Fashion

Sustainable Fashion Market

Report Overview

The Global Sustainable Fashion Market size is expected to be worth around USD 9.0 Billion by 2033, from USD 3.6 Billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

Sustainable fashion refers to clothing and accessories produced in an environmentally and socially responsible manner. It emphasizes the use of eco-friendly materials, ethical labor practices, and sustainable production processes to minimize the fashion industry’s impact on the planet and promote long-term ecological balance.

The Sustainable Fashion Market comprises businesses and products that prioritize environmental sustainability and ethical standards in the fashion industry. This market includes brands that use organic materials, recycled fabrics, and sustainable dyes, as well as those committed to fair labor practices and reducing waste throughout their supply chains.

![]()

Sustainable fashion is gaining traction as it promotes reduced environmental impacts and sustainable practices. The production of jeans, for example, typically consumes about 7,000 liters of water, but using organic cotton can reduce this water usage by up to 91%. Companies like Recover are scaling operations with significant investments, highlighted by a $100 million initiative from Goldman Sachs to enhance recycled cotton fiber production.

The market for sustainable fashion is buoyed by compelling growth factors and opportunities. Regulatory frameworks are strengthening, with the European Commission’s EU Strategy for Sustainable and Circular Textiles aiming for all textile products to be durable, repairable, and recyclable by 2030. Major brands are responding; Inditex’s $75 million investment in Ambercycle’s Cycora technology underscores a deepening commitment to sustainable materials.

Moreover, the industry’s impact on broader and local scales is profound. The EU produces around 4 million tons of textile waste annually, while the U.S. reported 17 million tons in 2018. In response, Puma has pledged to reduce its greenhouse gas emissions by 65% by 2026 from its 2017 levels, targeting carbon neutrality by 2050. These measures signify a significant shift towards sustainability, driven by consumer demand and enhanced by substantial government and private investments.

Key Findings in Sustainable Fashion Market

- The Sustainable Fashion Market was valued at USD 3.6 Billion in 2023 and is expected to reach USD 9.0 Billion by 2033, with a CAGR of 9.6%.

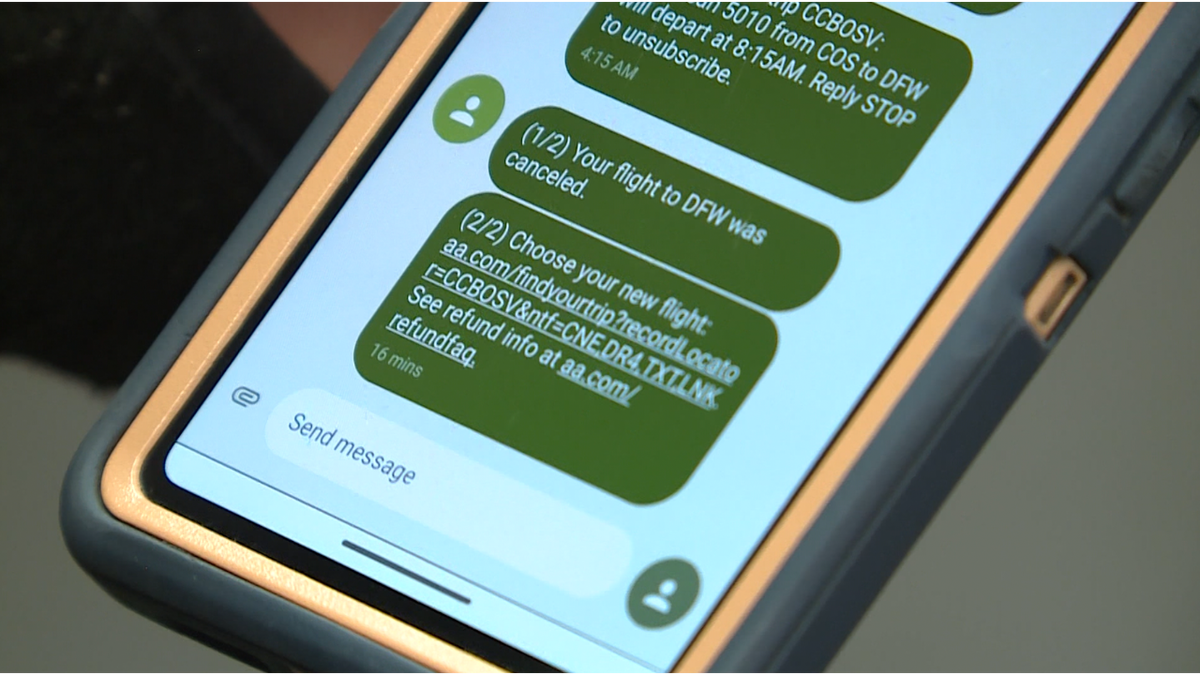

- In 2023, Pants and Trousers dominate the Type segment with 22.5%, driven by their versatility and demand.

