Jobs

S&P 500 Forecast Today – 06/05: Jobs Report Rally (Chart)

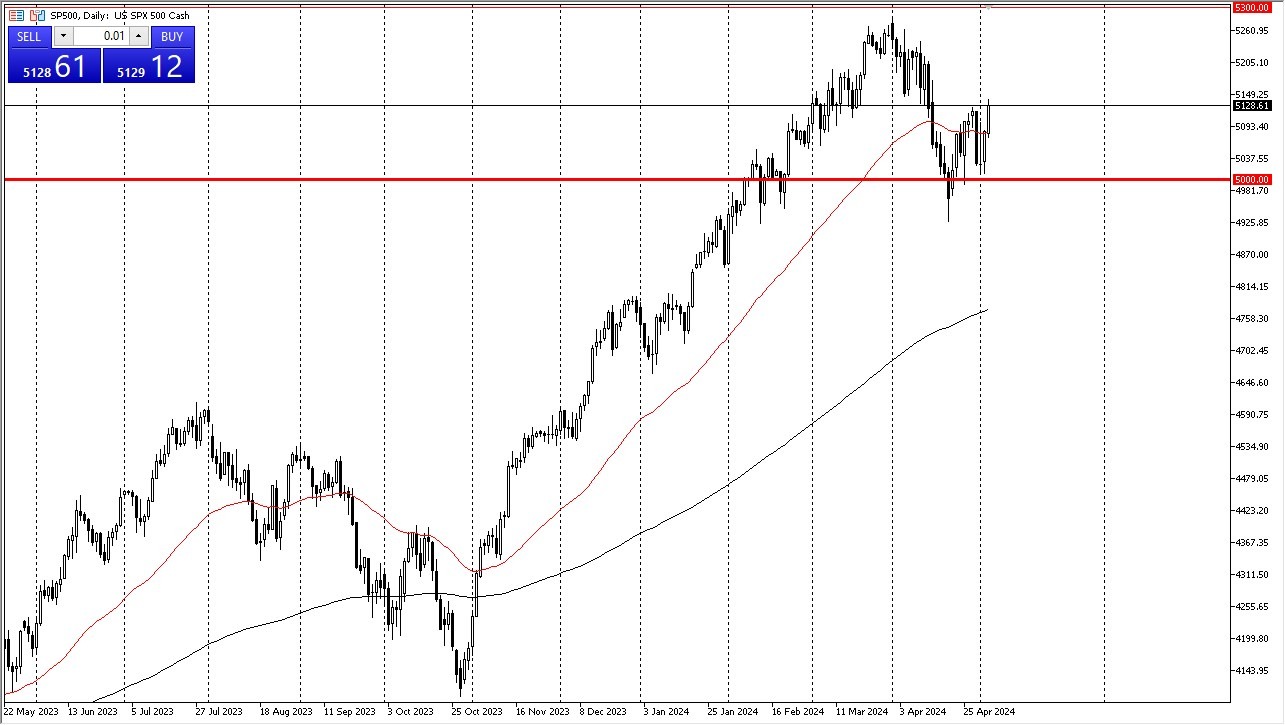

- The S&P 500 rallied rather significantly during the trading session on Friday, to break above the 5125 level, an area that previously had been significant resistance.

- This is mainly driven by the nonfarm payroll announcement that missed what most people had envisioned.

In fact, the United States produced 60,000 less jobs than anticipated, and therefore we have seen a lot of people been on the idea of the Federal Reserve having to react sooner rather than later.

Federal Reserve

The Federal Reserve is completely warped the market. This is something that has been going on since the Great Financial Crisis, as they flooded the market with so much liquidity that Wall Street has learned to trade based upon liquidity, and not the economy. In fact, the reality is that the worst economic statistics become, it’s very likely that we will continue to see stocks rally, due to the fact that people will be betting on looser monetary policy coming from the Federal Reserve.

Because of this, we are in a situation where “bad news is good news”, which of course makes me nauseous. That being said as well, the reality is that this is a market that we are trading. Large firms in New York City don’t really care about anything other than whether or not they can get cheap funds to gamble in the Wall Street casino, and that’s been the game for almost 15 years now.

Unfortunately, this is still the way we are trading, so the only thing you can do is either not traded all or realize that stocks move completely backwards from what you may have been taught. Occasionally, they will start to move higher based on the idea of a good economy, but the reality is that Wall Street will warp the narrative to fit whatever thing it is they are trying to sell you. Keep in mind that the S&P 500 is not an equal weighted index, so quite frankly this could be the function of something like 7 or 8 stocks. Either way, it looks like we are going higher so short-term pullback should continue to be buying opportunities, with the 5000 level being a major floor.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.