Fitness

Xponential Fitness: Embedded Growth At A Big Discount (NYSE:XPOF)

Maki Nakamura/DigitalVision via Getty Images

Shares of Xponential Fitness (NYSE:XPOF) fell 14% Friday in the wake of first quarter earnings – apparently investors were put off by slightly lower than expected same-store comps. As a battleground stock (discussed below), the market has shown an itchy trigger finger in reacting to Xponential’s quarterly results.

While the stock chart may be bumpy, I see Xponential as an attractive investment opportunity given:

- Franchised business model, which requires limited capital investment and should generate large amounts of free cash flow.

- Embedded growth in new studio openings based on franchise licenses already sold. Over the next 5-6 years, I expect total number of franchised studios to nearly double.

- Attractive valuation – at $11.50 per share, Xponential Fitness sells for less than 9x my estimate of 2024e EBITDAX (EBITDA less capex) and about 11x my estimate of 2024 free cash flow per share. Factoring in the embedded growth and looking out to 2027, these multiples fall to sub 5x EBITDAX and 7x free cash flow. I see 100%+ upside potential in Xponential shares.

- While fitness businesses tend to have fad risk, I believe that the value of Xponential’s Club Pilates business (which I consider to be durable – described below) supports the entire valuation of the company today.

Given my view that there is limited fundamental downside and significant upside potential, I have taken a position in Xponential shares.

Current Results

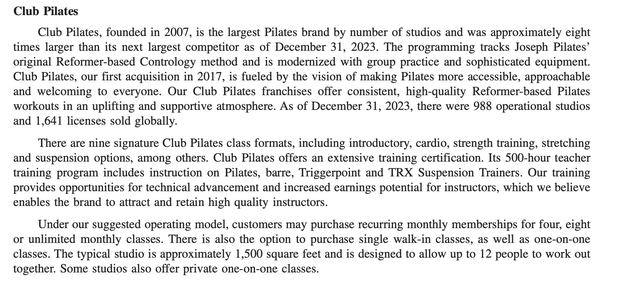

1Q24 Results (1Q24 Earnings Release)

While I consider a 9% same-store comp to be a reasonably strong number, this figure was below the ‘low double digit’ guidance given by management on the 4Q23 earnings call. Management attributed the 1Q24 comparable shortfall to some pull forward of demand/revenue as the company’s StretchLab and Pure Barre concepts sold pre-paid packages in November/December which increased visitation in 1Q24 but for which revenue had already been recognized (revenue recognized in 4Q23). While it is fair to say that management should have taken this into account when giving guidance, I consider this to be a minor miscue.

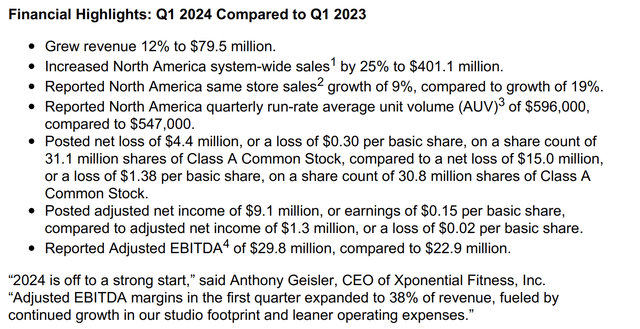

As shown below, the company maintained its full year guidance for new store openings, revenue, and adjusted EBITDA:

2024 Guidance (Investor Presentation)

My appraisal of the Bear Case

Xponential received plenty of negative attention in 2023 following a report from a short seller, a negative Bloomberg article, and an ongoing SEC investigation. This negative attention centers around poor results produced by some of the company’s less successful concepts (Row House, Cyclebar, Stride -Stride was divested in 1Q24) which have led to franchisees losing money/ceasing operations.

I acknowledge that these concepts may ultimately prove to be unviable (some have since been closed, and we will likely see more closures). It is important to understand that these concepts represent a small percentage of Xponential studios and an even smaller portion of the company’s revenue (less than 10% by my estimates as unsuccessful studios have low average unit volumes, generating limited franchise fees) and profitability.

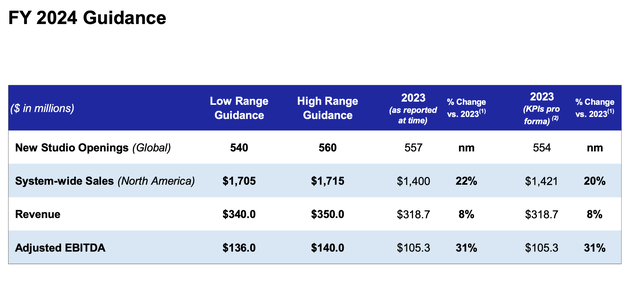

Meanwhile, what I consider the company’s core concepts (Club Pilates, StretchLab and Pure Barre) have demonstrated strong unit economics (Club Pilates which represents over 1/2 of systemwide sales, has average unit volumes of $900,000-$1,000,000) leading to franchisee success. Franchisee success is evidenced by many franchisees purchasing multiple licenses as shown below (Why would a franchisee buy multiple licenses if he/she were not earning an attractive return on units already owned/operated?).

