Fitness

Planet Fitness: Recommending A Hold Despite Tailwinds (NYSE:PLNT)

J. Michael Jones

Investment Thesis

I am recommending a Hold rating for Planet Fitness, Inc. (NYSE:PLNT). There are a lot of tailwinds for Planet Fitness in this current economy, as the company is expanding its business to target a new market and is leveraging their established business framework for further expansion. The company has also performed very well in recent years, with consistent revenue and EBITDA growth. Despite these positives, I find that the stock’s valuation is fair based on my DCF valuation. Thus, I recommend investors to “HOLD” and wait until the valuation improves from the current levels.

Company Overview

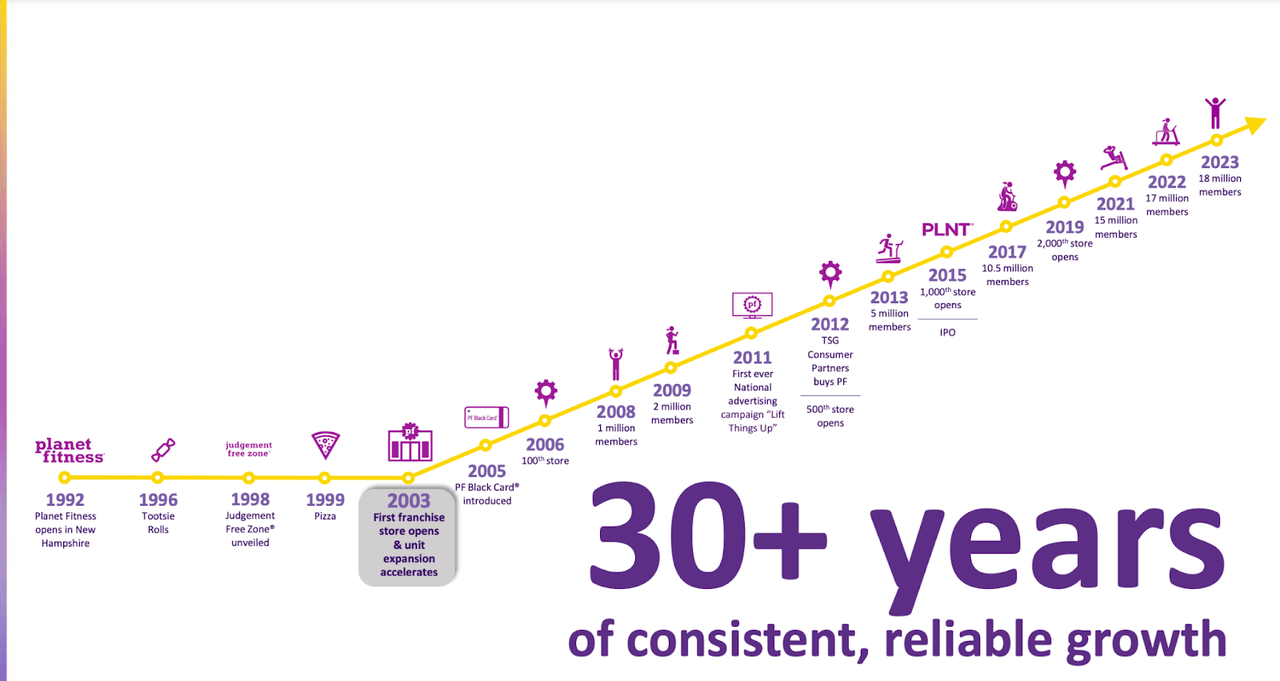

Planet Fitness, Inc. (PLNT) an American-based fitness company that started in 1992 in Hampton, New Hampshire, with the goal of enhancing people’s lives by providing a high-quality fitness experience in a non-intimidating way. Planet Fitness is in a competitive category of fitness centers that includes other companies such as Crunch Fitness, 24-Hour Fitness, LA Fitness and many more. Planet Fitness offers a wide range of services, such as cardio, weightlifting, showers, and more. Planet Fitness operates in the US, Canada, Australia, Mexico, and is currently looking to expand to New Zealand and Asia.

