Entertainment

Paramount: Why The Entertainment Giant Is A Modern Value Play (NASDAQ:PARA)

simpson33/iStock via Getty Images

Investment Thesis

Paramount Global (NASDAQ: NASDAQ:PARA) (NASDAQ: NASDAQ:PARAA) is a major conglomerate in the media and entertainment sector in the US, the company was established in 2019 by the merger of Viacom and CBS. National Amusements, Inc (NAI) directly or indirectly owned approximately 77.4% of the voting Class A Common Stock, and approximately 9.7% of the Class A Common Stock and non-voting Class B Common Stock on a combined basis.

PARA has been under a lot of scrutiny lately, due to its large debt, future profitability uncertainty, and potential acquisition target. However, it is a company that trades at a 64% discount to its book value and sell-side analysts expect an increase in profitability in 2024 and 2025, leaving the company trading at an attractive multiple from a value perspective.

Skydance has proposed to merge with Paramount Global in a rather convoluted deal that will be discussed below. The merger will be beneficial for reducing PARA’s long-term debt in an effort to get the balance sheet together and the consolidated company will benefit from synergies. PARA is expected to increase its revenues this year and the next, as well as its EPS.

The company at current levels is a BUY and is worth $10.00 per share more than what Skydance offered—at least $25.00 per share. The company’s increasing revenue and EPS forecast combined with its strong brand, management and future cash flows capabilities make PARA an attractive investment.

Merger with Skydance Media

There is quite a bit of interest in different divisions within Paramount Global. In March, Apollo offered to buy Hollywood Studios for $11.0bn, and the whole PARA conglomerate trades for $7.2bn. Shari Redstone (the controlling shareholder of NAI) was unconvinced by the offer and is negotiating a rival deal with David Ellison (Skydance).

In July, Paramount agreed to merger with Skydance after months of negotiations. Under the agreement, PARA will issue 317mm Class B shares at $15.00 per share (36% premium from Friday’s close) for Skydance, and in return, Skydance Consortium will make a $1.5bn investment in PARA. The primary capital will be used to re-capitalize New PARA’s balance sheet. PARAA shareholders will get $23.00 per share in cash or stock, while PARA shareholders will get $15.00 per share, for a total of $4.5bn available for public shareholders.

Skydance will also buy 100% of National Amusements (NAI) for $1.75bn. On the transaction, existing PARA shareholders will get diluted by almost a half (317mm Class B at $15.00 + 200mm in Class B warrants at $30.50 strike). However, shareholders will benefit from the Paramount/Skydance synergies that will reduce net leverage below 2.5x by 2027.

The deal also offers great incentives to the new management to bring up the price above $30.50 so that they can exercise the 200mm warrants. The merger is expected to close during the third quarter of this year and is pending regulatory approval. The agreement also includes a 45-day “go-shop period” for PARA to seek other offers.

Multiple

If the company achieves its consensus EPS estimates of $1.26 and $1.34 in 2024 and 2025, respectively, the company will be trading in the single-digit PE multiple (8.7x and 8.2x), which looks interesting at first glance, and future cash flows could be smartly used to start paying down its very large long-term debt. The EBIT multiple looks even more attractive because it does not account for the interest expense in their big pile of debt. The EBIT multiple is 3.3x and 3.4x for 2024 and 2025, respectively.

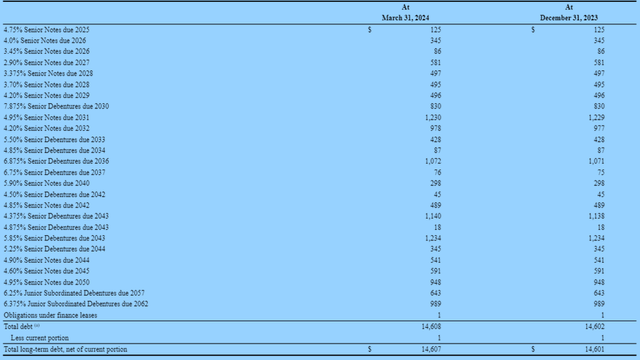

Although the amount of debt PARA has accumulated is quite high relatively to its market capitalization, most of the big principal payments on their debt is not due until 2030 as per the breakdown below, so the company has about 6 years until their debt starts to bring problems to the whole picture. Until then, there is no need to alarm.

