Travel

Visa’s Digital Payments Data Reveals Asian Travel Trends

Skift Take

Grasping the shift to digital payments in Asia would be a game-changer for the travel industry. Cashless is the future — think convenience and cool perks!

Nearly 80% of people across Asia don’t want to travel with any cash to their destination, according to Prateek Sanghi, head of Visa Consulting and Analytics for Asia Pacific.

Safety, security, and speed are driving this shift. “Digital payments offer convenience and specific rewards tailored for travelers,” according to Sanghi.

Visa’s latest study highlights this trend. It shows that 97% of travelers in the region prefer digital payments. Only 31% carried cash in 2023, down sharply from 79% in 2020.

Visa has responded by partnering with local payment giants in China, such as WeChat and Alipay. This allows international travelers to use Visa cards within these platforms, addressing the need for cashless transactions in a market dominated by local methods. “While there’s competition across payment methods, a lot of cash displacement still needs to happen,” Sanghi said speaking to Skift. “Travelers need to use the instruments they have, and we’re seeing new partnership models emerge.”

Visa’s Collaborations: Data-Driven and Payments Related

Visa is also working with travel agencies and local tourism bodies across Asia to improve the travel experience by helping them understand spending patterns. For example, in Japan, Visa collaborates with the Osaka Tourism Bureau to prepare for events expected to attract millions of new travelers. These partnerships extend to offering contextual promotions, such as discounts at specific restaurants or hotels.

