Shopping

Still loving Capital One Shopping, but with some caveats

If you have ignored previous coverage of the Capital One Shopping portal, you’re missing out on some terrific shopping portal returns.

Capital One Shopping, the public shopping portal that anyone can join, no Capital One card required, has re-won my heart this holiday season. That’s despite a couple of frustrations in recent months. I was more than a little frustrated at the one situation where it felt like they cheated me out of rewards, but I’ve since been paying close attention to detail and have returned to loving the insanity of their targeted offers.

For disambiguation: Capital One Shopping is different

Capital One has two similar but entirely different ways to earn rewards from shopping. This post is mostly about the public Capital One Shopping portal, which does not require any Capital One card account. The offers covered in post of the post below are public offers that anyone can get. When we talk about Capital One Shopping, we’re talking about this public shopping portal that works the same as a portal like TopCashBack or BeFrugal, only instead of getting cash payouts, the Capital One Shopping portal only offers gift cards as redemption options. The Capital One Shopping portal is not connected to a Capital One card account, so you can’t get a statement credit or cash out of the portal. Instead, you redeem for gift cards to places like Hotels.com, DoorDash, Safeway, Walmart, Home Depot, etc.

All that said, if you do have a Capital One credit card, you’ll also find similar shopping offers in your online account — but those operate a bit differently. I’ll cover that separately at the end of this post.

Crazy holiday shopping payouts

Over the past couple of weeks, my targeted Capital One Shopping offers have gotten really good.

In the past, offers seemed to top out at 30% back. However, over these past few weeks, there hasn’t really seemed to be a ceiling.

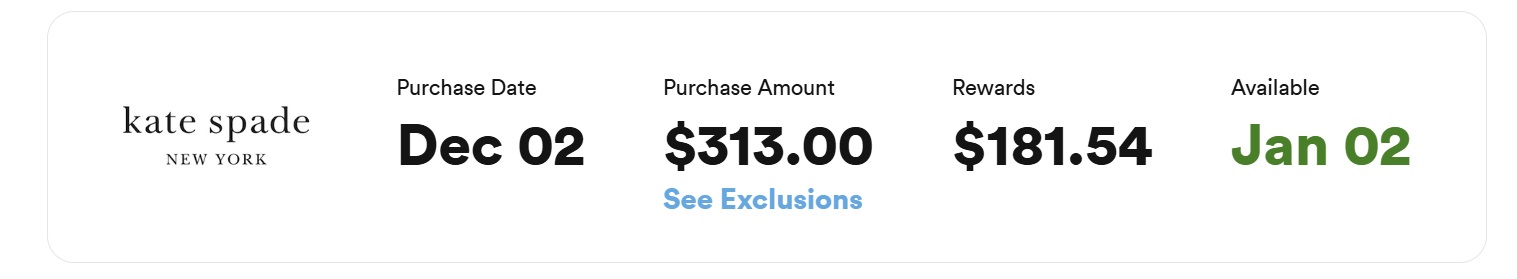

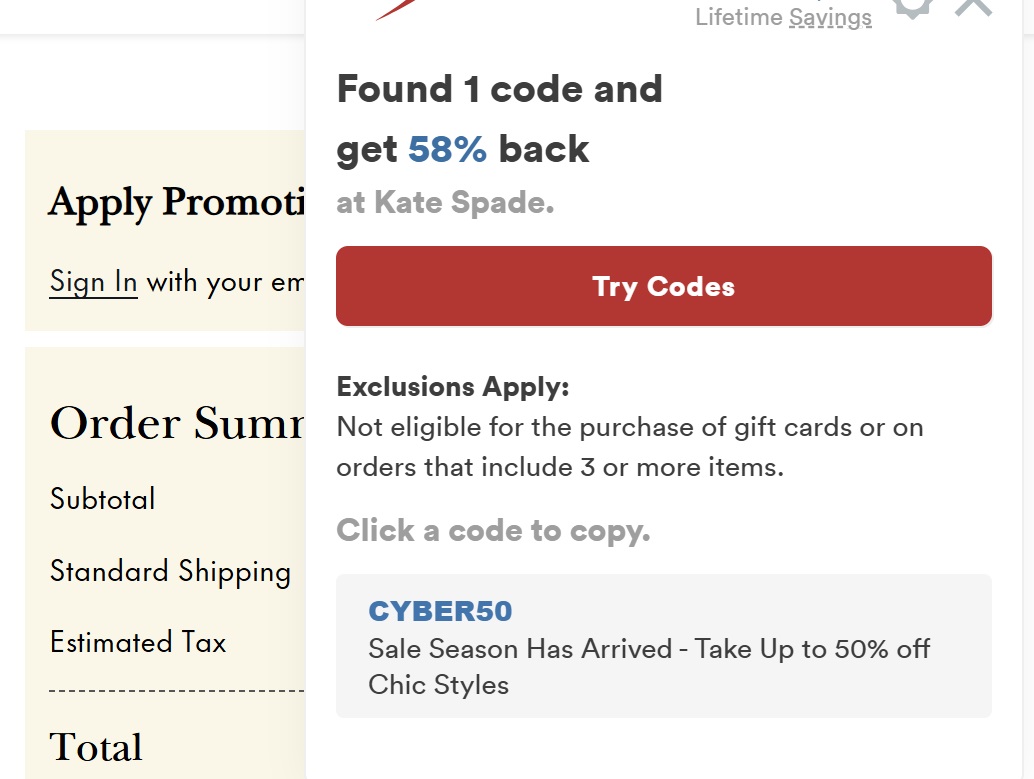

For instance, when I noticed that I had 58% back at Kate Spade New York, I encouraged my wife to pick out a new purse. She shopped the Cyber Monday sale and found something she liked as well as a gift for a family member. The 58% is on track to post as expected.

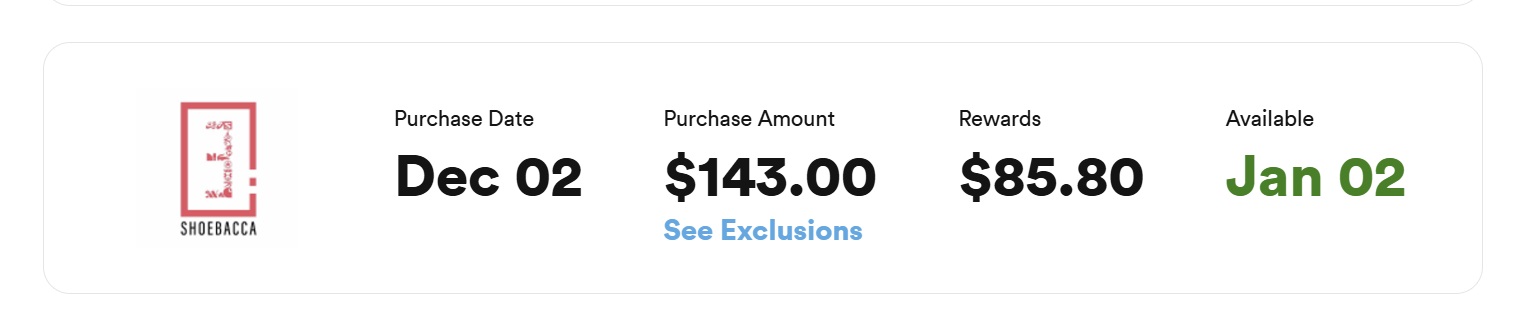

When I saw 60% back at Shoebacca, I grabbed some footwear that I didn’t necessarily intend to buy yet, but at 60% back I’ll be glad to have what I need in the closet at a nice savings.

