Travel

McKinsey: The evolving role of experiences in travel

Since the dawn of leisure travel, people have journeyed in search of new experiences. They long to meet friendly locals, eat new foods, stroll through unfamiliar landscapes, and witness (or maybe even join) cultural traditions that remind them that they’ve left home.

More and more, experiences have become powerful decision drivers for travelers: the possibility of a life-changing travel moment motivates people to book a trip. The quest for the right type of moment even influences which destinations people will choose. But despite the enduring excitement about experiences and the large pool of value they represent, the travel industry has yet to crack the code on an approach that can simultaneously please travelers, make sense for experience providers, and produce profit at scale for distributors and larger stakeholders.

Today’s travelers often find the breadth of available experiences overwhelming, and they crave easy-to-navigate platforms that can sort through experiences and offer seamless, real-time booking anywhere in the world. Experience providers (often small, passionate outfits, sometimes run by a single tour guide) want to create broad awareness of their offerings. But operators can become frustrated when a booking platform’s thumbnail descriptions fail to capture the appeal of a quirky activity—or when an intermediating player fumbles customer relations. Distribution platforms want to become comprehensive sites for one-stop experience shopping but face challenges as they try to scale profitably while cobbling together a fragmented array of experiential offerings. Meanwhile, legacy travel institutions, such as airlines and hotel chains, are still searching for ideal ways to fit magical travel moments into the machinery of complex corporate enterprises.

The global marketplace for travel experiences offers a more than $1 trillion opportunity. Younger generations, in particular, demonstrate an eagerness to splurge on experiences, suggesting the sector will continue to expand. Yet nearly half of the business of experiences is still transacted offline. As experience booking goes digital, a considerable share could be claimed by organizations that can anticipate and eliminate pain points at every stage of the process, up and down the value chain.

How can operators quench travelers’ thirst for magical experiences while finding new customer streams from around the world? How can distribution platforms simplify and scale the discovery and booking process while creating an attractive proposition for operators? How can airlines and hotels learn from the awe and wonder that a terrific tour guide can conjure, becoming distributors for experiences and also injecting the essence of that magic into their core businesses?

A new report, The evolving role of experiences in travel, produced by McKinsey and Skift, examines the world of travel experiences 1—ranging from stadium rock concerts to guided nature hikes to in-home culinary gatherings and everything in between. The report offers an assessment of the experience industry as it stands today, presents ideas that could help address current dissatisfactions, and looks at opportunities for various players to capitalize on growing interest.

Desire for experiences is reshaping travel demand

Once upon a time, travelers might have picked a destination first and only later started choosing what to do upon arrival. But today’s travelers don’t treat experiences as afterthoughts. Their travel decisions are increasingly based on specific activity interests. This can invert the trip-planning funnel, placing experiences at the top and destination choices further down the cone.

A recent McKinsey survey asked about the factors most important to travelers when selecting a destination.2 Survey respondents cited the range and quality of local activities on offer at a rate that trailed only the rates of their citations of essential needs, such as safety, navigability, cost, and accommodation range and quality (Exhibit 1). Respondents were nearly as likely to cite, as a decision factor, the ability to experience authentic local customs and culture.

Interest in experiences is unlikely to dissipate soon, as evidenced by the preferences of younger travelers. According to McKinsey survey data, 52 percent of Gen Zers say they splurge on experiences, compared with only 29 percent of baby boomers. 3 And Gen Z travelers say they try to save money on flights, local transportation, shopping, and food before trimming their spending on experiences.

Travel experiences could compose a market worth more than $1 trillion

The travel experience market is large and, by some estimates, rapidly growing. To size it, we began by examining the value represented by the entirety of the world’s tours, attractions, and activities. Our analysis indicates that this global market could be more than $3 trillion.