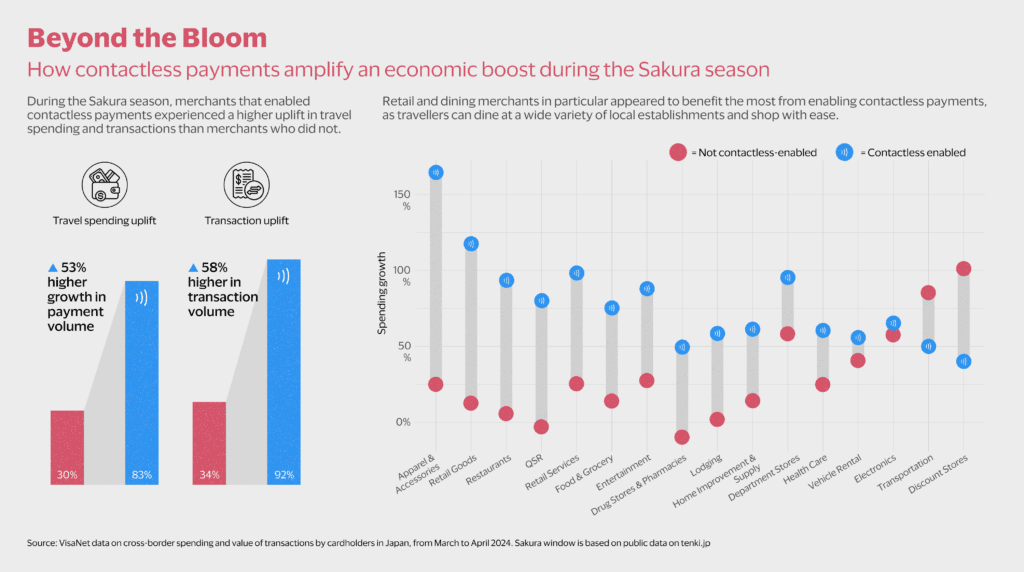

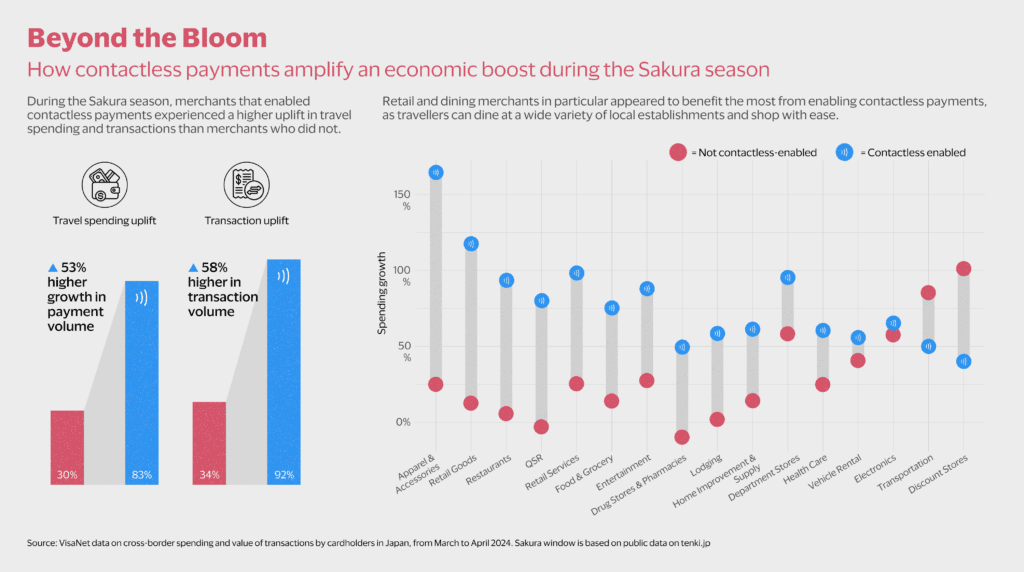

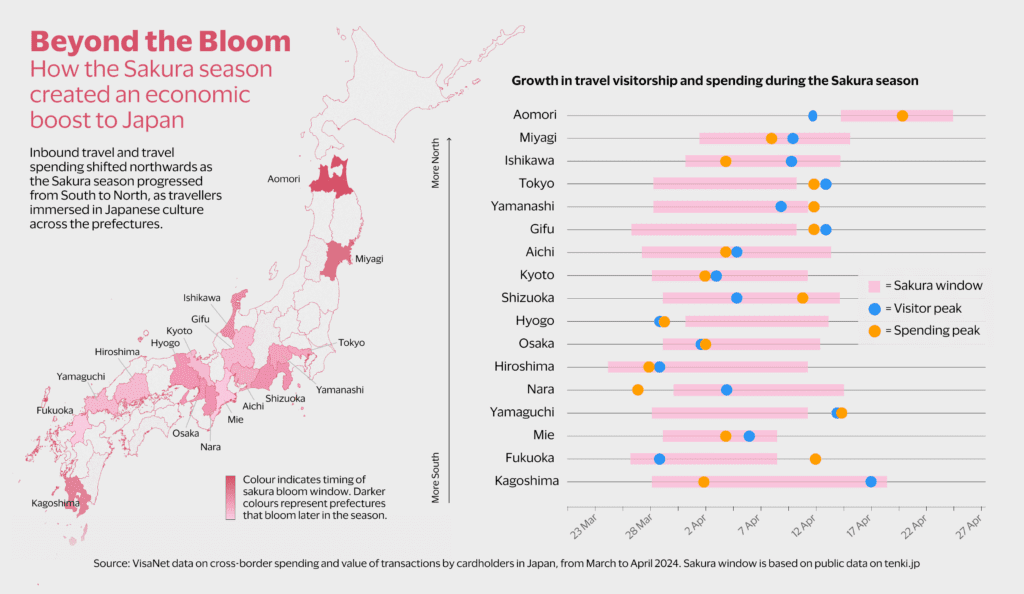

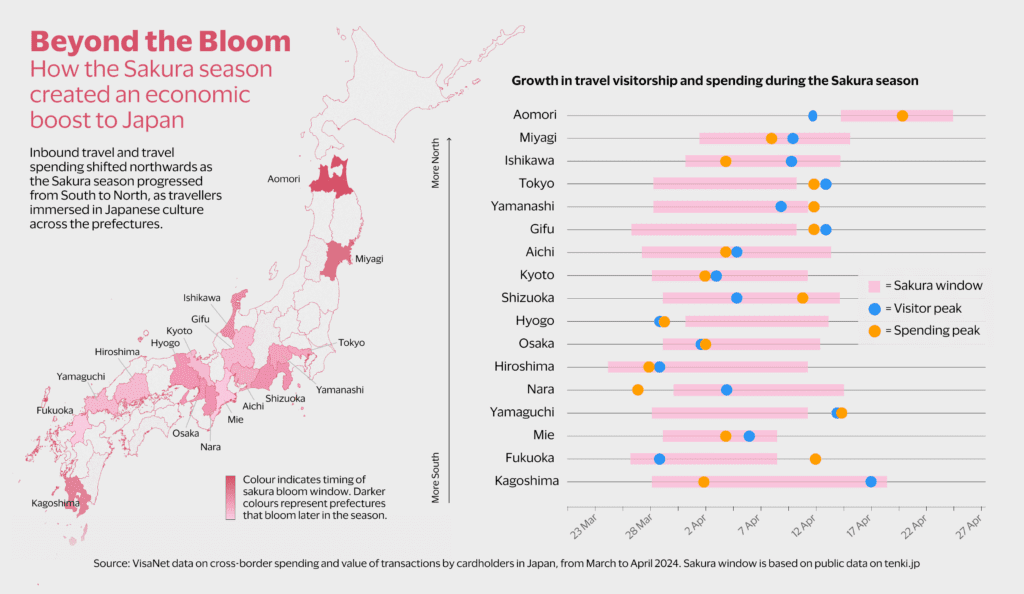

Visa’s use of AI and data helps predict travel patterns and offer relevant promotions through bank partnerships. In its latest “Beyond the Bloom” study, Visa examined tourist spending in Japan as a case study. Japan’s Sakura (cherry blossom) season, for instance, has become an economic force, attracting millions of tourists each year.

According to Visa, spending during this season has increased by 50% compared to pre-pandemic levels.

Insights Based on Spending

Japan is also becoming a top destination for Southeast Asian travelers, particularly from the Philippines, Indonesia, and Singapore, Sanghi said. A weak yen and the allure of unique cultural experiences are driving this trend. ” When you unpack the spend, what comes out is that people want to go to Japan to experience its food, geography and of course, the Sakura season,” Sanghi said. “Spending data shows that the surge in spending starts in southern Japan and moves northward as the Sakura blossoms spread.”

In broader trends, beach destinations and cities with unique cultural offerings are leading Asia’s travel boom. Bali, Tokyo, Singapore, and Bangkok are top choices for travelers seeking more than just a quick getaway, according to Sanghi. “The trend of longer trips, which began post-Covid due to higher travel costs and increased friction, is continuing. Travelers are now spending more time at their destinations, focusing on immersive experiences,” he said.

China Travel Boom: Recovery and New Trends

