Travel

The New World of Travel Startup Funding

This month, an 11-year-old startup called Flyr raised the largest single round of venture capital for a travel tech company in years: A total package of nearly $300 million.

It’s a tough time for startup funding, and the Flyr deal is a shining example of what investors are willing to bet on: Tech that promises to modernize outdated industries and has a real business model with recurring revenue.

Flyr’s basic pitch is to help airlines transform the retail experience into something more like online shopping with an AI-powered platform for dynamic pricing and personalized offers.

“We do deals that are tens of millions of dollars a year, and we do contracts that are five to 15 years in length,” Flyr CEO Alex Mans told Skift. “So that makes it a very, very strong business model with very high recurring revenue. And that, in turn, attracts great investors — especially long-term focused investors.”

Whether early or late stage, investors are more focused than ever on finding worthy startups.

“The number of companies that were raising in 2020 and 2021, it was just enormous compared to what we’re seeing today,” said Gaurav Tuli, partner of F-Prime Capital, the fund affiliated with Fidelity Investments. “It’s far, far fewer companies raising, and also of much higher quality today.”

F-Prime Capital has invested in travel tech companies including Lighthouse, Canary Technologies, ConnexPay, and AvantStay.

Skift has been tracking startup funding in weekly columns for years and the change is all too clear. We’ve spoken with founders who’ve run out of money and those who’ve made it through several funding rounds. And we’ve spoken with investors about what they’re looking for now. From after the go-go period post-pandemic to the depths of 2022 and 2023, they all tell a similar story: There’s money to be had, but the bar is much higher.

No More Money: ‘The Trough Is Closed’

For startups, the early 2020s felt a lot like the late 1990s.

During that first Internet stock boom, investors flooded the market with billions of dollars, betting on unproven tech startups that promised to become gold mines with the genesis of the world wide web. Many of those startups did not have much more of a business plan than adding “.com” at the end of their names. Stock prices soared.

But reality set in by the year 2000 as many of these companies failed to generate profits. Share prices tanked and numerous tech startups went bankrupt.

Companies like Apple and Amazon managed to weather the storm, however, emerging stronger and more dominant as many others faded into obscurity.

In the travel sector, the recent funding cycle is no different. As capital dries up, only the most resilient travel tech startups will survive.

John Tertan founded the streaming platform Heygo in 2020 as a way to help people “travel” virtually during the pandemic, generating millions of dollars in income for tour guides.

The startup raised $20 million in February 2022 — a high amount for a series A round compared to today’s standards — but the company shut down permanently just over a year later.

“The metrics changed post-Covid. There just wasn’t a big enough market for the amount of money that we raised,” Tertan told Skift at the time.

