Infra

Nutanix Stock: A Fairly Priced Leader in Hyperconverged Infrastructure (NASDAQ:NTNX)

Thapana Onphalai

Summary:

- Nutanix is a company that develops data management software based on the technologies of hyperconverged infrastructure (HCI) and data virtualization.

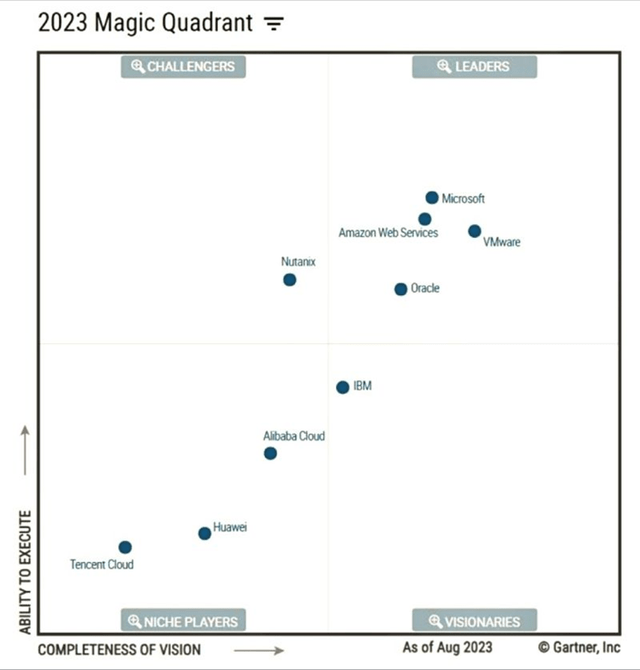

- Nutanix is currently closer to the status of an established business, according to Gartner.

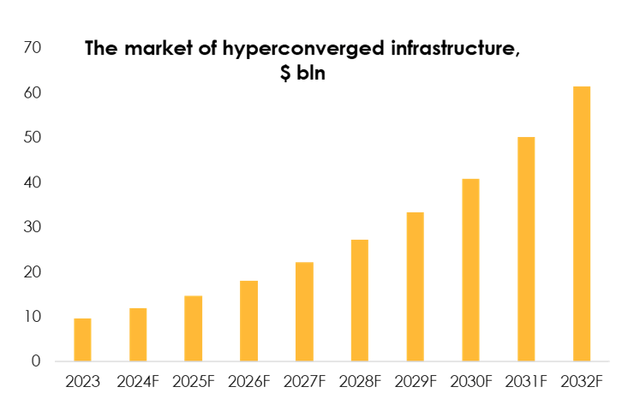

- The HCI market was valued at $9.6 billion in 2023 and the virtualization market totaled $3.9 billion in 2023. By 2030, these markets are projected to be worth $61.5 billion and $10.8 billion, respectively.

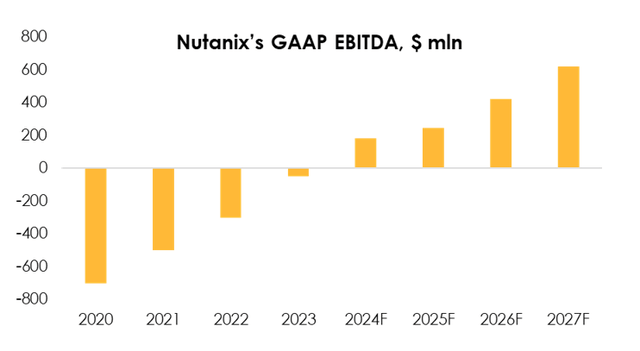

- We expect the company to continue delivering a positive EBITDA. Full-year EBITDA will turn positive for the first time in 2024, totaling $181 mln, and is set to rise to $244 mln (+34% y/y) in 2025.

- Despite that Nutanix is showing steady EBITDA and customer base growth, upcoming positive for the company is already in its price, so we can’t give it a Buy status. We put the fair value of Nutanix stock at $58/share. The status is HOLD.

Investment thesis:

We expect that due to a large customer base and the rising number of major customers, the company will deliver steady financial results. The CAGR of Nutanix main market is expected to be 22,7% up to year 2032. We see Nutanix as the strongest player in this market, as it has the most effective and applicable product and a large customer base. Currently, Nutanix valuation takes all the upcoming positive into account. We are neutral with Hold status and target price $58.

