Travel

SMEs in the driver’s seat: empowering Europe’s travel economy | By Inge Janssen

The travel industry is an essential pillar of the EU’s economy – accounting for roughly 10% of GDP and a similar share of employment. In many aspects, our sector doesn’t get the attention it deserves from policymakers, yet it is a key driver of EU competitiveness, a major source of service exports and a provider of local development all across our continent.

In the aftermath of the EU elections, we are looking forward to a new set of priorities, and hope to see government policies better calibrated to empower hospitality SMEs in Europe. The first step, as ever, is knowledge. What is on the minds of European hoteliers? Has the sector fully recovered from the biggest slump in the history of travel? Do international chain hotels or local SME accommodations find themselve benefiting more from government actions? And what kinds of policies would they find most helpful?

For the third year now, we’ve partnered up with Statista to survey nearly a thousand hospitality industry professionals for the European Accommodation Barometer. What we’ve learned might surprise you.

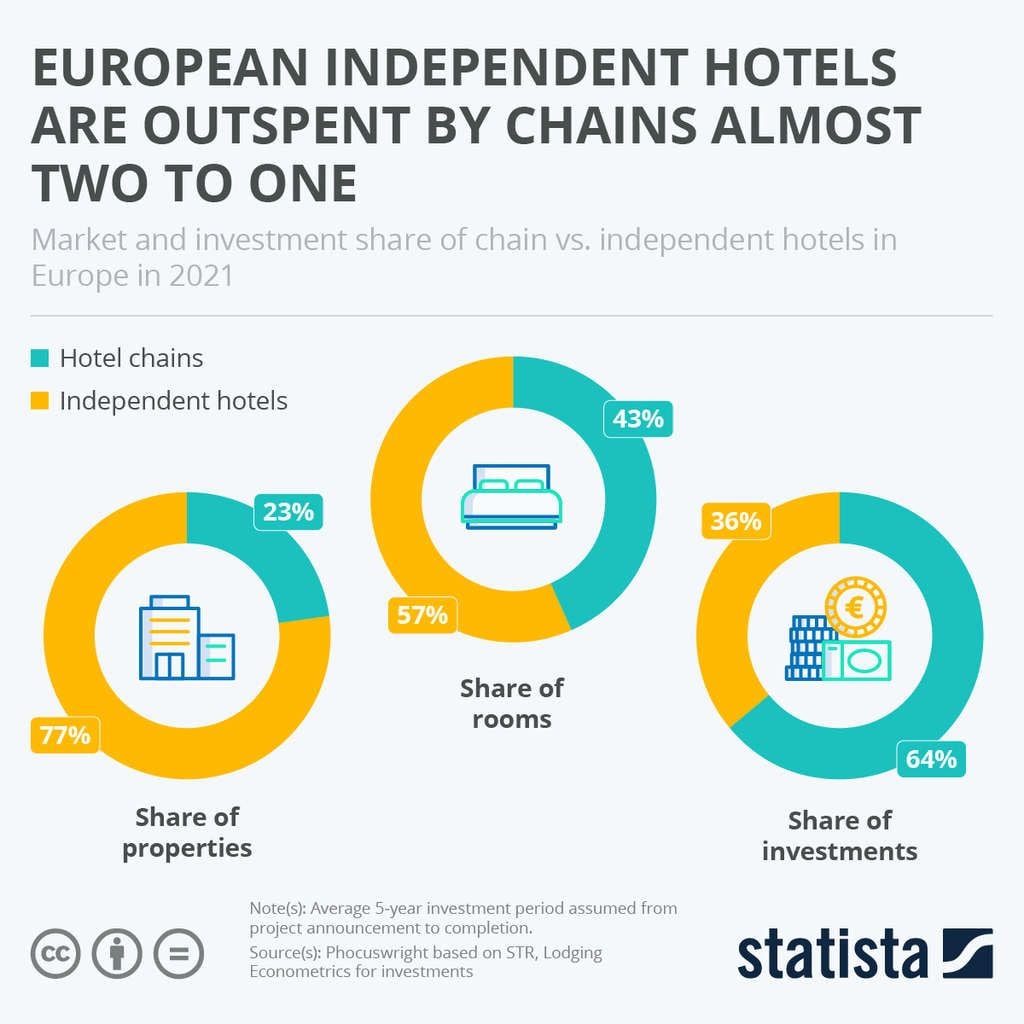

Despite making up the majority of Europe’s accommodations, independent businesses have seen a decline in their room-share over recent decades. The latest barometer shows that chain hotels continue to report strong performance over and above that of their smaller counterparts – covering a wide range of economic and sentiment metrics, such as access to capital as well as occupancy and room rate developments.