- In 2023, Online Sales lead the Distribution Channel with 58.2%, reflecting the growth of e-commerce platforms.

- In 2023, Organic Cotton dominates the Material segment with 29.7%, emphasizing its eco-friendly and sustainable appeal.

- In 2023, Medium-priced items represent the largest Price Range with 50.5%, catering to cost-conscious yet sustainability-focused consumers.

- In 2023, Women account for 49.1% of the End User segment, highlighting their significant contribution to the market.

- In 2023, Asia Pacific holds a 46.3% share with a market value of USD 1.67 Billion, driven by its large population and manufacturing base.

Sustainable Fashion Business Environment Analysis

The sustainable fashion market is witnessing increasing saturation as more brands pivot towards eco-friendly practices. According to eBay’s Circular Fashion Fund announcement in December 2024, the platform has committed $1.2 million to support startups that enhance circular economy models, illustrating the market’s dense competitive landscape.

Target demographics for sustainable fashion are evolving, with a significant focus on environmentally conscious consumers. Initiatives like Fibe’s potato-based textile innovation from September 2024 cater to those seeking alternatives to traditional fibers, indicating a shift in consumer preferences towards sustainability.

Product differentiation within sustainable fashion is marked by innovative material usage. For example, Fibe’s development of a textile fiber from potato harvest waste provides a novel alternative that reduces environmental impacts, setting a new standard for material innovation in the industry.

The value chain in sustainable fashion is becoming more integrated and focused on environmental impact reduction. Fashion for Good’s launch of the “World of Waste” tool in November 2024 helps companies track textile waste globally, optimizing recycling efforts and resource utilization within the industry.

Export-import dynamics in sustainable fashion are influenced by global demand for eco-friendly products. The rise of technologies that verify the sustainability and authenticity of textiles is drawing international investment, as seen with venture capital interest in September 2024, promoting a more transparent and responsible global trade environment.

Adjacent markets, including technology and waste management, are increasingly relevant to sustainable fashion. Ventures like Fashion for Good’s mapping tool integrate tech solutions with fashion, enhancing the industry’s capability to manage its environmental footprint effectively.

Type Analysis

Pants and Trousers dominate with 22.5% due to their versatility and widespread use in both casual and formal settings.

In the sustainable fashion market, the segment of ‘Type’ encompasses various categories, with pants and trousers holding the predominant position at 22.5%. This dominance is attributed to their essential role in everyday wardrobes, catering to a broad demographic that values both style and sustainability. They serve as a fundamental element in both casual and formal attire, making them versatile staples.

Tops and T-shirts are vital for their everyday utility and the ease with which they integrate into existing wardrobes, supporting casual comfort with sustainable choices.

Jeans and Denim remain popular due to their durability and the cultural staple they represent, aligning well with sustainable practices that prioritize long-lasting wear.

Shorts and Skirts appeal during seasonal peaks and offer sustainable options for warmer climates.

Sweaters are essential for their seasonal versatility and the increasing availability of eco-friendly materials.

Swimwear highlight the expansion of sustainable materials into niche markets, including water-resistant and eco-friendly fabrics.

Others, including activewear and loungewear, demonstrate the growing demand for comfort combined with sustainability, relevant in home and casual settings.

Material Analysis

Organic Cotton leads with 29.7% due to its minimal environmental impact and consumer awareness of its benefits.

Materials play a critical role in sustainable fashion, with organic cotton at the forefront, holding a 29.7% share. Its popularity stems from its reduced environmental footprint and the growing consumer awareness regarding the benefits of organic materials over conventional cotton.

Recycled Fabrics are gaining traction due to their role in reducing waste and promoting circular fashion principles.

Eco-friendly Dyes are important for reducing the chemical impact on the environment, appealing to eco-conscious consumers.

Hemp is valued for its durability and lower water usage during cultivation, fitting well with sustainable agriculture practices.

Bamboo is celebrated for its rapid growth and biodegradability, making it a popular choice among sustainable materials.

Others encompass a variety of innovative materials like pineapple leather and recycled polyester, highlighting the industry’s innovation in developing new sustainable fabrics.

Price Range Analysis

Medium-priced sustainable fashion dominates with 50.5% due to its balance of affordability and quality.

The price range of sustainable fashion is segmented into low, medium, and high, with medium-priced garments leading the market at 50.5%. This segment’s dominance is attributed to its appeal to a broad consumer base seeking a balance between affordability and quality sustainability.