Business Overview

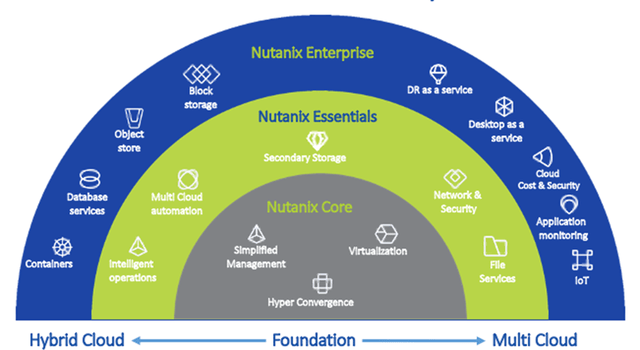

Nutanix is a company engaged in creating data management software. Nutanix has the following main business segments:

- Cloud Platform: data management solutions on a customer’s own cloud, which use hyperconverged structures technology. The product is also used for open and hybrid cloud structures. It allows working with data virtualization, creating high-loaded databases, proprietary services and solutions for AI and machine learning.

- Cloud Infrastructure: consists of a variety of services. AOS – data storage and interaction with data for server clusters, including data storage protection and optimization. AHV – data virtualization and management, works with the Nutanix cloud platform and is based on the open-source KVM technology. There are also services for working with proprietary networks, for deploying cloud environments, working with public cloud services (for example, AWS).

- Nutanix Cloud Management (NCM): a service for server workload planning, automation of application performance, analytics, and data administration.

- Nutanix Unified Storage (NUS): managing structured and unstructured data, a scalable solution to work with files and applications, which features a simple user interface.

- Nutanix Database Service (NDB): automated database management that can run on proprietary clouds or on public services.

Nutanix operates on a subscription-based business model. A distinctive feature of the company’s solutions is that they consist of building blocks, and, therefore, have flexibility to adapt to customer needs and make it easy to predict the cost of using the services. Nutanix’s block-based systems combine storage and computing power and offer a new model for a company’s server structure, which is more productive, mobile, and cheaper on an industrial scale.

The company has plans to develop products to work with AI, and in this area it has a partnership with NVIDIA, where they have developed joint solutions for virtualizing desktops and processes that are related to AI and machine learning.

Nutanix recently expanded the product portfolio by purchasing the D2iQ’s Kubernetes Platform (DKP) company. The deal took place at the start of 2024, and its value wasn’t disclosed. The platform deals with multi-cloud applications and AI solutions, which fits well into the Nutanix product line.

Nutanix regularly releases updates and add-ons for its products. In 2024 alone, there were updates for NDS, Cloud Infrastructure, Nutanix Move (3 updates), Nutanix Files and Nutanix Cluster Check. Generally, the company releases updates fairly often.

Nutanix GPT-in-a-Box 2.0. : This service for training the company’s own language models in partnership with NVIDIA was updated in May 2024. It was initially released in summer 2023.

It is also important to understand that the technology, which Nutanix provides for working with data, is more complex and places more focus on large customers that have bigger data management needs. This makes the Nutanix solution fundamentally different from Amazon’s cloud servers, which are more affordable but not suitable for complex tasks that require optimization.

Even though they are competitors, Nutanix is actively developing partnerships with Dell and Amazon (AWS). They enable customers to combine the functionality of Nutanix solutions and Dell servers and optimize the system without switching to another technology. The collaboration with AWS provides customers with the hybrid-cloud technology that Nutanix shared with Amazon users.

