Shopping

No-buy 2025: So you want to try a year without shopping?

Published

2 days agoon

By

Admin

There’s a common saying that when you step outside in London (or any city in England for that matter), £100 leaves your account almost instantly. Without realising, you’ve spent more money than you anticipated in a day because of the rising cost of living. Matters are made worse for our bank accounts by the fact that we are manipulated by Big everything: Big Beauty, Big Fashion, Big Sweet Treat and Big Matcha alike. We are told we can buy happiness and relaxation through “self-care” products like face masks and pamper sets and even buy a whole new life through purchasing the “right” clothes and shoes.

There’s a pervasive belief that consumption equates to happiness. I often catch myself feeling inexplicably sad if I’ve gone out for the day without spending any money, as though the act of leaving the house isn’t about enjoying fresh air or connecting with nature but about fulfilling the role of a “good” consumer. When I fail to meet that expectation, it feels like I’ve failed altogether.

More and more young people feel the same way and ended 2024 declaring they wanted to change their consumption habits by participating in a low-buy or no-buy year in 2025. “I have been living paycheck to paycheck, in and out of my overdraft, since I got my first job at 16,” explains 26-year-old Mia Westrap, who spearheaded the no-buy year trend on TikTok this time last year. “At university, I got into £3,000 worth of debt in my overdraft. What I’m doing with this no-buy year is using it as a tool to really understand my finances and take a hard look at where my money is going. I fell victim to lifestyle creep; whether I had a salary of £24,000 or £35,000 a year, I still ended up in the exact same position every single month.”

While it can be argued that Westrap ended up in her overdraft every month regardless of her salary because of the cost of living crisis and structural issues, Westrap and other no-buy commentators encourage people to take more responsibility for their finances. If you want to challenge your consumption habits and save money, here are some tips on how to successfully participate in a low-to-no-buy year.

Before embarking on a low-to-no-buy year, you need to familiarise yourself with your finances. For many, the idea of checking their bank balance is daunting, but understanding how much money you have coming in each month and where it’s going is essential. “Rather than viewing your money as your worst enemy, try to see it as your best friend,” Westrap tells Dazed. “I was determined to stop feeling a pit in my stomach every time I checked my bank account. So, on a day when I felt particularly brave, I went through three months’ worth of bank statements to see exactly where my money was going. Even by simply doing that and cancelling a few subscriptions, I was able to save myself three figures a month.” The more familiar you become with your finances, the less intimidating checking your bank account will feel.

Your excavation shouldn’t stop at your banking app. Before committing to a year without shopping, take stock of what you already own. “Shop your own belongings!” exclaims Westrap. “Go through your bookshelves or wardrobe and rediscover the things you already have.” Hannah Blass, a 29-year-old former shopaholic who participated in a clothing no-buy last year, agrees. “Focus on decluttering your wardrobe and analysing what you wear and don’t wear while you’re on your shopping break. This process kept me focused on what I already owned. Engaging with my wardrobe kept me busy, and my perspective shifted from seeing my closet as ‘half empty’ to ‘half full’.”

Keeping track of what you own can also be enjoyable. For instance, you could catalogue your books using the LIBIB library management app by scanning their barcodes with your phone. The app allows you to see your entire collection, helping you rediscover forgotten favourites and reignite excitement about what you already have.

It’s vital to make a realistic plan before you begin your low-to-no-buy year. The goal is to challenge your consumption habits and build discipline, not to punish yourself. For example, if Netflix is something you truly enjoy and use regularly, there’s no need to cut it out entirely. Instead, focus on eliminating services or expenses you use less frequently or are more willing to let go of. A practical approach will increase your chances of success.

“I structured my no-buy year into three lists: red, yellow and green,” Westrap explains. “The red list included absolute ‘no’s’ in terms of what I could spend my money on, notably Pepsi Max (which I spent around £2k a year on at that point), eating out at restaurants, takeaways, books and clothes. Yellow items were things I was allowed to spend money on but with some caveats, such as cinema tickets but no snacks or drinks at the cinema. The green list included things I didn’t restrict at all, like groceries. I didn’t want to set myself any covert ‘food rules’ due to a disordered eating past. If you’re like me and enjoy gamifying your life, having rules to hold yourself accountable can be the best approach to a no-buy year.”

Similarly, 35-year-old Elysia Berman who participated in a no-buy year last year, emphasises the importance of balance: “Having some allowances for small indulgences makes it easier to stick to your commitment to avoid more significant expenses like clothes or makeup. A moderate, flexible plan is key to making a no-buy year successful.”