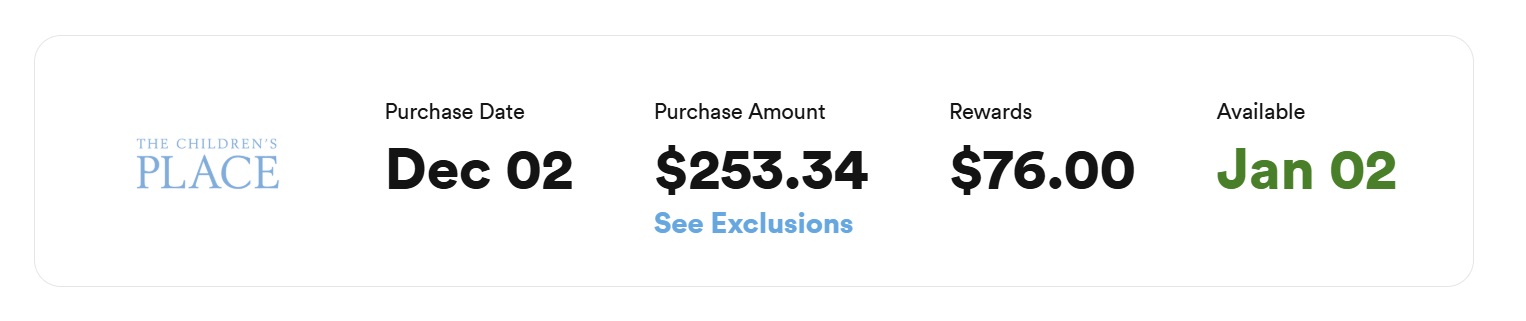

I jumped on yet another offer for 30% back at The Children’s Place. Our shopping cart had just over $250 in clothes and we’ve now got more than $75 coming from Capital One Shopping. On top of that, we earned $120 in reward bucks for The Children’s Place, so we’ll get another order of clothes in the next few days. I don’t know whether we’ll also get 30% back when using the reward bucks, but that’ll be icing on the cake if I do.

I had an offer for 10% back at GiftCards.com. Terms typically indicate that orders for more than $2,000 will not qualify for rewards, so I made a gift card purchase for a bit less and my 10% tracked.

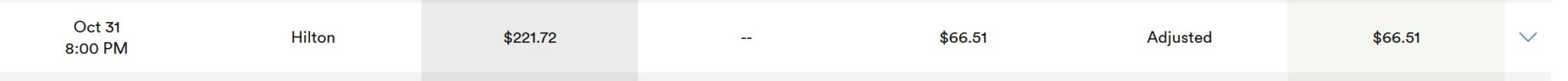

During our recent Million Mile Madness challenge, I booked several Hilton stays through a targeted offer for 30% back at Hilton.

That was on top of earning more than 6,000 Hilton points for the stay.

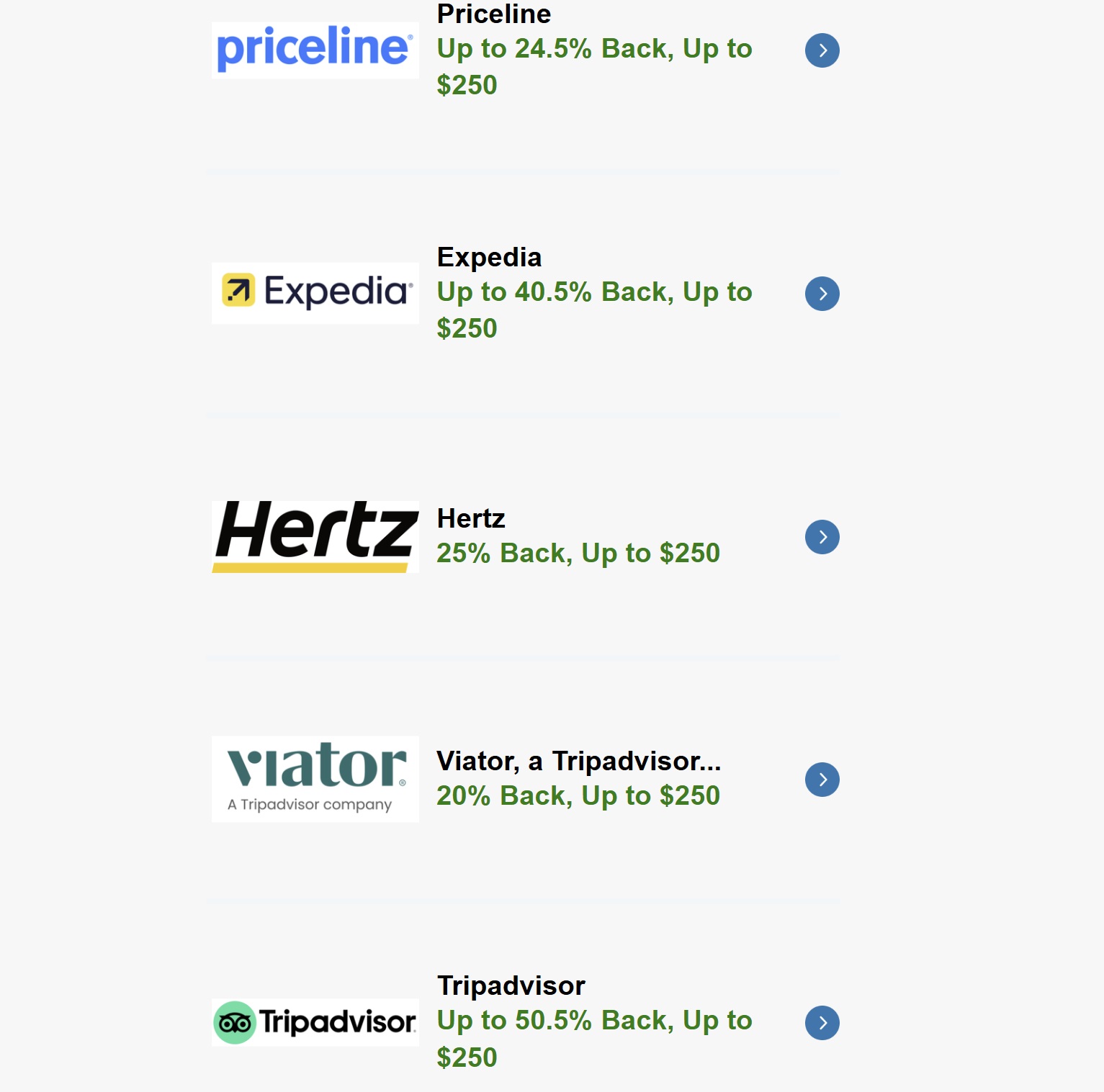

As you can see in the screen shot at the top, I’ve been targeted for up to 50.5% back at TripAdvisor. That rate is for activities bookings. I intend to book a couple of activities for trips next year to take advantage of that return.

Not quite everything has gone perfectly according to plan, though even in those cases it is a little difficult to complain.

