Travel

Top travel mistakes to avoid during hurricane season – The Points Guy

Vacations … aren’t they great? There’s nothing like heading to a beautiful tropical island in the Caribbean, Florida or the Gulf Coast in the summer or fall. Vacation can be wonderful — that is, until a seasonal tropical weather event or hurricane hits your destination. Then a vacation can become a huge headache or something even worse.

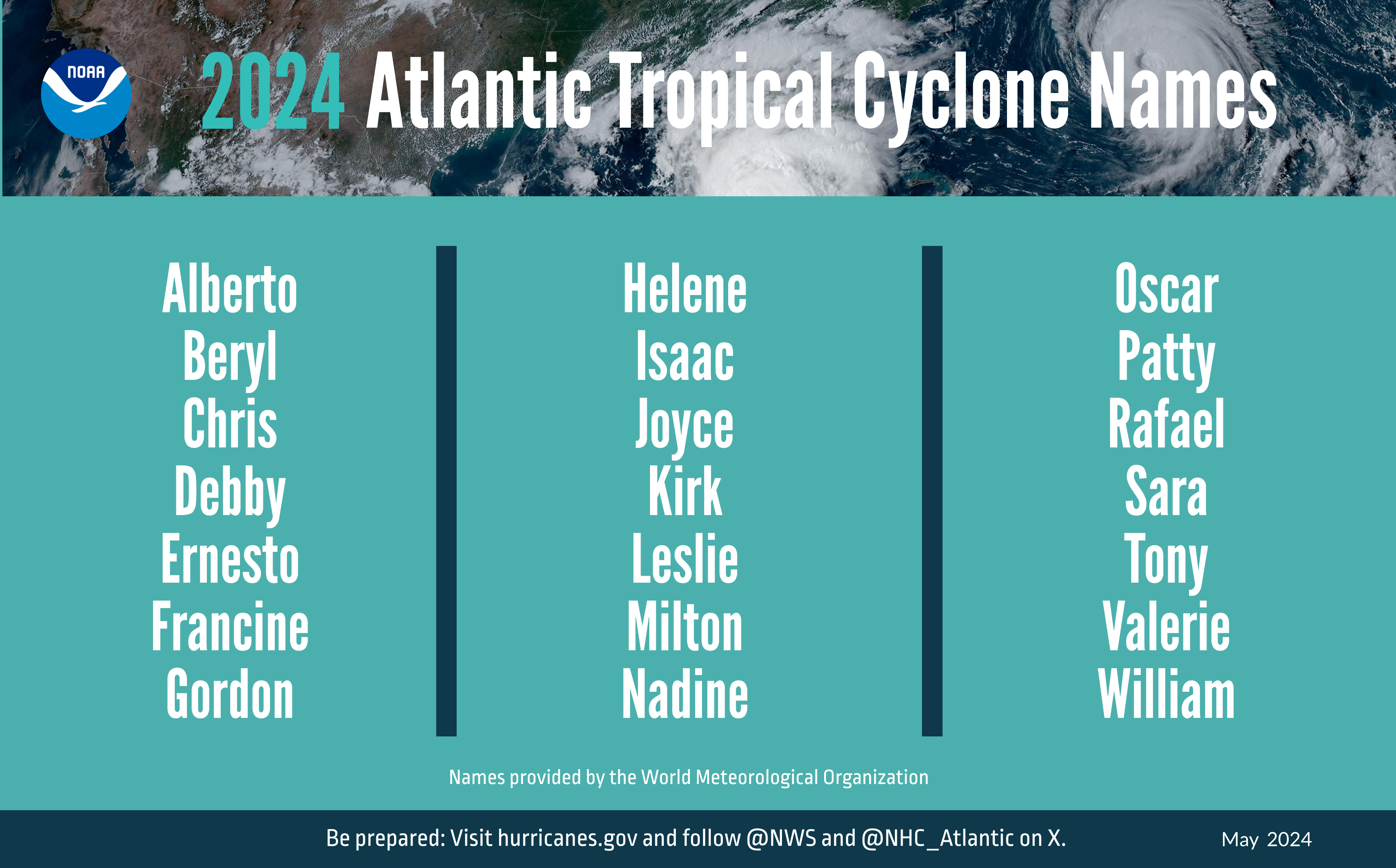

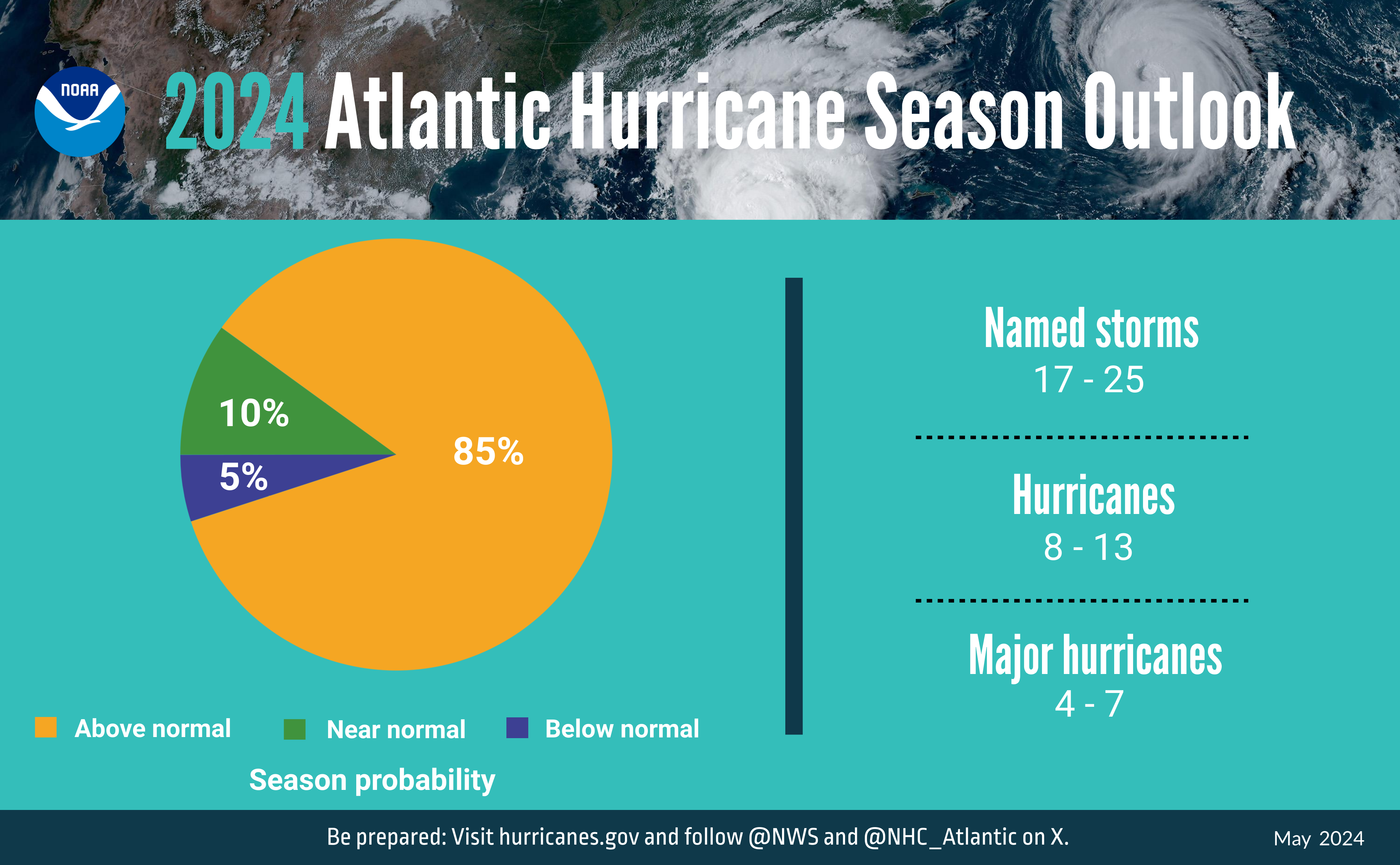

Since the 2024 hurricane season is predicted to be one of the most active on record, it’s important to be prepared to travel during the prime hurricane season. What’s one thing that can help when a tropical weather event strikes? Travel insurance.

“Travel insurance has become an essential part of travel planning for travelers vacationing in the Caribbean or Southeast seaboard during the Atlantic hurricane season [June through November],” says Stan Sandberg, co-founder of TravelInsurance.com.

Related: Hurricane season is here: TPG’s storm guide for travelers

But even if you’ve bought coverage or thought a credit card travel insurance policy covered you, a lot can still go wrong.

Want to avoid a hurricane headache? Read on for the top travel mistakes to avoid during hurricane season.

Thinking that hurricane season wraps up in the early fall

“Some people don’t realize that hurricane season isn’t confined to the summer months,” says Beth Godlin, president of Aon Affinity Travel Practice.

In reality, hurricane season runs through Nov. 30, according to Godlin. So, you’ll want to keep an eye on the weather and your travel insurance all the way through to the start of December.