Business Drivers

One main competitive advantage that Planet Fitness has is its business model, and how Planet Fitness uses their low-cost memberships to its advantage. Planet Fitness has cheaper memberships, from $10-$24, and has been able to monetize a business strategy where members rarely go to their gym, but keep their membership. This membership system coupled with the low pricing allows Planet Fitness to keep making money even if there are fewer members at their locations. Their low-cost, high-volume membership system seems to be working in their favor, as they are growing in membership, and seeing financial growth as well. This focus on aiming for a high volume of memberships will push the business forward as they increase engagement and open new locations.

Planet Fitness is also one of the largest gyms in the world with locations in the US, Latin America, and Canada. Additionally, the company would like to expand their locations in the coming years. Currently, Planet Fitness has plans to expand to Spain increasing their reach among fitness, and putting a bet on European fitness locations. This expansion may seem to be a bad decision as Europe already has large fitness companies, such as Basic-Fit, but it seems like quite the contrary to me. Due to the rise of the fitness/gym industry in Europe, I believe this is a smart decision that will continue to push the brand’s image and reach to people outside of their current landscape. If the gym industry in Europe continues to grow in popularity as projected, Planet Fitness would capitalize on the rise of a new industry, expanding their reach, and have a synergistic impact on Europe’s growing gym scene.

Financial Analysis

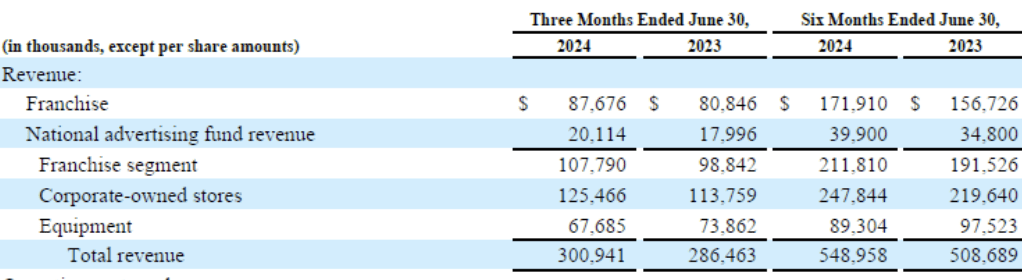

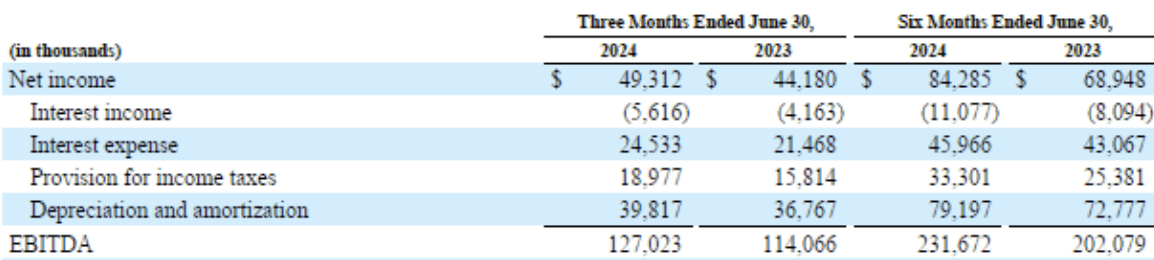

Based on the Investor presentation Planet Fitness shared in August 2024, the company’s financial performance has shown improvement, showing its ability to increase financials despite a challenged economy. Comparing the total revenue from six months after June 30th from 2023 and equivalent in 2024, revenue grew at a 7.16% YoY rate. Though more impressively, Planet Fitness’ EBITDA grew 14.64% YoY rate in the same time period from 2023 to 2024. I find these results are due to Planet Fitness’ ability to grow successfully, which, I believe, will mean that the company will be protected from economic downturn.