Valuation

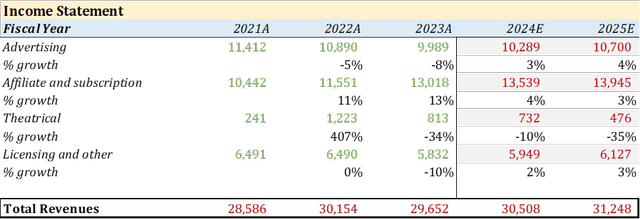

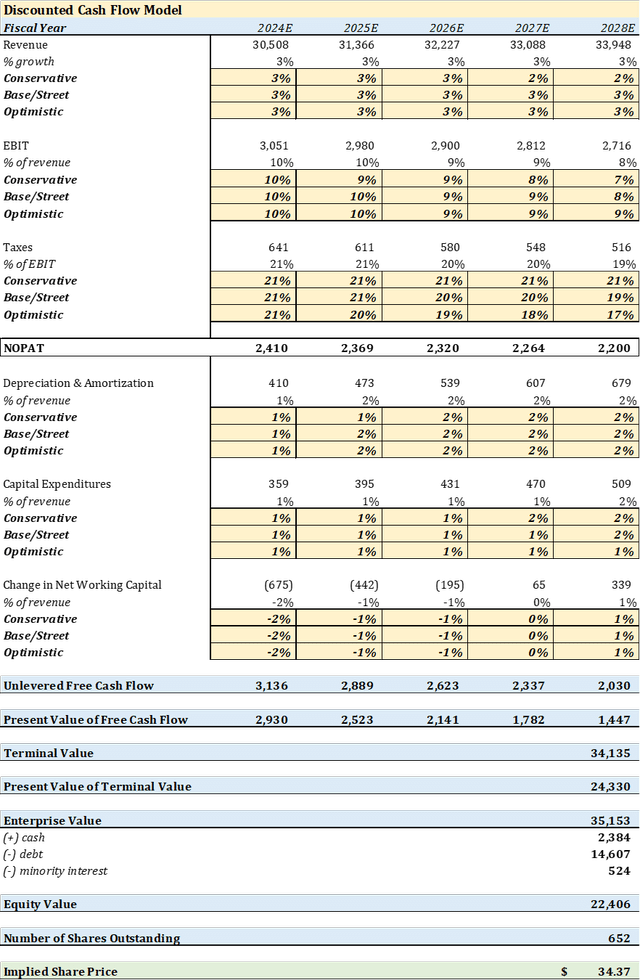

The DCF valuation model below discounts PARA’s future cash flows to come up with an accurate valuation. Using the below assumptions for the different revenue segments, we see revenue growth steadily in 2024 and 2025. Furthermore, EBIT margins were kept in the 8% -10% range as per historical averages. Taxes were kept at 21% as per the US corporate tax rate. PARA has a current market capitalization of $7.2bn ($11.00/share), trading at a steep discount to my DCF model’s implied equity value of $22.4bn, or $34.37/share.

Analyst Assumptions, Giacomo Bocanegra Analyst Assumptions, Giacomo Bocanegra

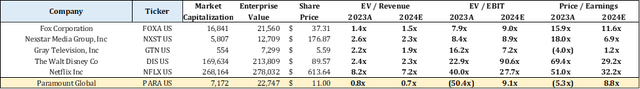

On the trading comparable side, PARA trades at a deep discount to its peers (Fox (FOXA), Nexstar (NXST), Gray Television (GTN), Disney (DIS), Netflix (NFLX)). As per my trading comparable analysis, PARA should be trading for at least $16.00 (being extremely conservative).

PARA’s most direct competitor, FOXA, trades for over 1.4x EV/revenue, higher than PARA’s 0.8x EV/revenue. PARA had a not-so-great 2023, where they lost $451mm before interest and taxes. This year is looking more promising for sure, and the multiple is expected to be almost 9x earnings this year – lower than any of its peers. GTN is the cheapest peer based on PE ratio, but this can be ignored as the company is expected to be unprofitable in 2025.