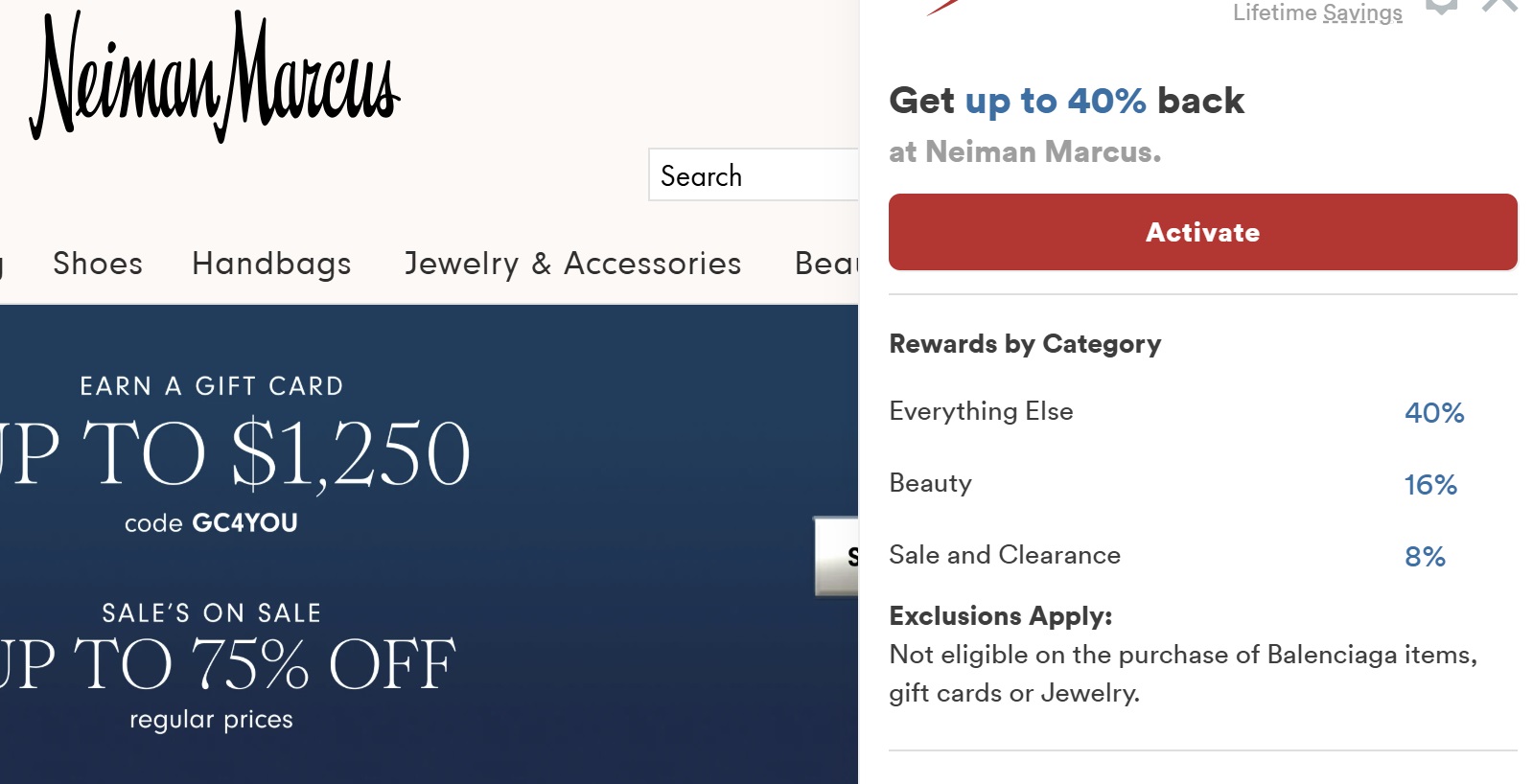

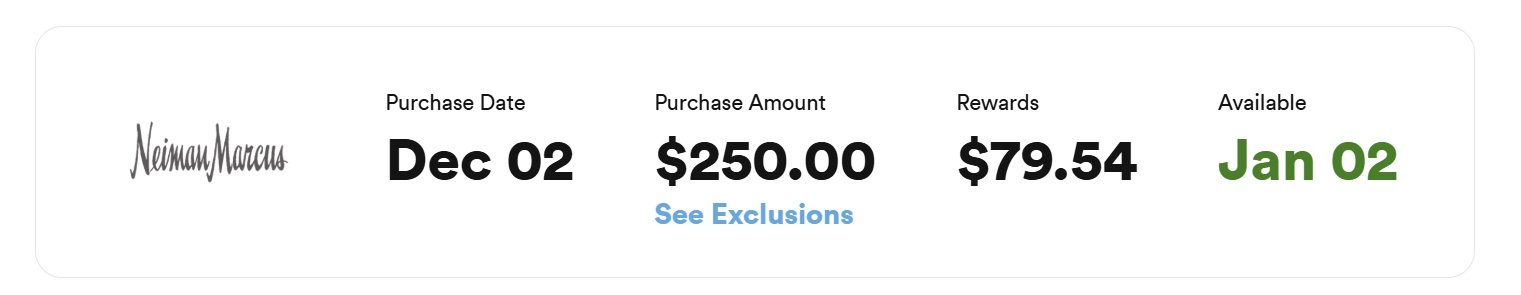

For instance, I bought something through Neiman Marcus after clicking through from an email link that advertised 40% back on “everything else”.

I purchased an item that was exactly $250 that typically isn’t discounted / isn’t eligible for most coupon codes. The exclusions above only excluded Balenciaga, gift cards, and jewelry, so I placed an order giving it a shot. My order did track — and at $79.54, it’s for a nice amount back….but that’s not 40%. Specifically, it’s about 31.8% back. I have no idea why I got that weird amount tracking.

I may follow up with customer service as my order should have earned $100 back and I can’t figure out where they got the weird percentage amount. At the same time, I would have made that purchase still at 31.8% back. It’s annoying though that you have to keep an eye on things like that.

Truth be told, it’s been pretty rare that I’ve seen an incorrect payout like that.

More disturbingly, Capital One Shopping occasionally sneaks in some pretty hidden deal terms and exclusions that are worth knowing about.

Sneaky Capital One Shopping exclusions

I noted the Kate Spade deal above. We originally had a few gifts in our shopping cart. Luckily, my wife had the eagle-eye for an exclusion that I nearly missed — the exclusions here note that cash back is not eligible on the purchase of gift cards or on orders that include 3 or more items.

Even after reading that, it was my wife who reminded me that I had 3 items in my cart and needed to drop one or risk not earning any rewards on the purchase. That seemed like an extreme exclusion, especially during the holiday shopping season (yes, separate orders seem to have tracked just fine).

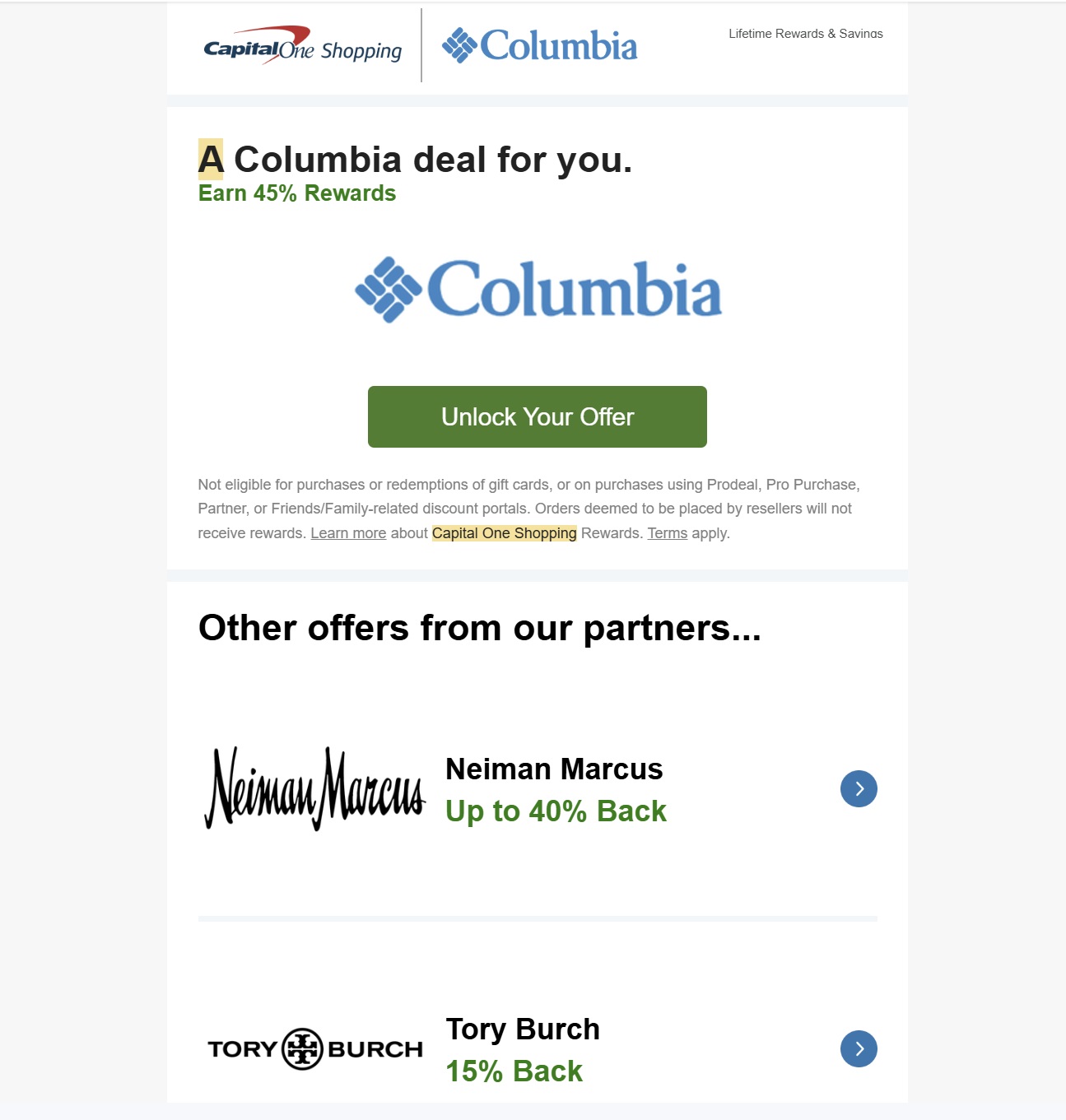

Sneakier yet are the targeted email offers. I get offers all the time that look like this one:

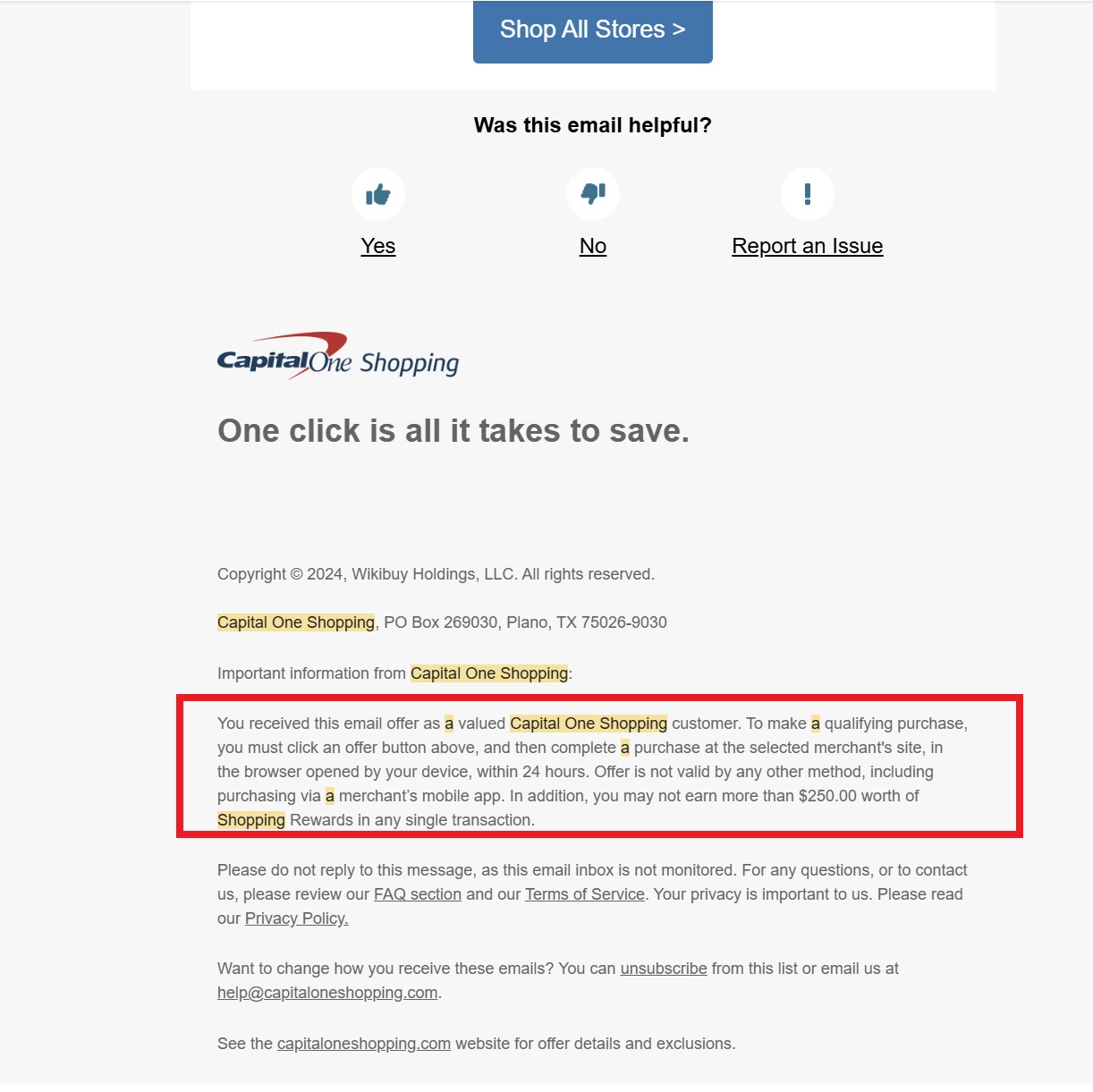

I got a good offer via email just like the above but for StubHub a few months ago. I clicked through and bought 9 tickets to an NFL game (a bunch of family members attended a game this fall). I expected something like 22.5% back on a purchase of a couple thousand dollars. Only $250 in rewards tracked. When I followed up with Capital One Shopping, they claimed a limit of $250 in rewards on a single transaction. I pushed back, having earned more than $250 in rewards from a single transaction numerous times before and not finding a limit listed in the online terms on the website. Customer service pointed me back to fine print at the bottom of the email offers:

As you can see, the email terms note that you may not earn more than $250 in rewards in any single transaction. That’s sneaky. It isn’t an official term found anywhere in the shopping portal terms & conditions — and I’ve earned more than $250 from a single transaction after clicking through from the portal website numerous times before. But the emails seem to contain this term (I would swear that they didn’t always have this because I don’t recall it being present in past emails, but I do see it in all new emails now).

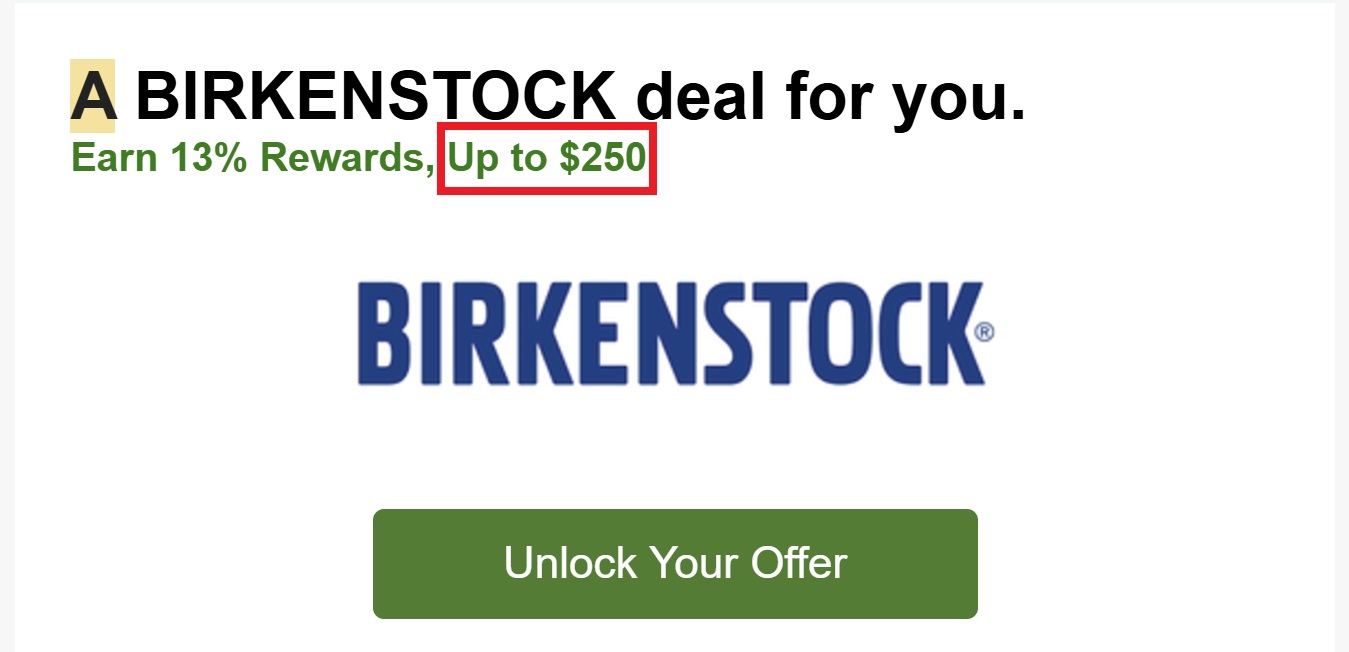

Newer targeted emails now sometimes make the $250 cap clearer as shown at the top of this post and below. That’s at least better than the emails that only advertise great headline rates with no mention of a cap.