While 77% of chain hotels report a positive economic situation, only 59% of independent businesses do so. Large hotels, particularly those with over 250 employees, benefit from economies of scale, making it easier to secure loans and manage rising costs. This advantage is reflected in the 84% of these larger hotels experiencing positive business development over the past six months, compared to just 50% of micro-enterprises with nine or fewer employees.

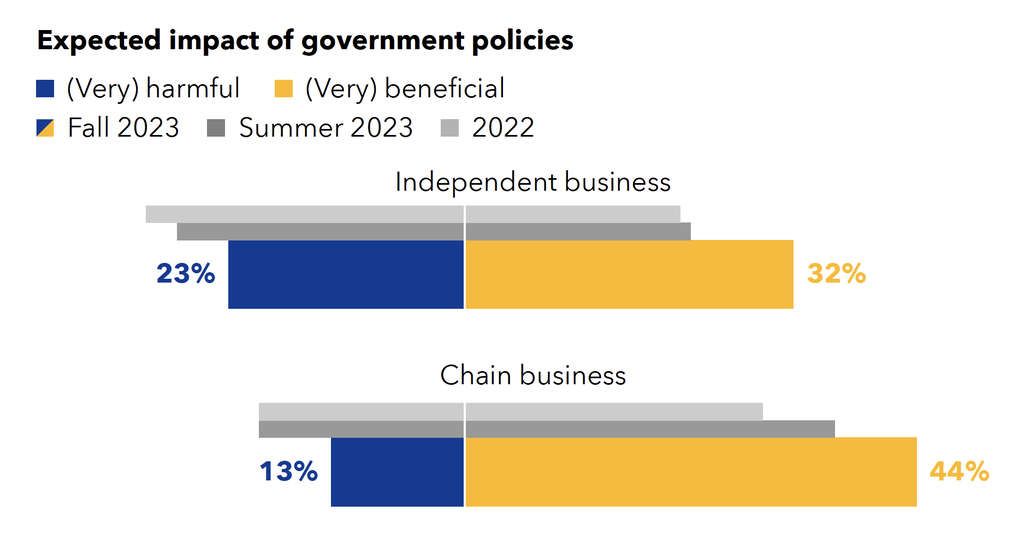

The Barometer reports also shed light on how government actions are perceived depending on the type and size of accommodations. While everyone recognizes the importance of the regulatory and political context in which our industry operates, chain hotels consistently reported a higher appreciation for government policies, with an 8-10 percentage point difference compared to independent establishments.

Geographically, the perception of government policies varies significantly. In the Nordic countries, a robust 59% of hoteliers in the fall of 2023 anticipated a positive impact from these policies. In stark contrast, German hoteliers were considerably less optimistic, with only 10% expecting positive outcomes and 50% predicting adverse effects. These statistics not only highlight regional disparities but also emphasize the need for tailored and hyper-localized policies sensitive to the specific economic and cultural contexts of each country, region, or destination.

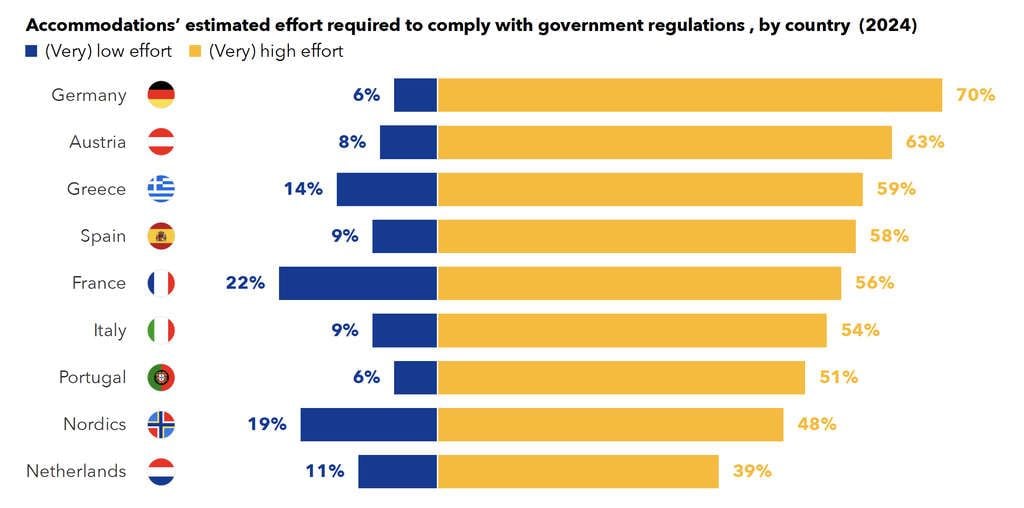

The survey results further reveal the effort required to comply with various requirements and mandates imposed by governments. Over the past year, an increasing number of European hoteliers (nearly half) reported a rise in the level of effort required to comply with government regulations, with only 6% feeling that compliance has become easier. This growing challenge is particularly pronounced among SME accommodations, which often do not have the same resources as larger chains to manage these demands.