Analyst Assumptions, Giacomo Bocanegra Analyst Assumptions, Giacomo Bocanegra

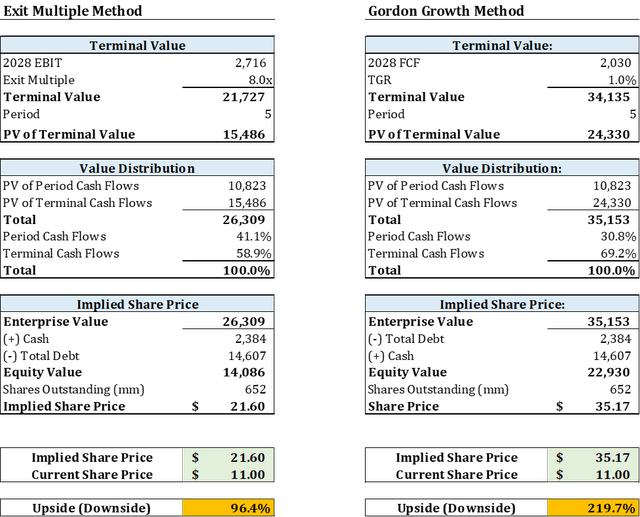

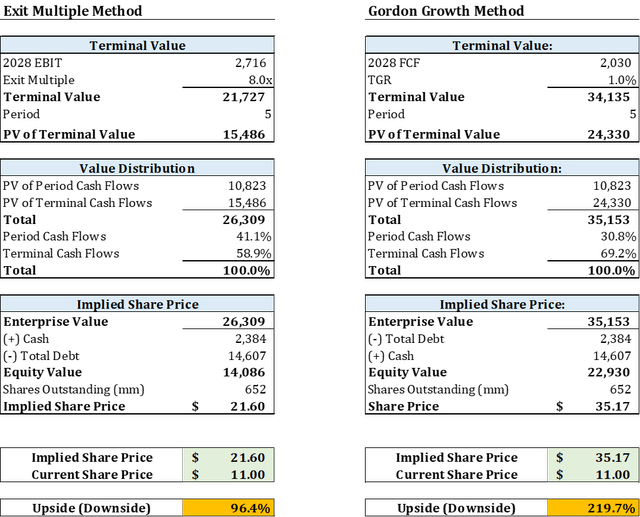

My Exit Multiple Method and Gordon Growth Method, also show great upside. Using a 8x exit multiple assumption (which is quite average), we see an equity value of $14.1bn or $21.60/share, 96% higher than Friday’s close. The implied share price will be higher if a higher exit multiple is exercised, the $14.6bn debt is reduced after the merger, and their cash positions improve from higher cash flows in the upcoming years due to synergies. The Gordon Growth Model, on the other hand, shows an equity value of $22.9bn or $35.17/share, implying an upside of 220% from current levels.

Analyst Assumptions, Giacomo Bocanegra

Risks

PARA is a company that has been accumulating a lot of Goodwill and intangible assets lately, therefore its fully diluted tangible book value is $3.2bn or 2.4x tangible book value. This is about $19.1bn less than its tangible book value.

Further, the agreement between Paramount/Skydance has a $400mm breakup fee in the case Paramount lands a better offer in the 45-day “go-shop period” or decides to terminate the merger. This could have an impact on the overall financials of PARA, but on a minimal basis. The merger is pending regulatory approval, this could extend the process and result in more costs for both parties involved.

Conclusion

The market has undervalued PARA due to its high long-term debt and its tough 2023 operating year. However, Paramount Global is nothing but a phenomenal entertainment company and one of the largest libraries of iconic and irreplaceable intellectual property (over 200k TV episodes and 4k films). Although the merger will dilute PARA shareholders, the combined company offers great benefits to shareholders that decide not to tender their shares, who will benefit from the combined synergies and management incentives to get the share price above $30.50 through warrants.

PARA on its own, presents a compelling value play, trading at a 64% discount to its book value (including intangibles). Despite its debt concerns and profitability uncertainties, the company’s prospects appear promising. Sell-side analysts predict increased profitability for this year and 2025, resulting in an attractive single-digit PE ratio of 8.7x and 8.2x, respectively. Not to mention, a deep dive into the comparable company analysis and various valuation models, including DCF and exit multiple, indicates significant upside potential, with target share prices ranging from $21.60 to $35.17.

Considering these elements, the value proposition of the Skydance/Paramount merger, along with the ability to inject capital and reduce the leverage and the possibility for increased EPS and revenue in the upcoming years, supports a BUY recommendation with a target price of at least $25.00 per share.