Nutanix Product Lineup:

Source: Nutanix Software Products List – HyperHCI.com

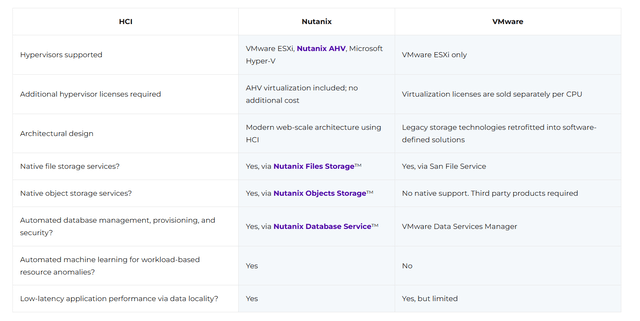

Nutanix has a direct competitor in VMware, which also deals with virtualization software and hyperconverged infrastructure. However, there are several factors that give Nutanix a critical advantage in these markets:

1. VMware solution is less efficient. Moreover, it is not recommended by the vendor itself for some tasks related to documentation processing and mail. It appears that it makes no sense for a customer to purchase VMware for only a part of his tasks when he can choose an all-round Nutanix solution.

2. Management priorities: At the end of 2023 VMware was acquired by Broadcom, which started a business optimization process that involves aggressive price increases and cost cuts, which affects the value of the product for users. As a consequence of the new policy, VMware is already losing customers (by some estimates, about 10,000 customers, or about 35% of the total, left so far), which is positive for Nutanix, as some of the competitor’s customers are coming to them.

Nutanix vs VMware solutions comparison:

Source: Nutanix vs VMware – Compare HCI & Hybrid Cloud Solutions | Nutanix

Other rivals, such as AWS and Dell, don’t pose a threat to Nutanix either.

Dell offers fairly similar solutions in hyperconverged infrastructure, but these solutions involve tight integration with Dell’s physical servers and VMware software, while Nutanix is more flexible and compatible with any hardware. Also, it is not a core product for Dell, so the company will not be able to seriously compete with Nutanix, which specializes in this niche.

AWS provides a fundamentally different technology with an open cloud server, so a customer company does not need to have its own servers and stores everything on the cloud provided by Amazon. This is a simpler way, but less efficient and not suitable for complex tasks that require optimization. The target audience for this solution is small businesses that don’t need large capacity to operate and are not ready to deal with a more complex system. The Nutanix solution only indirectly competes with AWS and is intended for a different target audience

Outlook for Nutanix

Nutanix can’t be directly compared to Dell and Amazon products, as the company offers services in a different niche, but with a similar target use. Only VMware is a direct competitor, but, as mentioned earlier, it is at a strong disadvantage to Nutanix. So, Nutanix is the leader in this market.

An assessment by Gartner takes note of all the niches where Nutanix operates, including their non-core areas, so this assessment doesn’t recognize the company as the leader, but places it into a group of established businesses. In part, it is true because the company has already taken a large share of the market and its acquisition of new customers will slow in the future.

Source: Gartner

The company has a score of 4.7/5 for its products on Gartner, and was named а leader by the research firm in 2020.

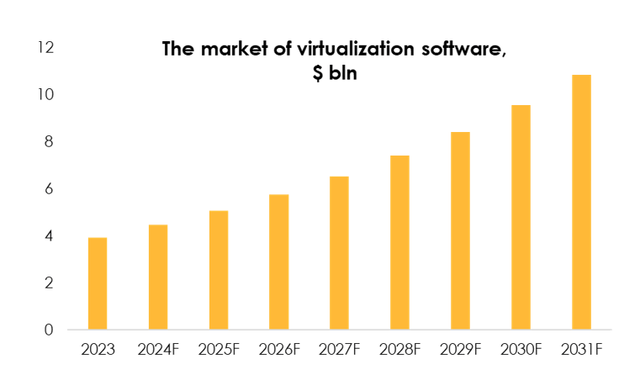

Nutanix operates in the markets of hyperconverged infrastructure and virtualization software.

The HCI market was valued at $9.6 bln in 2023. According to Fortune Business, the market value will expand to $12 bln in 2024, and will reach $61.5 bln by 2032. That means the industry’s compound annual growth rate will average 22.7% over the next 8 years.

Fortune Business Insights data

Source: Hyper-Converged Infrastructure Market Share & Growth (fortunebusinessinsights.com)

The compound annual growth rate of the virtualization market is estimated to average 13.5% for the period from 2023-2031, and the value of the market is set to reach $10.9 bln by 2029, from $4 bln in 2023. It is important to consider that it is not a core market for Nutanix.

Financial results outlook

Nutanix already has taken a large share of the hyperconverged infrastructure market and represents the most functional solution for the user, as it covers a multitude of tasks.