China’s travel sector is also recovering, though it lags behind global trends. While global travel has surged to 150% of pre-pandemic levels, Asia Pacific is at 130%, with China still playing catch-up. “While the number of travelers from China, just in absolute terms in the spends that they do, is significantly high, when you compare it to pre-pandemic, the country is still catching up to the rest of the world in terms of the consumer trends,” Sanghi said.

Experiential and immersive travel is gaining traction among Chinese tourists, with Japan being a favored destination for its natural landscapes, cuisine, and cultural experiences. France remains the most popular destination outside Asia Pacific for Chinese travelers, though domestic travel still holds strong appeal due to friction in some international corridors, Sanghi noted.

Visa observed that Chinese travelers use cards extensively for pre-trip related spends on big ticket items like transport and accommodation.

Co-Branded Credit Cards: Loyalty Programs Evolve

Co-branded credit cards are evolving, offering rewards beyond just airline purchases. Visa, along with banking and airline partners, is focusing on creating a larger loyalty ecosystem. “As airlines evolve their loyalty programs, we’re setting up an airline-focused practice within our consulting business,” Sanghi said.

“We have a team of experts that looks at our data as well as their business knowledge to work towards building a larger loyalty ecosystem for travelers and the customer base that the airline has,”

This includes partnerships with hotel chains and other travel-related services, offering a more holistic travel experience. These cards are now a tool for deeper engagement and brand loyalty, offering rewards that extend beyond flights to include accommodation, dining, and shopping

Sanghi pointed out that hotel co-branded cards are also emerging in some markets. “It’s not just about using the card, but about creating an ecosystem that leverages a network of partners.