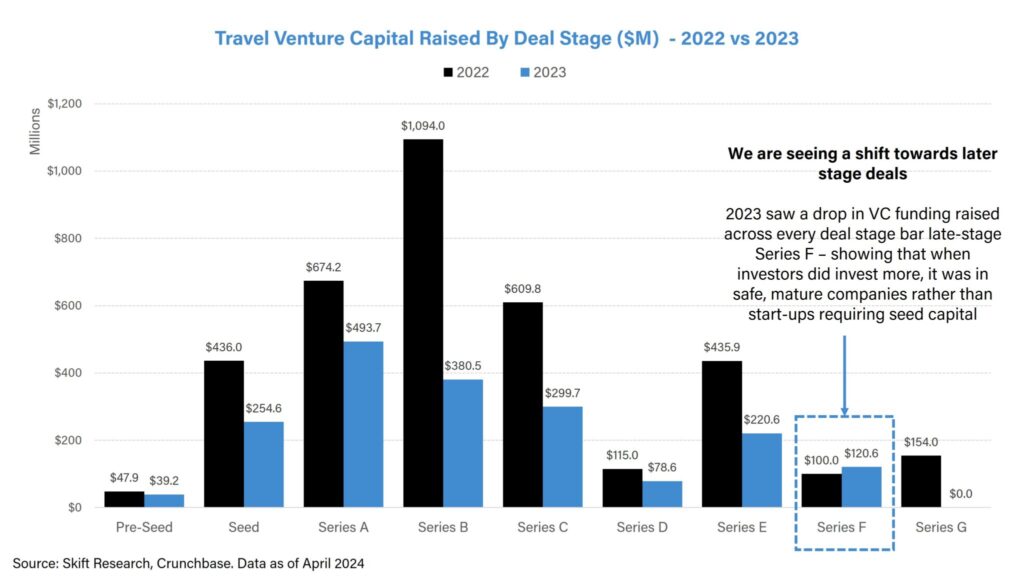

There was a record low in travel tech funding in 2023 as investors pulled back, wary of getting burned again.

Cabana, a camper van rental startup that also raised money during the pandemic, closed this year because it couldn’t secure another round of funding.

“You’re seeing situations like this, where companies that raised a lot a couple years ago are now having to come back to the trough,” travel investor Cara Whitehill said at the time. “And the trough is closed.”

But history shows that those who endure come out stronger for it.

“Better companies with better entrepreneurs are getting funded, and they’re getting funded into an environment where there’s less noise,” Chris Hemmeter, managing director for travel tech venture capital firm Thayer Ventures, told Skift earlier this year. “In the old days when money was free and capital was flowing too easy, too many weak companies were raising money, and then they were just making noise, so they were making it harder for the good companies to advance.”

A Rebound in Funding for Late-Stage Startups

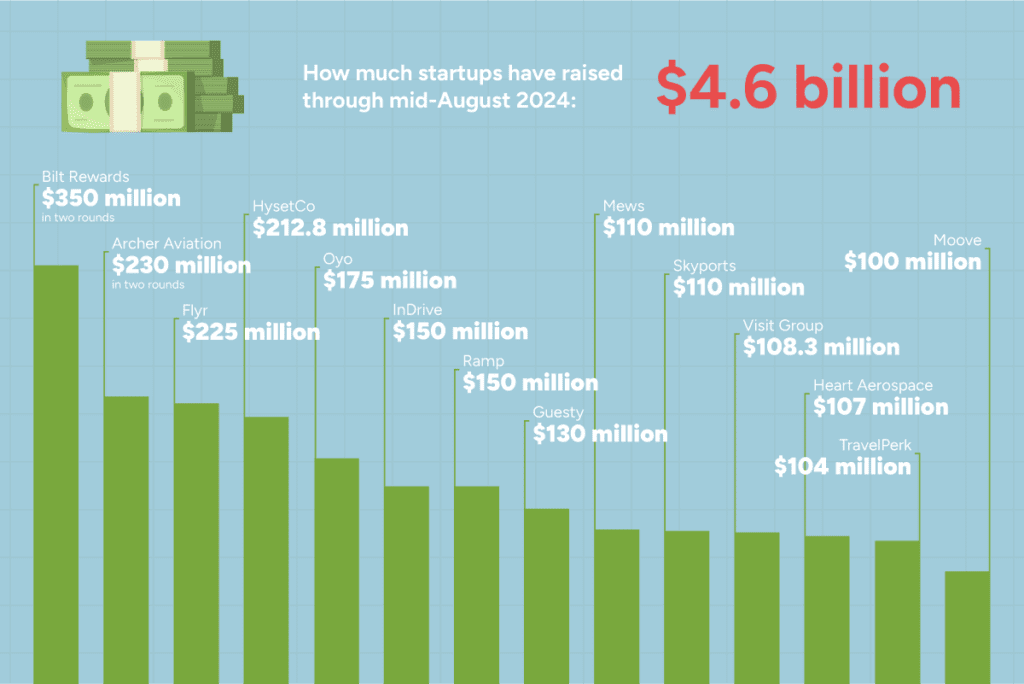

So far in 2024, there have been 15 travel startup fundraises exceeding $100 million. During the same period in 2023, that number was four.

