Shopping

Placer.ai: Black Friday shopping drives mall visit increases in November

Holiday shopping, including on and before Black Friday, helped propel indoor malls, open-air shopping centers, and outlet malls to a successful November.

According to retail analytic firm Placer.ai’s November 2024 Mall Index, all three segments saw year-over-year increases in traffic during the month, with indoor malls leading the way at a 6.4% increase. Open-air shopping centers followed at 4.8%, with outlet malls coming in at a 3.8% annual increase. In October, mall visits stabilized after a sluggish September.

Advertisement – article continues below

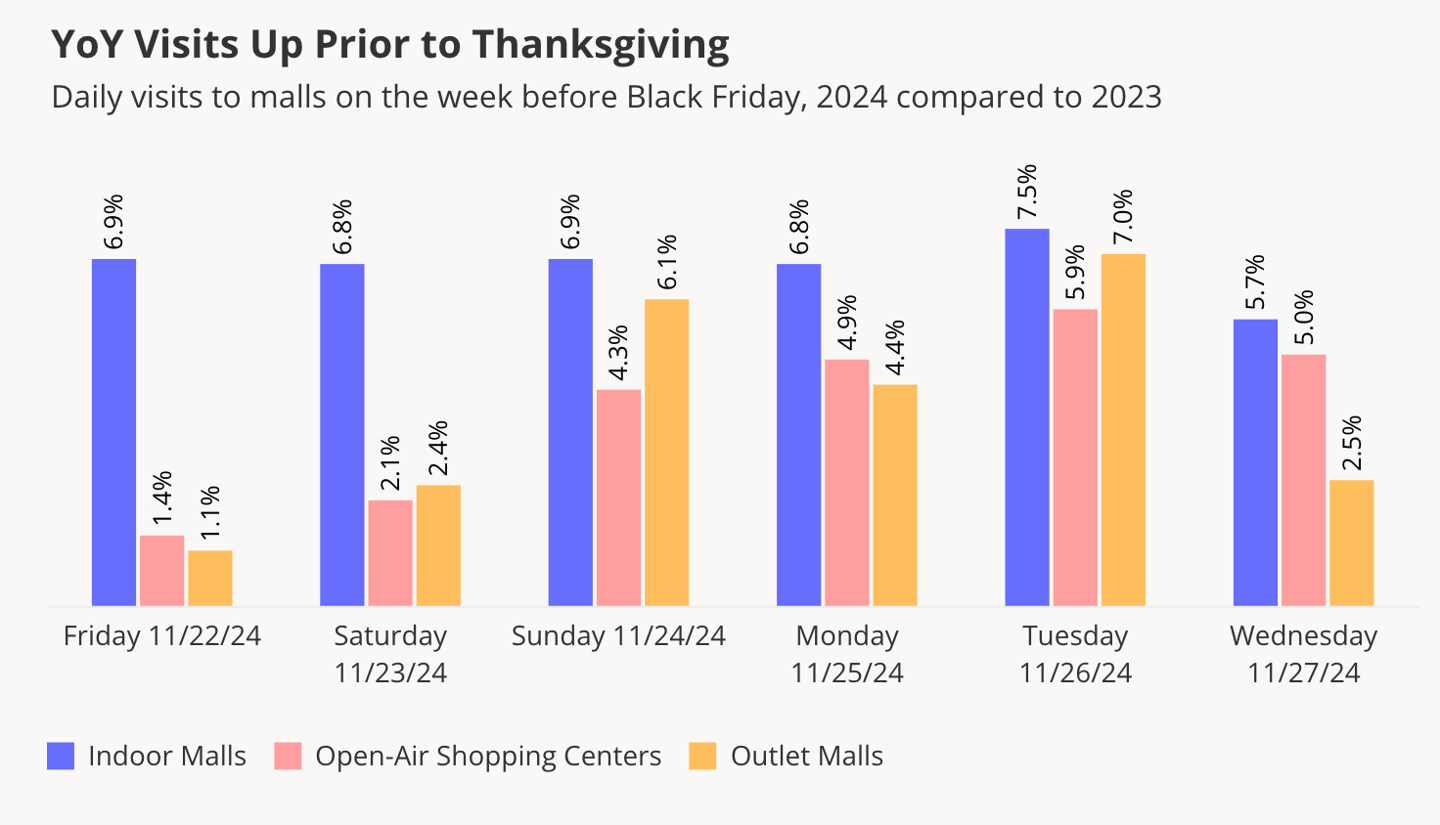

Comparing daily visits during the week before Black Friday (from Friday, Nov. 22 to Wednesday, Nov. 27) to visits during the equivalent days in 2023 (Nov. 17-22, 2023) reveals that malls received more pre-Black Friday mall visits this year than in 2023.