Examining the types of government actions that resonated with hoteliers, investments in destination marketing emerged as the most applauded policy by fall 2023, supported by 42% of respondents. Other favorable policies included support schemes for accommodations (38%) and education/training schemes related to the travel sector (33%). On the flip side, taxation was highlighted as the most burdensome policy area, with 50% of hoteliers deeming it negatively impacts their business.

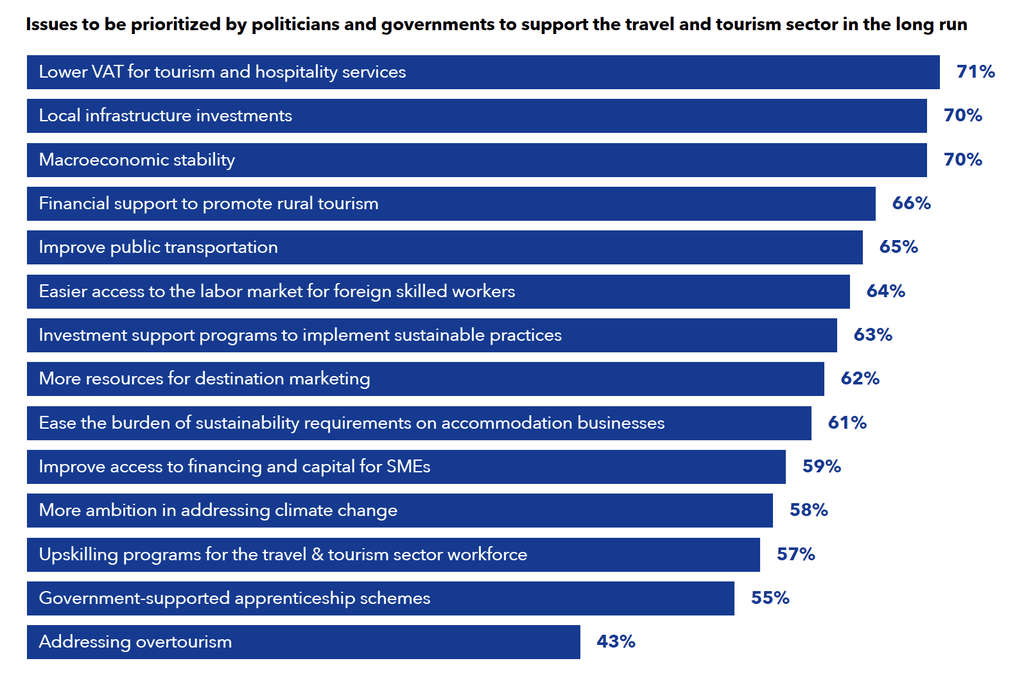

As the travel industry seeks to further galvanize progress, hoteliers articulated clear preferences for the types of government support they deem most vital. These include a desire for a reduced VAT rate, robust investments in local infrastructure, and a push for macroeconomic stability, with each of these areas receiving endorsements from over 70% of respondents.

Furthermore, the size of an accommodation inversely correlates with the perceived need for government intervention. Smaller accommodations, often without the buffer of extensive capital reserves or brand recognition to ensure a consistent guest flow, are more vulnerable and hence more reliant on supportive policies. For example, nearly four in five (78%) of the smallest businesses stressed the urgent need for macroeconomic stability, compared to just over half (53%) of the largest establishments.

Independently-run properties don’t have the access to the closed systems used by global chains and they face much higher hurdles when it comes to access or cost of capital. In an environment where international and intra-European travel plays an ever increasing role, this puts SME hotels at a structural disadvantage. A research paper looking at a Belgian hospitality market, found that hotels that list on digital platforms achieve higher profitability. Importantly, the smaller the property, the more prominent was this effect.

In the European accommodation sector, government policies and regulations have always been crucial for maintaining standards, ensuring consumer protection and fostering competition. It is imperative for policymakers, regulators, and government bodies at both the EU and nation-state levels to engage more deeply with all stakeholders, including hospitality’s microenterprises, global chains, and industry platforms like Booking.com, to craft policies that are not only responsive to the global mega-trends in travel, but also adaptive to the specific challenges faced by SME accommodations.