That activity has already contributed to a significant upward shift in the total amount of funding this year versus last — a prediction by Skift Research that seems to be coming true.

Startups involved in the travel industry, including next-generation aircraft companies, have raised $4.6 billion through mid-August 2024. That number was $1.8 billion in 2023.

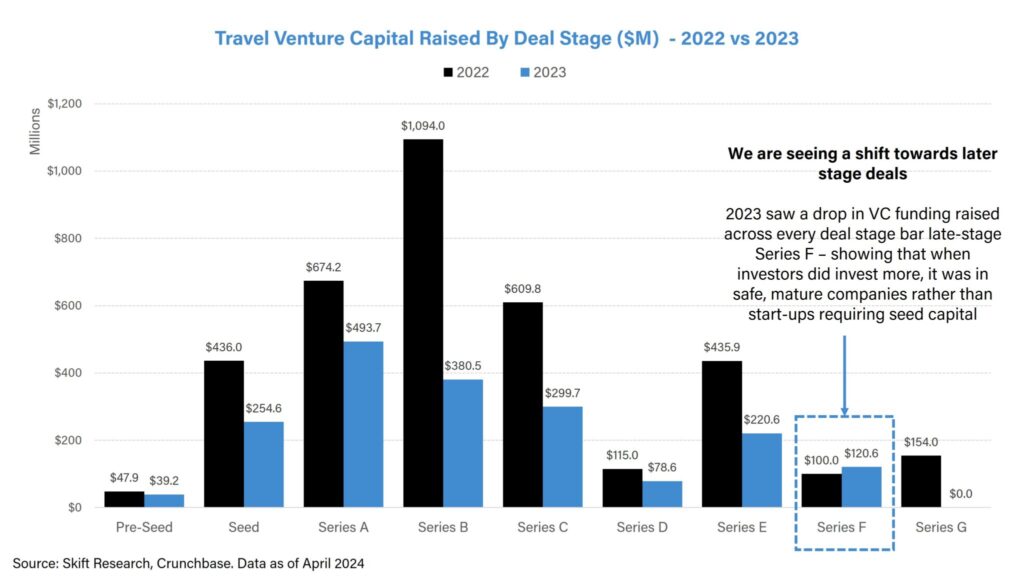

But it’s older, later-stage companies that are primed to see cash coming their way. Skift Research found that series F rounds, meant for more mature startups, was the only funding stage that increased from 2022 to 2023, while all others saw a drop.

Laurence Tosi, managing partner and founder of WestCap, was Airbnb’s CFO starting in 2015 and helped Brian Chesky secure billions of dollars in late-stage startup funding. More recently, WestCap led Flyr’s last two funding rounds.

Flyr, Mews, and TravelPerk are all attempting to cash-in on the long overdue need of upgrading the travel industry’s decades-old tech systems.

Flyr has raised over $500 million since it was founded. Its annualized recurring revenue grew by 290% over the past 12 months, the company said, with clients including Avianca, JetBlue, Air New Zealand, and Virgin Atlantic. “I’ve never seen demand, maybe anywhere, for an infrastructure business like I’ve seen for Flyr,” Tosi said.

Mews and Travelperk each secured over $100 million this year in later stage funding.

Mews has raised over $340 million since 2012 to replace the outdated property management system at hotels. Travelperk has raised $513 million since 2015 for a modern business travel management platform.

TravelPerk said it grew revenue 70% in 2023, and gross profit increased by more than 90%. Avi Meir, TravelPerk CEO and co-founder, told Skift that he decided to raise more capital to advance AI integrations.

“We didn’t need the money. We were well advanced in our path to becoming profitable and breakeven from a cash flow perspective,” Meir said in January. “And that’s why we could raise with really good terms.”

