Fitness

Planet Fitness: Visible Catalysts, But I Am Still Waiting For Growth To Accelerate (PLNT)

The Good Brigade

Summary

Following my coverage of Planet Fitness (NYSE:PLNT) in Mar’23, which I recommended a hold rating as I saw no fundamental improvements and that there were no catalysts that would have driven a strong recovery in the near term, this post is to provide an update on my thoughts on the business and stock. I believe PLNT has shown improvement over the past few months, and there are visible catalysts that could drive growth acceleration in the coming quarters (most likely in FY25). I also think the new CEO is a great fit for the business. However, I like to see these catalysts translate into actual growth before I revise my recommendation.

Investment thesis

On 06-08-2024, PLNT released its 2Q24 earnings, which saw revenue of $301 million, beating consensus expectations of $291 million, driven by franchise revenue of ~$88 million, national advertising fund revenue [NAFR] of $20.1 million, corporate-owned stores of $125.5 million, and equipment revenue of $68 million. Adj. EBITDA saw $128 million, beating street estimates by $4 million, and adj. EPS saw $0.71, beating street expectations by $0.05. Looking ahead, management reiterated FY24 guidance, expecting revenue to grow by 4-6%, adj. EBITDA by 7-9% y/y, and adj. EPS by 7-9%.

To frame up how PLNT has performed since I last wrote about it, I think improvements have been made and there is potential for PLNT to outperform over the next few quarters under the new CEO (more on this later).

In my opinion, the very encouraging data shared during the earnings was that members churn has eased and is on the right track to reaching normalized levels, although it is still elevated compared to historical levels. Notably, churn trends have sequentially improved throughout 2Q24, and this is a positive trend from 1Q24 (the first quarter that saw stabilization after the previous few quarters of continuous increases in cancellations). (Please refer to the past 8 quarters of the transcript from 1Q22 to get a sense of the churn trend, as management only qualitatively commented about it and this is not a disclosed metric.).

So, that has improved across the quarter and still elevated, but definitely better. Those cancel rates are definitely better than what we were seeing and got better across the quarter. 2Q24 earnings results call

The second encouraging development is on the macro side, where inflation has finally fallen below 3% and the labor market has become stable (a good indication that the US is not going into a hard landing). This bodes well for an improving consumer spending environment that benefits PLNT. As such, I believe the moment of growth inflection (growth to accelerate) might be around the corner (likely in FY25 based on the timing of the following catalysts). At this point, there are a few catalysts to look out for.

Firstly, management is running a test for two Black Card prices (priced at $27.99 and $29.99, respectively), and if they are well received this year, they could be implemented in early FY25, which is going to give a good pricing comparison vs. FY24. For reference, Black Card is priced at $24.99 currently, and if the price step-up is implemented, the midpoint ($28.99) represents ~16% of pricing uplift.

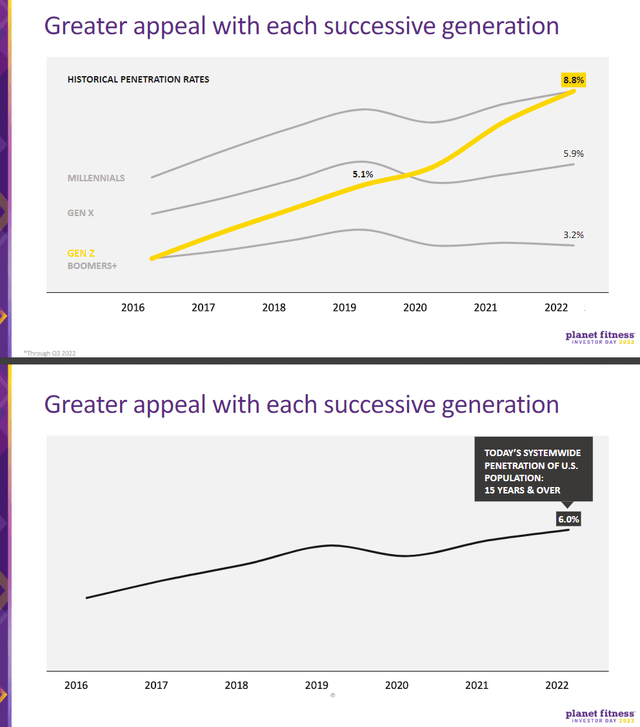

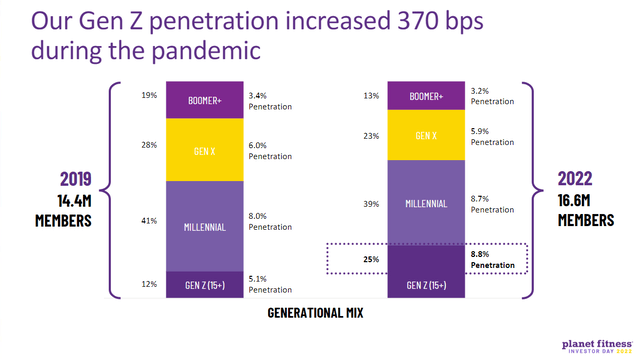

Secondly, PLNT should see an acceleration in unit growth as the new CEO, Colleen Keating, is focused on hiring a Chief Development Officer. I take this as a strong indicator that management is serious about driving unit growth. The way I see it, I do think there is still plenty of room for PLNT to grow its unit, given that the industry is still largely underpenetrated. Notably, PLNT has managed to position its brand to attract an increasing number of Millennials and Gen Z population (who value fitness a lot). Hence, if PLNT is able to hire the right guy to manage the unit growth strategy, the potential is certainly promising. To put things into perspective, PLNT was literally growing the number of franchise units by >10% pre-covid, but that has slowed down to mid-single-digits in 2Q24. Given that the secular trend has not been structurally impaired, this feels to be a misexecution of strategy that can be fixed.