I find this very problematic as many of their emails are misleading by burying the $250 cap in small print. However, again, I haven’t found the $250 rewards cap to apply when clicking through from the website, so I’m simply keeping under the $250-back limit when clicking through from emails.

I’m definitely still pretty burned over the StubHub offer, but in the overall scheme of things I’ve come out well ahead with offers like the ones noted in this post.

How do you find and use targeted Capital One Shopping offers?

The question above has a multi-pronged answer and is really the heart of Capital One Shopping complexity. The Capital One Shopping portal is not as simple as other portals, for better and worse.

You need to know that there are several different ways to access / get offers from Capital One Shopping. Offers frequently vary between these channels:

- Capital One Shopping website (“desktop” platform)

- Capital One Shopping browser extension

- Capital One Shopping emails

- Capital One Shopping app

- If you have a Capital One credit card, you’ll also find shopping offers in your online login, and those are often different.

It’s worth noting that you may get targeted offers from all of the above and they won’t necessarily match from one platform to the next. You want to be able to monitor all of them.

Capital One Shopping website offers

On the desktop site capitaloneshopping.com, you’ll find various targeted offers by scrolling on the home page when logged in (anyone can make an account for free — again, this isn’t a Capital One account but rather just a Capital One Shopping account).

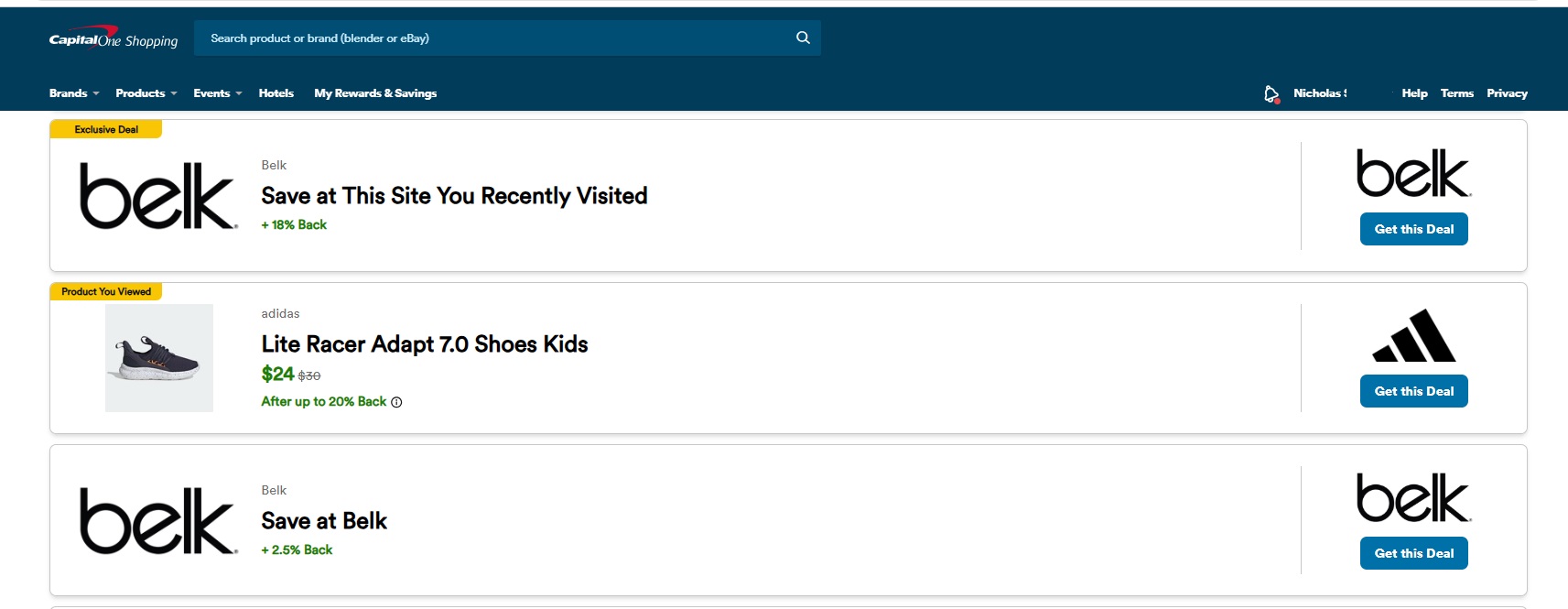

You’ll often see different targeted offers for the same store. See below — depending on which button I click, I could get either 2.5% back or 18% back at Belk. I should obviously click the 18% back button!

If I do this in the browser where I have the Chrome extension installed, it typically does pop up confirming the rate (in this case the 18%) during the checkout flow process. Which offer it shows just depends on which button you click. It’s worth mentioning that those buttons sometimes show specific products (like the Adidas one above that shows the “Lite Racer” sneakers). You do not need to buy the advertised product to get the advertised rate. Typically, buying anything at the website in question will get the advertised rate. There are a few exceptions to that — like if you click through any shopping portal to the Office Depot website and buy a gift card, rewards aren’t going to track because Office Depot doesn’t process gift card transactions directly (they use GiftCardMall). However, whether you buy a printer or a laptop or a ream of paper, it’ll track rewards regardless of which product may be shown in your targeted offers.

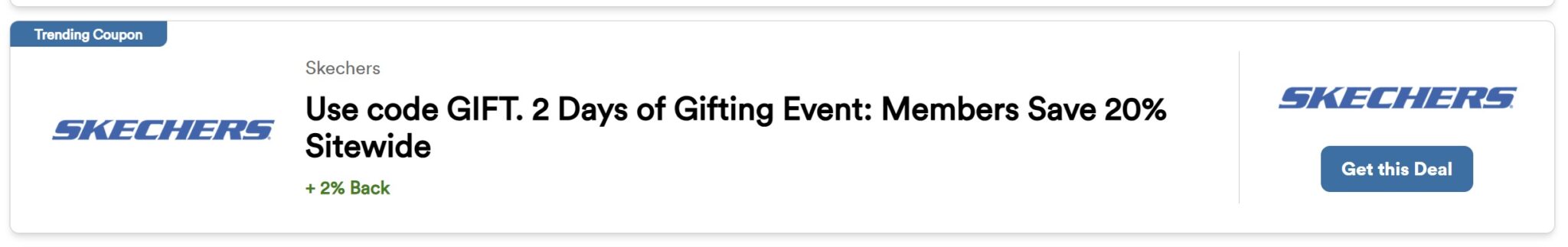

Note that the spread between different targeted offer buttons can be massive. For instance, I saw offers for Sketchers starting at 2% back.

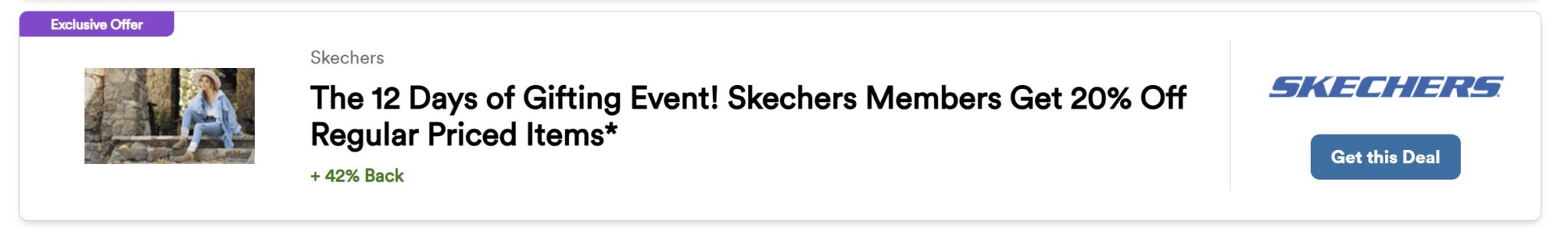

However, when I scrolled far enough, I eventually found a button good for forty-two percent back!