The startup Canary Technologies raised $50 million this year for a platform focused on hotel guest management, with guest-facing products like mobile check-in and checkout, upselling, guest messaging, and digital tipping.

Hotels are behind technologically, and like Mews, Canary’s pitch is helping them catch up.

“Hoteliers see the criticality around that,” said Canary co-founder and CEO Harman Narula.

Higher Stakes For Early Stage Startups

Earlier stage startups are still getting money, but it’s harder.

Fed Pereira spent two years working with angel investors on his startup before even approaching venture capital firms.

“You can’t just go to a VC with a great idea. If it’s not proven in some way, then the VCs aren’t going to back it nowadays. They’re not handing money out willy-nilly anymore,” said Pereira, CEO of Lovetovisit, a UK booking platform for ticketed events and attractions.

That’s why he’s glad that Lovetovisit has three founders.

While he was busy raising money, his co-founders — twin sisters Georgia Aubery and Alice Aubery — worked on building and growing the business. The startup said it has generated $9.5 million in revenue from more than 3.2 million users since it was founded in late 2020.

“When people say fundraising is a full-time job, it’s more than a full-time job,” Pereira said. “It was my life for about two years. I take my hat off to any sole founders out there. I do not know how they do it.”

Investors like to see what they call “market fit” – a proven demand from paying customers. When they see it, they sometimes jump in right away. That was the case for the young apartment subleasing startup Ohana.

The founders had previously approached Wave Capital — a fund founded by two former Airbnb execs — but were turned down. Then, sales for the startup jumped from nothing to $1.2 million this spring in response to new short-term rental regulations in New York City. The Ohana founders showed those new numbers to the Wave investors and closed a deal in two weeks.

“Before we found product market fit, it was very hard to raise. Once we had clear traction, it was really easy,” Ohana co-founder Ezra Gershanok told Skift in June.

Tara Spielhagen, co-founder and CEO of Swiipr, raised a series A round of $7.7 million in June, but investors wanted to give her company closer to $38 million. And Series B investors with deeper pockets have already started approaching her about the next round.

Swiipr enables airlines to digitize payments to passengers as compensation for delayed flights or other disruptions, reducing the need for paper vouchers, bank transfers, or issuing cash at airports. The company has 26 airline clients, including British Airways, Play, Air India, Latam, and Norse.

“It was terrible times for raising money. Very, very difficult times. We had a huge amount of traction nonetheless. We were oversubscribed five times on the investment,” Spielhagen said.

“They saw the need for it. They saw that we’re really plugging a gap and that there’s an absolute need to transform these legacy systems.”

Little Hope for the Rest

While early stage startups struggle to raise money even while generating revenue, there’s little hope for those looking to fund unproven ideas.

Most of the early AI trip planning startups released over the past couple of years were doomed from the start. They are attempting to build “revolutionary” apps on top of underwhelming generative AI tech, making next to no revenue.

While a handful of AI trip planners have managed to raise seed money, many have closed without raising anything at all.

Take Roam Around and Tripnotes. Each of them gained a lot of attention in early 2023 for websites that were basically ChatGPT wraparounds focused on trip planning.

Roam Around and Tripnotes both closed earlier this year and sold their assets to other startups, each of the founders joining the respective teams.

“The product that I was pitching was derogatorily referred to as a GPT-wrapper. That type of company was not getting funded,” Shie Gabbai, founder of Roam Around, told Skift earlier this year.

Gilad Berenstein, a travel investor and advisor who has surveyed dozens of AI trip planners this year, believes those types of apps do have a chance.

But the key, he told Skift earlier this year, is pushing forward to find the right niche market fit, probably not by directly competing with giants like Booking.com.

And finding the right fit goes for any travel startup, not just AI trip planners.

“The winners of the mobile revolution were not the first companies to have a mobile app,” Berenstein said. “It was the companies that made a commitment over multiple years to testing, to learning and iterating in the new medium.”