So I think some of what we’ve identified in the new growth plan, as well as the infrastructure that we’re building, and as I mentioned a few minutes ago, a Chief Development Officer, someone who wakes up every day and thinks only and exclusively about unit growth. I think that will help fuel the unit growth and also expanding into new geographies, as I mentioned, going into Spain. 2Q24 earnings results call

The new CEO seems like the right person

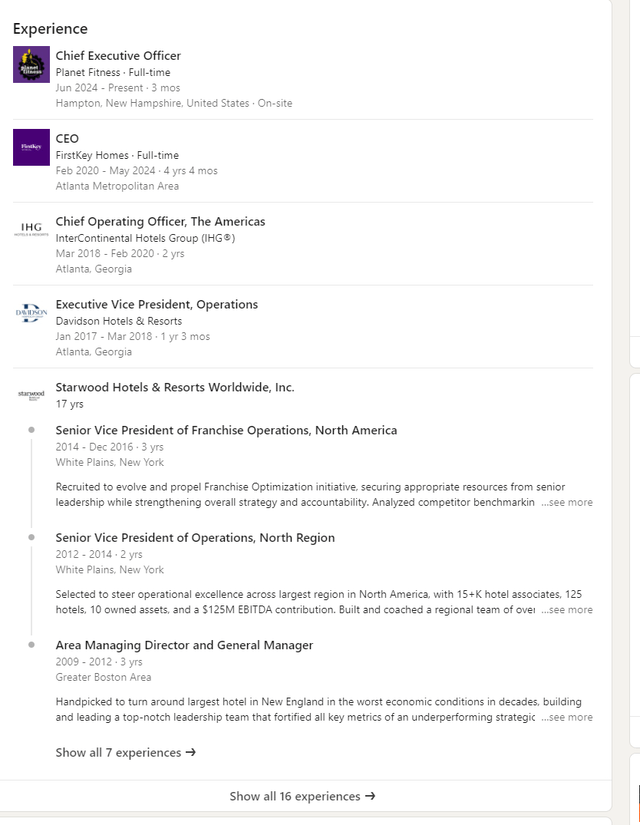

Among all the catalysts and developments I have mentioned above, the new CEO is perhaps the most important element that can drive growth acceleration. So far, I like the steps that she is taking. Specifically, she is considering hiring a COO at this time, as the plan is to work directly with all top management, including the current presidents of both the franchise (Bill Bode) and corporate (Jennifer Simmons) clubs. This is great not only for the business (the CEO is willing to go into the weeds to fix the business), but also for management creditability (as the market knows that the CEO knows what she is doing).

In addition, what I like most is that she has many years of experience in the hospitality sector, especially as COO for IHG Group. This well equips PLNT with someone that can elevate the membership experience as the business pivots to put more emphasis on delivering “high value” to members. More importantly, she has expertise in dealing with franchisees (IHG operates a franchise model as well), which is a critical attribute to have since 90% of PLNT units are owned and operated by franchisees.

Valuation

Whether PLNT will see more valuation re-rating upwards depends on whether it can reaccelerate growth to its historical double-digit level. I see two scenarios playing out from here:

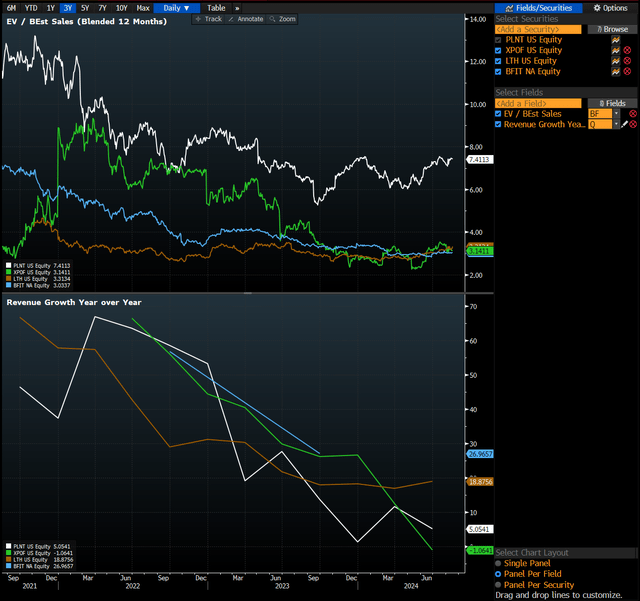

- PLNT growth accelerates from FY25 onwards, supported by all the catalysts above and the recovering macro environment. This will ensure PLNT can sustain its valuation premium against peers; PLNT is now trading at 7.5x forward revenue, vs. peers at ~3x. I believe the market is still optimistic that PLNT growth will accelerate, and hence, the premium.

- PLNT growth continues to disappoint as new strategies emerge, and the management team cannot turn around the situation. In this scenario, PLNT could see a strong derating from the current ~7.5x level to where peers are trading at 3x, which represents a big downside.

Conclusion

In conclusion, my rating for PLNT is still a hold. The positive updates so far is that PLNT managed to ease churn rates and the macro environment has gotten more favorable. The new CEO’s strategic focus and industry experience are positive, and upcoming catalysts such as pricing adjustments and unit expansion could drive growth acceleration in FY25. While these developments are encouraging, I maintain a cautious stance, preferring to see concrete evidence of accelerated growth before revising my recommendation.