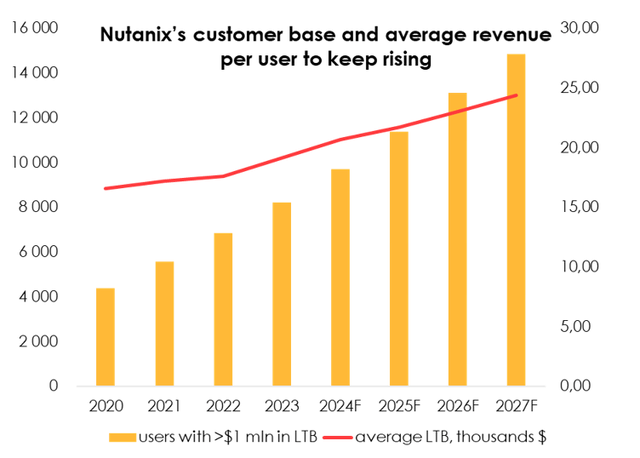

Nutanix had 2 470 large customers with lifetime bookings (LTB) of more than $1 mln as of the end of 3Q of fiscal 2024. We expect Nutanix solutions to continue to be popular due to integration with Dell and Amazon, as well as bringing new products to market. We believe the number of large customers will increase by 17% y/y in 2025 and 15% y/y in 2026 as growth in sales and marketing expenses will slow, and the company will seize a large market share. The number of customers with smaller average LTB, which stood at 23.4 thousand at the end of 3Q 2024, will rise by 4% y/y through the end of the forecast period, driven by organic growth in the company’s established business.

Source: Company data, Invest Heroes Calculations

We anticipate that the rising share of major customers will drive up LTB by an average of 5-6% y/y through the end of 2027, as prices will climb and new products will be released, while additional sales will be made to existing customers. LTB averaged $19.8 thousand in the third quarter of fiscal year 2024, and based on our assumptions mentioned above, this metric will top $24.4 thousand by the end of 2027.

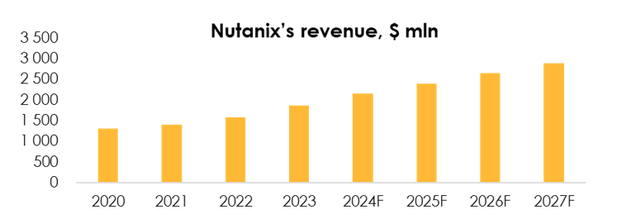

We expect Nutanix’s revenue to total $2 156 mln (+15.7% y/y) in 2024, and expand to $2 392 mln (+11% y/y) in 2025. The company will be able to achieve these results by steadily building up its customer base and retaining old customers. Nutanix offers solutions that are the best in their niche, which will help it to achieve the abovementioned.

Source: Company data, Invest Heroes Calculations

The proportion of the company’s spending on research and development declined in recent years. We expect the trend to continue, and the metric will fall from the current level of 22% of revenue to 20% of revenue by 2027. It is one of the most important expense items for a tech company, which defines its future earnings, so there will be no abrupt decrease there. We estimate that spending on research and development will total $479 mln (+8% y/y) in 2024, and will climb to $530 mln (+10.5% y/y) in 2025.

The company’s biggest expense item is spending on marketing and sales. In 3Q 2024 the metric totaled $245.9 mln (+7% y/y), or 43% of revenue. We expect spending on marketing and sales to total $972 mln (+5% y/y) in 2024, and climb to $1 059 mln (+8.5% y/y) in 2025. We believe that, as a percentage of revenue, the metric will drop from the current level of 43% to 35% by 2027. That’s because the company already gained its share of the market and won’t push aggressively to expand the customer base and hire sales managers.

General and administrative expenses will increase along with revenue, with the share of this expense item in revenue remaining at 7% until 2027 as the company’s business is gradually shifting into an established phase.

All of the abovementioned expenses are calculated on a GAAP basis, meaning they include employee bonus payments as cash costs. Payments under employee incentive programs will be incrementally curtailed as revenue expands and the company becomes profitable, and the company will have less incentive to dilute shareholders’ stakes to cover expenses.

