Bussiness

Spirit Airlines Abandons Business Model, Starts Selling Bundled Fares And First Class – View from the Wing

Spirit Airlines and its fat margins from low fares and significant fees were once the darling – and envy – of the airline industry. Six years ago now-American Airlines CEO Robert Isom laid out why Spirit and Frontier were the airlines to model at American:

[T]oday there is a real drive within the industry and with the traveling public to want to have really at the end of the day low cost seats. And we’ve got to be cognizant of what’s out there in the marketplace and what people want to pay.

The fastest growing airlines in the United States Spirit and Frontier. Most profitable airlines in the United States Spirit. We have to be cognizant of the marketplace and that real estate that’s how we make our money.

We don’t want to make decisions that ultimately put us at a disadvantage, we’d never do that.

All that has changed. Consumers haven’t wanted what Spirit and Frontier have been selling. Those airlines have struggled. They’ve responded by shifting the routes that they fly, and the products they sell. Frontier has upended its fares and now sells a premium product with both extra legroom and blocked middle seats. Now Spirit is moving in that same direction.

Spirit Changing How It Sells Fares

In a move that follows how Frontier has retooled its fares, Spirit is moving away from low fares and myriad fees to more bundled options. They’re instead offering four fare types:

- Spirit’s entry-level fare includes a personal item and free changes. That’s akin to its (now more generous) entry fare today.

- They then offer ‘Go Savvy’ which comes with seat selection and either a carry-on bag or checked bag.

- ‘Go Comfy is a level up, with blocked middle seat for extra space (note: they can sell this twice – the passenger in the window and the aisle both), Group 2 boarding, plus both a carry-on bag and a checked bag, as well as a drink and snack. Selling the blocked middle makes sense when they aren’t filling planes, but becomes more costly (and they should adjust price up) when loads are expected to be high.

- Finally, their premium option ‘Go Big’ is a domestic first class bundle with the Big Front Seat, Group 1 boarding, as well as free drinks, premium snacks, and free wifi.

These all start with bookings August 16, 2024 and onboard features go live August 27, 2014.

Spirit Airlines First Class

Originally Spirit Airlines only offered the Big Front Seat on planes because it was cheaper than removing the seats and putting in regular ones.

It was called the Big Front Seat because that’s what you were getting – a bigger seat up front – and not the rest of the things that go along with domestic first class on other airlines. That’s all changing.

The Big Front Seat becomes a bundled product, with bags and priority boarding as well as something to eat. Wifi will be free for first class passengers on Spirit – when it isn’t on American and United.

How they’re selling the Big Front Seat – as more of a domestic first class value proposition (albeit snacks, not meals, even on longer flights) – may be the biggest change happening here since you can still buy the most stripped down Spirit fare and the seats themselves onboard aren’t changing (the tightest pitch, no recline).

Spirit Airlines Goes Premium

There’s little more small-d democratic than flying Spirit Airlines today. Even with their Big Front Seat you queue like anyone else for any service you need, and they push you to self-service as much as possible. Someone flying ‘up front’ doesn’t actually board first and pays for their checked bags.

