World

Ranked by revenue, Aon is still the world’s largest reinsurance broker – Reinsurance News

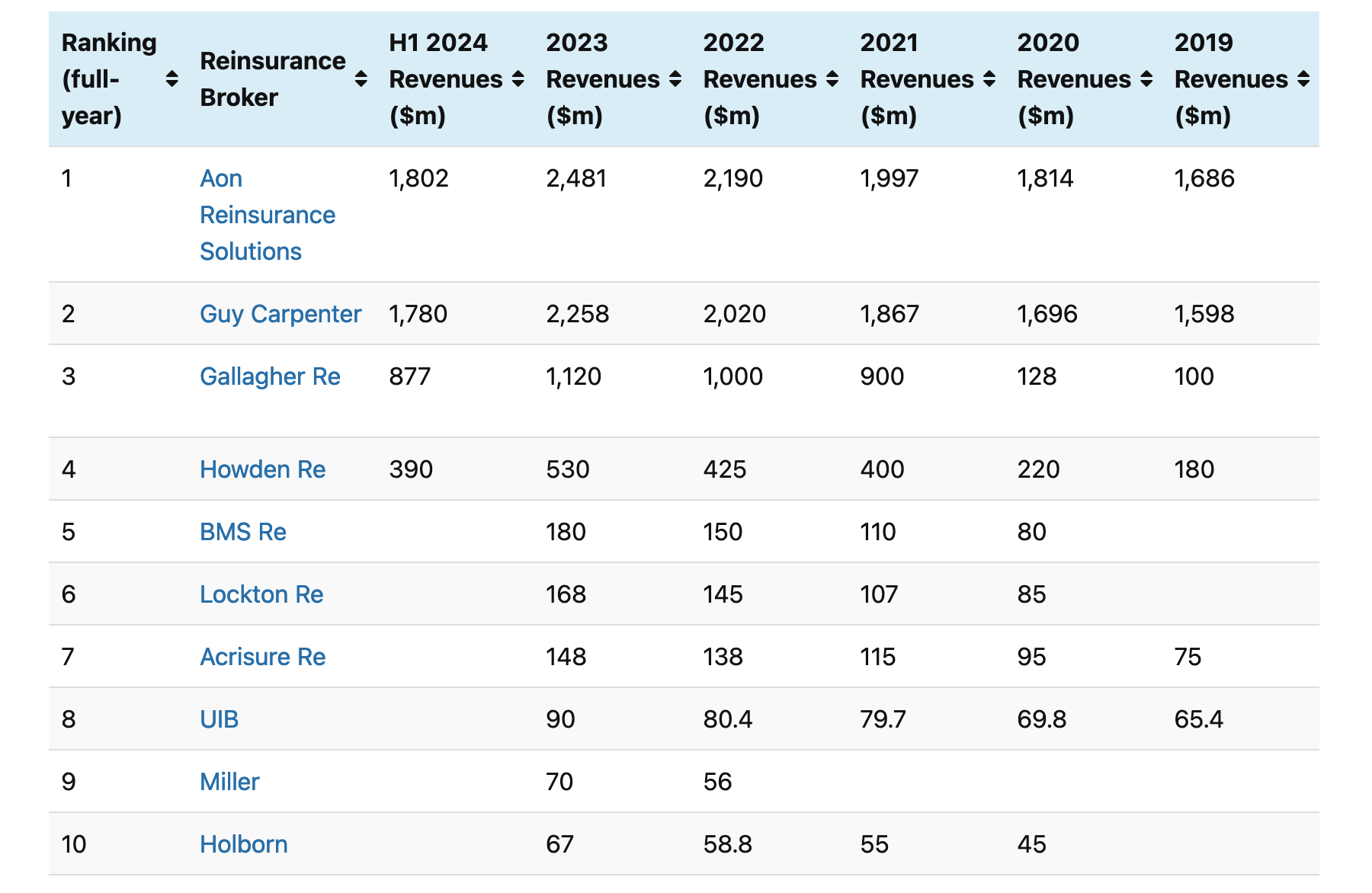

Based on fully-year 2023 and first half 2024 revenues, Aon Reinsurance Solutions, the reinsurance broking arm of the global intermediary, remains the world’s top reinsurance broker, and while Guy Carpenter is a close second so far this year, on an annual basis, Aon has consistently extended its lead at the top in recent years.

Our ranking of the top global reinsurance brokers in the world is based on data collated from annual reports, other company information sources, as well as our discussions with executive teams and sources, and ranks companies based on total revenues.

The data shows that, since 2019, Aon Reinsurance Solutions has consistently topped the list, with annual revenue hitting a huge $2.481 billion in 2023, rising from $2.19 billion in 2022.

In H1 2024, Aon Reinsurance Solutions generated revenue of $1.802 billion, which is up on the $1.684 billion reported in H1 2023.

But while Aon Re is leading the way, Guy Carpenter, the reinsurance broking arm of Marsh McLennan, isn’t too far behind, although the data suggests that Aon is slightly pulling away and extending its lead at the top.

In 2022, Guy Carpenter generated revenue of $2.02 billion, so $170 million less than Aon Re for that year. The following year, in 2023, Guy Carpenter’s revenue hit $2.258 billion, which while up year-on-year, came in $223 million below Aon Re’s total.

For H1 2024, Guy Carpenter’s revenue hit $1.78 billion, which is just $22 million below Aon Re’s total.

For H1 2023, Guy Carpenter’s revenue was just $8 million lower than Aon Re’s at $1.676 billion, revealing that Aon Re has again slightly extended its lead at the top of the table this year.

It’s important to note that the way revenues are accounted for can differ, particularly in terms of timing, while also different parts of the year can provide a greater contribution to one reinsurance broker’s revenues, compared to another.

After Guy Carpenter, in third place on the list, sits Gallagher Re, with revenue of an estimated $877 million in H1 2024. For the full-year 2023, the reinsurance broker’s revenue was estimated at $1.120 billion, up on the $1 billion generated in 2022, and the $900 million in 2021.

As a reminder, Gallagher Re completed the acquisition of Willis Re’s treaty reinsurance operations in late 2021, which saw the firm’s revenue jump significantly from $128 million in 2021 to the aforementioned $900 million in 2022.

Next, in fourth place, is Howden Re, with H1 2024 revenue of an estimated $390 million. The reinsurance broking arm of Howden Group has achieved steady growth in recent years, moving from an estimated $425 million in 2022 to $530 million in 2023.

You can see our ranking of the top global reinsurance brokers below, ranked by revenues from the most recent year and where we can we have excluded non-reinsurance income. Click on the image for the full table, which includes estimates for some of the smaller global reinsurance broking players. We welcome corrections and clarifications to this data, just get in touch.

Overall, the rising revenues of brokers underlines the growth in reinsurance limit deployed, as well as their ability to generate additional revenues through their value-add consultancy services, data offerings and analytics.

With reinsurance demand remaining high and expected to rise over the coming year, we would not be surprised to see the big reinsurance brokers increasing their revenues again, while some of the smaller brokers are set to increase their totals and perhaps rise up the ranks thanks to their team acquisitions, platform-build-outs and company growth.

Note: We provide our ranking of the world’s top reinsurance brokers on a best-efforts basis. Where reported data is not available we try our best to source input from companies, but where that is not possible our discussions with industry participants and sources informs our estimates.

As stated, we welcome any corrections and clarifications to this reinsurance broker revenue data, please reach out to get in touch.