Advertisement – article continues below

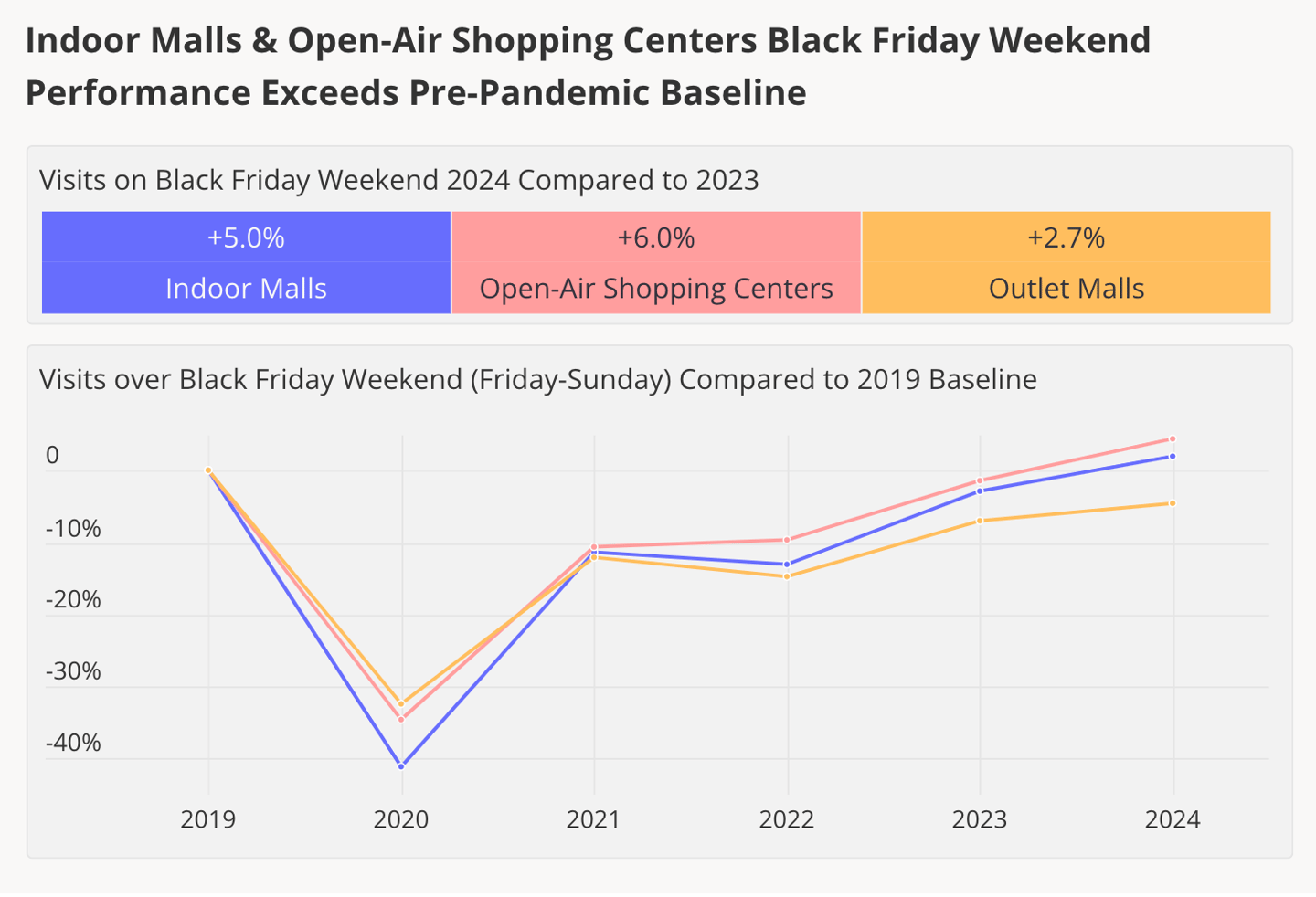

Despite the positive pre-Black Friday period, the majority of the November visit boost can likely be attributed to malls’ impressive Black Friday performance. All three mall formats saw year-over-year visit growth over Black Friday weekend, with open-air shopping centers seeing the largest visit increases (6.0%) compared to Black Friday weekend 2023. Placer.ai says that this year’s Black Friday numbers were so strong that visits to indoor malls and open-air shopping centers even exceeded pre-pandemic Black Friday weekend.

[READ MORE: Simon: Traffic up 6.4% across portfolio over Black Friday weekend]

“These numbers reveal that, despite the rise in early Black Friday deals and online shopping, many consumers still want to experience the excitement of Black Friday bargain hunting in person,” said Placer.ai content manager Shira Petrack. “And this powerful kickoff to the 2024 holiday season indicates that the unique experiential offering of malls – combining shopping, dining, and entertainment all under one roof – continue to play a central role in the wider retail landscape.”

Placer.ai’s monthly Mall Index analyzes data from 100 top-tier indoor malls, 100 open-air shopping centers (not including outlet malls) and 100 outlet malls across the country, in both urban and suburban areas.