Bussiness

WD-40 Company Stock: Fantastic Business That Is Incredibly Expensive (NASDAQ:WDFC)

Alexandr Lebedko

Introduction and thesis

WD-40 Company (NASDAQ:WDFC) is a global consumer products company known for its iconic WD-40 Multi-Use Product, as well as a range of household maintenance and cleaning products. The company was founded in 1953 and is headquartered in San Diego, California.

WD-40 is a fantastic business that is managed impeccably. Its unrivaled brand is utilized to its maximum to generate leading margins, without underinvestment in R&D. Products launched under its “WD-40 Specialist” segment are outgrowing the wider business and are primed to have a larger impact on the top-line going forward.

Alongside this, its broader strategy of optimizing commercial (exploiting premiumization and e-commerce) and operational (systems and supplier relationships) value should allow for margin appreciation in the coming years.

We see limited factors that can stop this business from continuing to compound in the coming years.

Despite this, we rate the stock a hold. Management is currently working toward what we believe to be optimistic targets, creating significant risk to its share price due to market expectations. This has led to a valuation we cannot justify, with a NTM EBITDA multiple of 30x and a FCF yield of 1.6%. We suggest investors remain patient or seek better opportunities elsewhere.

Share price

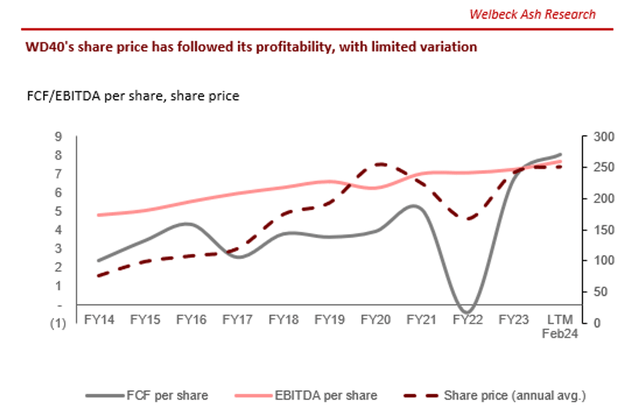

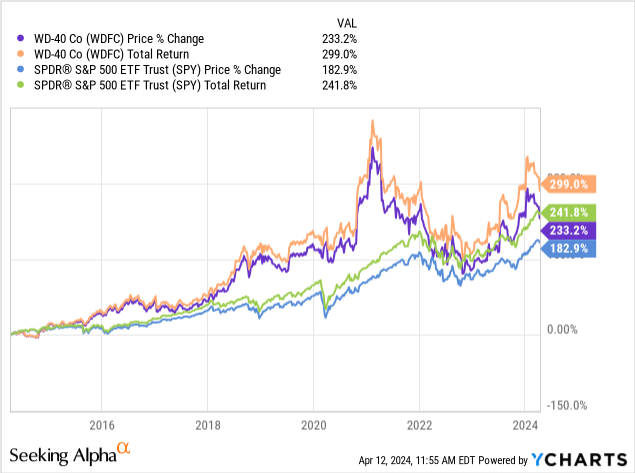

WD-40’s share price has performed well during the last decade, persistently outperforming the market. This has been delivered primarily through financial development and the optimization of shareholder returns.

Commercial analysis

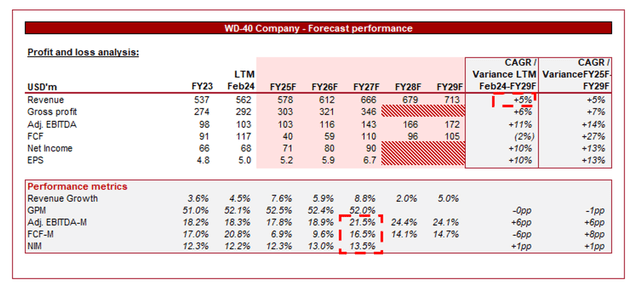

Presented above are WD-40’s financial results.

WD-40’s revenue has grown modestly during the last decade (CAGR: +4%), albeit with a linearity to time of 0.9 and limited M&A activity, reflecting an impressive organic trajectory given the maturity of its products.

Business Model

WD-40 offers a diverse range of maintenance and cleaning products under its flagship brand “WD-40”, including the original “WD-40 Multi-Use Product” (81% of FY23 revenue), as well as specialized formulations like WD-40 Specialist and WD-40 BIKE (13%). In addition to its WD-40 products, the company operates a Homecare & Cleaning segment (6%). These products cater to both the consumer and industrial channels.

In an almost unique way, the “WD-40” brand is globally recognized. Over the decades, the company has built an insurmountable reputation for reliability, effectiveness, and innovation, earning the trust of consumers, professionals, and businesses alike. Its products dominate its segment, with competition primarily in the form of lower-cost, less effective alternatives.

The company’s WD-40 maintenance products provide a high utility across a number of industries, allowing for persistent revenue growth with economic expansion. Its products remain market-leading in quality, whilst Management strategically focuses the business to capture incremental customers, knowing it will have a high recurring sales rate.