Not buying travel insurance before a storm is named

If there’s one thing you should remember about protecting your vacation investment during hurricane season, it’s this: Once a storm is named, it’s too late to buy travel insurance.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

There’s an important reason behind this.

“Insurance covers the unexpected,” says Jenna Hummer, public relations director of Squaremouth (a company that provides comparisons of travel insurance from major U.S. providers, “so once something is considered ‘foreseen’ — in this case, when a tropical storm or hurricane has been named — you can no longer get coverage for that storm.”

Waiting to purchase travel insurance during hurricane season

It’s no surprise, then, that every travel insurance expert I interviewed had the same advice if you’re planning to travel during a period when hurricanes could occur. They recommend buying your coverage as soon as you book your trip.

If you’re seeing reports that a hurricane is about to land in your destination or may close your home airport, you’ve likely already missed the window to cover your trip.

Thinking you can cancel your trip because a hurricane occurred at your destination

“A common misconception is that if a hurricane occurs near your destination, you can cancel your vacation and be covered,” Hummer says.

But the fact that a hurricane made land fall at your intended vacation destination before you did does not necessarily mean that you can cancel and be reimbursed.

According to Hummer, if your hotel is uninhabitable — meaning it’s not open or has no electricity or running water — then you would be covered. However, if the surrounding area is dealing with damage but the hotel is still open, “You’re on the hook to pay for your vacation.”

Not knowing what your travel insurance will cover

Most comprehensive travel insurance plans will include trip cancellation and interruption coverage, trip delay coverage and baggage loss and delay coverage.

“Trip cancellation and trip interruption will reimburse lost or unused prepaid, nonrefundable expenses due to a hurricane making it impossible to get to your destination,” Sandberg says. “Many plans will also provide coverage if there is a mandatory evacuation at the destination. A few plans will even provide coverage in the event there is a NOAA hurricane warning at your destination during your trip dates.”

Trip delay coverage will reimburse you for unexpected travel costs such as food, transportation, internet service and lodging when your flight is delayed for an extended period of time.

“Keep in mind, though, trip delays are not typically a covered reason for cancellation, and most policies won’t reimburse you if you choose to cancel because of a trip delay,” Godlin says. “However, your benefits may include reimbursement for the part of your trip you missed. For coverage to kick in, some trip delay terms require a minimum length of delay, which can range anywhere from four to 12 hours. Some terms may also only cover delays caused by specific-named perils, such as a hurricane that hits your destination and forces early departure.”

Counting on credit card policies to cover you

According to Hummer, this is a tricky one since many travelers carry credit cards with travel perks, including trip delay insurance, and therefore think they’re covered in case of a weather event like a hurricane.

“The problem with credit card coverage is that the coverage is very low, like $5,000 for medical,” she says.

That’s well below what you might need in a true emergency.

“Remember that your credit card won’t cover anything not purchased on that card,” Hummer says. “So, if you haven’t paid for your whole trip with that card or other people in your group used another payment method, you won’t be fully covered.”

Not buying a policy with a 24-hour help desk

If there’s a policy that costs less but doesn’t offer round-the-clock help, skip it.

“Make sure you buy a policy with 24/7 assistance,” Hummer says.

She also added that if you’re in a situation where a hurricane has closed the airport, “Call your travel insurer first; they can pay for hotels and meals while you’re waiting on hold with the airline.”

Not getting enough coverage

While you don’t have to pay a premium for a travel insurance package during hurricane season, you do need to have enough coverage to get you home and cover any emergencies.

According to Hummer, $50,000 in medical and $100,000 in medical evacuation are the minimums your package should include.

Forgetting that a hurricane can happen at home, too

Travel insurance can still be beneficial, even if you’re not going to a tropical area.

“Let’s say you live in South Carolina, but you’re taking an Alaskan cruise,” Godlin says. “As you’re getting ready to embark on your dream vacation, a hurricane hits the coast and decimates your home. What can you do? If you purchased travel protection and your home is rendered uninhabitable, that can be a covered reason for trip cancellation.”

That’s definitely a worst-case scenario, but it’s a good reminder that hurricanes can happen at home or while you’re away, depending on your origin and destination.

Paying too much for hurricane coverage

“Buy the cheapest policy with the coverage you need,” Hummer says.

Use a comparison engine, she suggests, and know that “just because you’re paying more doesn’t mean you get more coverage.”

She explains that different travel insurance agencies have different formulas and take a variety of factors into account, like age and destination — oftentimes, prices vary while coverage doesn’t. Instead, make sure you’re getting the coverage and assistance outlined above and choose the option that costs the least.

Related reading: