Bussiness

Vonovia Stock: #1 Recession Pick And Pivot To Capital-Light Business Model (OTCMKTS:VONOY)

Bjoern Wylezich

In my prior article on Vonovia SE (OTCPK:VONOY) (OTCPK:VNNVF) in April 2024, I argued that FOMO may happen quicker than expected. Since then, the stock has performed strongly on an absolute and relative basis delivering a total return of ~23% versus ~7% by the S&P 500.

In recent days, following weak economic data and the apparent weakening of the employment market in the U.S., the market has quickly switched to a potential recession narrative.

In this article, I will articulate why Vonovia should strongly outperform the market in a recession. Therefore, it is an exceptionally sensible allocation in a long-orientated portfolio like mine given macro uncertainties.

Background

Vonovia is Germany’s leading residential real estate company. Vonovia currently owns and manages ~500K residential units, mostly in Germany, but with some apartments in Austria and Sweden.

While rental income from holding residential apartments is by far its main business, Vonovia also has additional segments that include:

- Property development segment

- Recurring sales (disposal of non-core apartments)

- Value-add services (e.g., craftsmen, media, etc.)

I will discuss the other segments later as Vonovia, as discussed in its latest earnings report, is pivoting to a capital-light model.

Understanding the Rental Segment Dynamics

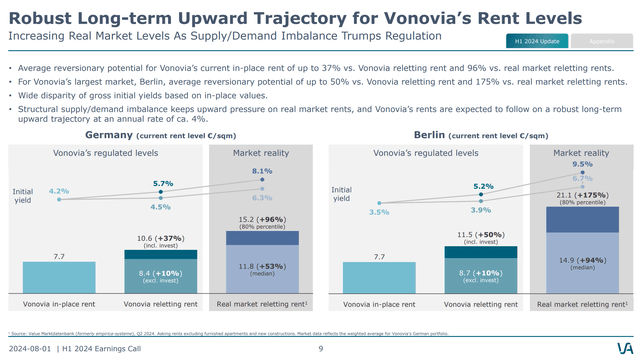

The rental segment is reasonably simple to understand. The top-line revenue is driven by rental income. However, in Germany, the rental market is highly regulated, as explained in my prior article, which means that Vonovia is currently collecting rental income that is substantially below market values. This is shown in the below slide from the Q2-2024 earnings report:

As can be seen, the reality is that Vonovia’s in-place rent is lower than median market values by ~53% in Germany overall and ~94% in Berlin. The German regulations, of course, allow Vonovia to raise rents but with a significant lag over time. Vonovia has guided now that it should be able to grow the top rental income by ~4%+ for the next 15 years or so. Important to note is the rental increase is quite mechanical (catch-up mechanism to market rates) and is not market-dependent. This provides exceptional visibility to the long-term revenue growth embedded in Vonovia’s portfolio.

Unfortunately, though, Vonovia’s cost of funds is also expected to increase substantially in upcoming years given current interest rates compared to the existing debt profile. As of 30th June 2024, Vonovia’s average cost of debt stands at 1.8% with a weighted average maturity of 6.7 years (currently at ~47% LTV and ~EUR42.9 billion debt) . The current cost of refinancing is ~3.5% to 4%, so in upcoming periods, the average cost of debt is projected to increase materially. Vonovia disclosed in the last earning call that it expects most of the rental growth (~4% p.a.) to be offset by the increased funding costs.

Why is Vonovia My Top Pick For A Recession?

The calculus is quite straight-forward, in a recession (even a hard one), the rental CAGR of ~4%+ is not going to be impacted. As discussed above, this is a function of the German rental regulations, and rental adjustments will be mechanically applied. In fact, current tenants are “happy” to pay market rates as there is no other alternative for them (they need a place to live) and vacant regulated apartments are scarce.

Importantly though, in a recession, one would expect interest rates in the Eurozone to decline and thus Vonovia’s debt refinancing costs should also fall commensurable. As the recession narrative begins to play out and on the back of expectations that the ECB will further reduce rates, the 10-year Bond as can be seen below, is already falling:

There are also other reasons why lower rates are exceptionally beneficial to Vonovia shareholders:

- Vonovia should be able to redeem the Apollo JV preferred shares (currently minority interest payments at interest rates of ~7% to 8%)

- Lower interest rates typically mean cheaper mortgages for buyers and in turn, drive property valuations and volumes higher

- Lower rates also increase the viability and profit margins of the development segment

- Finally, Vonovia shares are seen as bond proxies given their defensive characteristics. Investors often compare the dividend yield spread over the Bund. The current dividend yield is ~4.4% and generally not subject to withholding tax.

Pivoting To A Capital Light Model

One of the most interesting insights in the 1H-2024 earnings call has been the comments by CEO Buch on their plans to pivot to a more capital-light business model to drive growth irrespective of the higher funding cost.

CEO Buch did not reveal the details and only shared some hints as below:

What is equally important, once we are absolutely certain that we have passed the bottom of the cycle, we can stop playing defense and we can stop prioritizing liquidity over profitability. Our focus then can return to organic growth. The summer months are usually a bit quieter, and this year it is not different. We have been using this opportunity to work with our top management team to evaluate additional sources of growth other than traditional acquisitions. Our goal is to further mitigate additional drag on EBT from higher interest costs over the next five years. When we report our nine-month earning in November, we will be sharing with you our adjusted strategy and how we intend to bridge this period where we have increase burden from expensive refinancing — to bridge this period where we have the burden from expensive refinancing.

Whilst Vonovia did not share the details of the capital-light initiative, I suspect these will involve leveraging the Vonovia platform to provide services to 3rd parties. I envision the business proposal would be to provide asset management and property services to private capital firms such as Apollo (e.g. taking advantage of distressed property valuations). Vonovia has the skills and most importantly the scale to deliver on this and in the process generate capital-light revenue. I am very much looking forward to further details to be revealed on the 9th of November.

Final Thoughts

Vonovia massively benefits from low rates and a recession should not impact its top-line revenue growth in the rental segment. However, Vonovia management is not just waiting for rates to drop to drive profitability, it appears to be pivoting to deliver an incremental capital-light revenue stream. I suspect that Vonovia is looking to evolve to an asset manager/services business model and given its scale and expertise it is uniquely positioned to deliver on it. I expect it to partner with large private equity firms that will provide the capital (or majority thereof).

This could be a game changer for the valuation of the firm and in normalized times may translate to a premium over NAV. Currently, Vonovia is still trading at 0.65x NAV and thus I rate it as a strong buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.