Fitness

Xponential Fitness: Asymmetrical Reward Payoff At Current Valuations (NYSE:XPOF)

Pgiam/iStock via Getty Images

Investment Thesis

Xponential Fitness, Inc. (NYSE:XPOF) is a global franchisor of boutique fitness brands. It has established a market presence with a diversified portfolio of various unique fitness entities. Five components drive top-line growth for the company, 1) franchise revenues, 2) royalty revenues, 3) equipment revenue, 4) merchandise revenue, and 5) revenues from its franchise marketing fund.

With Mark King – former Taco Bell CEO – at the helm since June this year, XPOF is well-positioned as a differentiated player in the gym + fitness space with multiple competitive advantages against undifferentiated peers. I am a buy on XPOF due to these factors and also as 1) conservative forward estimates at sensible multiples imply asymmetrical payoff, 2) highly attractive economics [esp. with 7% royalty on system-wide sales – this creates a tail of income on the installed base], and 3) the discounted value of free cash XPOF could produce by FY’28 suggests the business is with ~$32/share today. Net-net, rate buy.

Figure 1.

Q1 Earnings Insights

XPOF continues to grow sales + store volume with a 25% YoY growth in its network’s revenues to $401mm for Q1 FY’24. This includes all the revenue booked by its franchisees but is not recognized by the company. Company sales were +12% YoY to $79.5mm with 73% of this recurring in nature. Management said on the call that “96% of the system-wide sales growth came from volume, or new members, which has remained consistent with historical performance, and 4% coming from price”. This is a critical point evidencing demand for its services – this ties into my points on its competitive advantages discussed later. Total active visits were +18% YoY indicating satisfaction with service in my view.

The breakdown was as follows:

- Franchise revenue was +27% to $41.8mm and is propped by the growth in system-wide revenues which threw off ~$28mm in royalty income.

- Equipment sales were +600bps YoY given more of its equipment-intensive brands opened during the quarter. This is attractive as these command higher price points and fees. Many existing franchisees apparently bought new inventory to accommodate for higher foot traffic.

- Merchandise sales were +14% YoY for the same reasons.

It deployed another 111 gross studies in Q1 (85 NA vs. 26 international) and expects back-end weighting on this in FY’24 with a “gradual increase each quarter of 2024″. It sold 173 licenses and management said it had >400 letters of intent signed for studios yet to be open which in my view will be bought online in the coming 2-3 quarters [if it did ~110 this quarter, and expects this cadence to increase, it could do 120/qtr in my view].

Management projects $1.7Bn system-wide sales on this (+22% YoY) with ~$340mm in company revenue. It expects +31% YoY EBITDA growth to $140mm on this.

Why XPOF is a great business

In my view, the company’s model enables it to enjoy franchise economics which involves a capital-asset light set of operations that requires little incremental capital to be committed in order to grow (since FY’21, maintenance CapEx runs ~6-10% of sales, growth investment at ~2-3%, producing >30% compounding revenue growth on a TTM basis).

It had 2,724 studios open in North America and 432 internationally at the end of Q1 (3,156 total). Its pipeline is robust with franchisees contractually committed to opening ~2,900 additional studios.

Moreover, its ’boutique’ services are highly differentiated in an otherwise commoditized industry. Instead of a one-size-fits-all approach like most gyms (with a hub and spoke model where the gym serves as a central location for all the offerings), XPOF has consolidated the offerings (e.g., pilates, yoga, rowing, and so forth) into a series of specialized studios (e.g., YogaSix, Club Pilates, Row House, etc.) that require memberships. There are two advantages to this:

(1). Competitive advantage vs. peers

- When it comes to selecting a health club/gym this is a hard-to-replicate business advantage in my opinion because the ‘niche’ offerings could arguably get customers to “cross the street” and come to XPOF’s clubs vs. a ‘generic’ club.

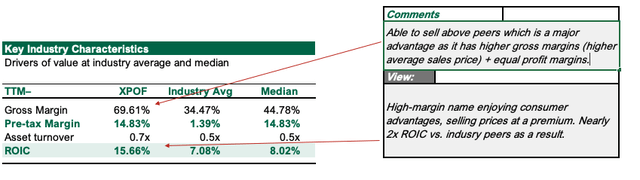

- This means it can price its offerings above industry peers because it enjoys this consumer advantage on its boutique offerings, separating itself from peers. This is a competitive advantage as it has 1) higher gross margins (higher average sales price) + 2) equal profit margins, meaning 3) XPOF is a high-margin name with capital efficiency, producing ~2x the industry returns on capital as a result.

Figure 2.

(2). Highly attractive economics

- Membership models have float-like economics whereby they receive cash flows upfront before the ‘service’ is provided. Most gymnasiums have the same benefit and can run on high fixed costs as a percentage of total expenses. This provides operating leverage. The issues are 1) often nothing differentiates one location from the other, and 2) fees/pricing are a race to the bottom to attract customers. Companies have tried to tackle this in the past with a volume approach – large real estate footprint with high sales/memberships per sq. ft. This becomes a capital-hungry endeavour. As mentioned above, differentiation is the other way – and XPOF sits at this end of the spectra.