Given that WD-40’s revenue is essentially wholly generated by the “WD-40” brand, the company has strongly emphasized innovation and product development to broaden the value proposition of its products. Whilst this has incrementally supported its competitive position, “WD-40 Specialist” only comprises 13% of revenue, limiting the benefits of diversification.

Diversification for WD-40 comes with its operational capabilities. The company has a strong international presence, with operations and distribution networks spanning multiple countries and regions worldwide. Further, its brand is powerful enough that its products receive preferential stocking across retailers and segments. Similarly to the above, however, this acts to maintain its market dominance but does not necessarily drive incremental growth potential beyond economic development.

Competitive Positioning

WD-40’s competitive position is based on two key components. Firstly, the company’s product, particularly the “Multi-Use Product”, is genuinely comfortably ahead of its peers, with its scale ensuring reinvestment will protect its market position.

Secondly, the “WD-40” brand has unrivaled recognition and reputation globally, for both quality and reliability. has strong brand loyalty among consumers and businesses, leading to strong recurring revenue.

Strategy

Management is currently delivering what it refers to as a four-by-four strategic framework, four must-win battles, and four strategic enablers.

These are broken down as follows, with our comments against each:

Battles to win

- Lead geographic expansion – Management estimates its total international growth potential to be ~$1b, driven in large part by rapidly developing countries, such as China, India, Bangladesh, and Saudi Arabia. WD-40 is seeking to align itself brand-wise to these markets, knowing its products will naturally gain traction in construction-heavy markets.

- Accelerate premiumization – Management is seeking to improve the quality of its products and end-user experience, allowing for growth and margin improvement. We believe this is an important component of its strategy, as WD-40 is slowly diversifying its products, but can also improve its unit economics, further offsetting risk. Its premiumization segment has achieved a 5Y CAGR of +7.3% (targeting >10%).

- Drive WD-40 Specialist growth – Naturally, Management is targeting product development under the “WD-40” brand. The range is developing well and we believe it is likely an underappreciated growth story due to its slow development (only 13% of revenue). The segment has grown at a CAGR of +14.2% in the last 5 years, reflecting compounding returns from historical investment. Management is targeting a >15% CAGR. This said, it is worth highlighting that its Homecare & Cleaning segment is currently under strategic review, announcing it would seek the sale of its US and UK portfolio, signaling a complete focus on WD-40.

- Turbo-charge digital commerce – Similarly to point 2, offsetting product development risk is the scope for improving unit economics. The benefit of e-commerce is that WD-40 can cut out the retailer, improving margins.

Enablers

- Ensure a people-first mindset – Whilst we hate people-related strategic goals (maximizing value from employees should always be the case), it is worth highlighting that WD-40 has a very experienced Management team and an employee retention rate of >89%.

- Build a sustainable business – Targeting net zero emissions and has ambitions to be a leader in its segment.

- Achieve operational excellence in the supply chain – Management is investing heavily in its supply chain capabilities, interestingly choosing to outsource manufacturing and distributions, yet having a hands-on approach that allows it to deliver excellence, such as <90 inventory and 90%+ on-time deliveries. The business essentially gets asset-light benefits while delivering asset-heavy operational capabilities; this is fantastic execution.

- Drive productivity via systems – Management is seeking to modernize its systems and functions, partially using technologies, to ensure it maximizes economies of scale and value. WD-40 has extremely respectable margins, with an EBITDA-M of 19%, and has shown room for further improvement given its historical peaks in FY17-FY19.

Whilst it is clear we are not totally convinced by WD-40’s business model, its strategy and development achieved thus far are impressive. Management is clearly self-aware of what WD-40 is (a company reliant on a brand) and what it is not (a diversified FMCGs business). Management is successfully delivering incremental value through a number of levers, minimizing the pressure to create new, standout products.

Financials

WD-40’s recent performance has been underwhelming. The company has achieved broadly consistent strong growth, with a top-line growth rate of +14.6%, +7.7%, +12.4%, and +6.8% in its last four quarters. However, its issue has been margin development, which has been limited.

WD-40 has driven top-line growth with consistent price increases, partially as a concerted effort to increase the visibility and sales of its premium products, benefiting from mix. Additionally, the company, similarly to its peers, has persistently lifted prices in response to inflationary conditions. This growth has primarily come from EIMEA in Q2 (+16%), which we have observed (in other consumer businesses) as a region seeing the most delays in price increases coming through.

Management believes there are ~3ppts of EBITDA margin to win back, which we concur with, albeit requires more action given inflationary pressures are subsiding and so the scope for price uplifts will also. Management must exploit the arbitrage opportunity to benefit.

Looking ahead, Management is incredibly bullish. It believes a long-term growth rate of mid-to-high single-digits can be delivered, driven in large part by EMEA and APAC. This is a blended assessment based on the mix shift discussed above, namely toward growth regions and premium products.

We consider this fairly optimistic. The company’s historical growth rate has been considerably below this (+4%), albeit is slightly masked by the mature growth rate of the “WD-40 Multi-Use Product” and the underwhelming developments of the Homecare and Cleaning segment. Even as “WD-40 Specialist” outgrows other segments and premiumization drives the business, we struggle to see how the growth rate can be lifted beyond ~7%.