Low-priced items cater to budget-conscious consumers who are beginning to explore sustainable fashion, offering an entry point without significant financial commitment.

High-priced sustainable fashion targets a niche market that values premium materials and craftsmanship, willing to invest more in superior eco-friendly products.

End User Analysis

Women lead the end-user segment with 49.1% due to their significant influence and decision-making power in fashion purchases.

End users of sustainable fashion are categorized into men, women, and kids, with women holding the largest share at 49.1%. This dominance is due to women’s significant influence and decision-making power in fashion purchases, combined with a strong inclination towards sustainable and ethical fashion choices.

Men are increasingly becoming aware and interested in sustainable fashion, reflecting a broader shift in consumer habits across all demographics.

Kids’ sustainable fashion is growing as parents increasingly prioritize sustainable and safe materials for children’s clothing, reflecting a long-term investment in environmentally responsible habits from a young age.

Distribution Channel Analysis

Online sales lead with 58.2% due to the convenience of shopping from home and the wider availability of sustainable options online.

The distribution channel for sustainable fashion is sharply divided, with online sales significantly leading at 58.2%. This surge is driven by the convenience of shopping from home and the expanded reach that online platforms offer, making sustainable fashion more accessible to a global audience.

Offline channels continue to be important for consumers who prefer the tactile experience of shopping and the assurance of trying on garments before purchasing, which remains a crucial aspect of buying decisions, especially in the context of fit and comfort.

![]()

![]()

Key Market Segments

By Type

- Tops and T-Shirts

- Pants and Trousers

- Jeans and Denim

- Shorts and Skirts

- Sweaters

- Swimsuits

- Others (Activewear, Loungewear, etc.)

By Material

- Organic Cotton

- Recycled Fabrics

- Eco-friendly Dyes

- Hemp

- Bamboo

- Others

By Price Range

By End User

By Distribution Channel

Driving Factors

Rising Awareness Drives Market Growth

Rising consumer awareness about ethical practices is a key driver for the sustainable fashion market. Shoppers are demanding transparency, as seen in brands like Patagonia, which openly shares its supply chain practices. This trend is further supported by regulatory frameworks such as the European Union’s Green Deal, which promotes sustainability in various industries, including fashion.

The demand for eco-friendly materials is also increasing. Fabrics like organic cotton, used by brands like Pact, and recycled polyester, utilized by Adidas in its Parley collection, are gaining popularity. Innovations in manufacturing, such as Levi’s waterless dyeing techniques and Stella McCartney’s biodegradable packaging, are making production more sustainable and efficient.

Advancements in technology are helping brands meet these demands. Tools like blockchain enable better supply chain tracking, which companies like Everlane use to demonstrate transparency.

Restraining Factors

High Costs Restraint Market Growth

High costs are a significant restraint in the sustainable fashion market. Organic cotton, often sourced for eco-friendly brands like Eileen Fisher, is more expensive than conventional materials. This increases production costs, making sustainable products less affordable for many consumers.

Limited consumer willingness to pay premium prices further restricts market growth. Many shoppers are price-sensitive, especially in developing markets, where disposable incomes are lower. Brands like H&M, despite their Conscious Collection, face challenges balancing sustainability with affordability.

Scaling sustainable supply chains remains a hurdle. Producing eco-friendly products at scale requires heavy investment, as seen with smaller startups like Veja, which focus on ethical sneakers but struggle to expand operations.

Additionally, the lack of standardization in sustainability certifications, such as varying criteria between Global Organic Textile Standard (GOTS) and Fair Trade labels, confuses consumers and undermines trust.

Growth Opportunities

Circular Economy Models Provide Opportunities

Adopting circular economy models offers immense opportunities for sustainable fashion. These systems focus on reducing waste and reusing materials. Brands like Renewcell are leading the way by recycling textiles into new fabrics, which large players like H&M use in their collections.

Emerging markets also present growth potential. For instance, countries like India and South Africa are seeing an increased interest in sustainable fashion, fueled by rising middle-class populations and local sustainable startups such as Doodlage in India. These regions offer untapped opportunities for global brands to expand.

Digital platforms are reshaping transparency in supply chains. Blockchain technology is enabling companies like Provenance to provide detailed product traceability, allowing consumers to verify ethical practices. Brands adopting these tools, such as TOMS, are gaining trust and loyalty among eco-conscious shoppers.

Collaborations with ethical organizations amplify growth potential. Partnerships between The North Face and the National Park Foundation showcase how aligning with environmental causes attracts like-minded consumers. Such collaborations enhance brand credibility and help companies connect with a broader audience.

