Sports

Sports Streaming Stands to Gain as Rising Ticket and Concession Prices Keep Fans at Home

This is just a glimpse of the insights available to CivicScience clients. Want to see the full picture? Let’s talk.

October will be a busy month for sports. All of the big four sports will be in action, alongside college football and the WNBA playoffs. But how are consumers responding as the industry enters this hectic month?

New CivicScience data reveal that the percentage of Americans who are ‘extremely’ interested in sports has climbed five points since July to reach 20% – its highest level since September 2019, prior to the pandemic. Similarly, the percentage of Americans watching sports on TV has gone up overall since July – those watching five or more hours per week increased by seven points, now at 26%, which also outpaces last September (24%). The increase is likely driven by the NFL.

Let Us Know: Which season is your favorite for watching sports?

The rising cost of tickets likely contributes to more time spent watching sports on TV – 62% of regular sports event attendees say they’ve avoided buying tickets in the past six months due to price hikes, matching last year’s figure and up from 54% in 2022.1

Concession prices also factor in as nearly 1-in-3 report the price of concessions has ‘a lot’ of impact on whether they will purchase tickets to a game. Another 27% of respondents report the concessions have at least ‘a little’ impact on their plans.2

ESPN+, Amazon Prime Video Poised for Boost as Fans Look for New Streaming Subscriptions

This is good news for sports streaming platforms, as sports interest grows and as fans opt to watch from home. Thirty-two percent of sports viewers say they’re at least ‘somewhat’ likely to subscribe to a new streaming service for fall/winter sports, while 14% have already subscribed to the platform they want.3

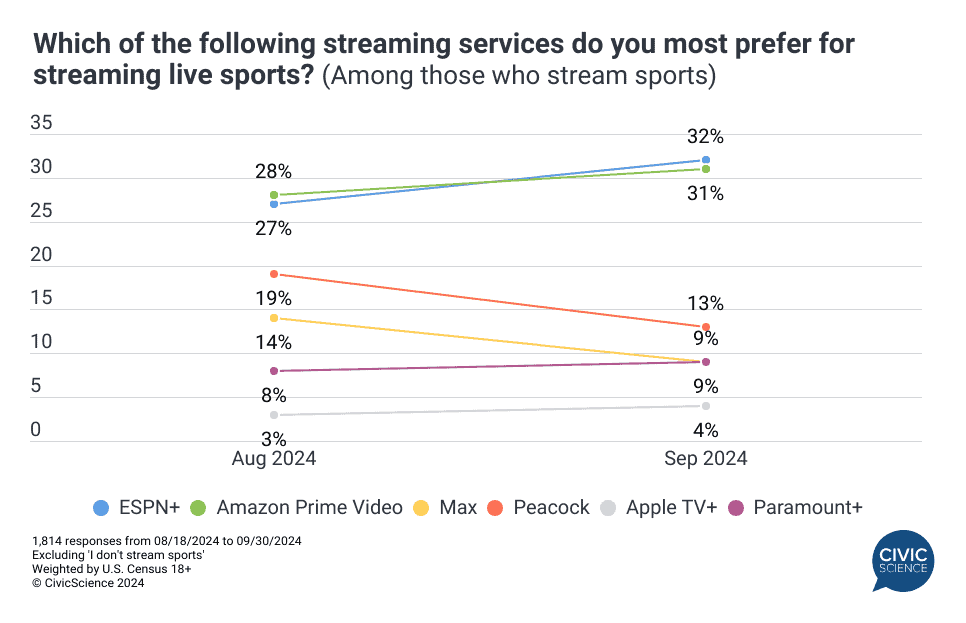

ESPN+ and Amazon Prime Video are the leading streaming platforms for live sports among fans, with the gap beyond them widening since August. Those preferring ESPN+ increased by five points, while Amazon Prime Video rose by three and could be primed for more after record viewership last Thursday.

However, those consumers with interest in new subscriptions for sports over-index as most likely to feel subscription fatigue and an intent to cancel a subscription as a result, compared to those who won’t add a new subscription.

Still, advertisers should take note – data indicate those considering a new sports subscription are far more likely to engage with relevant digital ads than those not planning to subscribe (79% vs. 51%).

“Caitlin Clark Effect” Helps Drive Big Spike in WNBA Interest

Of the October sporting events, sports fans are most likely to tune into NFL games (63%), followed distantly by MLB playoffs (35%) and NCAA football (34%). NBA (23%), NHL (19%), and WNBA playoff games (14%) are less common choices.4

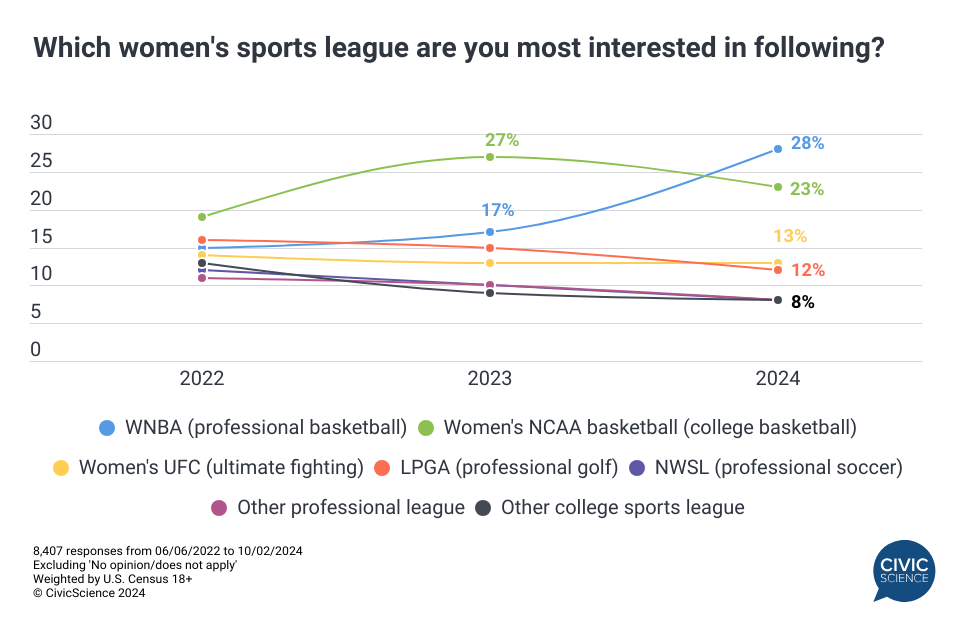

The WNBA is making its presence felt in fan interest as it has gained momentum this year and looks positioned to grow in comparison to other women’s sports, thanks to Caitlin Clark and other stars. New data find an 11 percentage point year-over-year increase in WNBA interest to 28% (excluding those without an opinion). Women’s college basketball saw a similar rise from 2022 to 2023 as Clark and stars like Angel Reese shined in the college ranks, though that interest has dipped slightly ahead of the new college season without them in the fold.

Take Our Poll: How do you feel about the future of live streaming sports services?

Consumers are likely to make this a strong season for the sports industry and election-related stressors could be one reason why. This growing interest in tuning into sports as leagues ramp up will offer ample opportunity for streaming platforms and advertisers to score as Americans prepare to spend hours watching their favorite teams on screen.