Travel budgets for 2025 will remain flat or increase compared to this year, according to a recent survey of travel advisors, part of TravelAge West’s Need to Know research series. In the survey of more than 200 advisors, 52% of respondents say 2025 budgets will be about the same as 2024, while another 41% expect them to increase.

“Initial budgets upon inquiry will likely remain the same for 2025, as travelers will likely want to watch the post-election economy carefully,” said Jennifer Kellum, owner of Neverland & Main Travel. “But the rising cost of services, the desire for authentic experiences and supply/demand will force budgets to increase.”

Credit: 2025 TravelAge West

The top factors influencing clients’ plans in 2025 are current economic conditions or budget constraints (63%); availability of flights/accommodations (57%); desire for unique/once-in-a-lifetime experiences (52%); and safety/security concerns (42%).

In addition, advisors report that the average booking window for 2025 is 7 to 12 months out (45%), followed by 4 to 6 months (31%) and 13 to 18 months out (11%). The average length of stay is expected to remain the same next year (57%).

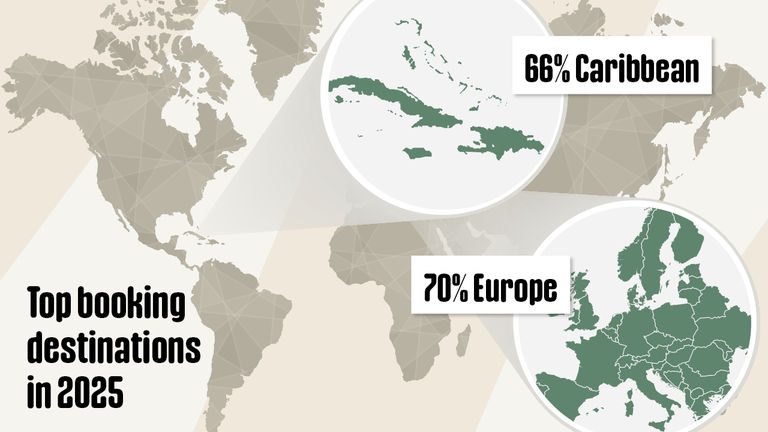

Credit: 2025 TravelAge West

Top destinations leading bookings in 2025, include Europe (70%), Caribbean (66%), Mexico (45%) and USA/Canada (38%).

Just under half of respondents (43%) say that 20-40% of their 2025 bookings involve travel during the off-peak/shoulder seasons.

“Mexico was the most-visited country last year by Americans, and will continue to finish strong with new construction, options for every budget and connectivity,” Kellum said. “In the Caribbean, we are seeing fewer clients requesting all-inclusive properties (as opposed to Mexico) and more clients requesting boutique hotels. Europe’s post-pandemic growth is on an upward trend that doesn’t seem to be leveling off at all.”

When it comes to luxury travel, advisors are fairly split on the amenities/experiences clients most willing to pay a premium for. Top choices include private guided experiences, including VIP access to attractions/events (67%); private transfers/exclusive transportation (67%); unique cultural experiences not available to the general public (49%); and suite/villa accommodations (47%).

/NTK_Dec_OceanCruises.jpg?tr=w-768%2Ch-432%2Cfo-auto)

Credit: 2025 TravelAge West

The travel sectors seeing the strongest growth in booking volumes for 2025, include ocean cruising (55%), all-inclusive resorts (52%), river cruising (39%) and multigenerational group travel (36%).

“Ocean cruising will always be popular with travelers who want to be entertained throughout the journey while they dabble in each destination,” Kellum said. “This is evident in the newer, bigger cruise ships rolling out across many lines. I think those advisors who focus on high-end to luxury travel will see a decrease in mass-market cruising and an increase in small ships for the personal attention and tailored excursions.”

Credit: 2025 TravelAge West

Advisors say the top travel trends they are seeing include a rise in multigenerational/family travel (67%), a shift toward more immersive local experiences (55%) and a stronger appetite for adventure and outdoor travel (45%). An additional trend to watch includes a shift away from the most popular locations to secondary destinations/destination dupes (49%).

“Coming off the last few years, where families eased back into traveling with theme parks, then Mexico/Caribbean, then cruises, they are now looking for ways to experience the world with their extended family,” Kellum said. “They desire quality time that doesn’t always depend on apps and technology, but authentic and immersive experiences instead. They are celebrating milestones, looking for sustainability and wellness, and also searching for destinations that give them the most bang for their buck.”

Interestingly, nearly two-thirds of respondents (61%) report that the outcome of the Presidential election has had little impact on clients’ travel plans, while 22% say it hurt bookings and 17% say it helped.

Need to Know Survery Series

“Need to Know” is a research series from TravelAge West that tracks the responses of travel advisors as they relate to various travel trends and topics. This survey recorded the responses of 220 advisors across the U.S. See more Need to Know stories here.