Secondly, whilst we do believe ~3ppts of EBITDA-M is capturable, limited progress is currently being made. In a normalized economic environment, WD-40 will face far more difficulty driving improvement relative to current market conditions.

We believe growth of 5-7% can be achieved, alongside margin improvement of ~0.5-1ppt of EBITDA-M in the coming years. This reflects a more realistic trajectory we feel, adequately quantifying its positive strategic developments.

Analysts are more critical than we are regarding growth, forecasting +4%, while expecting better margin development.

Balance sheet & Cash Flows

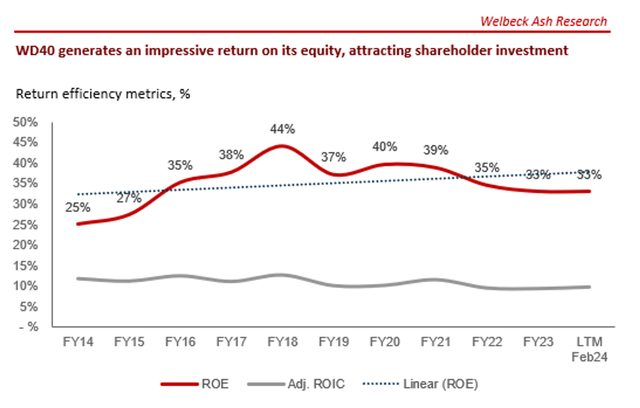

WD-40 is conservatively financed and generates impressive FCFs, owing to its strong absolute margins and minimal capex commitments. This, alongside its asset-light model, has allowed it to generate an impressive ROE.

Management has supplemented these impressive returns with distributions, with dividends growing at a CAGR of +9%, alongside periodic buybacks.

The company is compelling from a ROE perspective, suggesting the ability to generate strong long-term returns with incremental growth.

Industry analysis

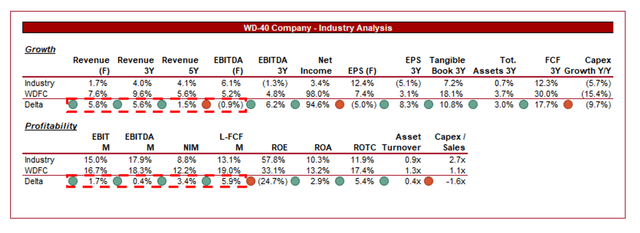

Presented above is a comparison of WD-40’s growth and profitability to the average of its industry, as defined by Seeking Alpha (12 companies).

WD-40’s performance relative to its peers is impressive, with superior growth and margins. As we have stated already, what Management has done with the resources at hand is incredibly impressive. The business is optimized impressively well, with genuinely strong margins and growth despite the recent fall in EBITDA-M.

This has been delivered through a combination of its competitive advantage and operational capabilities. We see limited threats to this in the medium term. Our predicted growth rate of 5-7% would take the company comfortably above its peer group’s 5Y average.

Valuation

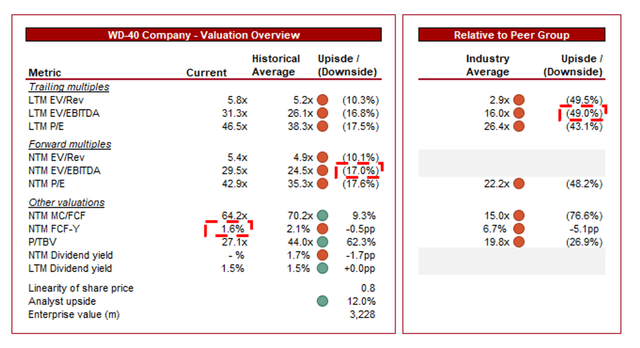

WD-40 is currently trading at 31x LTM EBITDA and 30x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is not easily justifiable in our view, as although strong development has been achieved through progress toward its strategic objectives, the company has also seen margin erosion. FCF has only remained elevated due to the tapering of capex spending and supreme working capital management, which cannot be expected to continue. This said, we would suggest a premium of ~10% can be fairly argued, implying the stock is slightly overvalued.

Further, WD-40 is trading at a considerable premium to its peers, ~48-50% on an LTM EBITDA / NTM P/E basis. This is incredibly difficult to justify. The company’s ROE and FCF positive delta clearly suggest a large premium is warranted, but we struggle to see the accompanying growth that can push the company toward value.

Overall, we believe the stock is likely overvalued, with considerable execution risk associated with Management’s current guidance. With a FCF yield of 1.6%, investors are likely better placed allocating capital elsewhere.

Key risks with our thesis

Given Management’s bullish forecasts, the upside risk is clearly the inability to deliver on this, while the downside risk is negative margin progression.

Final thoughts

WD-40 is a fantastic business. The company has incredible brand value, underpinned by genuine innovation and market-leading utility to users. We see limited risks to this position and expect the business to successfully maintain its expansionary efforts.

This said, we cannot reconcile its current valuation. For a mature business such as this, investors need a margin for error or face an inefficient allocation of capital. At a FCF yield of 1.6%, we just do not see sufficient upside, thus rating the stock a hold.