Entertainment

Six Flags Entertainment Corp (NYSE:FUN): The Birth of a New Titan – TipRanks.com

The recent merger between Six Flags and Cedar Fair has birthed a new titan in the world of amusement parks: Six Flags Entertainment Corporation (NYSE:FUN). With an anticipated $3 billion in annual revenues, this new entity boasts 27 theme parks and 15 water parks. While not yet a rival to reigning champion Disney (NYSE:DIS), whose parks and experiences generated revenue of nearly $32.6 billion in 2023, the united company aims to harness its growing momentum to bolster its scale.

Beyond popular buzzwords like “synergy,” the newly-formed corporation projects roughly $120 million in cost savings and $80 million in increased profits within three years as combined entities, suggesting upside potential from current valuation levels. This stock is an intriguing option for investors looking for a pure play on amusement parks.

What to Know About the Six Flags Merger

Six Flags Entertainment Corporation is now North America’s largest regional amusement resort operator after a successful merger with Cedar Fair Entertainment Company. This merger has significantly increased Six Flags’ scope, consolidating its position as a premier amusement park operator across the U.S., Canada, and Mexico. The combined entity, operating under the Six Flags brand name, will continue to provide entertainment experiences with an impressive portfolio of 42 parks.

Effective from July 1, 2024, the merger agreement states that Cedar Fair unitholders received one share of common stock in Six Flags Entertainment Corporation for each unit owned, while Former Six Flags shareholders received 0.5800 shares of common stock in the newly merged entity for each share owned.

Although being hailed as a “merger of equals,” the management structure of the combined company suggests otherwise. Analysts following the merger have viewed the Cedar Fair management team as the steady hand that the Six Flags assets have needed for some time.

The management team of Cedar Fair will essentially take over operations of the combined entity under the leadership of CEO Richard Zimmerman (former President and CEO of Cedar Fair). In contrast, Selim Bassoul, former president and CEO of Six Flags, will move to the board and serve as the Executive Chairman of the Board.

Is FUN Stock a Buy?

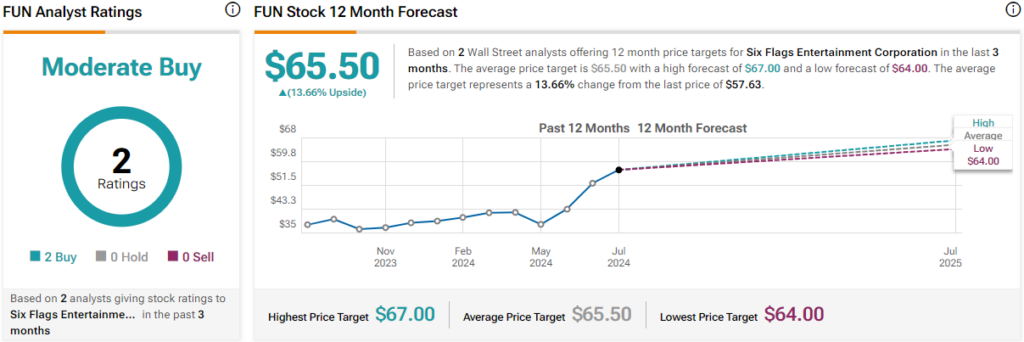

Since the merger, two analysts covering the company have weighed in, and both have been constructive on the stock. Citi analyst James Hardiman issued a Buy rating on the shares with a price target of $64, while Oppenheimer analyst Ian Zaffino issued an Outperform rating and a price target of $67. Both analysts noted meaningful upside potential from this merger.

Six Flags Entertainment Corporation is rated a Moderate Buy overall based on the combined recommendations. The average price target for FUN stock is $65.50, representing a potential upside of 13.66% from current levels.

With a Trailing Twelve Months (TTM) P/E ratio of 23.77x, the stock appears to be trading at a discount to peers in the Leisure industry, which sports an average P/E of 28.02x. If the combined entity’s management can indeed manage costs while improving revenues, the stock is poised for significant multiple expansions.

Six Flags in Summary

The merger between Six Flags and Cedar Fair has created a compelling investment opportunity for those interested in the sector. With Cedar Fair’s leadership at the helm, there is optimism about cost management and revenue increases, which could catalyze a promising potential upswing in the shares from the current undervaluation.