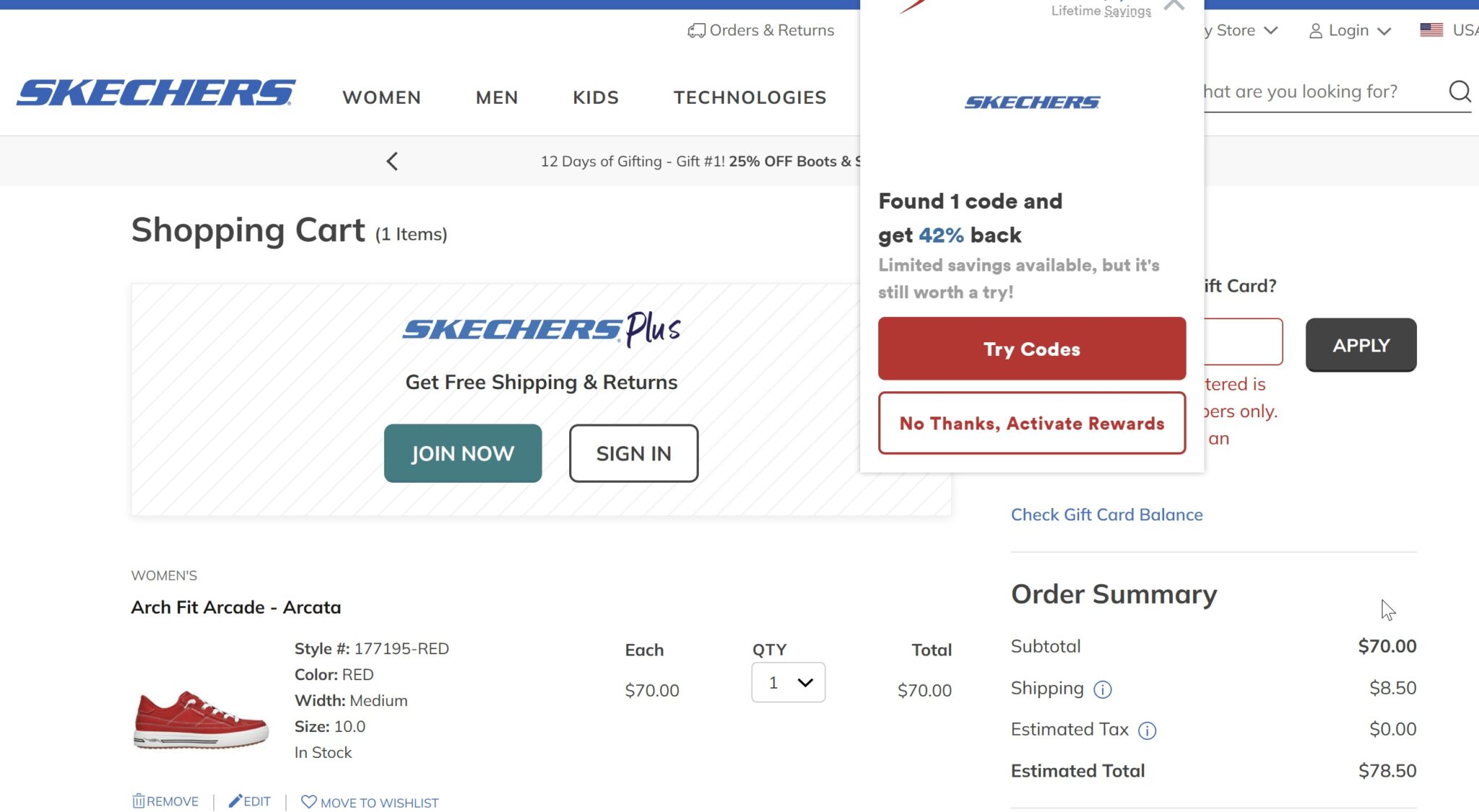

Sure enough, if I click through that 42% button, the Capital One Shopping extension confirms the 42% back with an activation button once I go to my shopping cart.

I wasn’t actually buying those shoes, I just threw something random in my cart to demonstrate how the extension would pop up with the correct rate based on the button I’ve clicked.

An important note: I never use the search box on the Capital One Shopping home page! That’s because searching in that box only checks regular rates. Targeted rates, which you’ll find by simply scrolling down (or checking email) are very often far, far better. If I don’t have time to scroll through endlessly, I’ll just quickly drag the mouse to the bottom of the page repeatedly (too fast to actually see everything). Then, when I finally find the bottom (which takes quite a while even this way!), I’ll use Ctrl+F on my keyboard to search the page for a store name — and I’ll be sure to “next” through every mention of the store name looking for the best payouts.

Capital One Shopping email offers

Capital One Shopping frequently sends targeted email offers. These often seem to be influenced by websites you browse in the browser where you have the Capital One Shopping extension installed. If I’m hoping for an offer for a particular site, I’ll often open it up and browse around in the browser where the extension is installed. I often get a targeted email offer for that site a few days later.

Clicking through from an email offer in the browser where you have the extension installed should also result in the extension popping up confirmation of that email-advertised payout provided that you’ve clicked through from the email. For instance, I have recently received email offers for 34% back at Belk.

If I click through from that email, the extension should pop up confirmation of that offer during the checkout process.

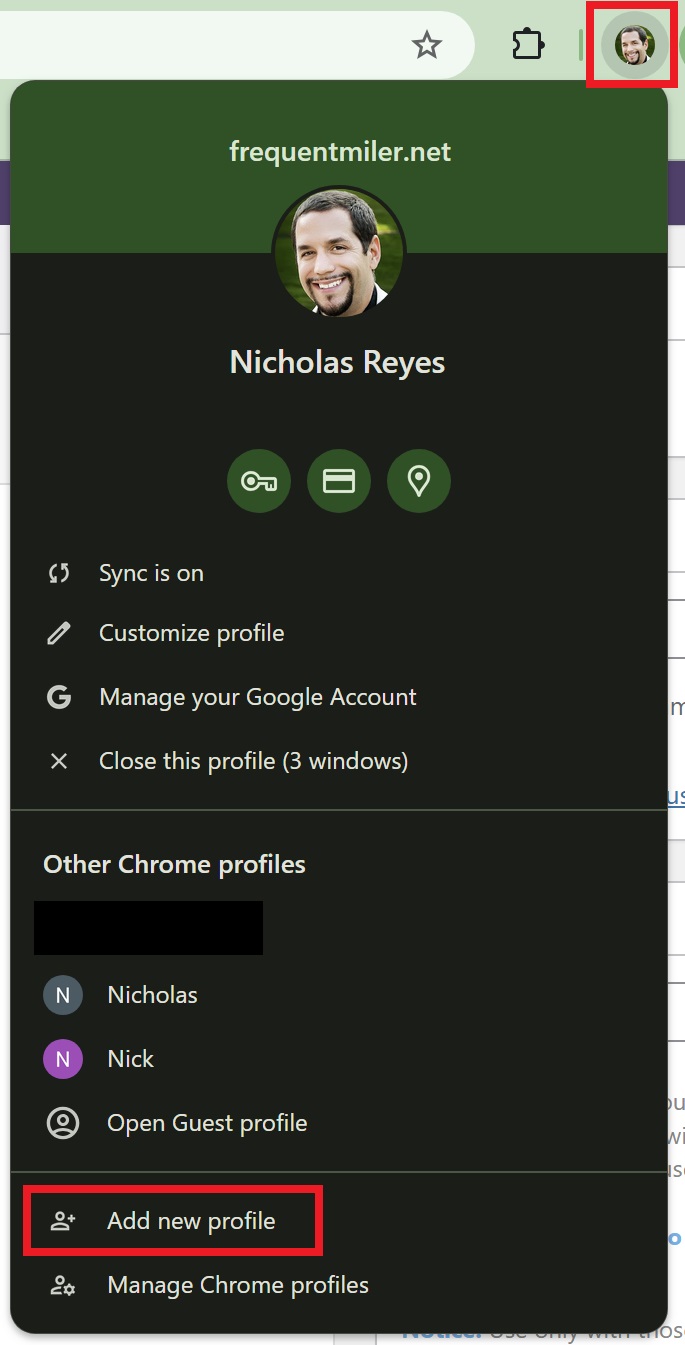

Personally, I prefer not to have the extension installed in my main browser instance collecting all of my browsing data, so I created a separate Chrome profile that I only use when I want to use Capital One Shopping. You can add a Chrome profile by clicking on your picture or initial in the top right corner of Chrome.