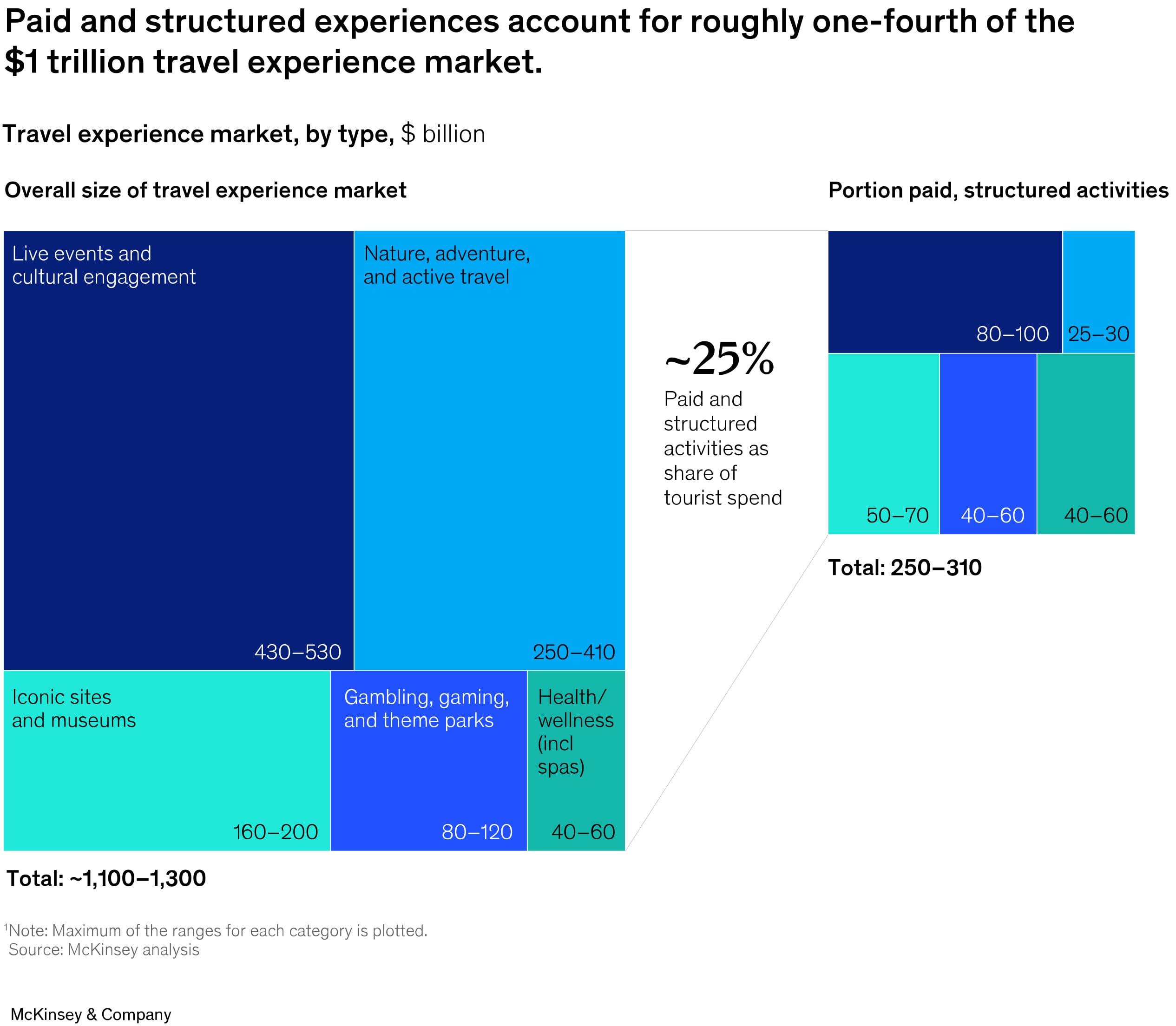

Many local residents participate in the experiences offered at a given destination. But per our research, destination visitors—both domestic and international—account for roughly 30 percent of the experience market, spending about $1.1 trillion to $1.3 trillion on experiences. This is how we defined the total addressable market for travel experiences.

Next, we quantified the serviceable available market by assessing the proportion of travel experiences that are in some way structured (for example, a professionally guided tour or a live ticketed event) versus those that are independently undertaken (for example, a tourist strolling up to an art museum’s ticket window and then perusing its galleries). The segment involving paid, structured activities represents a large part of the market that’s in play for experience providers (such as tour operators), intermediaries (such as online-booking platforms), and stakeholders from other parts of the travel industry (such as hotels and airlines).

We estimate that paid, structured tourist activities account for roughly 25 percent of global experience spending, totaling about $250 billion to $310 billion per year (Exhibit 2). This number comprises tourist spending on rock concerts, baseball games, history walks, nature hikes, theme park visits, spa treatments, museum tours, and a host of other activities. And it continues to expand: experts estimate growth in this segment of more than 14 percent per year by 2025. 4

There’s an emerging recipe for creating magical experiences

A top-notch experience can be the cornerstone of a trip, lingering in a traveler’s memory for years to come. In our conversations with 19 experience providers, several crucial components for creating great experiences became apparent:

- Entertainment comes first. Experience operators observe that, no matter the type of experience, what travelers want above all is to have a good time and be entertained.