Moreover, I see the very recent addition of former Domino’s (DPZ) CFO Jeffrey Lawrence to the board of directors as further evidence that on the whole, Xponential is not a ‘House of Cards’ as suggested in the short-seller report. It seems extremely unlikely to me that a former senior executive of one of the world’s most successful franchisors would associate himself with a company of dubious quality.

Embedded Growth

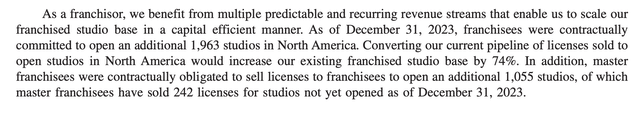

Embedded growth from Licenses Already Sold (10-K)

As shown above, Xponential has already sold licenses which indicate a significant (74%) increase in its North American footprint. I expect most of these locations to be opened over the next five years (at a similar cadence to the 500-600 opened per year in 2023 and expected for 2024). As these franchisees open additional stores (most of which are successful core concepts, i.e. Club Pilates, StretchLab, and Pure Barre), this will generate significant growth in franchise fees. With limited incremental costs, a large percentage of this incremental revenue will flow through to the bottom line.

Beyond licenses already sold, Xponential continues to actively sell new licenses (1Q24 saw license sales meaningfully exceed new openings, which is positive for future growth).

Valuation

As shown above in the ‘Current Results’ section, management has guided to $138 million of EBITDA at the midpoint for 2024. I use a slightly lower figure of $125 million (10% below management’s guidance) to account for the possible closure of weaker locations and the possibility of comparable sales coming in a bit softer than expected. Using the high end of management’s capital expenditure guidance, this gets me to an EV (enterprise value) to EBITDAX (EBITDA less capex) of just under 9x. Looked at another way, after deducting interest, taxes, capex and preferred dividends from EBITDA I get $1.05 per share in free cash flow, implying an 11x free cash flow multiple.

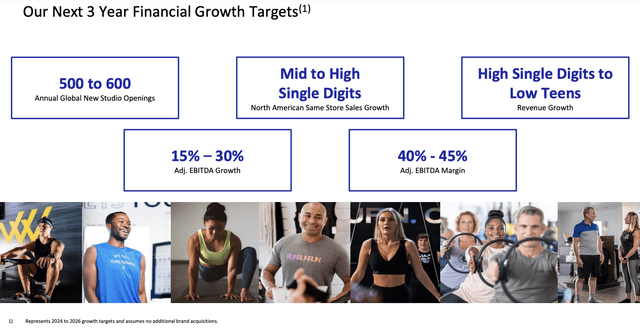

Given the embedded growth discussed above and assuming just 2-3% comparable growth, I estimate that Xponential will generate $175-180 million in 2027 EBITDA. Taking into account free cash flow generated over the horizon, this implies that Xponential is trading at just 4.6x 2027e EBITDAX and just over 7x my $1.55 free cash flow per share estimate. I’d also note that there is an element of conservatism here – as shown below, management’s guidance suggests $180 million of EBITDA in 2026 (using the low end of the 15-30% EBITDA growth). Using a more reasonable 15-20x FCF multiple (most franchised business models trade for a minimum of 20x FCF), I get to a $23-31 per share valuation suggesting 100%+ upside.

Medium Term Guidance (Investor Presentation)

Downside Protection: Club Pilates

Lastly, I would highlight that because fitness tends to be fad driven (remember Jazzercize??), I have given some additional thought to downside protection here. It is possible that a concept which is currently quite popular and successful like StretchLab (assisted stretching) ultimately falls out of favor and has minimal value.

The concept in which I have the greatest confidence is Club Pilates. Pilates has been around for around a century (has been widely practiced in the US for decades) and requires costly, space consuming equipment making delivery via studios optimal.

As shown above, Club Pilates currently has nearly 1,000 locations and should have 1,600 plus looking out 5-6 years (based on licenses already sold – the company is actively selling more licenses). Per management, Club Pilates has an average unit volume of $900,000-$1,000,000. This implies current systemwide sales of nearly $1 billion (slightly more than half of current systemwide sales) and a path to $1.5-1.6 billion looking out 5-6 years assuming new units produce similar results to existing units. The $1.5-1.6 billion of expected future Club Pilates systemwide revenue is only 6-12% below management’s expected 2024 results for the entire company. As such, I believe that Club Pilates alone is capable of generating $125 million in EBITDA in 5-6 years time. Given the success (8x larger than nearest competitor) and durability of this concept, I believe that it would be worth at least 12x EBITDA. Discounting back to today at a 10% rate (and deducting debt and preferred) implies that the present value of Club Pilates roughly approximates today’s share price.

Risks

- As mentioned above, fitness is prone to fads and ultimately some of Xponential’s concepts will be failures.

- Xponential’s stock price has been very volatile – largely due to negative articles as discussed above.

- Xponential has financial leverage with debt plus preferred equating to roughly 3x EBITDA. Given the company’s robust growth profile, I think this should be manageable.

Conclusion

I see current share price weakness as an opportunity to purchase a growing business with high returns on capital at a very attractive price.