Bussiness

Worried About Costco’s Business Over the Long Term? You’ll Want to See This Stat.

On a typical Friday evening in the 1990s, vast numbers of families in the U.S. paraded down to their local Blockbuster to pick up some weekend entertainment by renting a movie or a video game cartridge. The chain was a dominant force in its segment of the entertainment space. But as time went by, its management failed to react effectively to rising competition from companies offering first DVD rental by mail, and then streaming video on demand. It’s clear how that turned out.

In short, the business models that work best today are not certain to thrive forever. And when you think about it, this can be particularly problematic for long-term investors. Warren Buffett has often said, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.” But so much can change in 10 years — an entire business model can become irrelevant over that length of time.

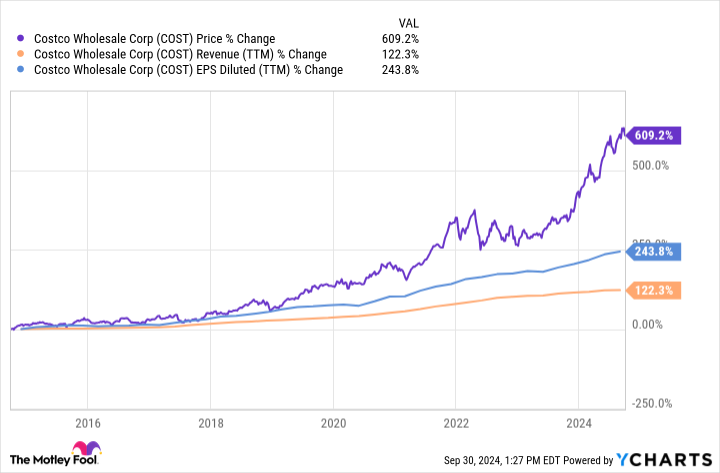

Retail chain Costco Wholesale (NASDAQ: COST) is one of the most popular companies on the stock market right now, and understandably so. Over the last 10 years, it has more than doubled its revenue as it’s opened new locations and gained new members. Profits have soared with strong operational efficiency, and that resulted in huge gains for the stock.

But how can investors predict what the next 10 years have in store for the warehouse chain? How can those who buy shares of Costco today have any confidence regarding how this business will be faring a decade into the future? Well, management did just provide one metric that is extremely promising when thinking about the relevance of Costco’s business long term.

The stat that buy-and-hold investors need to see

Costco makes most of its profit from selling memberships. Consumers must pay annual membership fees to shop in its sprawling warehouse-style stores, but are rewarded with low prices. The company has nearly 900 locations around the world, and nearly 137 million members.

According to Costco’s management, it added about 9 million new cardholders during its fiscal 2024, which ended on Sept. 1. But here’s the important statistic for long-term investors: Of those 9 million new members, roughly half were under 40 years old. Moreover, the average age of Costco’s members has been steadily dropping since the start of the COVID-19 pandemic.

Costco’s membership renewal rate is over 90%, and has been for a long time. Therefore, it’s reasonable to assume that many of these younger Costco members will stay members for many years.

It should be immediately apparent why this is important information. Buy-and-hold Costco investors are trying to predict the future of the business. Considering that the chain’s customer base is getting younger and renewal rates remain strong, I’d say that Costco’s business is looking quite healthy when it comes to long-term relevance.

What does this mean?

It’s important to remember that a business and its stock are related, but they are not quite the same. A business can be poised for resilience over the long term, but that doesn’t necessarily mean that investors will enjoy robust returns. Therefore, there’s still more information required when constructing an investment thesis for Costco stock.

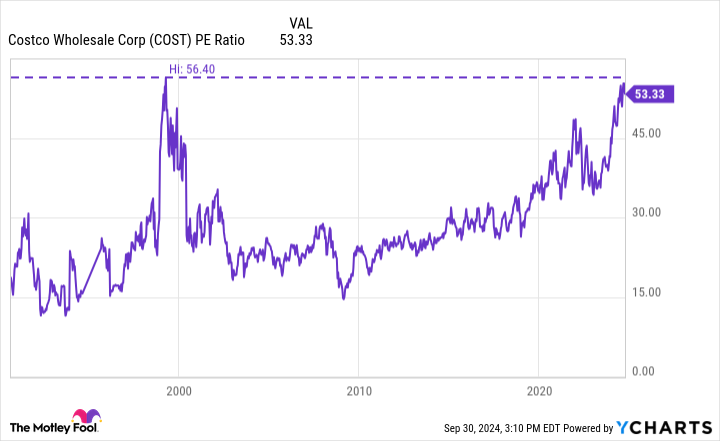

One thing for investors to keep in mind today is that Costco trades at more than 50 times its earnings — that’s quite pricey for a low-growth business. In fact, its shares haven’t been this expensive since the dot-com bubble more than 20 years ago.

This metric would lead me to believe that Costco stock could be somewhat overvalued right now. Consequently, I wouldn’t be surprised if the stock came down over the next year or so, which would give investors a more attractive entry point.

But take that comment with a grain of salt. Valuation is just one part of investing, and it’s not even the most important part. Identifying businesses that can thrive and grow for 10 years or even more is a far more consequential exercise.

Costco’s customer base is getting younger and its renewal rates are holding strong. If you’re an investor who might have been concerned about the long-term future of this brick-and-mortar retail chain, that information should help put you at ease.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale. The Motley Fool has a disclosure policy.

Worried About Costco’s Business Over the Long Term? You’ll Want to See This Stat. was originally published by The Motley Fool