jeff Brabant explained the impact of the looming massive tax hike on small businesses should the 20% Small Business Deduction expire at the end of 2025. The 20% Small Business Deduction was created as a part of the 2017 tax law to level the playing field between small businesses and larger corporations. Its expiration would result in an unprecedented tax hike on nine out of 10 small businesses.

Our take: Congress needs to protect America’s small businesses and make the 20% Small Business Deduction permanent.

Take Action: Help stop the massive tax hike by telling Congress to make the 20% Small Business Deduction permanent.

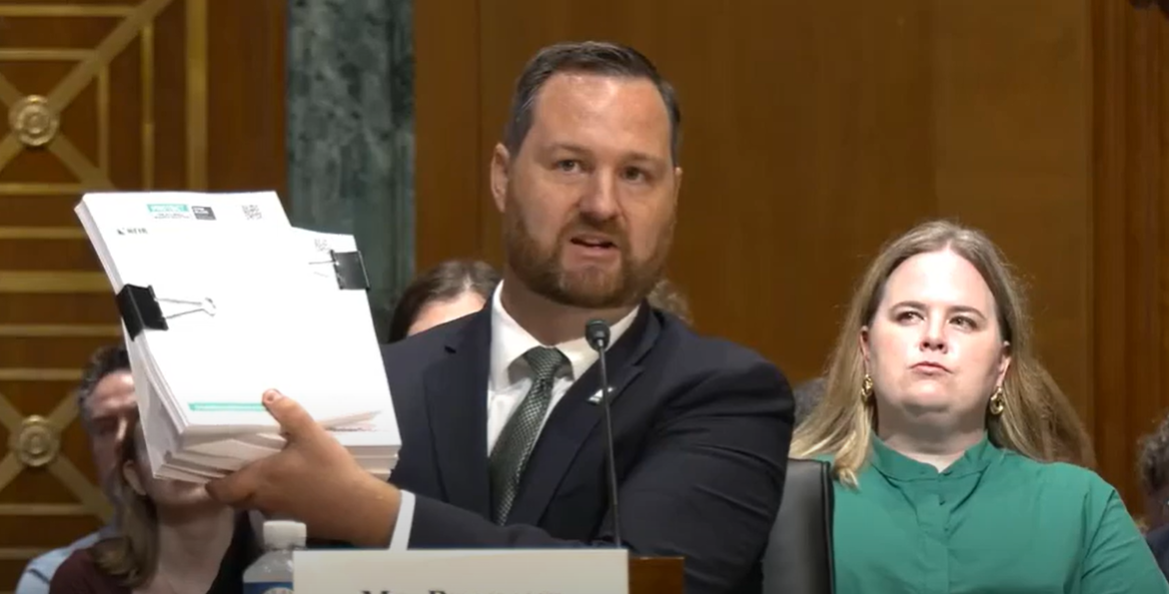

NFIB Vice President of Government Relations Jeff Brabant testified before the U.S. Senate Finance Committee in a hearing titled “The 2025 Tax Policy Debate and Tax Avoidance Strategies,” on the importance of making the 20% Small Business Deduction permanent to avoid a massive tax hike on 30 million small businesses.

“The creation of the 20% small business deduction has been crucial to the survival of small business owners. Since its passage, the small business economy has endured a plethora of issues including a pandemic that closed many businesses for long periods, record inflation, and a historically tight labor market. This deduction empowered small business owners and allowed them to not only survive these difficult times but to thrive,” said Brabant.

Learn more and watch the hearing in its entirety.

Take Action: Tell Congress to stop the massive tax hike and make the 20% Small Business Deduction permanent.