I only have the Capital One Shopping extension installed in the “Nick” profile above, so I use that browser instance for Capital One Shopping. I’ll also open those email offers in that browser instance and then click through so that the extension can pick up the click and confirm the rate.

I should note that there are some instances where the extension will pop up a different offer. It’s unclear exactly how long targeted email links will work. Some may work longer than others.

For instance, within the last week, I received an email offer that included a link for 70% back at Extra Holidays, a booking engine for Wyndham vacation rental properties.

A few days later, I received a targeted email offer for 30% back from Extra Holidays. A few days after receiving that 30% offer, I went back to the email with the 70% offer. I clicked through from that email to the Extra Holidays site in the browser where I have the Capital One Shopping extension installed. Sure enough, the extension popped up with the 70% offer during the booking flow.

That particular booking hasn’t tracked yet, so the jury is still out.

Capital One Shopping phone app

Truth be told, I installed the Capital One Shopping app a long time ago, but I haven’t spent much time checking targeted offers in the Capital One Shopping app on my phone recently. However, I have definitely noticed different payouts there in the past, so it’s probably worth checking there also!

Keep in mind that you’re trading cash for gift cards

One thing I want to mention about the above is to keep in mind that you shouldn’t value the payouts quite like cash back. That’s because Capital One Shopping rewards can only be redeemed for gift cards.

While I was happy to get high payout rates for holiday shopping purchases, the fact is that I was trading cash for gift cards.

For instance, that Kate Spade offer shown above was for $313 and we received $181.54 back. But that’s not cash! That’s gift cards. So while it is really tempting to mentally account for it as though the bags only cost $132 (since I got $181 back), the truth is that I spent a full $313. I’ve just tied up $181.54 in gift cards. Essentially, I paid $313 and I got two purses and a $181.54 Walmart gift card (that’s how I’ll redeem the rewards).

In my case, I value that closer to cash back than some will. That’s because Walmart is back as a redemption option and we do a fair amount of dry goods grocery shopping at Walmart. We certainly spend at least as much per month as I’ll have earned in rewards from the shopping trips noted above. So, in my case, I’d have spent that money at Walmart anyway, I’m just sort of indirectly buying the gift cards.

However, your situation may vary. It’s important to remember that you’re tying up that “return” in gift cards that may have less than face value to you (particularly true since many of those brands can be purchased at a discount).

Note that some readers have reported problems

I want to mention here that we have received some reader complaints about orders not tracking properly through Capital One Shopping.

I should first note that over the years, we have received reader complaints about every single shopping portal in existence (and most hotels and airlines). If I stopped writing about every company with which some readers have had a bad experience, I’m not sure there would be any companies left to write about.

But I note here that we’ve received some reader complaints about Capital One Shopping because I know that some readers who are very experienced with portals have had stuff fail to track properly with Capital One Shopping. It’s even happened within our own team: Greg and I have both had great success with Capital One Shopping, but Tim has had difficulty getting orders to track.

I don’t know why some have had a lot of trouble with Capital One Shopping. I follow the same best shopping portal practices with Capital One Shopping that I use with othr portals and my orders always track as expected. I sometimes receive a reader report that they think the portal mysteriously failed to track their order because it was a “big order”, but in my case I’ve earned thousands of dollars in gift cards from Capital One Shopping almost without issue (apart from the StubHub deal noted above, a Saks order that didn’t track at the right rate once (at a time when Saks orders were wacky across the board), and one order I placed at Lenovo where customer service helped when I followed up. I’ve had tons of success otherwise — certainly more than failures.

Still, it’s worth knowing that you may be in for frustration with Capital One Shopping. I personally still recommend it to friends and family because I’ve found it to work well, but I suppose your mileage may vary.

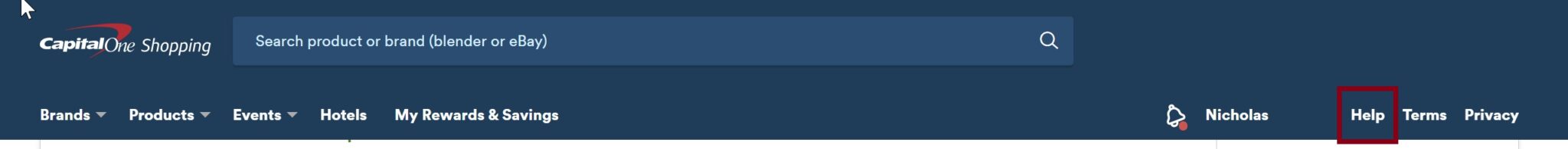

How do you know that a Capital One Shopping order tracked? When will it pay out?

I’ve written about this before, but I find that many don’t know how and where to see pending Capital One Shopping transactions. If you go to the web platform and click on “Help” in the top right corner, it will show recently tracked transactions with a purchase date and the date rewards are expected to become redeemable. This is where I found the many screen shots above showing my tracked orders.

Capital One Shopping does sometimes send out an email to let you know that an order has tracked. However, that isn’t consistent — I only sometimes receive those emails (and when I do, it is typically well after I’ve seen the order tracked in the “help” tab).

Keep in mind that it typically takes at least days and sometimes longer (maybe weeks) before a tracked order shows up. While some portals have become remarkably good at reporting tracked orders quickly, I’ve been playing the shopping portal game for long enough to remember when portals often took 30 or 45 days to track an order. I’m pretty patient about waiting. My orders usually track as expected.