- Well-trained guides set the tone. Because creating a magical, guided experience depends so much on the guide, experience operators focus on molding high-quality frontline employees.

- Authenticity and local engagement matter. Visitors appreciate thoughtfully crafted itineraries that bring a specific locale to life.

- Expectations should be managed—and then exceeded. Overcommunicating and overdelivering are crucial.

- Guests need to feel they’re in sure, safe hands. Travelers like to feel that a tour guide is in control every step of the way.

Booking platforms might consider these components when deciding which experiences to give prominent visibility. Larger travel players, such as hotel chains and airlines, might also keep these ingredients in mind—both when thinking about add-on experiences to offer through their own platforms and when exploring how to scale magical experiences across a chain of hotel lobbies or a schedule of transoceanic flights.

Finding and booking experiences remains a frustrating process—offering opportunities for improvement

Many travelers enjoy the process of planning a vacation. They have fun searching for the individual elements that will add up to a perfect trip. But the discovery and booking process for travel experiences can be alternately thorny and exhausting. It can present travelers with an overwhelming menu of options but doesn’t always surface the best ones. It sometimes fails to accurately describe an activity, which can create expectation mismatches.

Meanwhile, the experience industry’s move to digital is still in progress. According to 2023 data, 47 percent of experience booking still happens offline—either via walk-ups or telephone calls or through offline conduits, such as hotel concierges and traditional travel agents. 5 Only 22 percent of booking occurs through online intermediaries, such as booking platforms.

Many experience providers have faced difficulties as they shift their booking operations toward online distribution platforms. And for the platforms, scaling while maintaining or expanding margins has been a challenge.

Travelers aren’t always getting what they want or need from online booking

Booking platforms that offer experiences sometimes serve up a large database presented as a list, which might not have been carefully curated. These lists can be overwhelming for a customer who isn’t sure what to look for. And they might fail to surface hidden gems. What’s more, the tours and activities that appear on platforms aren’t always especially well vetted. They might not meet travelers’ expectations for quality or value—or might not align with the thumbnail descriptions travelers see on the platforms.

There’s an opportunity here to create a discovery and booking process that features more fun and fewer hiccups. Travelers could benefit from simplified and more enjoyable discovery systems (including ones linked with social media), a streamlined booking process in which platforms become seamless (or even invisible), and a detangled customer service approach (in which it’s always clear who to contact, even on short notice).

Experience operators can benefit from the transition to digital—but may also encounter challenges

Of the 19 operators we interviewed in June 2024, 78 percent already receive at least half of their bookings through platforms. Platforms can help attract online eyeballs and raise product awareness in ways an experience provider couldn’t on its own. One reason is that platforms tend to perform better in search engine results than an individual operator’s website does on its own—in part, because platforms can afford to pay more for local language translation, search engine optimization, and search keyword marketing than a typical experience operator could.

Despite all the advantages that online platforming can offer operators, it also presents some structural challenges. For instance, the variety of experience offerings—ranging from strenuous outdoor adventures to quiet cooking classes and from giant group tours to intimate gatherings—is difficult to fit into the one-size-fits-all listing approach that platforms sometimes take. Unlike, for example, air travel, where the ticket offerings tend to be fundamentally similar and easily compared, distinctively crafted activities and tours can often benefit more from a bespoke framing of offers.

The intermediary role of the booking platform can also create frustration for experience providers. When service issues arise or customers wish to cancel or reschedule a booking, execution isn’t always smooth. For instance, the customer might attempt to interact with the platform when it would be more effective to interact directly with the operator. The operator might become aware too late of a service issue or booking change request—or might not become aware at all.

Online booking platforms are hoping to scale a fragmented industry

Online-booking platforms enjoy natural advantages when it comes to selling experiences to travelers. Because the experience space is so fragmented—full of countless smaller operators—travelers look to save time and effort by turning to a platform that can aggregate and sort through an overwhelming number of options. Platforms can also lower payment and communication hurdles for a traveler, particularly when experience operators speak foreign languages or transact in foreign currencies.

Many booking platforms have thus far focused on prioritizing top-line growth instead of maximizing profitability. Building a large platform can incur significant expenses related to both acquiring a large supply of inventory and ensuring that the platform’s tools and algorithms can handle it. A central question for platforms will be how effectively they’ll be able to expand revenue while also growing margins.