- Franchise agreements are ~10 years on average with a 5-year successor terms available. The initial franchise fee ranges from ~$35K – $60K per studio depending on what the agreement is. For example, a single development fee is ~$60K, but development agreements enable one operator an exclusive license to a specific ‘territory’, and the fee is $350K for 10 sites. Critically XPOF receives the funds when the franchisee signs the agreement. From FY’21-’23 yearend, avg. conversion time from signing to opening was ~15 months per studio. It then receives (a) a 7% royalty fee on all franchisee sales [to me this is ‘equity-like’ as you’re participating in the good fortune of the business, but higher up the capital structure], and (b) 2% of all franchisee sales are rolled into a marketing fund [further reducing XPOF’s reinvestment requirements to stay competitive].

These are hard-to-replicate business advantages that require exquisite focus on building brand strength and emphasizing differentiation to present a more compelling and consolidated value offering for clients to pay their memberships.

Additional high-quality business characteristics I’ve analyzed for XPOF include the following:

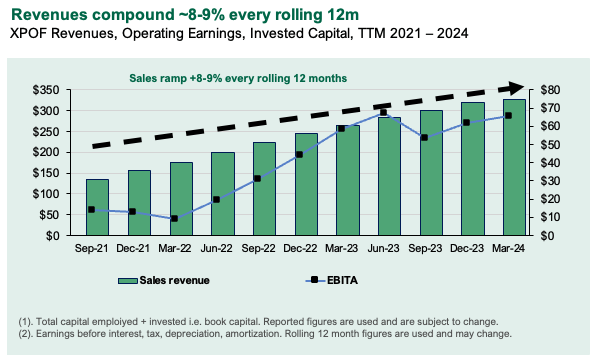

- The sales ramp is +8-9% every rolling 12 months – this is relevant as its persistent consensus has a similar annualized growth rate to FY’26. More critically, pre-tax earnings are +$51mm since FY’21, engendered from $109mm of reinvested capital, producing 47% marginal return on capital. This is ~3x its trailing ROIC and tells me 1) its new investments are more profitable i.e. new store openings are pulling their economic weight, and 2) the business can grow on very little incremental investment.

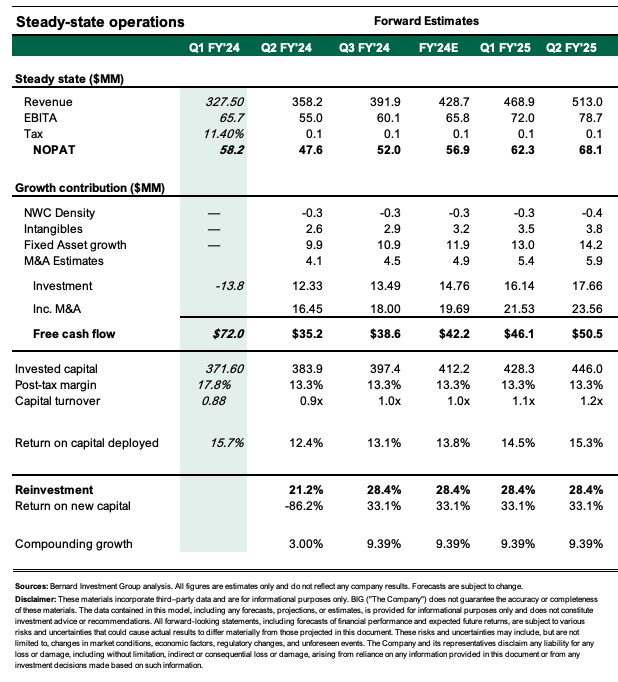

Figure 3.

Company filings

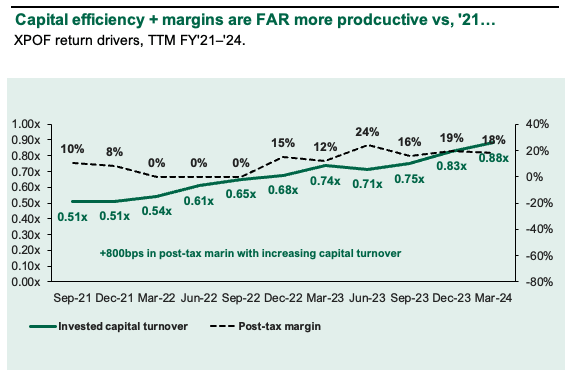

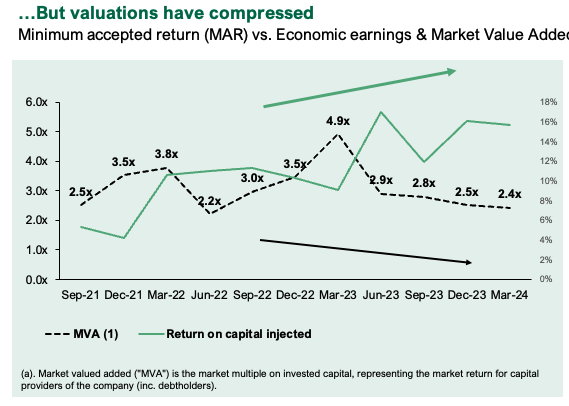

- FCF conversion is ~90% as 1) reinvestment requirements are minimal to maintain its competitive position and grow, and 2) ROICs are high and expanding – the economic leverage is tremendous with NOPAT margins +800bps vs. FY’21 and capital turns up linearly to 0.8x producing $0.15 in NOPAT for every $1 of investor capital that’s been put into the business, up from $0.05 in ’21 (Figure 4). The capital-asset light operating model is due to the franchise economics, whereby the investment required to produce $1 in sales is low and the margin collected on this is high. The critical point is the market has failed to appreciate this, re-rating the stock from ~3-3.5x EV/IC in FY’22/’23 to

Figure 4.