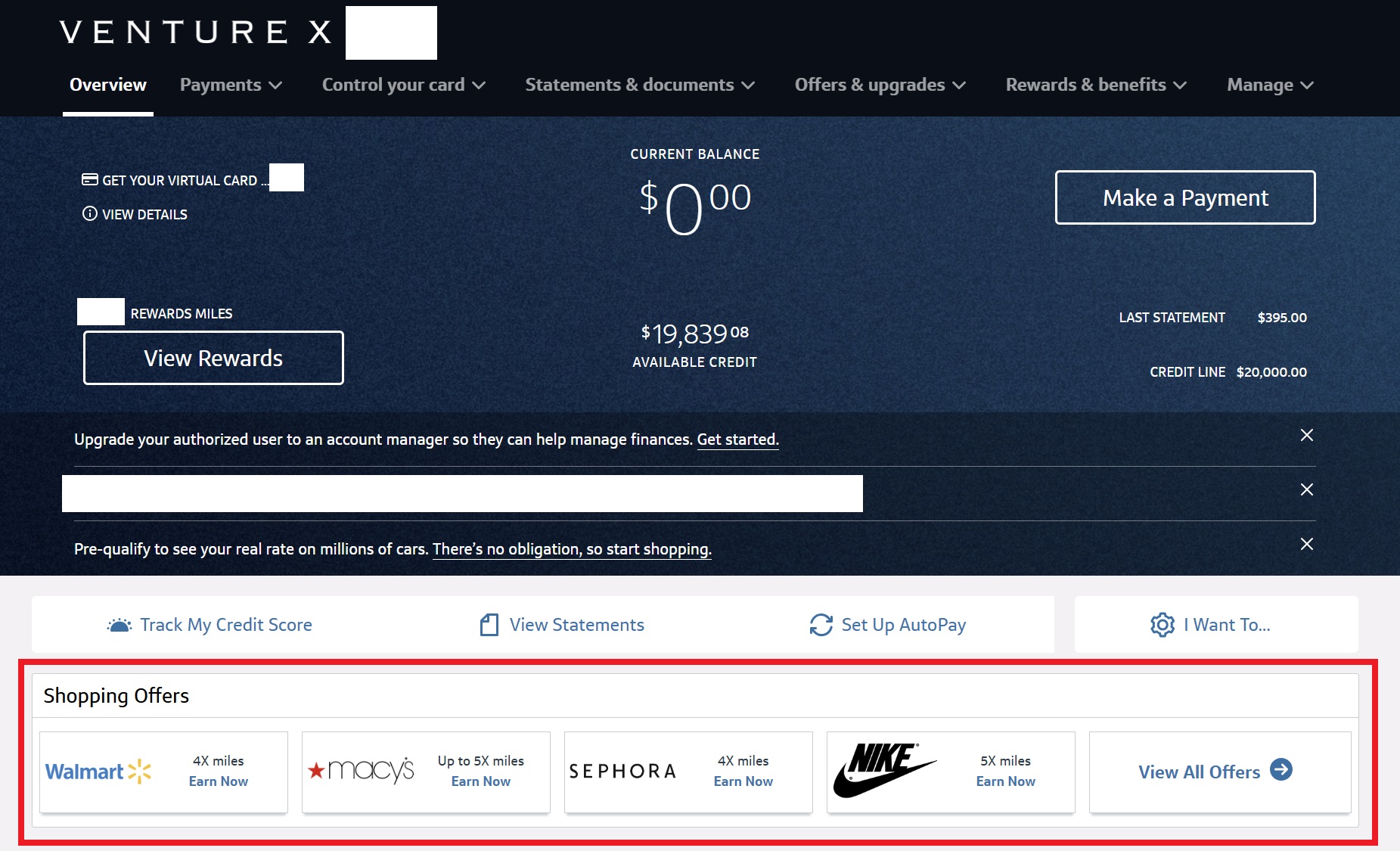

If you have a Capital One credit card (and if you prefer miles), try logging in to your credit card account

Everything above applies solely to the public shopping portal that anyone can join.

However, if you have a Capital One credit card, it’s worth logging in to your credit card account and checking out targeted offers there as well. You’ll find these under your card information in your credit card login.

Until sometime this year, those offers only yielded “cash back” in the form of statement credits. However, these days, if you have a card that earns miles, you’ll see mileage payouts. They can sometimes be very good — perhaps even better than rates through Capital One Shopping.

For instance, my wife was browsing her offers yesterday and saw one goof for 30x miles at Staples.

If you value Capital One miles somewhere around 1.5c per mile, that could be a really attractive portal rate.

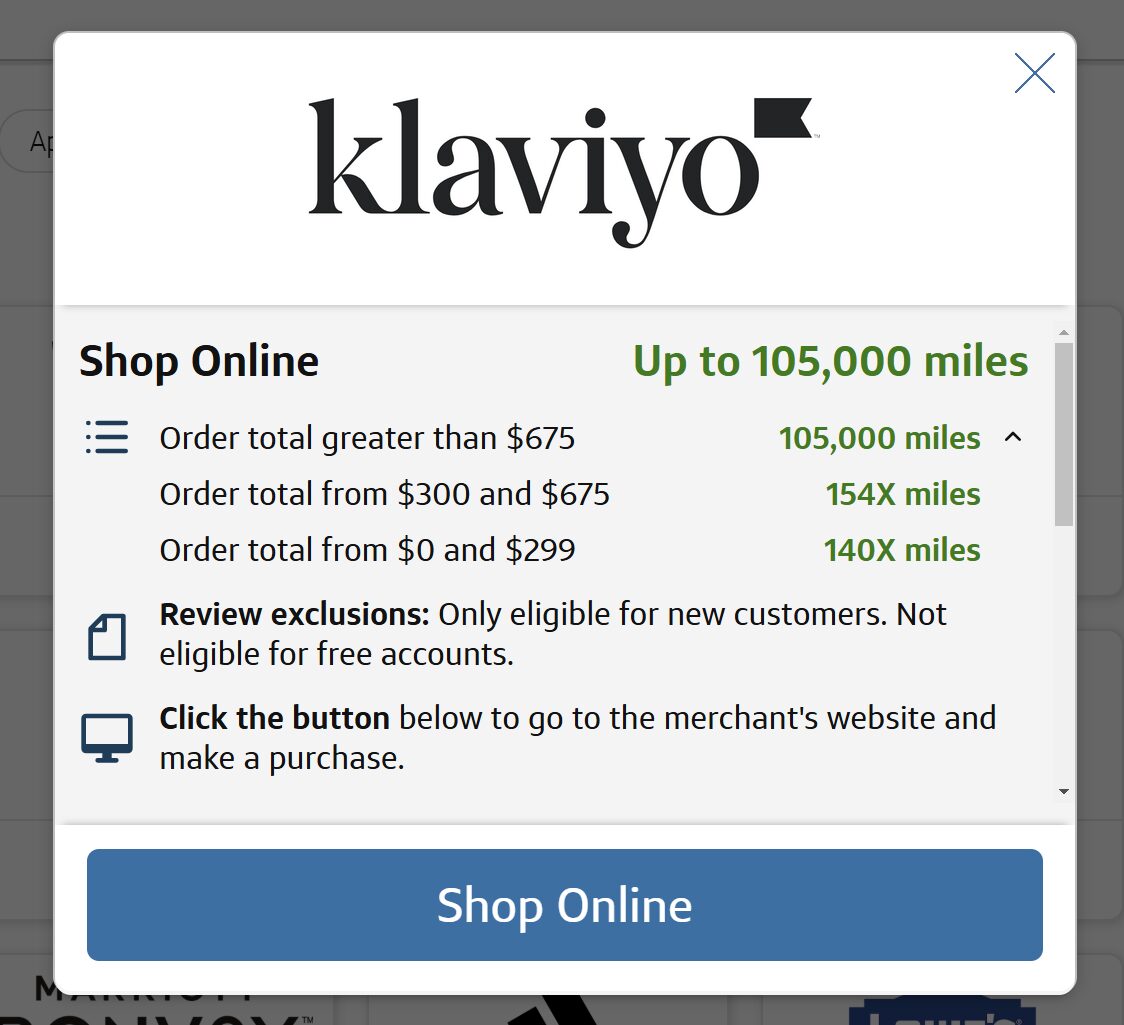

A member of our Frequent Miler Insiders Facebook group noticed an even more compelling offer yesterday, with an email/SMS marketing subscription service offering up to 154 miles per dollar spent.

I didn’t end up using that one because it wasn’t clear to me how long you need to be subscribed to receive the payout, but some folks found a subscription that costs more than $675 for a month and they took a shot at earning 105,000 miles.

Note that in my experience, when clicking through from offers in my online account, I did have to use my Capital One card to get the advertised payout. That’s not true on the public Capital One Shopping portal offers covered in most of this post, but it has been true for those offers I found within my Capital One credit card login.

Bottom line

I continue to rock the Capital One Shopping offers. While I’m not completely enamored with the portal, the returns have been hard to ignore. While some have reported problems with orders tracking, I’ve had nearly 100% success with the portal. Targeted offers had slowed considerably during the first half of 2024, but holiday shopping offers have really started heating up recently. I’ve been particularly excited by payouts like 50% back on activities at TripAdvisor, 30% back on Hilton, 25% back on Hertz, and other similar offers that have enabled me to earn a really nice return on some of my travels. However, for holiday shopping, I’ve also done really well checking all of my various targeted offers.

If you’ve been sleeping on Capital One Shopping, it might be time to wake up — the payouts they offer probably won’t last at these types of rates forever, but it’s well worth keeping an eye on them for now.

Want to learn more about miles and points? Subscribe to email updates or check out our podcast on your favorite podcast platform.