This tip is crucial for a successful low-to-no-buy year: eat before leaving the house and, if possible, bring snacks with you. In fast-paced city life, where we’re always rushing from one place to another, eating often takes a backseat. However, a significant portion of our spending goes on food and drinks we could prepare at home. Taking the time to plan meals and snacks not only saves money but also allows you to improve your cooking skills.

“Get used to carrying a heavy bag around with everything you’d be tempted to buy,” Westrap advises. “I would never leave the house hungry; otherwise, I’d grab quick, easy food while I was out. I’d carry a coffee flask, a book and an extra layer of clothing so I wouldn’t be tempted to shop unnecessarily.” Small preparations like these can make a big difference, helping you stay on track and reduce impulse spending while you’re out.

Self-discipline can be challenging, but you don’t have to navigate your low-to-no-buy year alone. Share your plan with friends and family and ask them to help keep you accountable when temptation strikes or when you’re considering bending the rules. Seek second opinions before making purchases or enlist your most opinionated friend to challenge your decisions. Do you really need those shoes, or could that money be better saved or directed towards mutual aid?

“As part of my no-buy rules, I recruited an accountability partner (my fiancé),” explains Blass. “They regularly checked in on my progress, providing that extra external pressure to stay consistent.”

You will slip up and break your rules from time to time – it’s inevitable! When you’re accustomed to mindless consumption, breaking the habit is no easy feat. However, deciding to challenge your overconsumption is already a significant step towards becoming a more mindful consumer, saving money and spending on what truly matters to you.

“I thought I’d be really hard on myself whenever I broke my no-buy year rules, but I ended up showing myself a lot of grace,” admits Westrap. “My weight fluctuates throughout the year, and during the summer, I felt so low about my body image that buying one top and one pair of trousers was the best thing I could do for myself. They became staples in so many outfits, and because it was a planned and thoughtful purchase, I didn’t feel too guilty. For anyone doing a no-buy year, I think it’s important to focus on how well you’re doing overall. Even one day of not buying anything unnecessary is better than zero days, and that’s often the starting point for most of us.”

Westrap also warns against falling into a defeatist mindset: “It’s easy to think, ‘What’s the point?’ especially for those living paycheck to paycheck or in debt. You might say, ‘I’m going to max out my overdraft this month anyway, so why not now?’ This can quickly spiral into, ‘I’ve broken my no-buy year, so I might as well spend freely for the rest of the month.’ Instead, recognise that breaking one arbitrary rule doesn’t define your progress. Acknowledge it, move on and keep going.”

Winter Storm Blair: 1,400+ Flight Disruptions And Counting

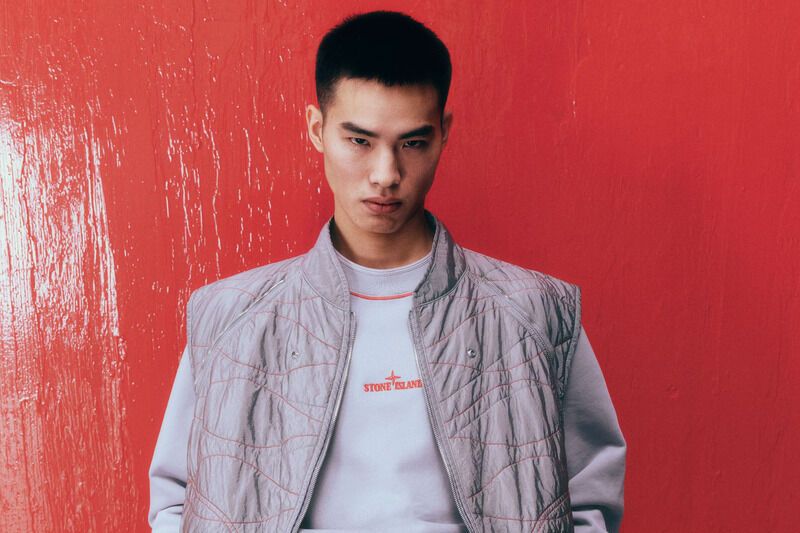

LNY-Inspired Technical Fashion

Human Condition: City Park and Metairie Cemetery are historic and connected

More Jobs Data This Coming Week: Nothing To Suggest A Change In Trend Is Afoot

Jobs report highlights first full trading week of 2025: What to know this week

What is next for the Browns’ longest-tenured player?

Broncos’ depth chart for today’s game vs. Chiefs

Five bold perspectives parents can take as their kids play youth sports