As a result, we expect the GAAP EBITDA metric will become positive in 2024 for the first time ever, totaling $181 mln, and will reach $244 mln in 2025 (+34% y/y) amid improving financial results.

Source: Company data, Invest Heroes Calculations

The proportion of revenue that goes toward staff incentives will be reduced from the current 15.7% to 8% in 2027. These expenses will total $322 mln (+3.1% y/y) in 2024, and $320 mln (-0.5% y/y) in 2025. Incentivizing employees with stock-based compensations helps to retain key players in the company and create an industry-leading product. The company slowed the pace of stock dilution recently, and we expect the trend to continue but still have a meaningful impact over the next two years amid releases of new products.

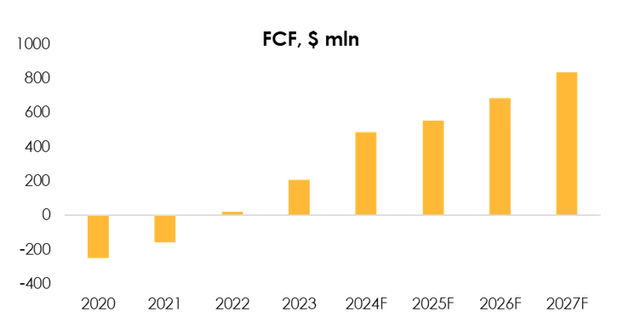

The company’s net cash flow is set to total $487 mln (+135% y/y) in 2024, and $553 mln (+13% y/y) in 2025.

Source: Company data, Invest Heroes Calculations

Valuation

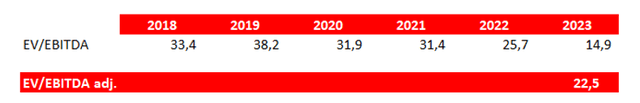

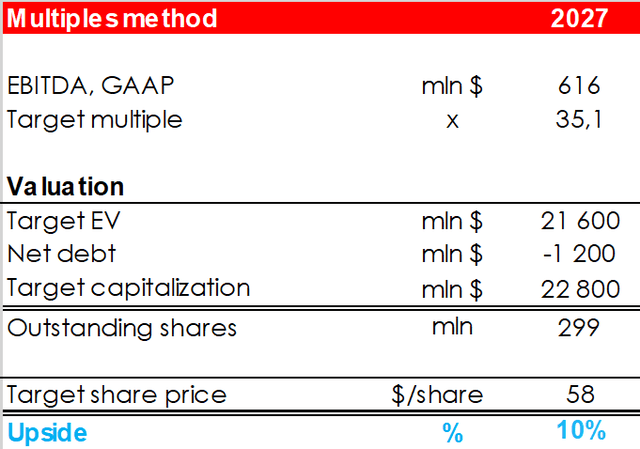

We’re evaluating Nutanix shares fair price based on EV/EBITDA multiple of 35.1x, which is in line with the industry’s historical multiples and FY2027 financial results discounted at 13% per annum.

We are using 22x base multiple, adjusted for further growth rates (59,5% per annum on average). 22x is a base historical multiple for Salesforce, adjusted for growth rates. We are using Salesforce as a proxy, as it is one of the biggest B2B SaaS companies with a representative valuation horizon.

Source: Company data, Invest Heroes Calculations

The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

According to our calculations, the fair price of Nutanix shares is $58/share. The status for the stock is HOLD.

Source: Invest Heroes Calculations

Risks

Investments in Nutanix are also having some risks:

1. Loss of market share

Non-significant risk, given that the company has strong product and weak peers in its market. Though, alternative solutions can take some of the market share from Nutanix.

2. Slowdown in customer base growth

Due to high rates and overall tightening economic situation, Nutanix can face difficulties with sales of its products, as customers might be willing to save money on investments in infrastructure.

Conclusion

Nutanix is showing strong financial performance as its market share reaches a significant part of the overall market. The company finally reached profitability and is going to bring strong positive financial results over time, as it will continue to be the HCI market leader. Though, all the positive changes in Nutanix business are already into its share price. We see the fair value of Nutanix stock as $58 a share. Our status is Hold for now. To manage the position, we recommend keeping an eye on financial statements of Nutanix and its competitors (VMWare, Dell) and industry research (Gartner, Seeking Alpha).