Planet Fitness Investor Presentation 2024 Planet Fitness Investor Presentation 2024

Risks

A risk that is common among gyms is a threat from competition, mainly Crunch Fitness and Anytime Fitness. All of these gyms provide monthly memberships, similar machines, and similar services, such as showers, hydromassage, and more. All services are provided in locations across the states – specifically, Crunch Fitness has 400 clubs, Anytime Fitness has roughly 2,300 locations, and Planet Fitness has roughly 2,400 locations in the US. It is clear that Planet Fitness is in the top of the pack out of the three. I believe that this risk can be largely mitigated by the fact that Planet Fitness is very price effective, and offers lower price points compared to its competitors. As of right now, the prices are as follows: $24.99 at Planet Fitness, $26.99 at Crunch Fitness, and $41 at Anytime Fitness. The lower price point will benefit Planet Fitness even during major economic downturns.

Planet Fitness Investor Presentation 2024

Another risk Planet Fitness may face is the growing industry of home gyms. There has been a steady rise of home fitness in the past years, due to many factors, such as hygiene, cost, space, and privacy, and most of all, COVID-19. COVID-19 shook the landscape for many gym companies with Planet Fitness in 2020, having a more than 50 percent decrease in EBITDA in 2020 compared to 2019. Additionally, with COVID-19 came the surge of individuals creating home gyms, with a 34% increase in home gyms in 2019 to 2020, eventually peaking at 36% in 2021. I believe this risk can be mitigated by the fact that the number of gym memberships is still growing and recent underperformance of companies like Peloton demonstrate that home gyms seem to be less disruptive than once forecasted. With Planet Fitness growing its members more and more, year after year (now 18 million members in 2023 compared to just 5 million in 2013), Planet Fitness should stay strong in the face of alternative competition.

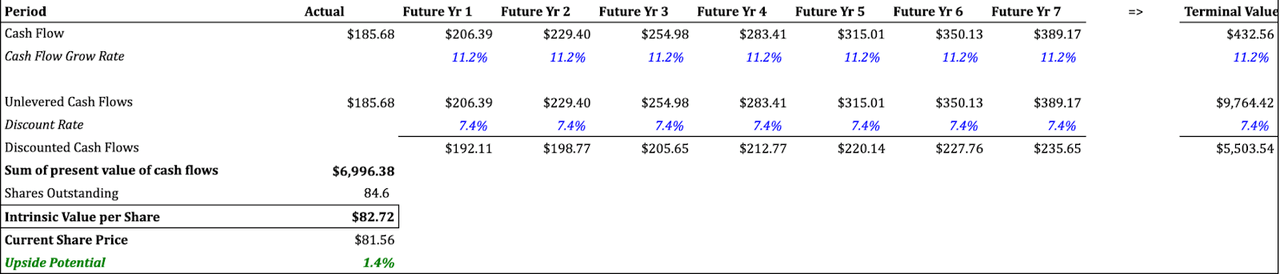

Valuation

I conducted a DCF on Planet Fitness to determine the value of the stock. I assumed that the Free Cash Flow would grow on average at 11.15%, as the company’s revenue CAGR over the past 3 years was 11.15%. This growth seems reasonable and appears to be conservative, as Planet Fitness is expanding their facilities across Europe as the fitness industry continues to grow. The terminal growth rate of 3.0% was chosen based on the current inflation rate. With these assumptions, the model implies only a ~1% upside from current levels.

Conclusion

Despite the solid business fundamentals, I recommend a Hold rating for Planet Fitness, Inc. as the valuation indicates that there is a very small upside that I see based on my DCF, and believe your money is better invested elsewhere to generate better alpha. I believe Planet Fitness is worth watching as the business is steadily growing year after year, and Planet Fitness is quite protected from risks concerning personal fitness spaces, and competition. As always, I will continue to follow any new growth regarding Planet Fitness, and will update readers appropriately.