Travel

Why You Shouldn’t Rely on Credit Card Travel Insurance Alone

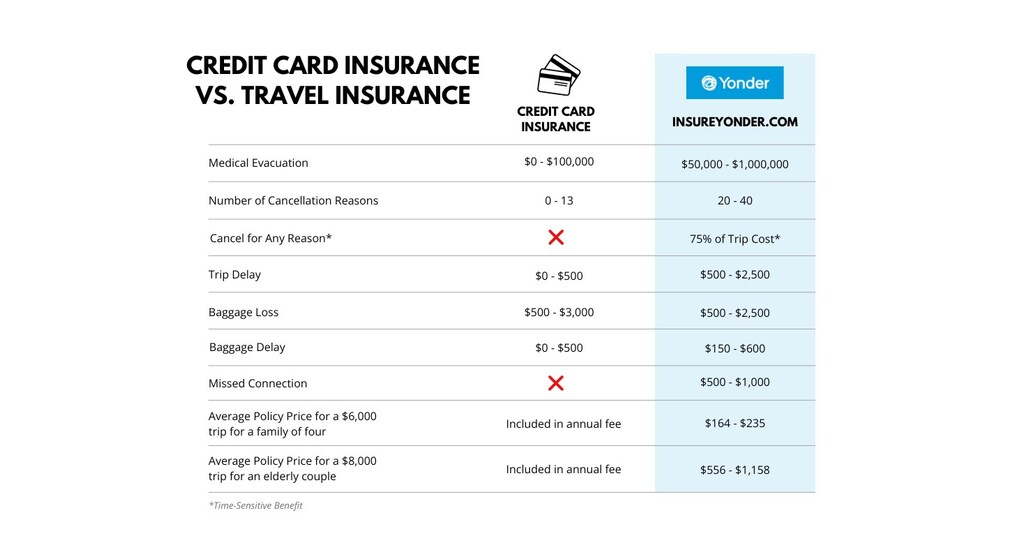

MINNEAPOLIS, May 7, 2024 /PRNewswire/ — Although some credit cards include travel insurance, is it actually reliable coverage? The travel insurance experts at Yonder Travel Insurance compared the insurance offerings of several top credit cards with their comprehensive policies available on their comparison site. Yonder’s research findings reveal that travelers shouldn’t rely on credit card coverage alone.

Difference Between Credit Card Travel Insurance and Travel Insurance

While general retail travel insurance typically offers comprehensive coverage, surprisingly, not many credit cards with travel insurance included do.

“Even if you pay a high annual fee for your credit card, the coverage offered lacks critical benefits to protect you and your trip investment,” says Terry Boynton, co-founder and president of Yonder Travel Insurance.

Is Credit Card Coverage Enough?

Shockingly, numerous credit cards that offer travel insurance fail to provide sufficient benefits for an emergency before or during your trip.

Yonder found the following discrepancies when it comes to credit card coverage:

- 20-27 less reasons to cancel your trip

- 10x less medical evacuation coverage

- 5x less trip delay coverage

When You Should Consider Additional Travel Insurance

Even if your credit card provides some coverage, ensuring you have sufficient third-party medical coverage during your trip should be first priority.

“Medical evacuation and medical expense benefits are rarely included with credit card coverage, leaving you to pay any medical bills incurred during your trip,” says Boynton.

Additionally, some credit cards have capped trip cancellation limits. If your trip cost exceeds this amount, the remaining trip costs might not be reimbursed if they aren’t insured through additional insurance. Conversely, not paying off your credit card balance for the trip amount could cause you to pay interest on the trip costs.

Fill in the gaps of your credit card coverage by opting for comprehensive coverage through a travel insurance comparison site like Yonder Travel Insurance. Insure trip costs above your card’s trip cancellation/interruption limits and make sure your combined medical expense and medical coverage total at least $100,000 each if traveling internationally.

The experts at Yonder Travel Insurance have poured over hundreds of policies from the best travel insurance providers in the US to provide the best travel insurance recommendation for how YOU travel.

Contact:

Meagan Palmer, Marketing Director

(952-358-6459)

[email protected]

SOURCE Yonder Travel Insurance