Entertainment

Paradise Entertainment And 2 High-Yield Dividend Stocks For Your Portfolio

In the midst of escalating tensions in the Middle East and a surprising surge in U.S. job gains, global markets have been navigating a complex landscape with mixed investor sentiment. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams, particularly as oil price fluctuations and geopolitical uncertainties continue to impact market dynamics. A good dividend stock typically offers consistent payouts and financial stability, making it a potential cornerstone for portfolios aiming to weather volatile market conditions.

Top 10 Dividend Stocks

|

Name |

Dividend Yield |

Dividend Rating |

|

Tsubakimoto Chain (TSE:6371) |

4.15% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

5.02% |

★★★★★★ |

|

Financial Institutions (NasdaqGS:FISI) |

4.84% |

★★★★★★ |

|

Mitsubishi Research Institute (TSE:3636) |

3.75% |

★★★★★★ |

|

CVB Financial (NasdaqGS:CVBF) |

4.43% |

★★★★★★ |

|

FALCO HOLDINGS (TSE:4671) |

6.28% |

★★★★★★ |

|

CAC Holdings (TSE:4725) |

4.43% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.73% |

★★★★★★ |

|

GakkyushaLtd (TSE:9769) |

4.48% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.87% |

★★★★★★ |

Click here to see the full list of 2004 stocks from our Top Dividend Stocks screener.

Let’s dive into some prime choices out of the screener.

Simply Wall St Dividend Rating: ★★★★★☆

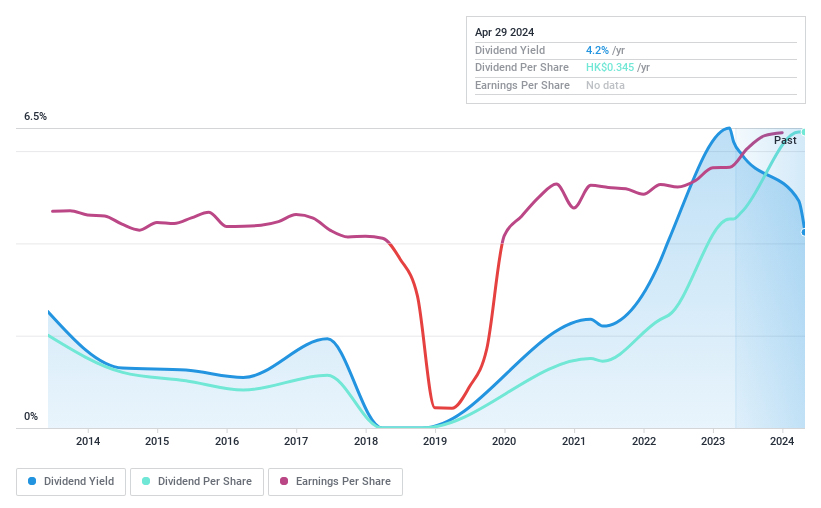

Overview: Paradise Entertainment Limited is an investment holding company that primarily offers casino management services in Macau, the People’s Republic of China, and the United States, with a market cap of HK$904.88 million.

Operations: Paradise Entertainment Limited generates revenue from various segments, including HK$121.46 million from Gaming Systems, HK$681.22 million from Casino Management Services, and HK$10.15 million from Innovative and Renewable Energy Solutions Business.

Dividend Yield: 10%

Paradise Entertainment’s interim dividend of HK$0.05 per share, payable on October 15, 2024, is well-supported by earnings with a payout ratio of 29% and cash flows at a cash payout ratio of 65.4%. Despite becoming profitable this year with significant sales and net income growth, the company’s dividend history shows volatility and unreliability over the past decade. Trading at a substantial discount to its estimated fair value, it offers an attractive yield within Hong Kong’s market context.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries with a market cap of approximately HK$1.34 billion.

Operations: Jutal Offshore Oil Services Limited generates revenue primarily from its oil and gas segment, which accounts for CN¥2.98 billion, alongside contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Dividend Yield: 8.6%

Jutal Offshore Oil Services announced an interim dividend of HK$0.03 per share, payable on October 16, 2024. The dividend is well-covered by earnings with a low payout ratio of 15.5% and cash flows at a cash payout ratio of 24.1%. Despite recent strong earnings growth and substantial revenue increases, the company’s dividend history has been volatile and unreliable over the past decade, though it trades significantly below its estimated fair value.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited focuses on the research, development, manufacture, and sale of agricultural and power machinery globally, with a market cap of HK$18.42 billion.

Operations: First Tractor Company Limited generates revenue primarily through its agricultural and power machinery segments worldwide.

Dividend Yield: 3.6%

First Tractor’s dividends are supported by a low payout ratio of 31.3% and cash payout ratio of 40.2%, indicating coverage by both earnings and cash flows. Despite a 34.5% earnings growth over the past year, its dividend history has been volatile and unreliable, with payments not consistently growing over the last decade. The stock trades at a discount to its estimated fair value, but its dividend yield is lower than top-tier payers in Hong Kong markets.

Make It Happen

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1180 SEHK:3303 and SEHK:38.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com