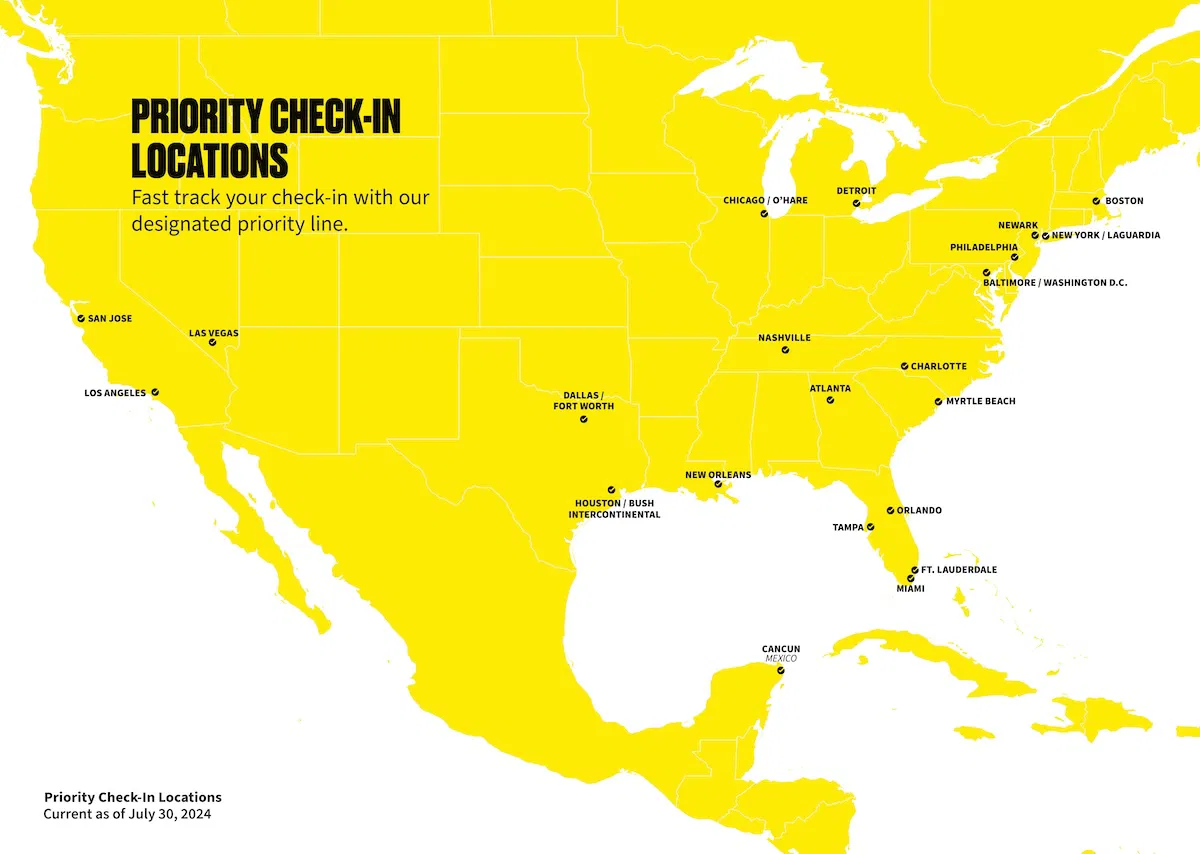

Yet Spirit is introducing priority check-in for first class Go Big passengers, Spirit Airlines Free Spirit Gold elites, and co-brand Free Spirit Mastercard customers.

This will eb offered at around 20 airports, skipping the queue for the first-available agent at the ticket counter.

In addition, a new boarding process will align with their premium offerings. They’ll have priority boarding for their two higher-fare tier customers along with elite frequent flyers and co-brand cardmembers (and active-duty military and their families).

Does Upending Its Business Model Make Sense For The Struggling Carrier?

During the United Airlines second quarter earnings call, Chief Commercial Officer Andrew Nocella diagnosed what he thinks low cost carriers like Spirit and Frontier are doing and why it doesn’t work.

- “First, when you face this type of problem, airlines generally push to grow out of the problem, but that usually doesn’t work and this happened in the previous quarters.”

- “The second step is network churn, where you think, well, we picked the wrong markets and we can fix that. But the next set of markets is usually worse than these markets you’re flying today.”

- “Then the next change is business model changes, right? We noticed Airline X is doing something different from us, let’s match. That’s really hard and slow.”

- “I think the next step is that everybody thinks, well, let’s go premium. But that’s a generational adjustment that just does not occur over a few quarters.”

- “And then the next one is let’s push capacity on good days and months but cut hard on off peak and that’s really hard to do because it’s an inefficient use of assets.”

- “And then the next one is closing schedule changes because you’re really concerned about your P&L and what’s going on. And I think we see a lot of closing schedule changes today from many of our competitors.”

- “And then the last part is you just shrink.”

Businesses have their models because they’ve believed it is the best one that plays to its strengths – its core capabilities and its opportunities – so changing the business model doesn’t really work. Opportunities may change, and they need to acquire new and different capabilities. That is hard and takes time and usually fails.

On the other hand, the model that says doing something different may work is one that says tough times may drive an airline (or other business) out of its complacency.

- It likely sticks with a model or product longer than it should, even in the face of changing opportunities.

- When there’s plenty of cash there’s no real urgency to change. In a big public company, where the managers are well-paid employees rather than owners, there’s little incentive to stick your neck out. You have a plan everyone accepts. Try to change it, step on sacred cows, and you may be out.

- But when things go badly there’s no choice but to change, to re-examine assumptions, and to take risks. You may lose your perquisites anyway.

So you cut routes that may have had political support. It’s easier to run over opposition during lean times, because you don’t have the luxury that ossified bureaucracies do of simply paying taxes to internal (or external) interests, and you have a narrative for why change is needed.

Will Spirit Succeed?

Spirit is in the midst of several ‘bet the company’ moves. Their costs have been going up, and they can’t just grow to make up for it. So they need to bet on higher revenue. The thesis, like at Southwest, is that the shift by consumers to premium is a long-term secular trend. That may be wrong, in which case a new carrier with lower costs would have a shot at filling the gap left by Spirit (but for huge barriers to entry into the industry, roadblocks in place by both federal and local governments).

Either way, the days of Spirit’s ’69’ sale (it was exactly what you think it was) and MILF sale (Many Islands, Low Fares) are long gone.

:max_bytes(150000):strip_icc()/mom-embraced-solo-travel-late-in-life-tout-826784213bfd4a988a7f807609690a03.jpg)

![AEW EVP Kenny Omega Returns At Worlds End In Dramatic Fashion [Video] AEW EVP Kenny Omega Returns At Worlds End In Dramatic Fashion [Video]](https://cdn.itrwrestling.com/app/uploads/content/1708434153477271156/05-kyle-fletcher-vs-kenny-omega_10_18_aew_dynamite_0002-7ky9HhPqBQ-1680x945.jpg)