Other players are seeking profitable ways to get involved with experiences

Experiences are gaining enough traction in the travel ecosystem that other players are now eyeing the market. The margins for sales of experiences can be high: operators told us they typically achieve up to 60 percent margins, even after deducting a booking platform’s commission (with labor constituting the bulk of the operator’s cost). That can make this an appealing space for businesses to enter.

Which strategies might help stakeholders find success in the experience marketplace?

The evolving role of experiences in travel could create favorable circumstances for stakeholders across the value chain. Industry players in various sectors should consider how best to capitalize on emerging opportunities.

Experience operators should generate the magic that will enable industry growth

For experience providers, it begins with delivering the distinctive, authentic moments that travelers crave. Once this crucial prerequisite is met, other success factors can be considered:

- Meeting consumer demand. This requires monitoring changing trends, catering to evolving traveler tastes, and making guests feel they’re in safe hands from start to finish.

- Savvy marketing. Using the right words and images can communicate an experience’s value proposition.

- Discovery systems. For experiences, discovery systems are still in flux, so it’s important to find customers where they are—including on social media.

- Booking strategy. Different operators can benefit from different booking strategies. It’s important for operators to consider how their needs could evolve over time when evaluating the trade-offs that come with various booking approaches.

Booking platforms could profit from making sense of a large and growing market

Distributors might find themselves in a sweet spot, as demand for travel experiences grows and the corresponding rise in supply creates an ever-more-confusing marketplace. Platforms might consider how to effectively gather, intelligently curate, artfully display, and smoothly broker the sale of experiences in ways that will appeal to overwhelmed travelers who want one-stop activity shopping:

- Building supply might involve building relationships with operators. Experience providers want to list on platforms that offer visibility and value.

- Curation can make a traveler’s discovery phase relatively easy and fun. Most travelers don’t have the time, ability, or desire to conduct a long, difficult search for a hard-to-find experience.

- A seamless booking process is likely to draw customers in and keep them coming back. Customers shouldn’t need to wade through multiple pages and filtering tools to find what they’re looking for.

- Platforms might advise—or even become—experience providers. Booking platforms have a high-level vantage point and an ability to access large amounts of data, so they are in a good position to spot unmet demand in the marketplace and help generate supply that’s likely to be appealing to travelers.

As demand for experiences grows, travel industry players could look for new ways to get involved

Stakeholders across all travel sectors could benefit from viewing their roles through the lens of serving up memorable, positive experiences to travelers. This might involve reframing services a company already provides, or it might mean looking for new opportunities to integrate experiences into a traveler’s journey:

- Hotel stays. Hotels might use experiences as incentives for travelers to book stays. Strong brand recognition and existing digital infrastructure can help hotel chains act as distribution channels for experiences. There might also be an opportunity to improve on-premises experiences that a hotel more closely controls—for instance, at the hotel’s spa or through a pop-up event in the hotel’s lobby.

- Short-term rentals. Short-term-rental platforms might offer experiences alongside accommodation bookings. Given that many short-term-rental bookings already happen online, it might make sense for short-term-rental platforms to claim a share of experience booking. These platforms have established online relationships with many customers, and they have already integrated online payments and scheduling into their operations.

- Flight packages. Many airlines already generate significant revenue from package holidays, which could be supplemented with add-on experiences. Airlines might take advantage of customer data and contexts to surface attractive experience options at the time of flight booking, which tends to happen early in the trip-planning process.

- Reframed core products. Travel stakeholders can view their core products through the lens of experiences. Hotels might consider how to turn lobbies into experiential opportunities. Airlines might examine what travelers want from experiences and then apply the insights to create in-flight presentations and improve cabin atmospheres. Spaces might be revamped in ways that make them social media worthy.

Destinations could offer support for the experience ecosystem

Visitor bureaus and destination management organizations have roles to play in helping meet traveler demand for great experiences. The distinctive capabilities and resources of these groups could aid them in shaping the experience landscape.

Magical experiences are what leisure travel is all about. They bring people joy. They shape people’s identities. They can be the chapters of people’s lives that they’re most eager to tell the world about.

The business of travel experiences is quickly growing and evolving. Today’s marketplace could be at an inflection point, poised to transform in ways that will better connect travelers, providers, platforms, and other players. The travel industry should look for opportunities to collaborate and innovate to improve the commercial elements of travel experiences while never losing sight of the essential magic that turns a travel experience into a life-changing event.