Shopping

Retail REITs: Steady consumer spending underpinned improved Q2 demand for shopping spaces

martin-dm/E+ via Getty Images

Retail and other areas of the commercial real estate (CRE) market saw fundamentals firming in Q2, aided by solid spending by consumers, Wells Fargo said.

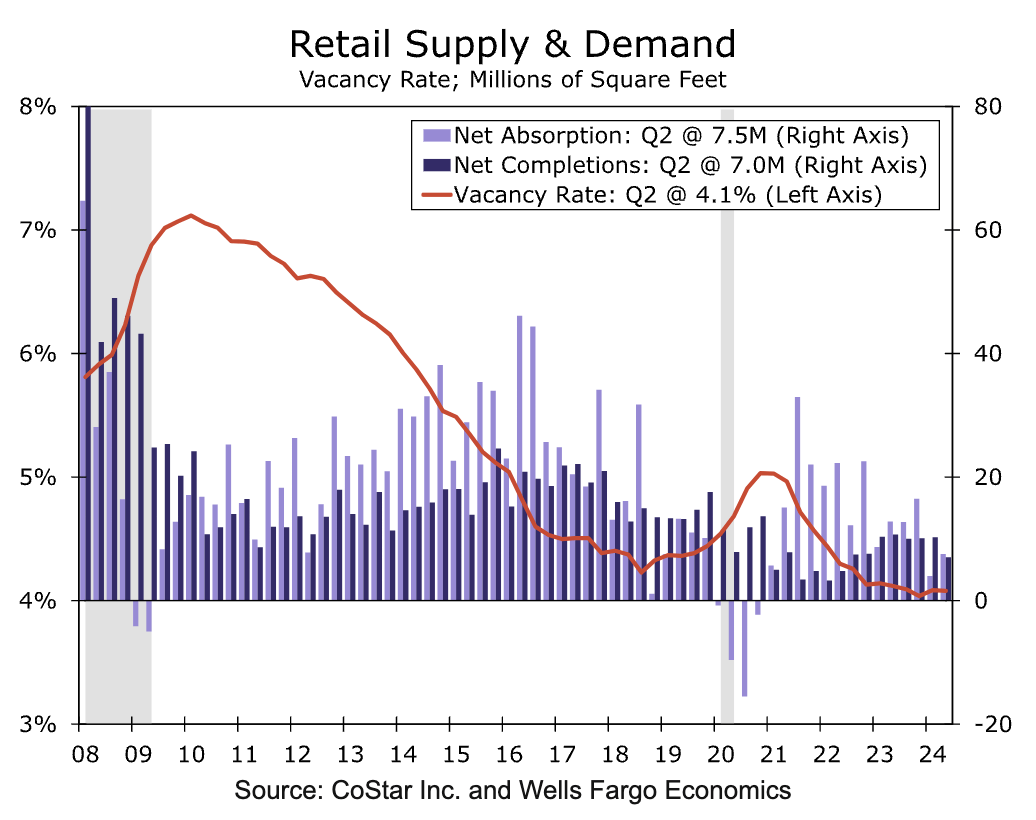

In the retail space, net absorption – a measure of leased spaced – nearly doubled to 7.5 million square feet in Q2, after “somewhat of a lull” in Q1, Wells Fargo economists said in a report Tuesday. While conditions remain soft, most major property classes performed relatively well during the April-June period.

“Steady consumer demand has kept the retail market in solid shape, underpinning 14 straight quarters of firmly positive demand for retail space,” Charles Dougherty, senior economist at Wells Fargo, said. The report did not include figures for specific real estate companies.

“Experiential categories, such as fitness, health and beauty were significant drivers, but new leasing activity was propelled mostly by quick-service restaurants, discount grocery, off-price stores and other cost-friendly platforms,” he said. Meanwhile, a strong pace of ecommerce retail sales continued to outpace sales growth at brick-and-mortar businesses, driving an upshift in warehouse leasing from major ecommerce companies.

In retail, a sluggish pace of new construction has contributed to low retail availability. Just 4.7% of retail space is currently available for lease, the lowest level running back to 2006, Wells Fargo said, citing CoStar data.

“Unwavering” consumers helped drive a quarterly improvement in net absorption for most major property types, Wells Fargo said.

“Consumers have become more cost-conscience and more discernible with their purchases, yet consumer spending continues to cut through the headwinds of higher prices and more moderate income growth and expand and at a solid pace,” Dougherty said.

Here’s how some of the biggest retail real estate investment trusts have performed in the equity market so far in 2024:

- Simon Property Group (SPG) – YTD gain: +15.6%. Market cap: $61.5B

- Realty Income Corp. (O) – YTD gain: +8.9%. Market cap: $54.20B

- Kimco Realty (KIM) – YTD gain: +9%. Market cap: $15.7B

- Regency Centers (REG) – YTD gain: 8.1%. Market cap: $13.2B

- Federal Realty Investment Trust (FRT) – YTD gain: +11%. Market cap: $9.7B

- NNN REIT (NNN) – YTD gain: +9.7%. Market cap: $8.63B

- Brixmor Property Group (BRX) – YTD gain: +17.4%. Market cap: $8.3B

- Agree Realty (ADC) – YTD gain: +15.8%. Market cap: $7.3B

- Kite Realty Group (KRG) – YTD gain: +13.1%. Market cap: $5.8B

- Phillips Edison & Co. (PECO) – YTD gain: +1.2%. Market cap: $5B

Among retail and ecommerce ETFs: (XRT), (RTH), (IBUY), (ONLN), (EBIZ), (RETL), and (EMTY).

The S&P 500 Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) has risen +9% this year, versus the S&P 500’s (SP500) rise of ~16%.