Company filings

Figure 6.

Company filings

Figure 7.

Author’s estimates

Attractively valued asymmetrical payoff

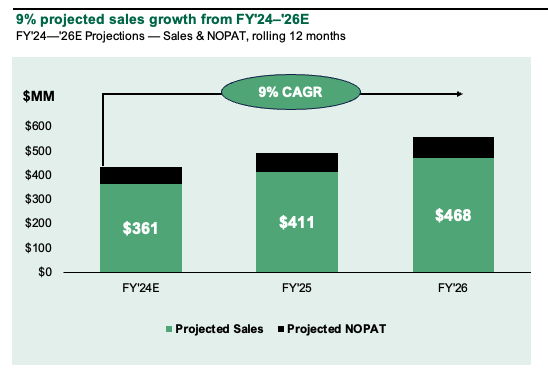

XPOF is growing earnings at high rates with minimal reinvestment requirements enabling >90% FCF conversion. It if keeps similar ratios up its corporate valuation can compound at high rates of return in my opinion.

Valuation insights

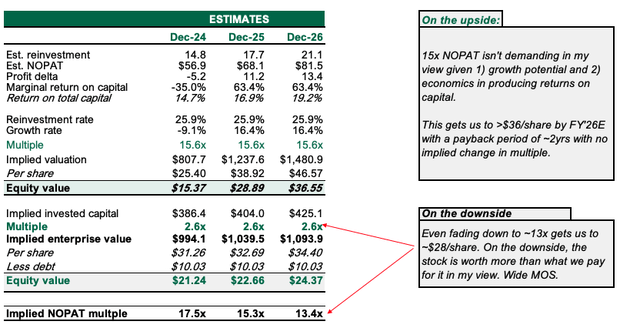

- The stock trades ~15x NOPAT and 2.4x EV/IC as mentioned which are both compressed vs. history, but the business has divested operating units in FY’23 and thus could be viewed differently, Regardless, ~15x NOPAT isn’t demanding in my view given 1) growth potential and 2) economics in producing returns on capital. I assume ~9.3% compounding sales growth, 15% pre-tax margin, and a capital reinvestment rate of ~40% on the dollar. Note these are more constrictive vs. current trends.

- On the upside, this gets us to >$36/share by FY’26E with a payback period of ~2yrs assuming no implied change in multiple. Even fading down to ~13x gets us to ~$28/share.

- On the downside, the stock is worth more than what we pay for it in my view even with a compression to 13x NOPAT, indicating a wide margin of safety.

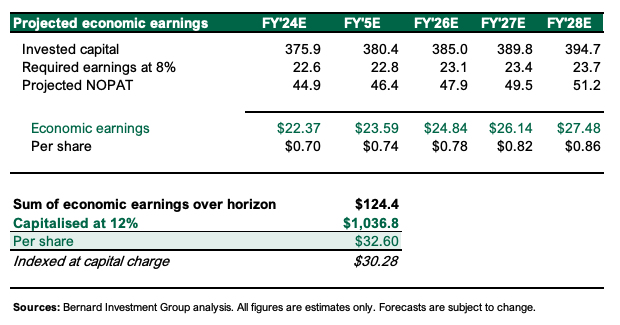

Figure 8.

- The discounted value of cash my FY’24-’26E assumptions projected at highly conservative assumptions suggests XPOF would be worth ~$1.03Bn in private market value – otherwise $32/share. This outpaces an investment of comparable risk-earning LT market rates of ~12% p.a. thus the projected earnings will create economic value at these starting valuations if they’re in the ballpark.

Figure 9.

Author’s estimates

Risks to thesis

Downside risks to the thesis include 1) less than 5% sales growth which squashes the valuation, 2) a sudden halt in opening of new stores, 3) any branding issues with its portfolio companies [low probability], and 4) the macroeconomic risks currently plaguing equity markets, in particular the interest rate situation. Another hike could compress equity valuations across the board.

Investors must understand these risks in full before proceeding.

In short

XPOF is an emerging company with a highly differentiated offering in the gym and fitness domain. It has consolidated various gym services into a suite of individual studios, each with its own membership, unlocking value away from a centralized hub-spoke model. It enjoys consumer advantages of this alongside franchise economics that result in >90% FCF conversion with expanding ROICs. My view is the private market value of the company is ~$32/share, an asymmetrical 84% upside. On the downside, the stock is worth about what we pay for it in my opinion. Net-net, rate buy.

Appendix 1.

Author