Emerging Trends

Social Media and Minimalist Fashion Are Latest Trending Factors

Social media is revolutionizing the sustainable fashion market. Platforms like Instagram and TikTok are driving awareness, with influencers like Venetia La Manna advocating for eco-friendly brands such as Reformation. Viral challenges, such as styling thrifted outfits, further boost consumer interest in sustainable choices.

Second-hand and thrift shopping is another significant trend. Platforms like Depop and Poshmark are popularizing resale, making pre-loved fashion stylish and accessible. Even luxury apparel players like Gucci have entered this space through partnerships with resale platforms like The RealReal, reinforcing the trend’s mainstream appeal.

Zero-waste and minimalist fashion are gaining momentum. Designers are emphasizing timeless styles and durable materials. For example, Eileen Fisher focuses on producing versatile, high-quality pieces that align with minimalist values. These products appeal to consumers looking for long-lasting wardrobes that reduce frequent purchasing.

Direct-to-consumer (DTC) brands are leveraging these trends. Startups like Everlane and Allbirds bypass traditional retail to offer eco-friendly products directly to customers. This approach reduces costs and strengthens relationships with consumers, enhancing their loyalty.

Regional Analysis of Sustainable Fashion Market

Asia Pacific Dominates with 46.3% Market Share

Asia Pacific leads the Sustainable Fashion Market with a 46.3% share, amounting to USD 1.67 billion. This substantial market presence is driven by the region’s rapid adoption of eco-friendly practices and a growing middle class increasingly aware of sustainability issues.

The region benefits from a strong network of local and international brands that emphasize sustainable production methods. High consumer demand for environmentally friendly products, combined with government support for sustainable initiatives, further propels the market growth.

The influence of Asia Pacific in the global Sustainable Fashion Market is likely to increase as awareness and demand for eco-friendly products continue to rise. Investments in sustainable technologies and textiles are expected to expand, enhancing the region’s competitive edge and market share.

![]()

![]()

Regional Mentions:

- North America: North America is a major player in the Sustainable Fashion Market, with a focus on innovation and ethical sourcing. The market is driven by consumer awareness and the presence of numerous sustainable brands.

- Europe: Europe maintains a robust sustainable fashion scene, characterized by stringent environmental regulations and a long-standing tradition of quality and craftsmanship in fashion.

- Middle East & Africa: The Middle East and Africa are slowly increasing their stake in sustainable fashion, with a focus on luxury brands incorporating sustainable practices as a selling point.

- Latin America: Latin America shows potential growth in sustainable fashion, driven by local artisans and the use of indigenous techniques that naturally incorporate sustainable practices.

Key Regions and Countries Covered in the Report

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape of Sustainable Fashion Market

In the Sustainable Fashion Market, Patagonia, Stella McCartney, Everlane, and Reformation are prominent leaders, setting standards for ethical practices and environmental stewardship.

Patagonia not only commits to using recycled materials but also actively engages in environmental activism, influencing the industry and consumers towards more sustainable practices. This approach has helped Patagonia build a strong brand loyalty among eco-conscious consumers.

Stella McCartney is a pioneer in luxury sustainable fashion, known for her commitment to cruelty-free and eco-friendly production methods. Her brand uses innovative materials such as recycled fabrics and organic cotton, catering to a high-end market that values both style and sustainability.

Everlane stands out for its transparency, offering customers detailed insights into the production costs and origins of each garment. This openness regarding its supply chain has attracted a dedicated customer base that values honesty and ethical production practices.

Together, these companies are driving significant change in the fashion industry by demonstrating that style and sustainability can coexist, which encourages other brands to follow suit and increases consumer demand for sustainable products.

Major Companies in the Market

- Patagonia

- Stella McCartney

- Everlane

- Reformation

- Eileen Fisher

- Allbirds

- Veja

- TOMS

- Outerknown

- People Tree

- Girlfriend Collective

- Thought Clothing

- Mud Jeans

Latest Developments of Sustainable Fashion Market

- Reformation and For Days: In 2023, Reformation, a leading sustainable fashion brand, acquired For Days, known for its commitment to circular fashion, for $200 million. This strategic acquisition aims to enhance Reformation’s sustainable offerings and strengthen its position in the eco-friendly apparel market.

- Adidas: In 2023, Adidas introduced a new line of sneakers crafted from recycled ocean plastic, reinforcing the company’s dedication to sustainability and innovation in eco-friendly materials.

- Nike: In 2023, Nike launched a new line of shoes made from sustainable materials, including recycled polyester and plant-based components, demonstrating the brand’s commitment to environmental responsibility and sustainable fashion.